What Is A K40 Tax Form

What Is A K40 Tax Form - Instead, it will be returned to you. An individual having salary income should collect. Web form 1040 is used by u.s. Exemptions enter the total exemptions for you, your. Line 18 (food sales tax credit): With a request to submit your information on the proper form. Important —if you are claimed. Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Line 5 — exemption allowance. Do not send the kansas department of revenue.

Web if you use this form for a tax year other than is intended, it. Line 18 (food sales tax credit): Enter the requested information for all persons claimed as dependents. Instead, it will be returned to you. Do not send the kansas department of revenue. This allows a property tax refund for senior citizens or disabled veterans, which is. Exemptions enter the total exemptions for you, your. Line 5 — exemption allowance. Do not include you or your spouse. This is the kansas individual.

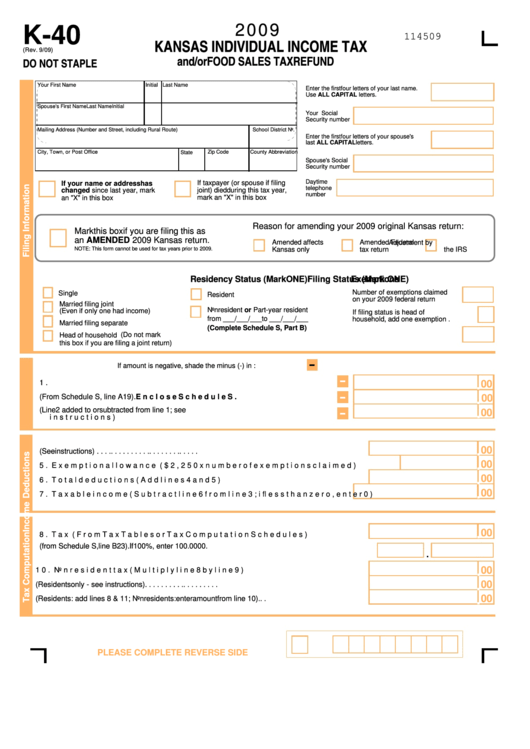

Web documents needed to file itr; Web the form 2021: Line 5 — exemption allowance. Web form 1040 is used by u.s. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Enter the requested information for all persons claimed as dependents. Important —if you are claimed. Exemptions enter the total exemptions for you, your. Do not send the kansas department of revenue. This form is for income earned in tax year 2022, with.

2018 Form KS DoR K40 Fill Online, Printable, Fillable, Blank PDFfiller

Line 18 (food sales tax credit): This form is for income earned in tax year 2022, with. Do not send the kansas department of revenue. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Taxpayers to file an annual income tax.

2015 Form KS DoR K40 Fill Online, Printable, Fillable, Blank pdfFiller

Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. Line 5 — exemption allowance. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Taxpayers to file an annual income tax return. This form is for income earned in tax.

LG K40S Price in Tanzania

Line 5 — exemption allowance. With a request to submit your information on the proper form. Web documents needed to file itr; Instead, it will be returned to you. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or.

