What Is A Beneficial Owner Form

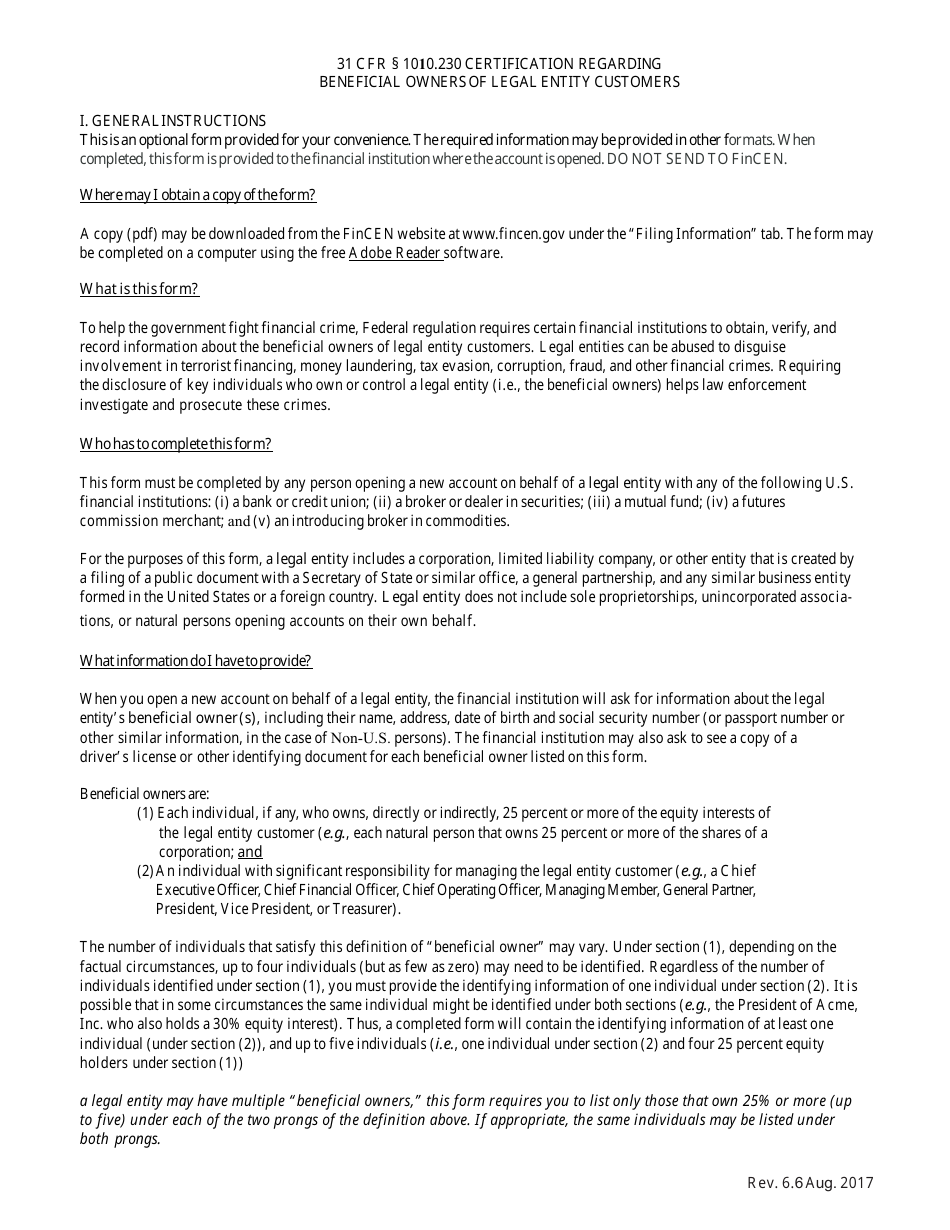

What Is A Beneficial Owner Form - Web under the rule, a beneficial owner includes any individual who, directly or indirectly, either (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. Web beneficial ownership information reporting. The rule defines the terms “substantial control” and “ownership interest.” A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web fincen is issuing a final rule requiring certain entities to file with fincen reports that identify two categories of individuals: Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). The form to use depends on the type of certification being made. Beneficial ownership information will not be accepted prior to january 1, 2024. Or (v) an introducing broker in commodities. The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do.

