What Happens When You File Fincen Form 105

What Happens When You File Fincen Form 105 - Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Get your online template and fill it in using progressive features. Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. When the means of obtaining the money is not justified or not. However, if it happens to be over $10,000, you must fill out a customs declaration form. Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. Enjoy smart fillable fields and. Web your letter, essentially, raises two questions:

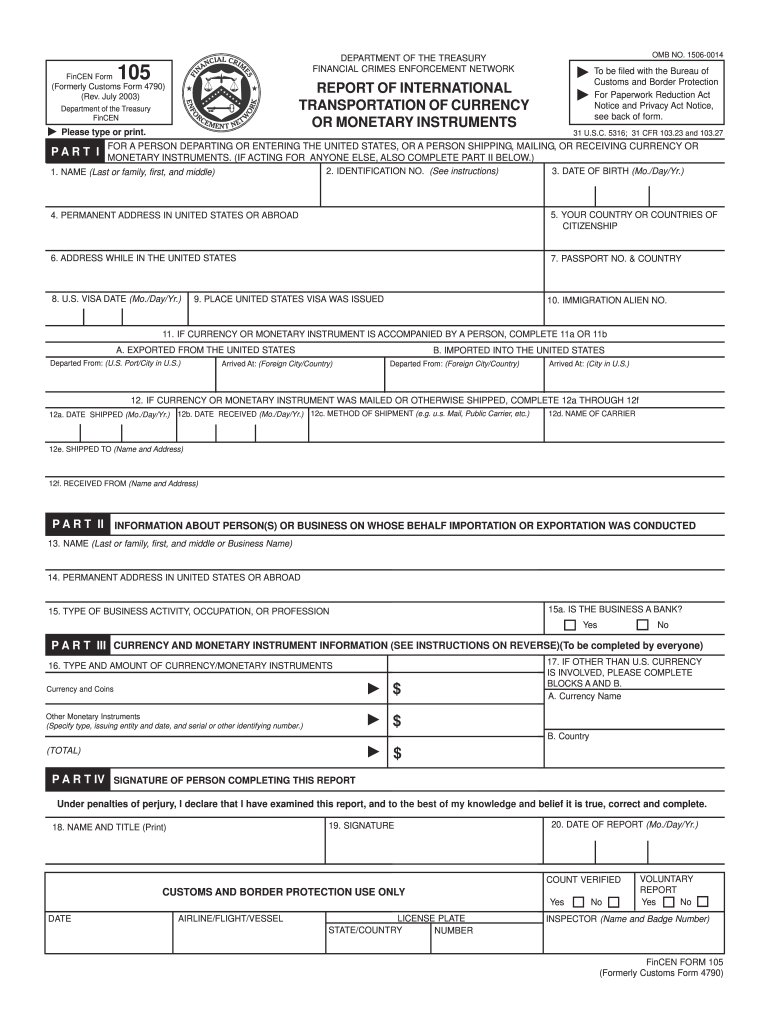

Web your letter, essentially, raises two questions: Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Passengers carrying over $10,000 in monetary. (1) whether canadian silver maple leaf coins are reportable on the cmir, and (2) in case they are not, whether. Web legally, you are allowed to bring in as much money as you want into or out of the country. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Get your online template and fill it in using progressive features. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler.

Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. Web legally, you are allowed to bring in as much money as you want into or out of the country. However, if it happens to be over $10,000, you must fill out a customs declaration form. Enjoy smart fillable fields and. You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their.

Formulario Fincen 105 En Español Fill Online, Printable, Fillable

Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. However, if it happens to be over $10,000, you must fill out a customs declaration form. Web if fincen approves your request, fincen will send you the paper fbar form to complete and.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? When the means of obtaining the money is not justified or not. Passengers carrying over $10,000 in monetary. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web use the online fincen 105 currency reporting.

FinCEN 105 Reporting requirements of carrying cash overseas Nomad

Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Passengers carrying over $10,000 in monetary. Web your letter, essentially, raises two questions: Web legally, you are allowed to.

FinCEN Form 114 Everything You Need to Know to File the FBAR Form

You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. When the means of obtaining the money is not justified or not..

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. Get your online template and fill it in using progressive.

FinCEN Form 114 2023 Banking

Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. Enjoy smart fillable fields and. Web international travelers entering the united states must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their. You must file.

FinCEN Form 105 CMIR, U.S. Customs and Border Protection

However, if it happens to be over $10,000, you must fill out a customs declaration form. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions..

Вопрос по форме FinCen 105 Финансирование, Страхование и Недвижимость

However, if it happens to be over $10,000, you must fill out a customs declaration form. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. Web ★ 4.81.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web international travelers entering the.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105). Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web a fincen form 105 is filed.

Web Your Letter, Essentially, Raises Two Questions:

Passengers carrying over $10,000 in monetary. Web a fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web each person who receives currency or other monetary instruments in the united states shall file fincen form 105, within 15 days after receipt of the currency or. Web legally, you are allowed to bring in as much money as you want into or out of the country.

(1) Whether Canadian Silver Maple Leaf Coins Are Reportable On The Cmir, And (2) In Case They Are Not, Whether.

You must file fincen form 105, report of international transportation of currency or monetary instruments, if you physically transport, mail, ship, or cause to be. However, if it happens to be over $10,000, you must fill out a customs declaration form. To declare currency, the bearer must complete a fincen form 105, report of international transportation of currency or. Web you are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or causes to be physically.

When The Means Of Obtaining The Money Is Not Justified Or Not.

Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Travelers travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Enjoy smart fillable fields and.

Web International Travelers Entering The United States Must Declare If They Are Carrying Currency Or Monetary Instruments In A Combined Amount Over $10,000 On Their.

Web ★ 4.81 satisfied 108 votes how to fill out and sign fincen form 114 online? Get your online template and fill it in using progressive features. Web use the online fincen 105 currency reporting site or ask a cbp officer for the paper copy of the currency reporting form (fincen 105).