What Is A Draw Draft Payment

What Is A Draw Draft Payment - A demand draft is a prepaid instrument;. Web bank drafts are a popular payment method that is widely used for international transactions, including purchasing goods and services, making payments, and transferring money. Web this draft lottery has proven as volatile as it can get. Web the draw schedule is a detailed payment plan for a construction project. A total of 13 teams enter the event. (it’s sometimes called “autopay” or “ach withdrawal.”) then your payment is deducted from your account on the same day every month. Learn how bank drafts work, their advantages, and how they compare to other payment options. It is a kind of auto payment. Web a bank draft — also referred to as a bank check, banker’s draft, or teller’s check — is a financial instrument that a bank issues on behalf of its customers. When you automatically draft payment, you get paid faster than when you use checks.

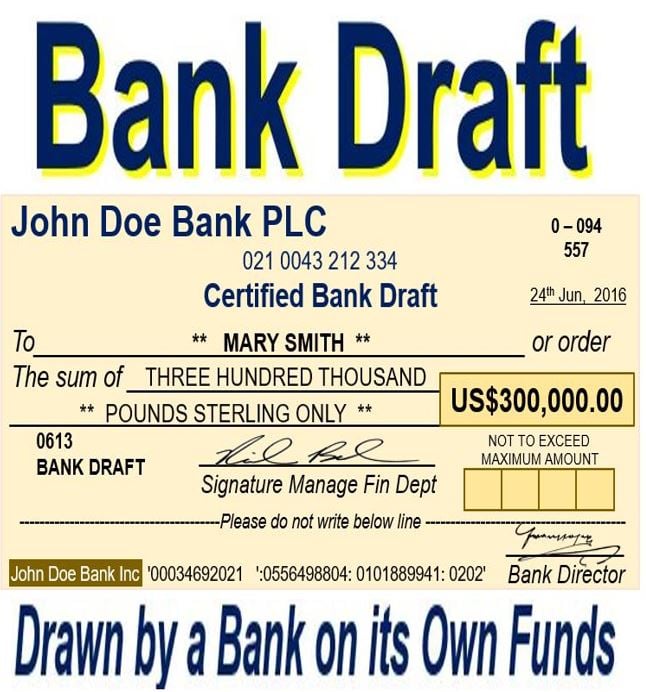

How does a bank draft work? Web a bank draft is a payment instrument that carries a guarantee of funds from your financial institution. Once the person or company pays in your cheque, their bank asks your bank to transfer over the money. to get a banker’s draft, a bank customer must have funds (or cash) available. These are typically split up into various milestones or phases of the overall project. A bank draft is a payment that is guaranteed by the issuing bank. The order of the top 14 picks in this year's draft will be determined this weekend via the 2024 nba draft lottery. It’s a paper document that looks a lot like a regular cheque. But unlike personal checks, a draft is guaranteed by the issuing bank, with no chance that the check could bounce. The main difference is that someone who receives a bank draft has a guarantee that the funds are available, as opposed to a regular cheque, which could bounce.

Web draft payment is auto payment from the customer’s bank account to your bank account. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. A total of 13 teams enter the event. The order of the top 14 picks in this year's draft will be determined this weekend via the 2024 nba draft lottery. to get a banker’s draft, a bank customer must have funds (or cash) available. It is a kind of auto payment. Web this draft lottery has proven as volatile as it can get. It is commonly used in financial transactions, particularly for larger sums of money. Learn how bank drafts work, their advantages, and how they compare to other payment options. Discover the ins and outs of bank drafts, a secure payment method guaranteed by the issuing bank, commonly used for significant transactions.

