What Is A 944 Tax Form

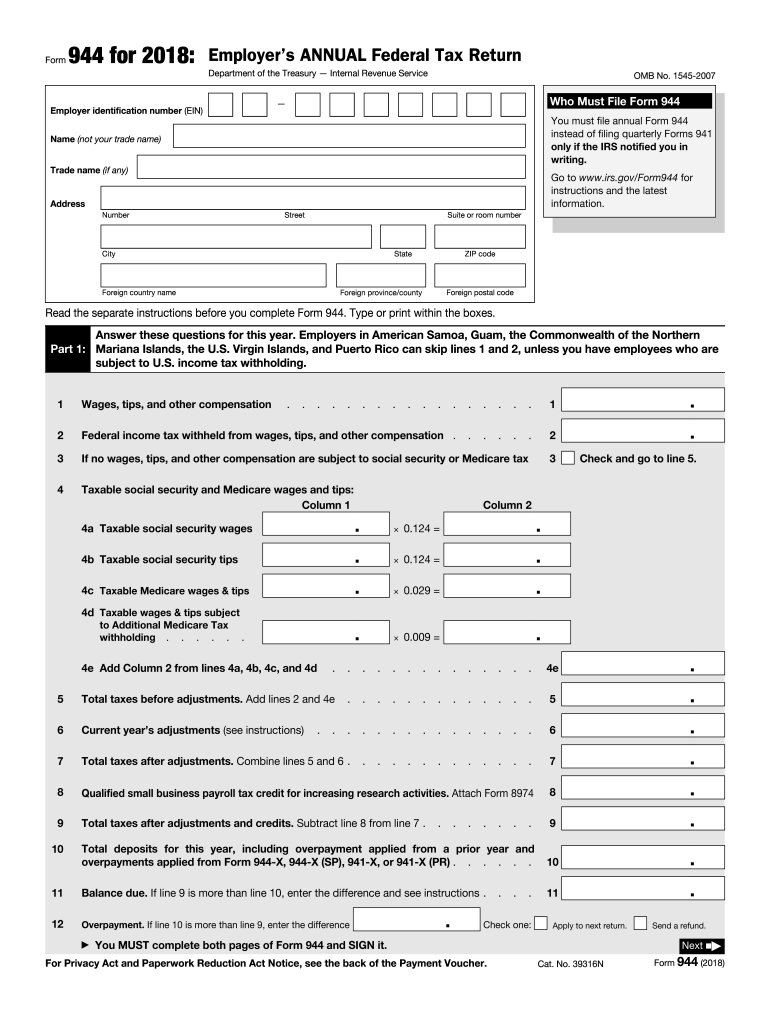

What Is A 944 Tax Form - Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. This form is designed specifically for very small businesses with a tax liability of $1,000 or less. Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. For instructions and the latest information. Should you file form 944 or 941? Form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. Only if the irs notified you in writing. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your employees’ paychecks. Who must file form 944.

