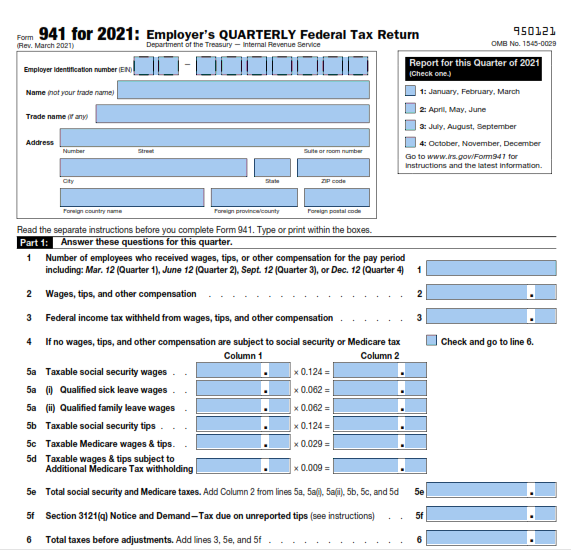

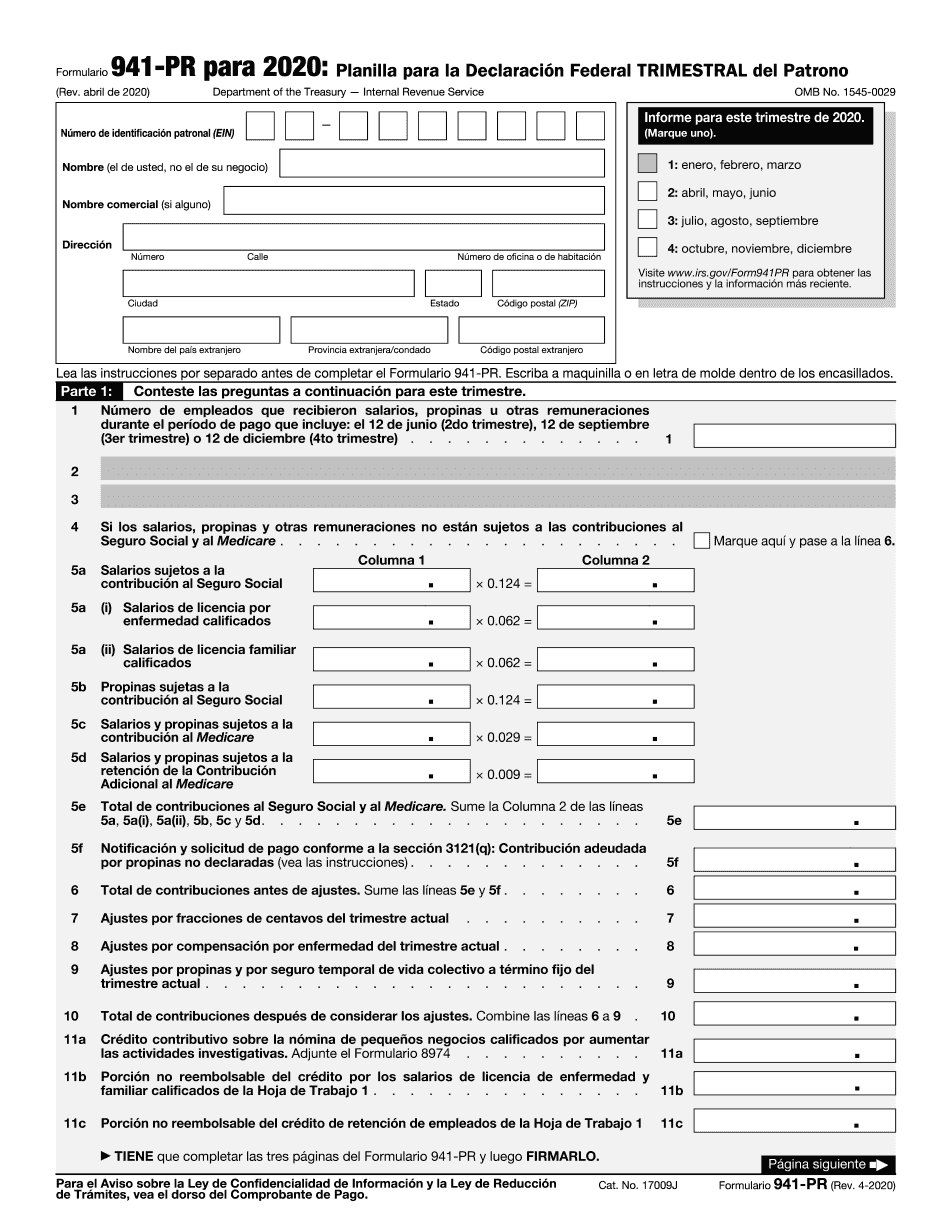

What Is 941 Form 2022

What Is 941 Form 2022 - 26 by the internal revenue service. Ad upload, modify or create forms. The deadline is the last day of the month following the end of the quarter. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Web you file form 941 quarterly. The irs form 941 is an employer's quarterly tax return. Web overview you must file irs form 941 if you operate a business and have employees working for you. These instructions have been updated for changes due to the. Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for.

Web overview you must file irs form 941 if you operate a business and have employees working for you. The last time form 941 was. These instructions have been updated for changes due to the. Web this is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. Web form 941 for 2022: Form 941 reports federal income and fica taxes each. The deadline is the last day of the month following the end of the quarter. The draft form 941 ,. Web payroll tax returns. It also provides space to calculate and.

The irs form 941 is an employer's quarterly tax return. Web what is irs form 941? Web report for this quarter of 2022 (check one.) 1: Employers use this form to report income taxes, social security. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. Form 941 reports federal income and fica taxes each. Try it for free now! Certain employers whose annual payroll tax and withholding.

Top10 US Tax Forms in 2022 Explained PDF.co

Web form 941 for 2023: Employers use this form to report income taxes, social security. Web payroll tax returns. Web report for this quarter of 2022 (check one.) 1: Web form 941 is a internal revenue service (irs) tax form for employers in the u.s.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Form 941 reports federal income and fica taxes each. Ad upload, modify or create forms. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

Web payroll tax returns. You must complete all five pages. Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for. Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. The irs form 941.

How to Complete Form 941 in 5 Simple Steps

Certain employers whose annual payroll tax and withholding. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to the irs. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. March 2023).

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web given that most us employers are required to file quarterly federal tax returns, 2022 form 941, the employer’s quarterly tax form, is an essential tax form for. The last time form 941 was. Type or print within the boxes. Use the march 2022 revision of form 941 only to report taxes for the quarter ending march 31, 2022. It.

Printable 941 Form Printable Form 2021

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web overview you must file irs form 941 if you operate a business and have employees.

