What Is A Form 2210 Penalty

What Is A Form 2210 Penalty - Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. This penalty is different from the penalty for. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Web you may owe a penalty. No you may owe a penalty. No you may owe a penalty. Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some form, not everyone pays standard. To avoid penalties, your total estimated tax must at least be equal to the lesser amount.

Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a. The form doesn't always have to be. Why isn't form 2210 generating for a form. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210. If you pay 90% or more of your total tax. Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. How do i avoid tax underpayment penalty? If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Does any box in part ii below apply?

Why isn't form 2210 generating for a form. Examine the form before completing it and use the. Does any box in part ii below apply? This penalty is different from the penalty for. How do i avoid tax underpayment penalty? Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. If you pay 90% or more of your total tax. Web to complete form 2210 within the program, please follow the steps listed below. Web you may owe a penalty. Web if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form 2210.

Ssurvivor Form 2210 Line 4

The form doesn't always have to be. No do not file form 2210. No you may owe a penalty. If you don’t qualify for penalty removal or. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

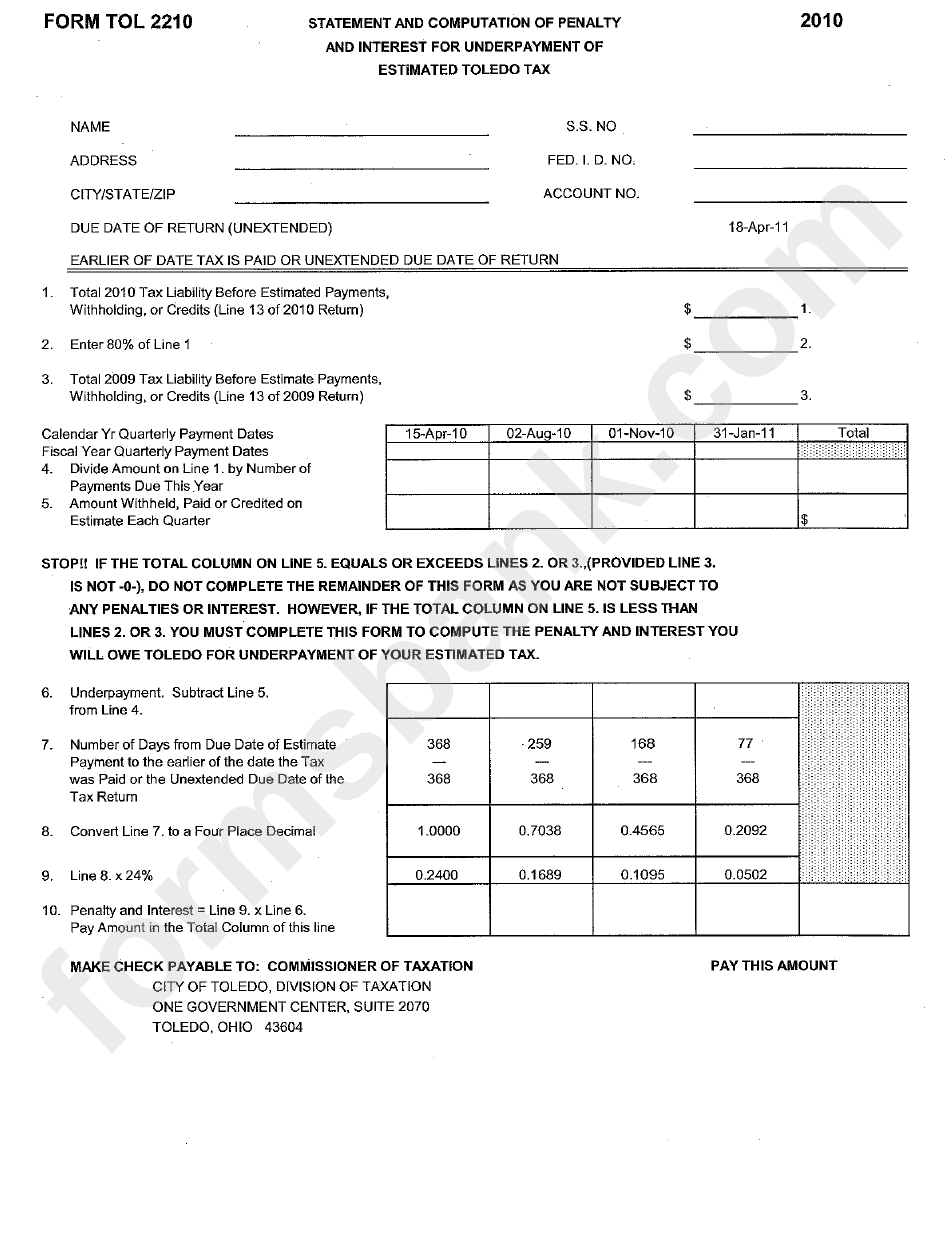

Form Tol 2210 Statement And Computation Of Penalty And Interest For

Web below are solutions to frequently asked questions about entering form 2210 underpayment penalty information in the fiduciary return. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form.

Form 2210Underpayment of Estimated Tax

If you don’t qualify for penalty removal or. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. Web if a person does not pay sufficient estimated tax, the irs charges.

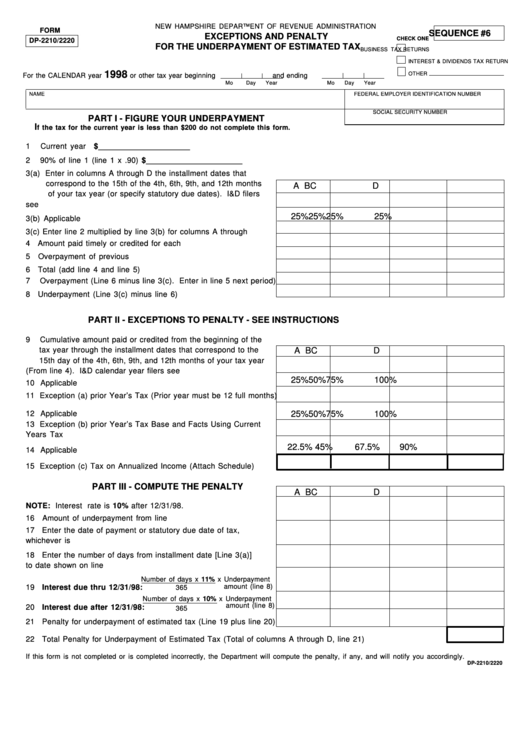

Fillable Form Dp2210/2220 Exceptions And Penalty For The

Web if a person does not pay sufficient estimated tax, the irs charges a penalty. If you pay 90% or more of your total tax. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. To avoid penalties, your total estimated tax must at least be equal to the lesser amount. Web.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

You are not required to figure your penalty because the irs will figure it and send you a bill. To avoid penalties, your total estimated tax must at least be equal to the lesser amount. No you may owe a penalty. How do i avoid tax underpayment penalty? Does any box in part ii below apply?