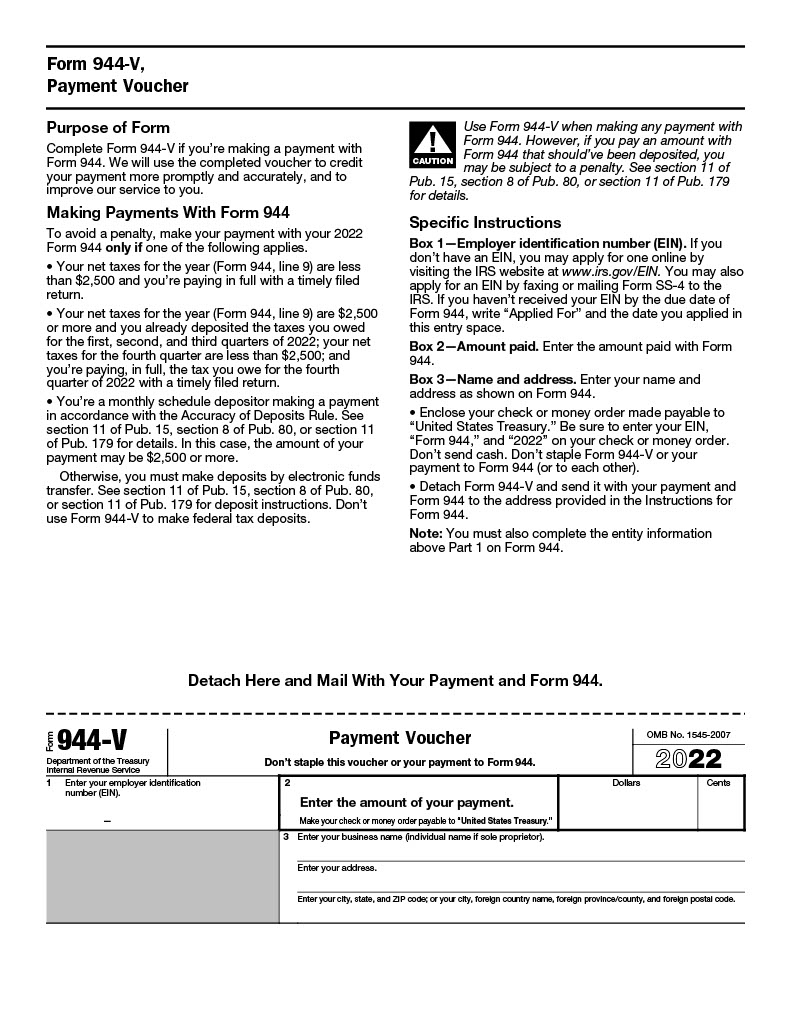

Should you file form 944 or 941? You must file annual form 944 instead of filing quarterly forms 941. Employer’s annual federal tax return department of the treasury — internal revenue service. Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. Who must file form 944. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Web form 944 for 2022: Only if the irs notified you in writing. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. Web irs form 944 is the employer's annual federal tax return.

Web form 944 for 2022: Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. The deadline for the form 944 is january 31. Only if the irs notified you in writing. Should you file form 944 or 941? Web irs form 944 is the employer's annual federal tax return. If you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you may be eligible to update your filing requirement to form 941, employer's quarterly federal tax return. File form 944 only once for each calendar year. Employers who use form 944, employer’s annual federal tax return, report wages. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023.

Annual Form 944 Read below definition as well as explanation to the

Web what is form 944? The deadline for the form 944 is january 31. If you filed form 944 electronically, don't file a paper form 944. Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. However, if you made deposits on time in full payment of the taxes due.

Form 944 Fill Out and Sign Printable PDF Template signNow

Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Who needs to file form 944? The deadline for the form 944 is january 31. Only if the irs notified you in writing. Web irs form 944,.