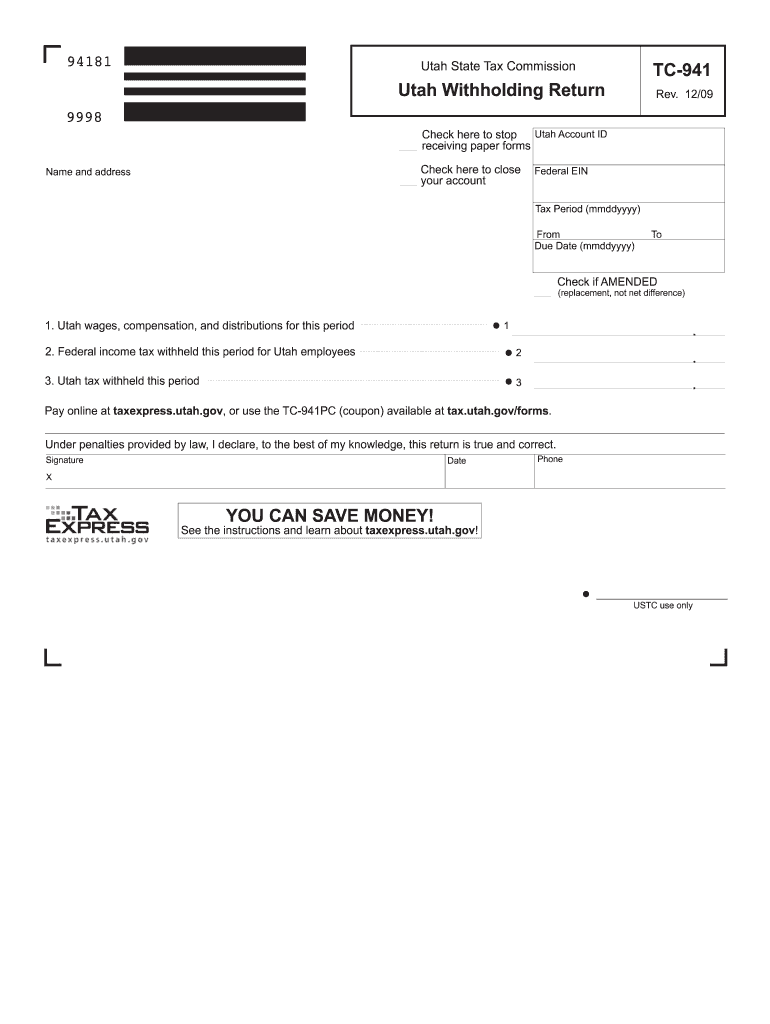

Tc 941E Fill Out and Sign Printable PDF Template signNow

Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web overview you must file irs form 941 if you operate a business and have employees working for you. The draft form 941 ,. Web given that most.

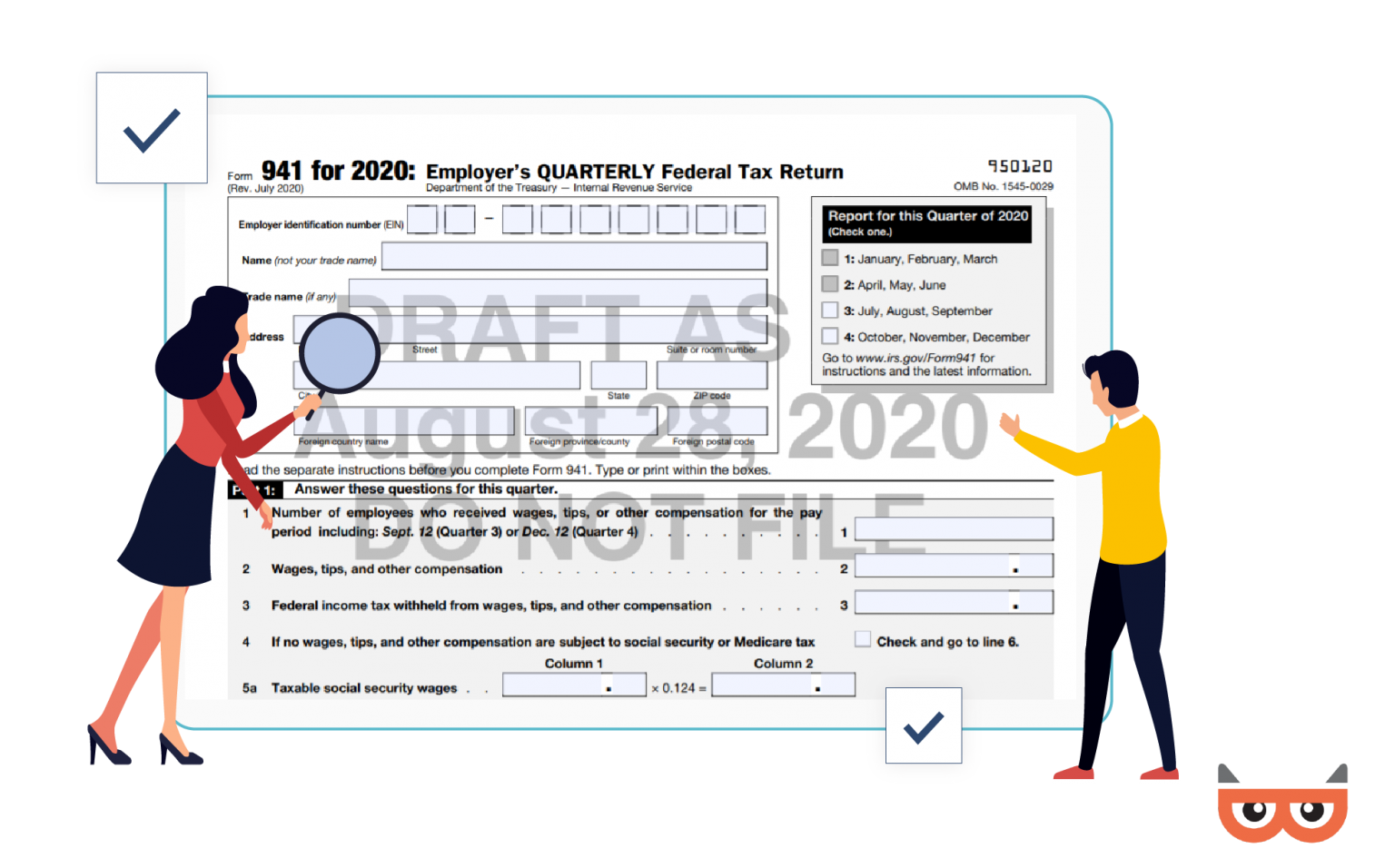

Form 941 Is Revised Yet Again For The Third Quarter Of 2020 Blog

Web report for this quarter of 2022 (check one.) 1: Web payroll tax returns. Try it for free now! Web overview you must file irs form 941 if you operate a business and have employees working for you. Ad irs 941 inst & more fillable forms, register and subscribe now!

