What 1099 Form Is Used For Rent

What 1099 Form Is Used For Rent - You are not engaged in a trade or business. You are engaged in a trade. Employment authorization document issued by the department of homeland. There are several types of 1099s used for different purposes, and. If you have not already entered the applicable. You will then receive a form 1099 form. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know if. The new 1099 form requirements have been delayed until 2024. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. The american rescue plan of 2021 included a provision to change the requirements for filing.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. You are engaged in a trade. If you have a commercial tenant that pays you over $600 of rent. Employment authorization document issued by the department of homeland. The new 1099 form requirements have been delayed until 2024. If you have not already entered the applicable. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. The american rescue plan of 2021 included a provision to change the requirements for filing. There are several ways landlords and property managers can collect rent.

Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. There are several types of 1099s used for different purposes, and. Employment authorization document issued by the department of homeland. If you have a commercial tenant that pays you over $600 of rent. The american rescue plan of 2021 included a provision to change the requirements for filing. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web new 1099 requirements for landlords and rental property taxes. You can use a rent. The new 1099 form requirements have been delayed until 2024. Web you are not required to file information return (s) if any of the following situations apply:

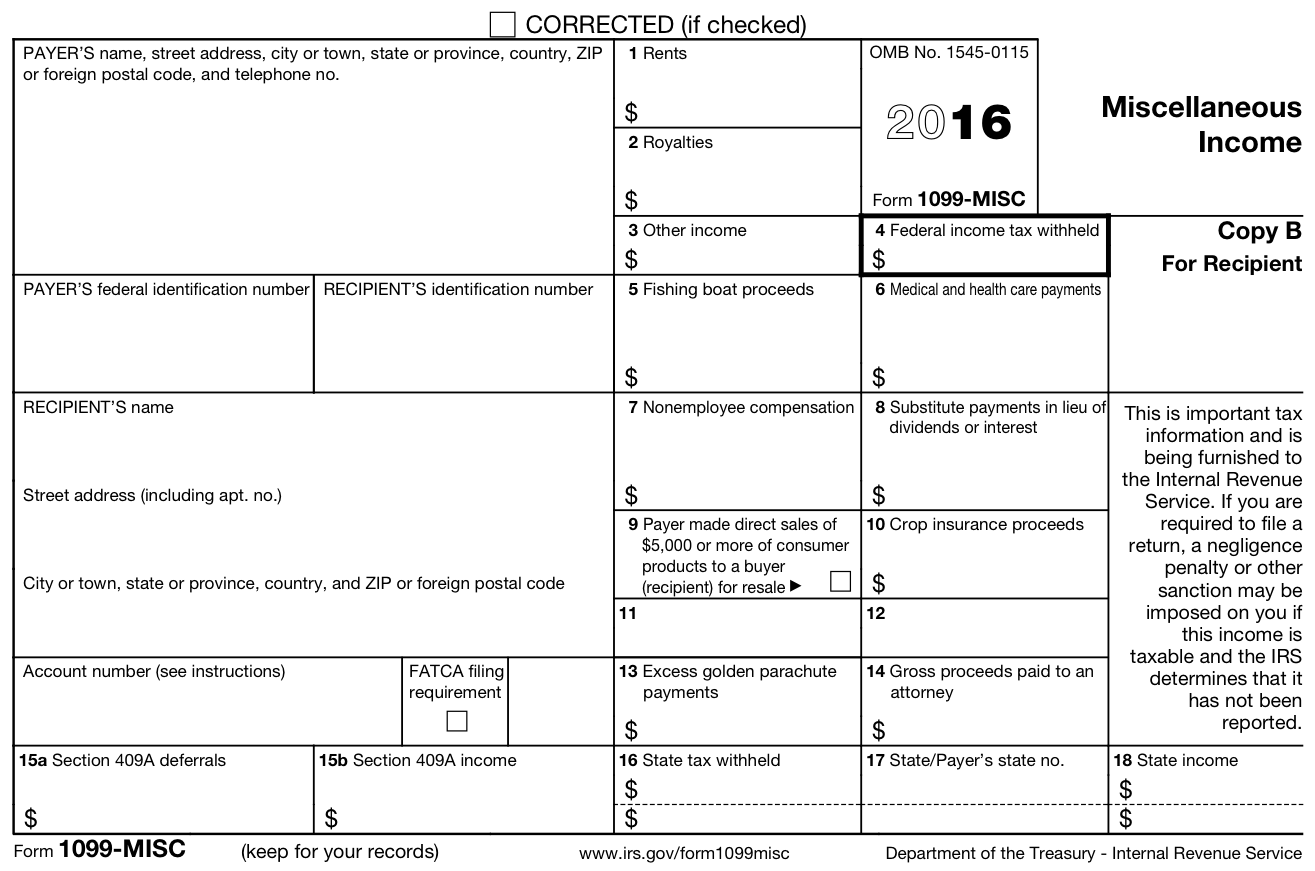

What Is a 1099MISC? Personal Finance for PhDs

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Employment authorization document issued by the department of homeland. Web new 1099 requirements for landlords and rental property taxes. The american rescue plan of 2021 included a provision to change the requirements.

Form 1099 USEReady

Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know if. You will then receive a form 1099 form. Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. There are.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

You are engaged in a trade. Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. There are several types of 1099s used for different purposes, and. If you have not already entered the applicable. Web the irs 1099 form is a collection of tax forms documenting different types of payments.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. You are engaged in a trade. There are several.

Form 1099 Misc Fillable Universal Network

If you have a commercial tenant that pays you over $600 of rent. Web new 1099 requirements for landlords and rental property taxes. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you have not already entered the applicable. The.

What is a 1099Misc Form? Financial Strategy Center

The new 1099 form requirements have been delayed until 2024. Web you are not required to file information return (s) if any of the following situations apply: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web you can generally use.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

If you have a commercial tenant that pays you over $600 of rent. The new 1099 form requirements have been delayed until 2024. There are several types of 1099s used for different purposes, and. Web you are not required to file information return (s) if any of the following situations apply: Web by quickbooks september 2, 2022 a 1099 is.

Free Printable 1099 Misc Forms Free Printable

You are not engaged in a trade or business. The american rescue plan of 2021 included a provision to change the requirements for filing. You can use a rent. Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web new 1099 requirements for landlords and rental property taxes.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Web new 1099 requirements for landlords and rental property taxes. Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. If you have not already entered the applicable. The new 1099 form requirements have been delayed until 2024. There are several ways landlords and property managers can collect rent.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you have a commercial tenant that pays you over $600 of rent. There are several ways landlords and property managers can collect rent. Web you are not required to file information.

Web The 1040 Form Is The Official Tax Return That Taxpayers Have To File With The Irs Each Year To Report Taxable Income And Calculate Their Taxes Due.

If you have a commercial tenant that pays you over $600 of rent. You are engaged in a trade. You will then receive a form 1099 form. There are several ways landlords and property managers can collect rent.

You Are Not Engaged In A Trade Or Business.

Web by quickbooks september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web new 1099 requirements for landlords and rental property taxes. You can use a rent. The new 1099 form requirements have been delayed until 2024.

Web You Are Not Required To File Information Return (S) If Any Of The Following Situations Apply:

The american rescue plan of 2021 included a provision to change the requirements for filing. There are several types of 1099s used for different purposes, and. Web you can generally use schedule e (form 1040), supplemental income and loss to report income and expenses related to real estate rentals. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know if.

If You Have Not Already Entered The Applicable.

Employment authorization document issued by the department of homeland. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)