(i) a bank or credit union; Web fincen is issuing a final rule requiring certain entities to file with fincen reports that identify two categories of individuals: The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). The form to use depends on the type of certification being made. (iv) a futures commission merchant; The rule defines the terms “substantial control” and “ownership interest.” Web under the rule, a beneficial owner includes any individual who, directly or indirectly, either (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. (ii) a broker or dealer in securities;

(i) a bank or credit union; Beneficial ownership information will not be accepted prior to january 1, 2024. Or (v) an introducing broker in commodities. Web beneficial ownership information reporting. (iv) a futures commission merchant; Web under the proposed rule, a beneficial owner would include any individual who (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. Web the beneficial owner form. Web fincen is issuing a final rule requiring certain entities to file with fincen reports that identify two categories of individuals: The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022.

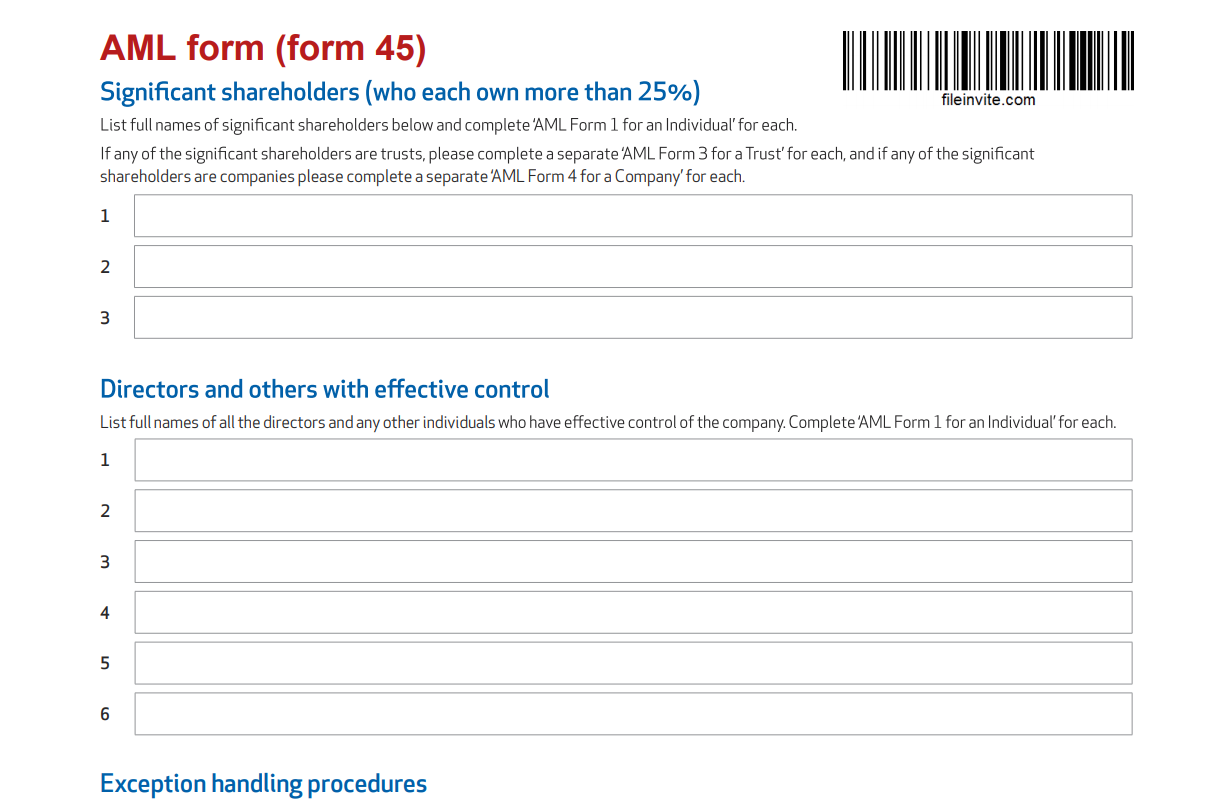

Create an online Beneficial Ownership Declaration Form with FileInvite

Where such an interest is held through a trust, the trustee (s) or anyone who controls the trust will be registered as the beneficial owner (s). (iv) a futures commission merchant; Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the.