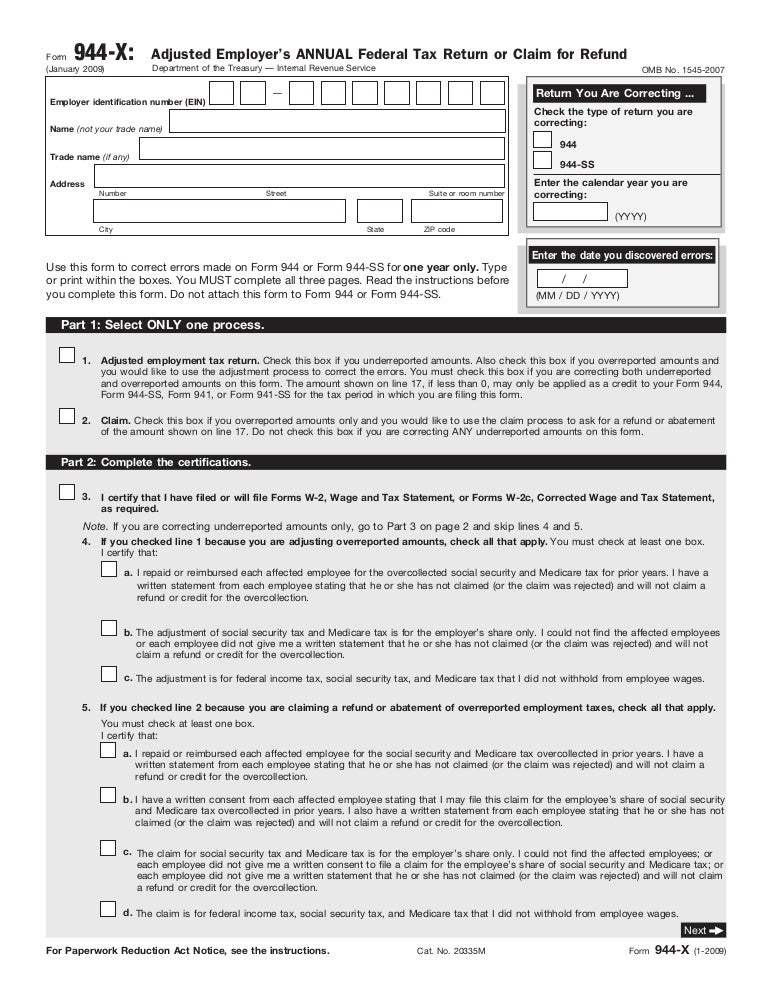

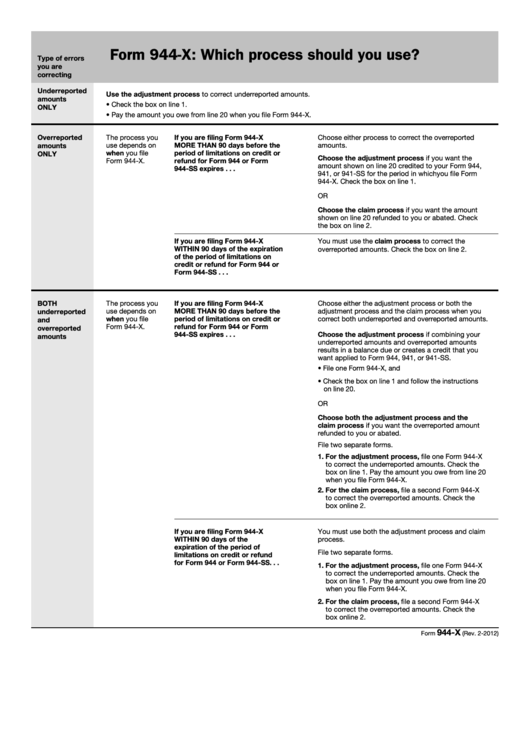

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Employers who use form 941, employer’s quarterly federal tax return, report wages and taxes four times per year. You must file annual form 944 instead of filing quarterly forms 941. Who must file form 944. The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well.

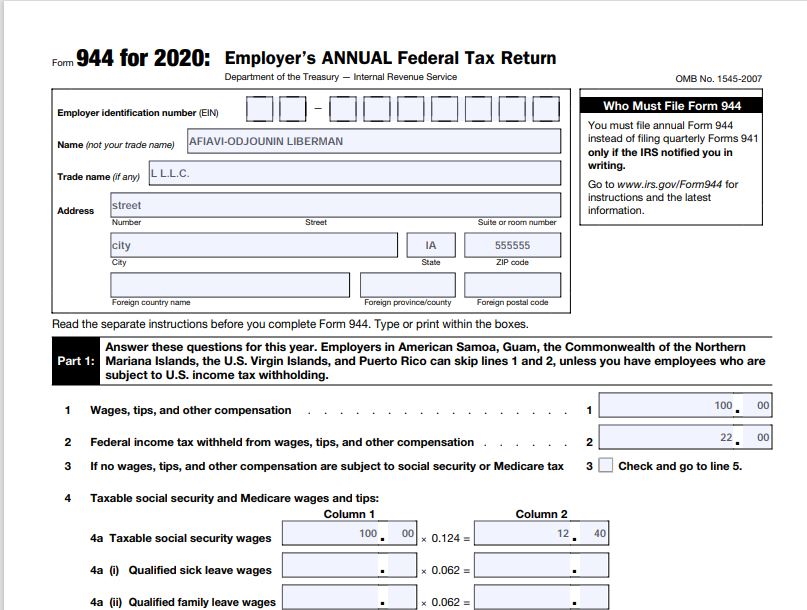

How to Complete Form 944 for 2020 Employer’s Annual Federal Tax

However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is.

Instructions For Form 944X Adjusted Employer'S Annual Federal Tax

Small business owners also use irs form 944 to calculate and report their employer social security and medicare tax liability. The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. This form is designed specifically.

Form 944SS Employer's Annual Federal Tax Return Form (2011) Free

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. Web form 944 is an irs tax.