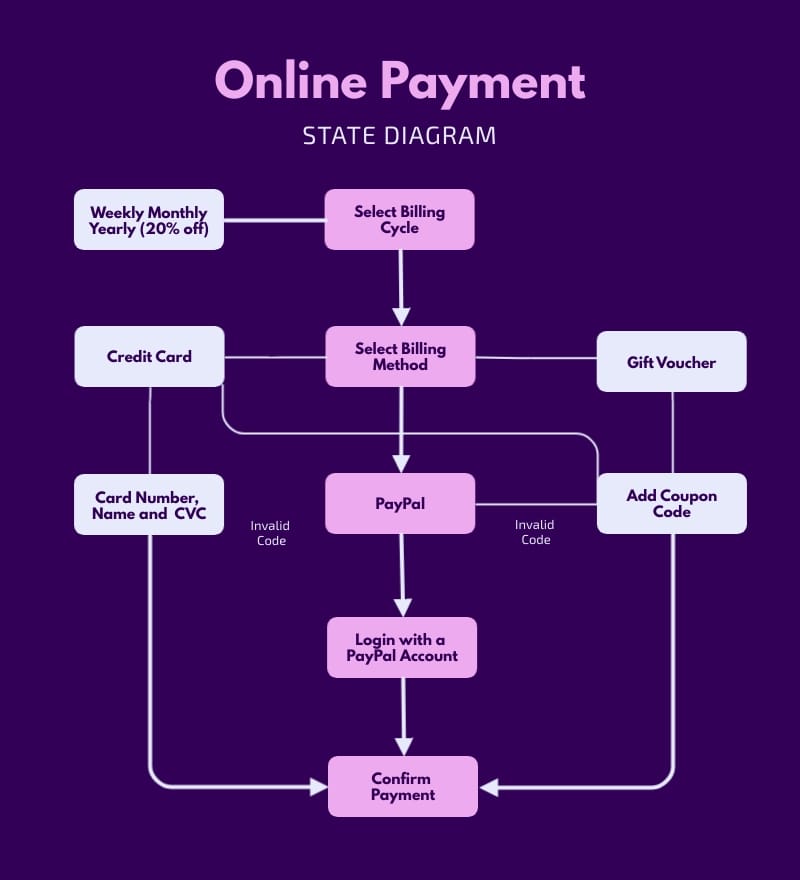

Online Payment State Diagram Template Visme

A bank draft is a payment that is guaranteed by the issuing bank. similar to a cashier’s check, a legitimate bank draft is safer than a personal check when accepting large payments. (it’s sometimes called “autopay” or “ach withdrawal.”) then your payment is deducted from your account on the same day every month. Web this draft lottery has.

Payment systems models Paiementor

to get a banker’s draft, a bank customer must have funds (or cash) available. Web the term bank draft (also called a banker's draft, bank check, or teller's check) is a paper document that resembles a traditional paper check. Web bank drafts are a popular payment method that is widely used for international transactions, including purchasing goods and.

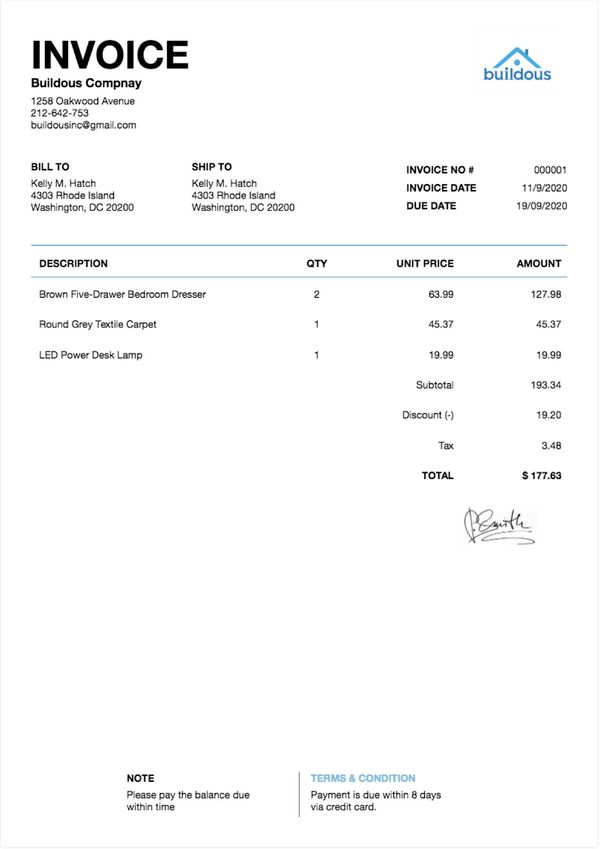

How to Make An Invoice & Get Paid Faster (10+ Invoice Templates)

Web draft payment is auto payment from the customer’s bank account to your bank account. A cheque is an official piece of paper from your bank that you can use to pay with, a bit like an iou. Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount.

Direct Draw Draft System Examples

When you automatically draft payment, you get paid faster than when you use checks. With a draw schedule in place, an owner or project manager will submit a detailed report of the work completed at certain points in the project. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a.

52 BANK DRAFT EXPLANATION BankDraft

It is issued by banks to transfer money from one bank account to another. Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one account and credited to. Web a draft is a widely accepted method of payment that allows one party to send.