Beneficial Ownership Form Blank Fill Online, Printable, Fillable

When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap. (ii) a broker or dealer in securities; The rule defines the terms “substantial control” and “ownership interest.” Beneficial ownership information will not be accepted prior to january 1, 2024. Web new standards for teaching black history in florida’s public schools.

Do you need a Beneficial Owner Tax Transparency Certification for your

Web beneficial ownership information reporting. Web new standards for teaching black history in florida’s public schools were approved wednesday that include teaching pupils how slaves developed beneficial skills. The form to use depends on the type of certification being made. Or (v) an introducing broker in commodities. Web fincen is issuing a final rule requiring certain entities to file with.

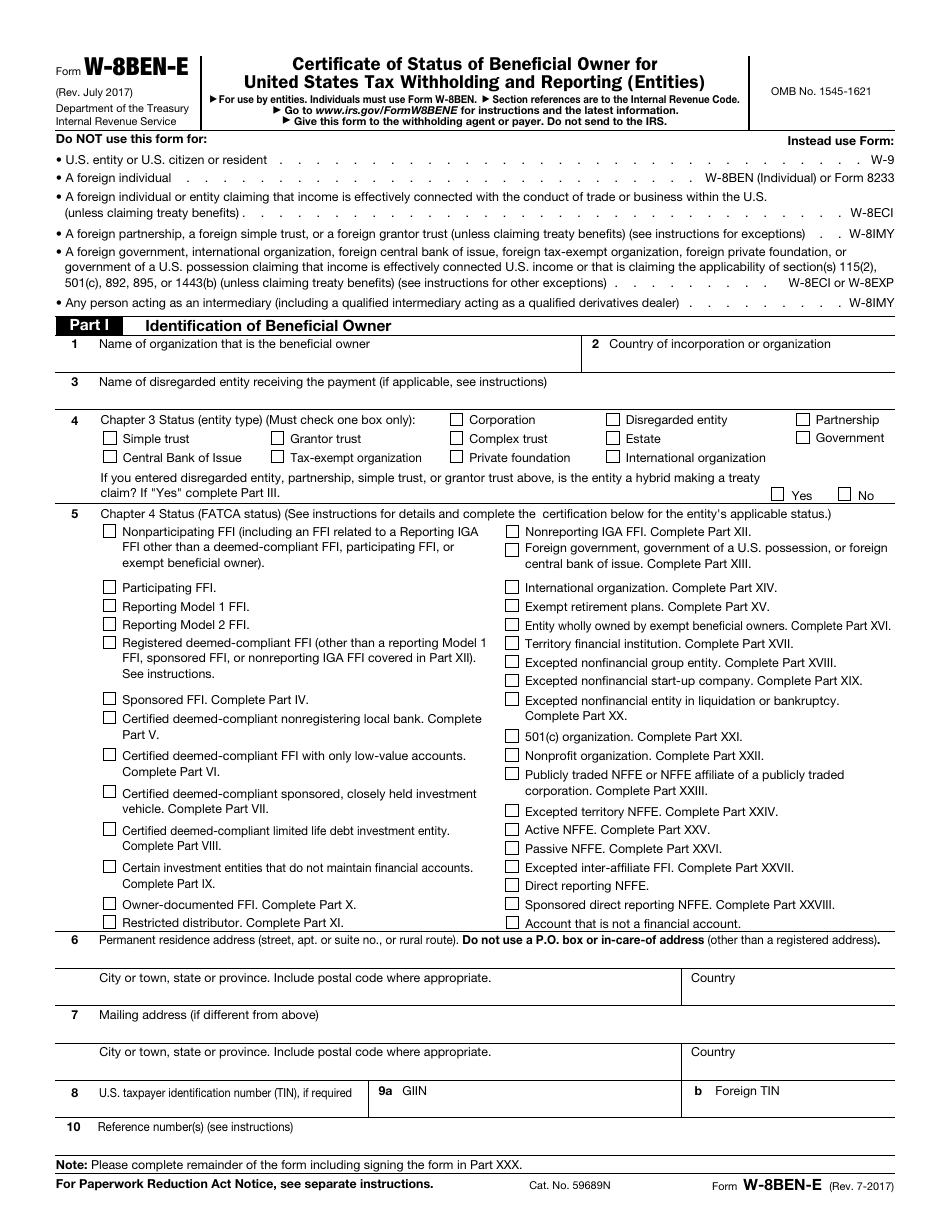

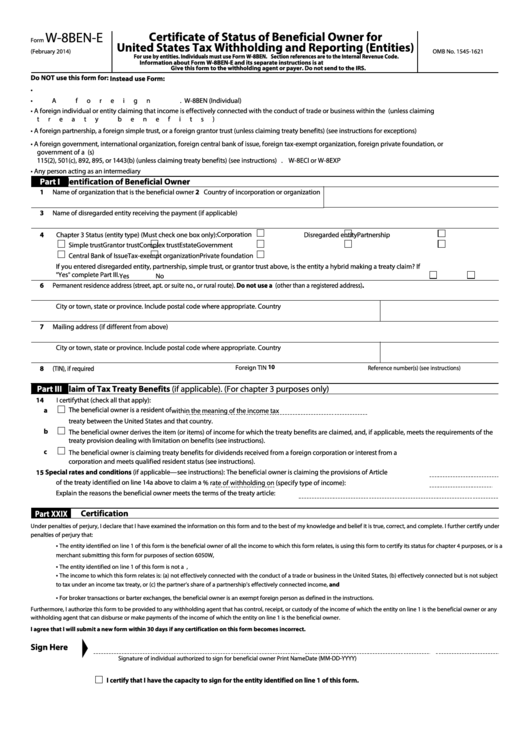

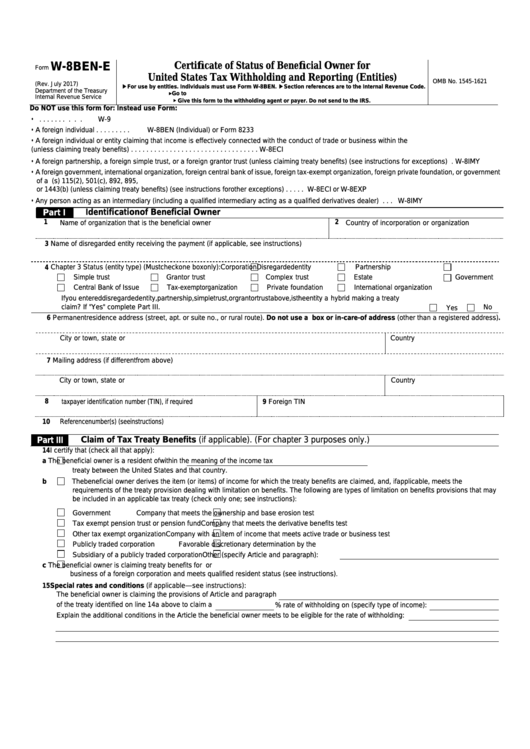

Form W8BENE Certificate of Entities Status of Beneficial Owner for

The rule defines the terms “substantial control” and “ownership interest.” Web the beneficial owner form. (i) a bank or credit union; Or (v) an introducing broker in commodities. Web beneficial ownership information reporting.

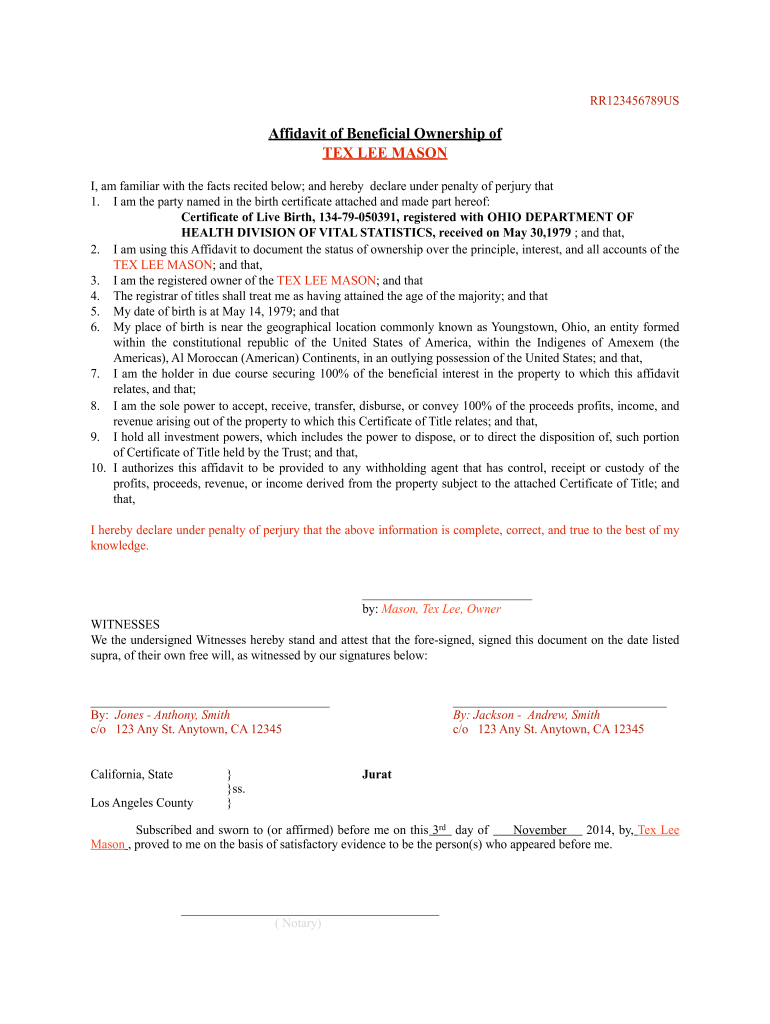

Rule 220 Affidavit Of Ownership Fill Out and Sign Printable PDF

Beneficial ownership information will not be accepted prior to january 1, 2024. These regulations go into effect on january 1, 2024. Web beneficial ownership information reporting. The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing. The rule defines the terms “substantial control”.

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Web the beneficial owner form. Web new standards for teaching black history in florida’s public schools were approved wednesday that include teaching pupils how slaves developed beneficial skills. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. The form to use depends on the type of certification being.

Certification of Beneficial Owner(S) Download Fillable PDF Templateroller

(i) a bank or credit union; Beneficial ownership information will not be accepted prior to january 1, 2024. These regulations go into effect on january 1, 2024. (iv) a futures commission merchant; When opening an account at fifth third bank, national assocation, the beneficial ownership form must be completed by the nap.

IRS Form W8BENE Download Fillable PDF or Fill Online Certificate of

Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web the beneficial owner form. Or (v) an introducing broker in commodities. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022. Web fincen.

Fillable Form W8benE Certificate Of Status Of Beneficial Owner For

Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. Beneficial ownership.

Form W8benE Certificate Of Status Of Beneficial Owner For United

The rule defines the terms “substantial control” and “ownership interest.” Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to.

These Regulations Go Into Effect On January 1, 2024.

Web fincen is issuing a final rule requiring certain entities to file with fincen reports that identify two categories of individuals: The form to use depends on the type of certification being made. Web a beneficial owner is an individual who ultimately owns or controls more than 25% of a company’s shares or voting rights, or who otherwise exercises control over the company or its management. Web under the rule, a beneficial owner includes any individual who, directly or indirectly, either (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company.

When Opening An Account At Fifth Third Bank, National Assocation, The Beneficial Ownership Form Must Be Completed By The Nap.

The beneficial owners of the entity, and individuals who have filed an application with specified governmental authorities to create the entity or register it to do. Web new standards for teaching black history in florida’s public schools were approved wednesday that include teaching pupils how slaves developed beneficial skills. (i) a bank or credit union; (iv) a futures commission merchant;

Where Such An Interest Is Held Through A Trust, The Trustee (S) Or Anyone Who Controls The Trust Will Be Registered As The Beneficial Owner (S).

The rule defines the terms “substantial control” and “ownership interest.” Web this form must be completed by the person opening a new account on behalf of a legal entity with any of the following u.s. Web under the proposed rule, a beneficial owner would include any individual who (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. A final rule implementing the beneficial ownership information reporting requirements of the corporate transparency act (cta) was issued in september 2022.

Or (V) An Introducing Broker In Commodities.

(ii) a broker or dealer in securities; The form requires, among other information, the name, business address or primary residence address, date of birth, social security number (as applicable), the name of the issuing. Beneficial ownership information will not be accepted prior to january 1, 2024. Web beneficial ownership information reporting.