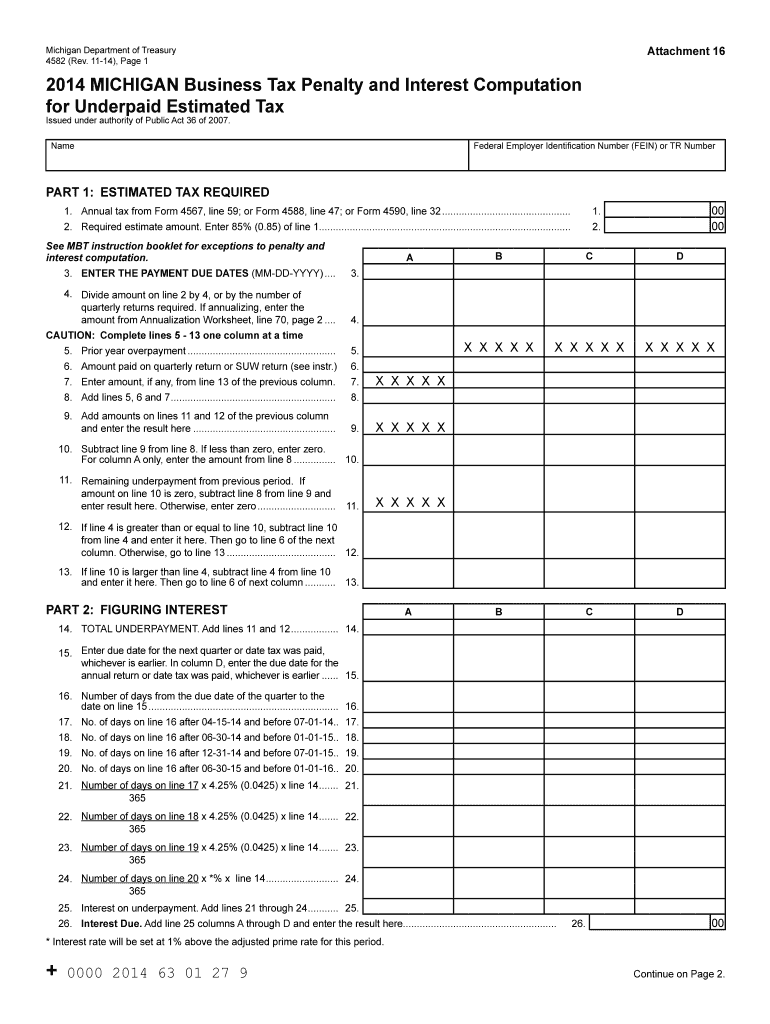

Taxes Why Am I Being Charged MI 2210 Penalty and Interest? Fill Out

Does any box in part ii below apply? Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. Web what is form 2210 underpayment penalty? Web below are solutions to frequently asked questions about entering form 2210 underpayment penalty information in the fiduciary return. Web to complete form 2210 within the program,.

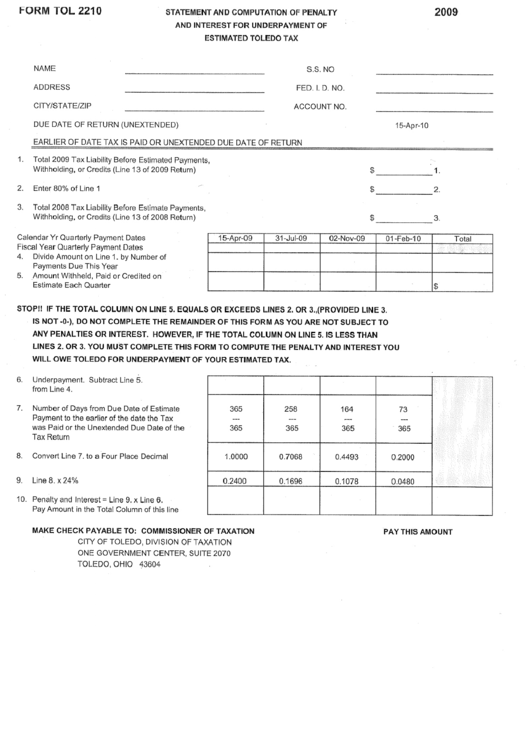

Form Tol 2210 Statement And Computation Of Penalty And Interest

If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. The form doesn't always have to be. Web what is irs form 2210? You are not required to figure your penalty because.

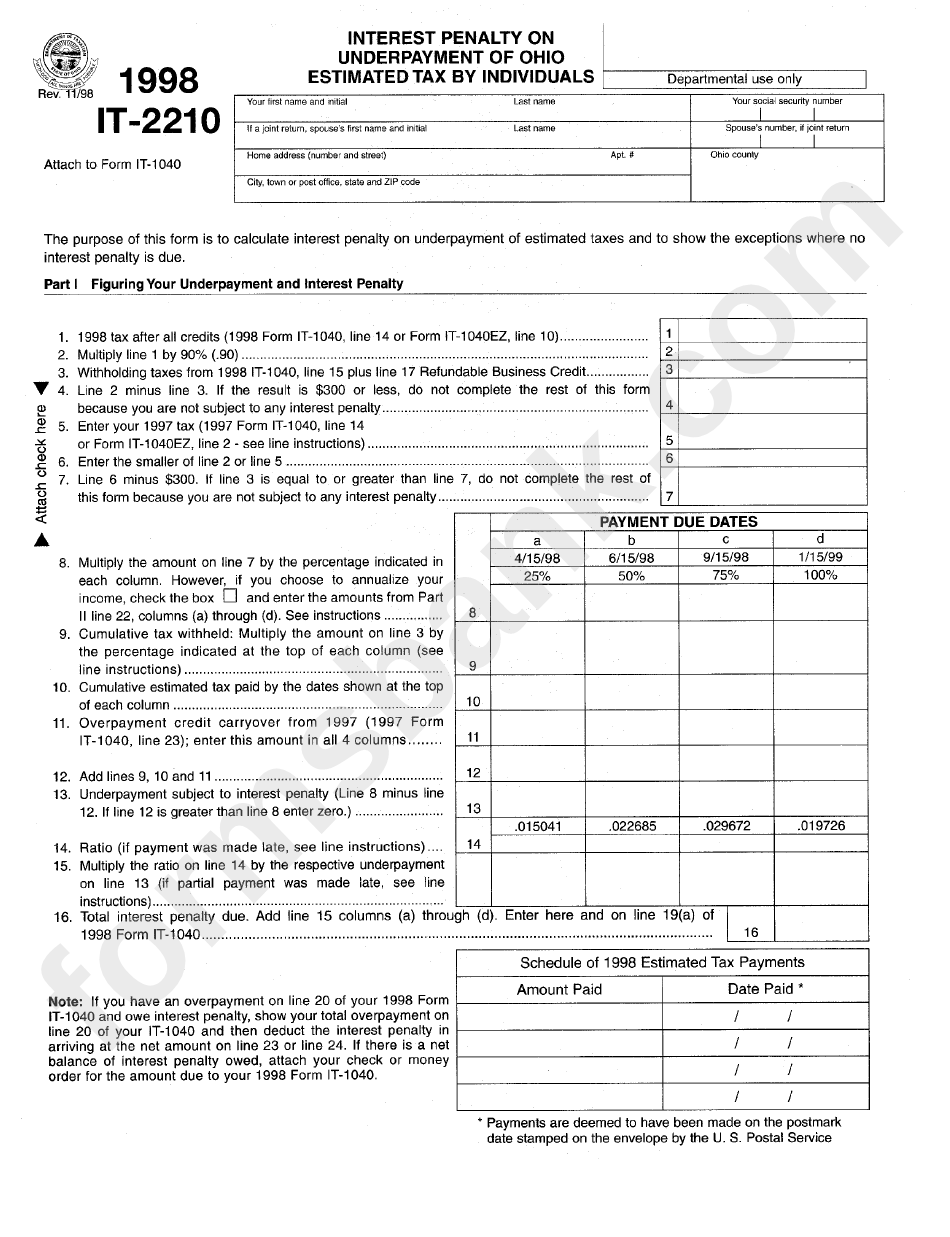

Fillable Form It2210 Interest Penalty On Underpayment Of Ohio

Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. If you don’t qualify for penalty removal or. Web if.