Direct Draw Draft System Examples

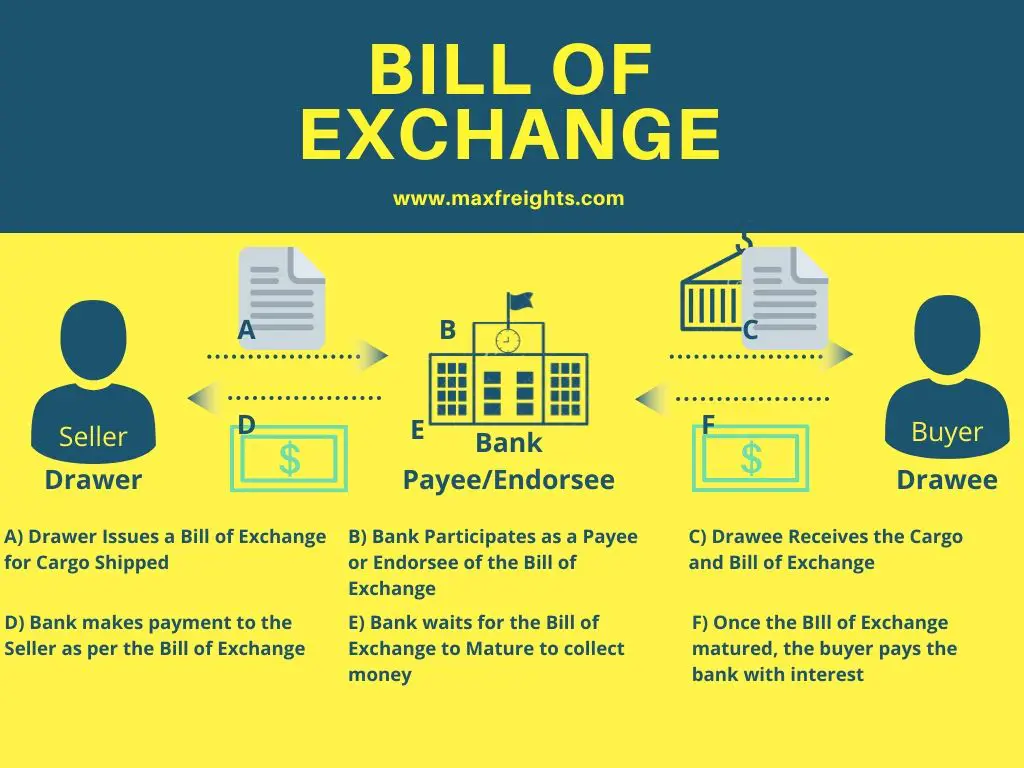

Web what is autodraft? Web a time draft indicates payment a certain number of days after a date or an event for the payment, for example, “30 days after the bill of lading date.” in summary, the drawer demands payment from the drawee and instructs the drawee to make payment to the payee of a certain amount on a certain.

Long Draw Draft Systems Better Beer Revolution Dallas/Fort Worth

Web a draft, in the context of banking, refers to a written order that instructs a bank to pay a specific amount of money from one account to another. It’s a secure way of making payments, ensuring that the funds are available and will be transferred to the recipient. Web a demand draft (dd) is a financial instrument that functions.

