What Is A Form 8615

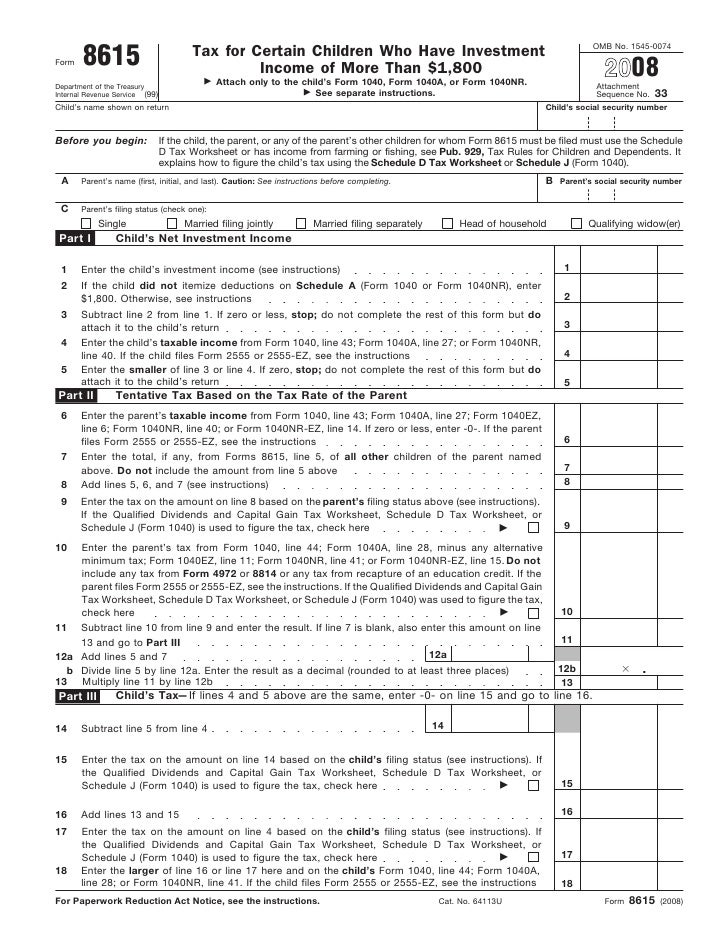

What Is A Form 8615 - Web per the irs instructions, the following notes will appear at the top of printed versions of these forms: When using form 8615 in proseries, you should enter the child as the taxpayer on the. Signnow allows users to edit, sign, fill and share all type of documents online. Web form 8615 must be filed for any child who meets all of the following conditions. Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. The child had more than $2,300 of unearned income. Web what is form 8615, tax for children under age 18? Obviously, in order to calculate the tax at.

Unearned income includes taxable interest, ordinary dividends, capital. You had more than $2,300 of unearned. Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed for any child who meets all of the following conditions. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. When using form 8615 in proseries, you should enter the child as the taxpayer on the. Web for form 8615, unearned income includes all taxable income other than earned income as defined later.

The form is only required to be included on your return if all of the conditions below are met: Web for form 8615, unearned income includes all taxable income other than earned income as defined later. Attach the completed form to the. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Web form 8615, tax for certain children who have unearned income. Web what is form 8615, tax for children under age 18? Signnow allows users to edit, sign, fill and share all type of documents online. Refer to each child's taxpayer's information for use when. Web form 8615 must be filed for any child who meets all of the following conditions. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet.

Form 8615 Kiddie Tax Question tax

Web for form 8615, unearned income includes all taxable income other than earned income as defined later. Web form 8615, tax for certain children who have unearned income. Under age 18, age 18 and did. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web form 8615 is used to figure your.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. Under age 18, age 18 and did. Web per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web form 8615 must be filed for any child.

DADS Or HHSC Form The Texas Department Of Aging And Dads State

Web what is form 8615, tax for children under age 18? Unearned income includes taxable interest, ordinary dividends, capital. You had more than $2,300 of unearned. Web form 8615 must be filed for any child who meets all of the following conditions. Under age 18, age 18 and did.