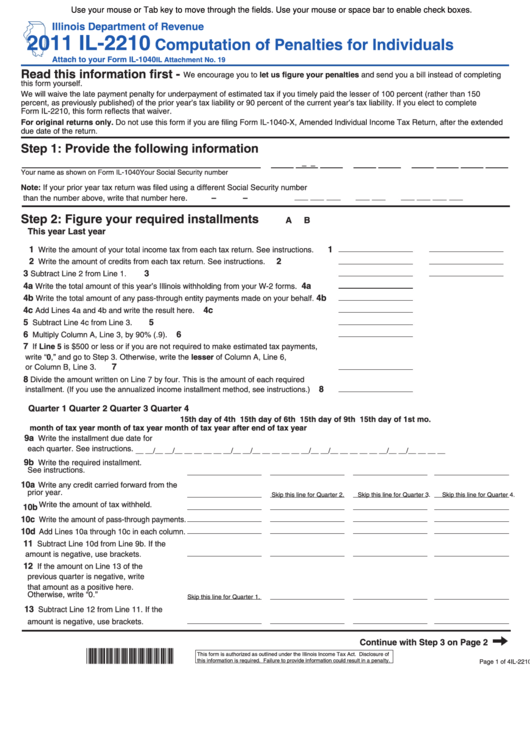

Fillable Form Il2210 Computation Of Penalties For Individuals 2011

Web you may owe a penalty. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Web to complete form 2210 within the program, please follow the steps listed below. No you may owe a penalty. Web form 2210 is used to determine how much you owe in underpayment.

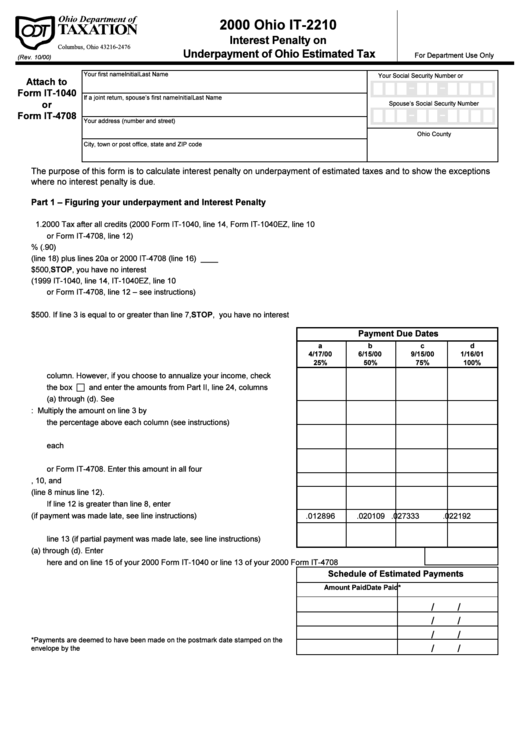

Form It2210 Interest Penalty On Underpayment Of Ohio Estimated Tax

Web if a person does not pay sufficient estimated tax, the irs charges a penalty. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web the “ estimated tax safe harbor ” rule means that if you paid enough in tax, you won’t owe the estimated tax penalty..

Don’t File Form 2210 Unless Box E In Part Ii Applies, Then File Page 1 Of Form 2210.

Penalty for underpaying taxes while everyone living in the united states is expected to pay income taxes to the irs in some form, not everyone pays standard. Does any box in part ii below apply? Web to complete form 2210 within the program, please follow the steps listed below. How do i avoid tax underpayment penalty?

Web Form 2210 Is Used By Individuals (As Well As Estates And Trusts) To Determine If A Penalty Is Owed For The Underpayment Of Income Taxes Due.

Does any box in part ii below apply? The form doesn't always have to be. Web below are solutions to frequently asked questions about entering form 2210 underpayment penalty information in the fiduciary return. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210.

If You Pay 90% Or More Of Your Total Tax.

Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). To avoid penalties, your total estimated tax must at least be equal to the lesser amount. If you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Why isn't form 2210 generating for a form.

No You May Owe A Penalty.

Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to calculate. Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a. No do not file form 2210. This is when the need of hiring an expert tax professional arises to manage things.