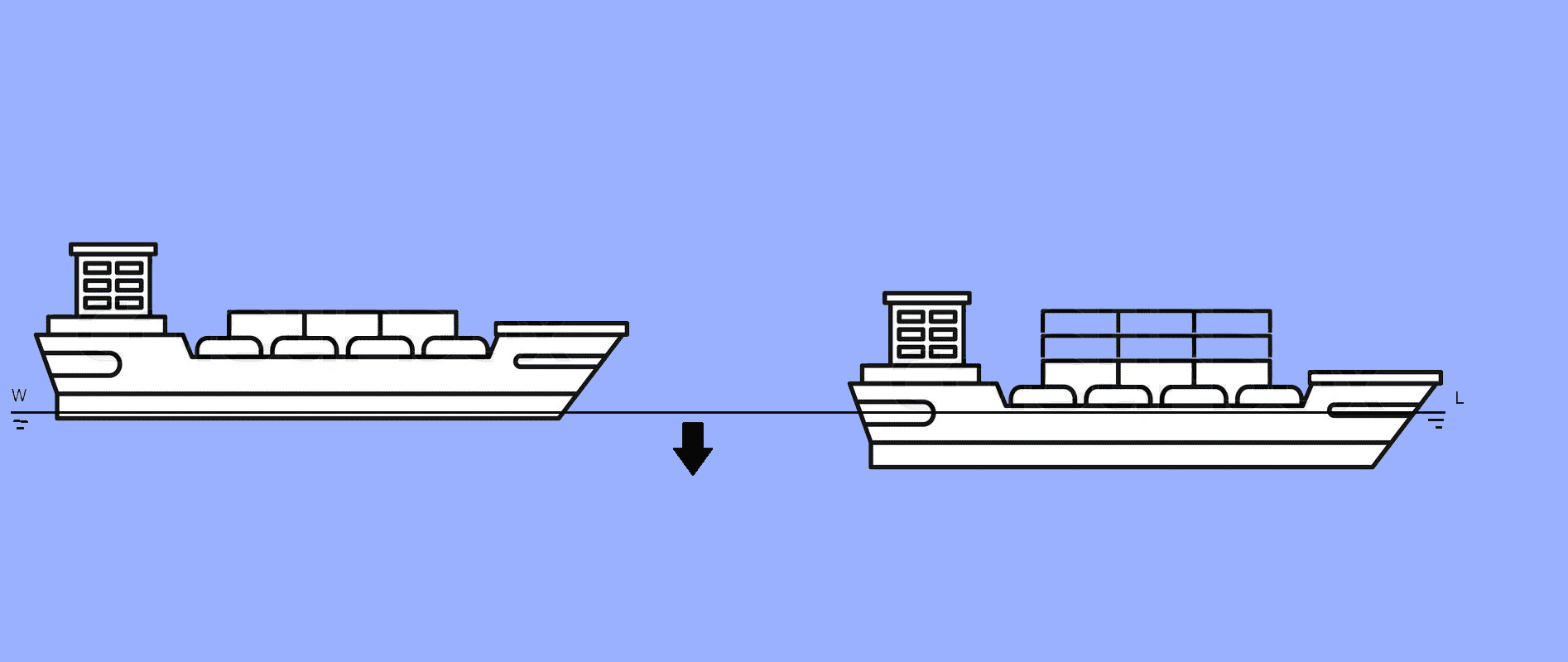

What Is Draft or Draught Of A Ship?

The goal is to make progress. But unlike personal checks, a draft is guaranteed by the issuing bank, with no chance that the check could bounce. When you automatically draft payment, you get paid faster than when you use checks. Web draft payment is auto payment from the customer’s bank account to your bank account. Web a draft is a.

Direct Draw Draft System Examples

If a bank is financing the project, the draw schedule determines when the bank will disburse funds to you and the contractor. Web a time draft indicates payment a certain number of days after a date or an event for the payment, for example, “30 days after the bill of lading date.” in summary, the drawer demands payment from the.

Explain the Difference Between a Drawer and a Drawee IsiahhasIbarra

Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one account and credited to. Web bank drafts are a popular payment method that is widely used for international transactions, including purchasing goods and services, making payments, and transferring money. (it’s sometimes called “autopay” or.

Web A Bank Draft — Also Referred To As A Bank Check, Banker’s Draft, Or Teller’s Check — Is A Financial Instrument That A Bank Issues On Behalf Of Its Customers.

In simple terms, a draft is a written order issued by a person or entity instructing a bank or financial institution to pay a specific amount of money to a named recipient. Bank drafts are a type of check that is issued by a bank, and it is guaranteed by the bank that the funds will be available when the check is presented for. The main difference is that someone who receives a bank draft has a guarantee that the funds are available, as opposed to a regular cheque, which could bounce. Web a time draft indicates payment a certain number of days after a date or an event for the payment, for example, “30 days after the bill of lading date.” in summary, the drawer demands payment from the drawee and instructs the drawee to make payment to the payee of a certain amount on a certain date.

Web This Service Allows Users To Authorize Their Utility Bills To Be Paid Automatically, On A Recurring Basis For Each Billing Cycle, By Authorizing Entergy To Draw A Draft On An Account At A Bank, Credit Union, Or Other Financial Institution.

A bank will guarantee a draft on behalf of a business for immediate. Learn how bank drafts work, their advantages, and how they compare to other payment options. Web draft payment is auto payment from the customer’s bank account to your bank account. Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one account and credited to.

A Total Of 13 Teams Enter The Event.

These are typically split up into various milestones or phases of the overall project. It is a common financial instrument used in banking transactions for facilitating payments between individuals, businesses, or financial institutions. Web bank drafts are a popular payment method that is widely used for international transactions, including purchasing goods and services, making payments, and transferring money. Web a bank draft, sometimes referred to as a banker's cheque, is a payment instrument issued by a bank on behalf of the payer.

It Is Issued By Banks To Transfer Money From One Bank Account To Another.

to get a banker’s draft, a bank customer must have funds (or cash) available. Web a construction loan draw schedule is a detailed payment plan for the construction project. Web the public is invited to attend the unveiling of the countdown clock at approximately 6:30 p.m. Web the draw schedule is a detailed payment plan for a construction project.