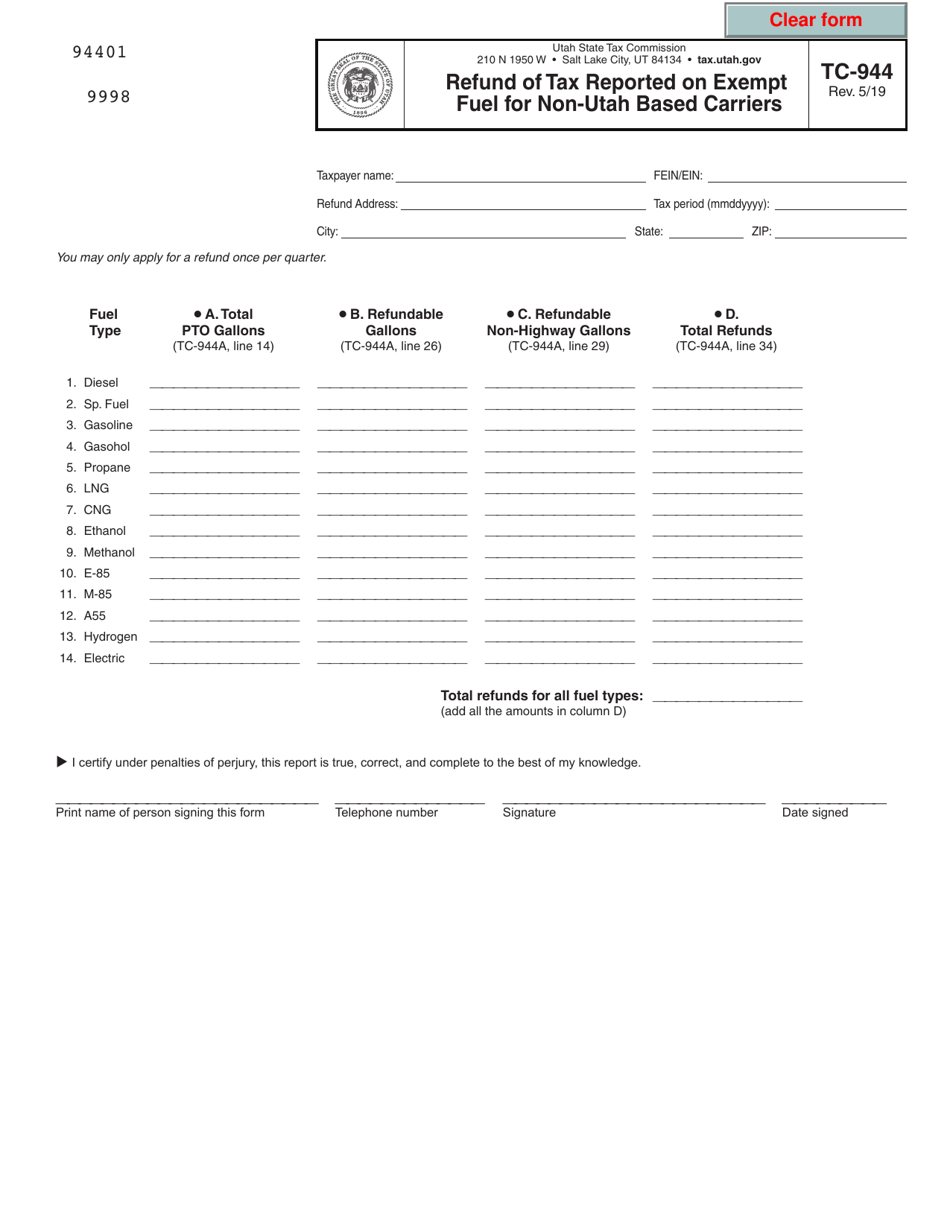

Form TC944 Download Fillable PDF or Fill Online Refund of Tax Reported

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10,.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

Should you file form 944 or 941? Web forms 941 and 944 are the two forms that employers use to report employee wage and payroll tax information to the irs. Who needs to file form 944? Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual.

Form 944 2023, Employer's Annual Federal Tax Return

Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly. Form 944 also reports payroll taxes, however, this form is an annual form rather than a quarterly form. You must file annual form 944 instead of filing quarterly forms 941. The deadline for the form 944.

File Form 944 Online EFile 944 Form 944 for 2022

The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. File form 944 only once for each calendar year. Form 944 also reports payroll taxes, however, this form is an annual form rather than a.

If You Filed Form 944 Electronically, Don't File A Paper Form 944.

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The form was introduced by the irs to give smaller employers a break in filing and paying federal income tax withheld from employees, as well social security and medicare payments owed by employers and employees. If you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than $1,000, you may be eligible to update your filing requirement to form 941, employer's quarterly federal tax return. Form 944 allows small employers ($1,000 or less of annual liability for social security, medicare, and withheld income taxes) to pay yearly, not quarterly.

Small Business Owners Also Use Irs Form 944 To Calculate And Report Their Employer Social Security And Medicare Tax Liability.

File form 944 only once for each calendar year. Web for 2022, file form 944 by january 31, 2023. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Employer’s annual federal tax return department of the treasury — internal revenue service.

Web Form 944 For 2022:

Web form 944, employer’s annual federal tax return, is a form that eligible small businesses file annually to report federal income tax and fica tax (social security and medicare taxes) on employee wages. Small business employers with an annual liability for social security, medicare, and withheld federal income taxes of $1,000 or less have to file annual information returns instead of the quarterly form 941. For instructions and the latest information. Who must file form 944.

Should You File Form 944 Or 941?

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. This form is designed specifically for very small businesses with a tax liability of $1,000 or less. You must file annual form 944 instead of filing quarterly forms 941. Web irs form 944 is the employer's annual federal tax return.