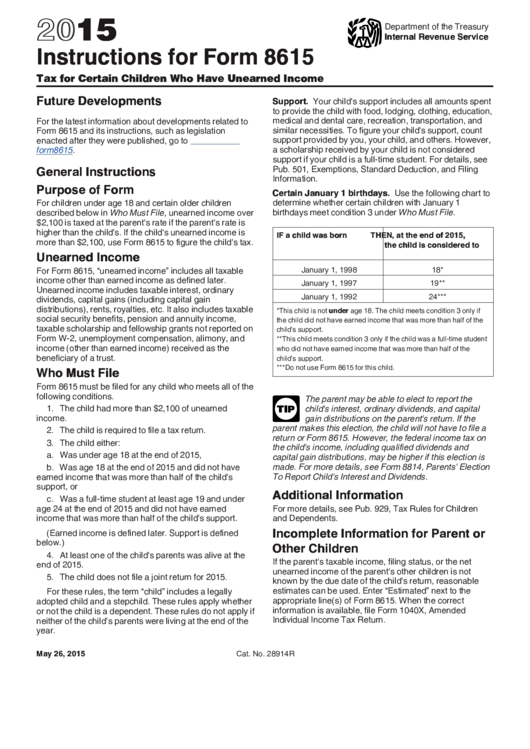

Form 8615 Instructions (2015) printable pdf download

Web what is form 8615 used for. The child is required to file a tax return. The child had more than $2,300 of unearned income. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. Ad register and subscribe now to work on your irs.

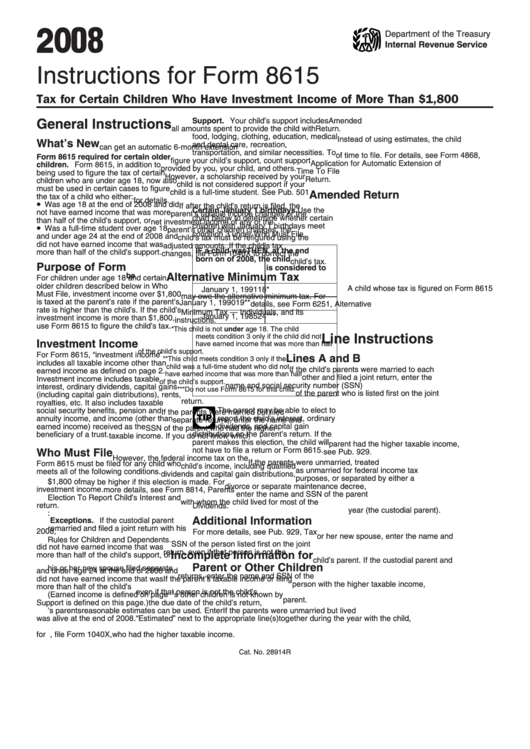

Instructions For Form 8615 Tax For Certain Children Who Have

Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: You had more than $2,300 of unearned. Form 8615 must be filed with the child’s tax return if all of the following apply: Under age 18, age 18 and did. Web for form 8615, unearned income includes all taxable income other than.

What Is Form 8615 Used For?

Ad register and subscribe now to work on your irs 8615 form & more fillable forms. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Attach the completed form to the. Web form 8615 is used to figure your child's tax on unearned income. The service delivery logs are available for the.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web form 8615 must be filed for any child who meets all of the following conditions. When using form 8615 in proseries, you should enter the child as the taxpayer on the. Attach the completed form to the. Web per the irs.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. The child had more than $2,300 of unearned income. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web use form 8615 to figure your tax on unearned income.

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Web what is form 8615 used for. The service delivery logs are available for the documentation of a service event for individualized skills and socialization. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. The child had more than $2,300 of unearned income. The.

Form 8615 Office Depot

Refer to each child's taxpayer's information for use when. Web form 8615 must be filed for any child who meets all of the following conditions. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. The child is required to file a tax return. Web for form 8615, unearned income includes all taxable.

Web Per The Irs Instructions, The Following Notes Will Appear At The Top Of Printed Versions Of These Forms:

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web what is form 8615, tax for children under age 18? The child had more than $2,300 of unearned income. The form is only required to be included on your return if all of the conditions below are met:

The Child Is Required To File A Tax Return.

Form 8615 must be filed with the child’s tax return if all of the following apply: Attach the completed form to the. Web what is form 8615 used for. Unearned income includes taxable interest, ordinary dividends, capital.

Web Form 8615 Is Used To Figure Your Child's Tax On Unearned Income.

Web form 8615 must be filed for any child who meets all of the following conditions. Web the line 5 ratio is the last line of the appropriate line 5 worksheet divided by the first line of the line 5 worksheet. Web form 8615, tax for certain children who have unearned income. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax.

Under Age 18, Age 18 And Did.

Signnow allows users to edit, sign, fill and share all type of documents online. Web from 8615 is for the kiddie tax, which calculates the tax on your investment income over $2,100 at your parent's tax rate. Obviously, in order to calculate the tax at. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: