What Is A 2290 Form

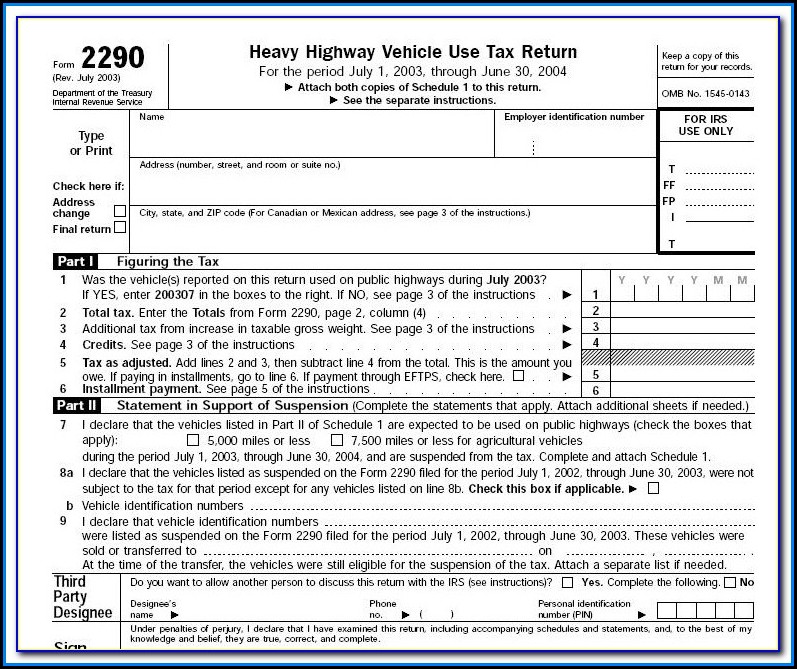

What Is A 2290 Form - The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Irs form 2290 instructions can be found on the irs website. If you place an additional taxable truck registered in your name on the road during. Include the last two pages, if applicable. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Calculate and pay the tax due on vehicles that weigh (fully loaded: Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). As defined by the irs, the 2290 tax form is used to: Tractor and trailer) 55,000 lbs or more.

If you place an additional taxable truck registered in your name on the road during. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. See when to file form 2290 for more details. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? As defined by the irs, the 2290 tax form is used to: The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Web when form 2290 taxes are due. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? Include the last two pages, if applicable. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Web what is a form 2290? The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. See when to file form 2290 for more details. Complete the first four pages of form 2290.

Fillable Form 2290 20232024 Create, Fill & Download 2290

See when to file form 2290 for more details. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. In short, a form 2290 is a tax document used to record and calculate the.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web 2290 tax form. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. It is due annually between july 1 and august 31 for vehicles that drive on.

File 20222023 Form 2290 Electronically 2290 Schedule 1

The current period begins july 1, 2023, and ends june 30, 2024. See when to file form 2290 for more details. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Include the last two pages, if applicable. Calculate and pay the tax due on vehicles that weigh (fully loaded:

Electronic IRS Form 2290 2018 2019 Printable PDF Sample

Calculate and pay the tax due on vehicles that weigh (fully loaded: Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. The tax amount due is based on the vehicle’s.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web what is a form 2290? In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of.

Form 2290 Irs Phone Number Form Resume Examples v19x1DoY7E

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

Tractor and trailer) 55,000 lbs or more. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web when form 2290 taxes are due. Web what is a form 2290? Web the irs form 2290 is what you file to pay the heavy highway vehicle use.

Irs.gov Form 2290 Form Resume Examples

For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Irs form 2290 instructions can be found on the irs website. Web when form 2290 taxes are due. See when to file form 2290 for more details. Tractor and trailer) 55,000 lbs or.

How to Efile Form 2290 for 202223 Tax Period

Irs form 2290 instructions can be found on the irs website. If you place an additional taxable truck registered in your name on the road during. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. See when to file form 2290 for more details. (this runs from.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Irs form 2290 instructions can be found on the irs website. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290? Form 2290 must be filed by the last day of the month following the.

Web Form 2290 Is An Irs Tax Form That You Need To File If You Own A Heavy Vehicle Weighing 55,000 Pounds Or More.

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web what is a form 2290? Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Everyone must complete the first and second pages of form 2290 along with both pages of schedule 1.

See When To File Form 2290 For More Details.

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Include the last two pages, if applicable. Web the irs form 2290 is what you file to pay the heavy highway vehicle use tax. (this runs from july 1st to june 30th each year) what is the purpose of a form 2290?

Calculate And Pay The Tax Due On Vehicles That Weigh (Fully Loaded:

The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. The tax amount due is based on the vehicle’s weight as well as mileage traveled during the year. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. As defined by the irs, the 2290 tax form is used to:

Tractor And Trailer) 55,000 Lbs Or More.

In short, a form 2290 is a tax document used to record and calculate the use of heavy highway vehicles that operate on public highways, exceed a gross weight of 55,000 pounds, and travel more than 5,000 miles in the taxable year. If you place an additional taxable truck registered in your name on the road during. It is due annually between july 1 and august 31 for vehicles that drive on american highways with a gross vehicle weight of 55,000 pounds or more. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31.