New 941 form for second quarter payroll reporting

The irs form 941 is an employer's quarterly tax return. The last time form 941 was. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Employers use this form to report income taxes, social security.

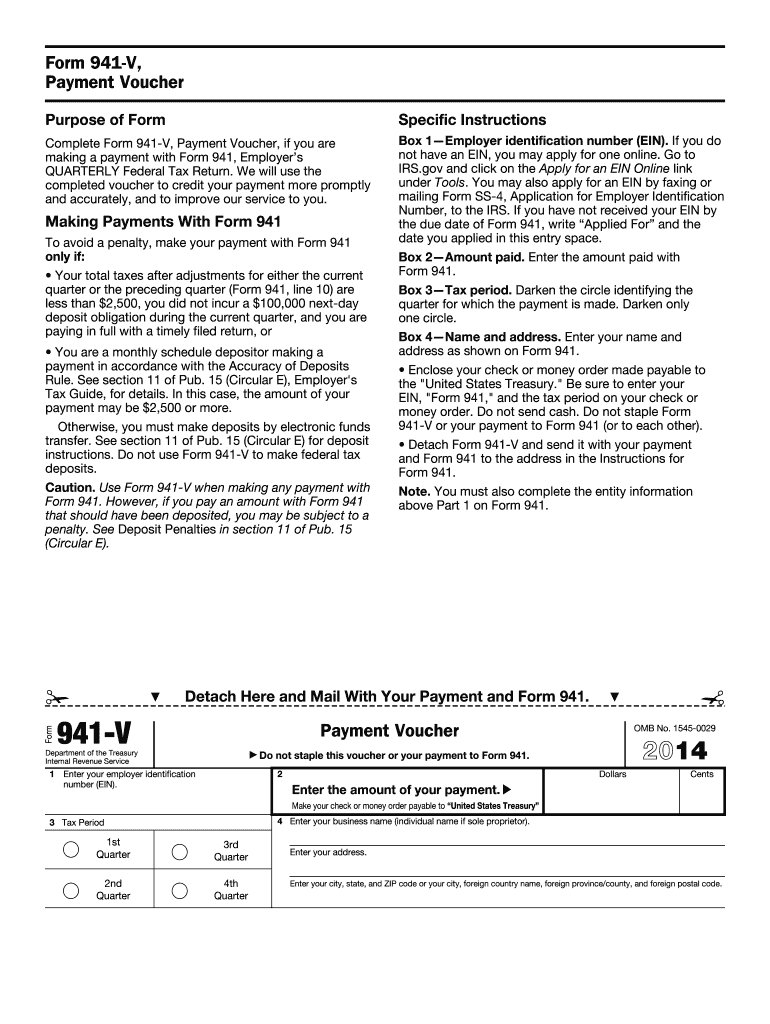

941 V Fill Out and Sign Printable PDF Template signNow

Employers use this form to report income taxes, social security. Certain employers whose annual payroll tax and withholding. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web report for this quarter of 2022 (check one.) 1: Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was.

The Deadline Is The Last Day Of The Month Following The End Of The Quarter.

June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Certain employers whose annual payroll tax and withholding. Web form 941 for 2023: Ad upload, modify or create forms.

Web A Draft Version Of The 2022 Form 941, Employer’s Quarterly Federal Tax Return, Was Released Jan.

Type or print within the boxes. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Ad irs 941 inst & more fillable forms, register and subscribe now! Web you file form 941 quarterly.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950122.

Web overview you must file irs form 941 if you operate a business and have employees working for you. The last time form 941 was. These instructions have been updated for changes due to the. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

It Also Provides Space To Calculate And.

Employers use this form to report income taxes, social security. Get ready for tax season deadlines by completing any required tax forms today. 26 by the internal revenue service. Employers use tax form 941 to report federal income tax withheld, social.