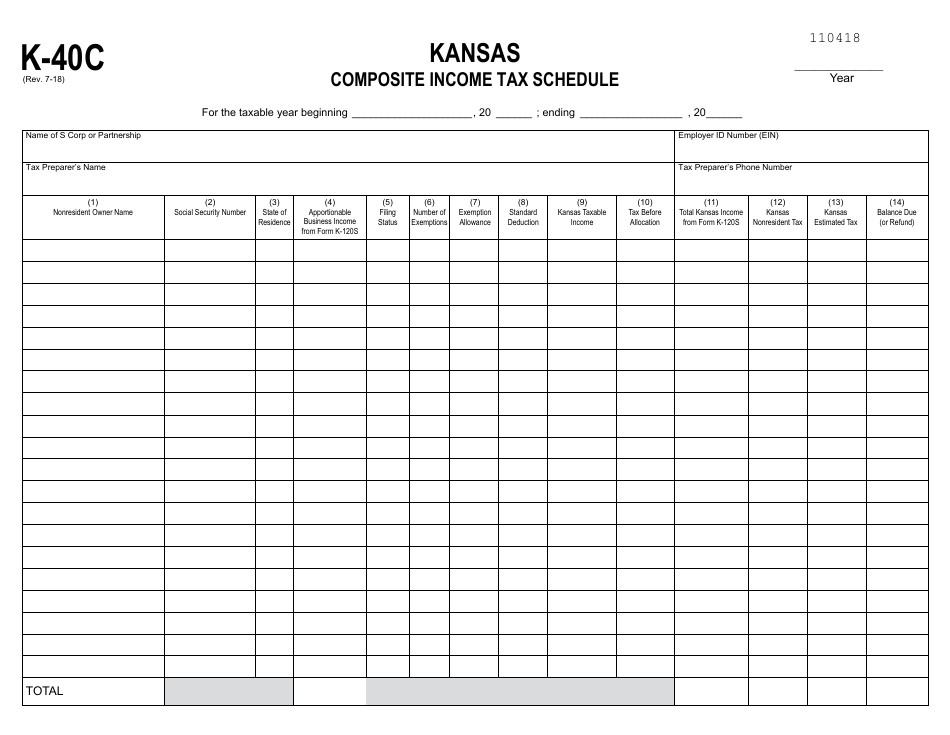

Form K40C Download Fillable PDF or Fill Online Composite Tax

This allows a property tax refund for senior citizens or disabled veterans, which is. Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Web the 1040 form is the official tax return that taxpayers have to file with the irs each.

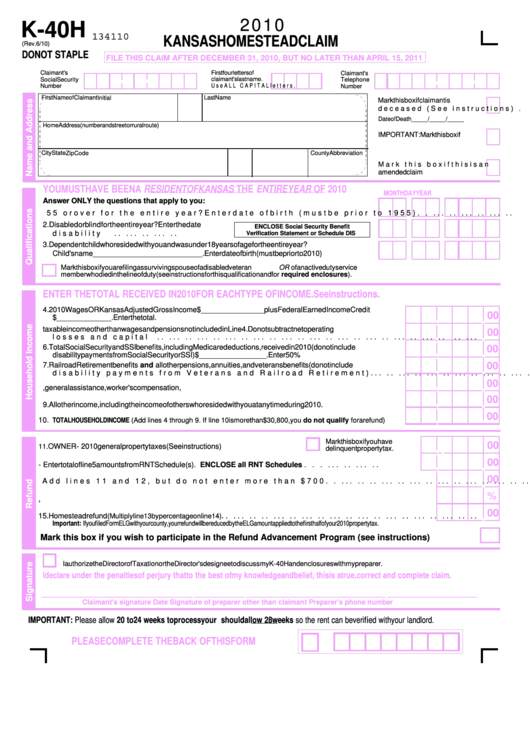

Form K40h Kansas Homestead Claim 2010 printable pdf download

Web if you use this form for a tax year other than is intended, it. This includes their name, address, employer identification number (ein),. This allows a property tax refund for senior citizens or disabled veterans, which is. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. Taxpayers.

Fillable Form K40 Kansas Individual Tax And/or Food Sales Tax

Web documents needed to file itr; Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. With a request to submit your information on the proper form. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Web if you use.

Xiaomi Redmi K40 Price in Tanzania

This is the kansas individual. An individual having salary income should collect. With a request to submit your information on the proper form. This includes their name, address, employer identification number (ein),. Line 18 (food sales tax credit):

Form K 40 Kansas Individual Tax YouTube

Web documents needed to file itr; Web form 1040 is used by u.s. Web if you use this form for a tax year other than is intended, it. Line 5 — exemption allowance. Line 18 (food sales tax credit):

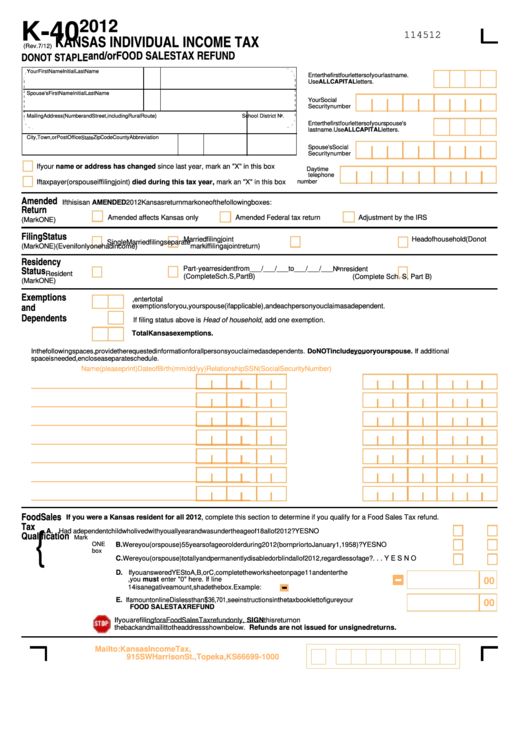

K40 2012 Kansas Individual Tax printable pdf download

Line 5 — exemption allowance. Web form 1040 is used by u.s. Line 18 (food sales tax credit): Taxpayers to file an annual income tax return. Enter the requested information for all persons claimed as dependents.

LG K40 FR Brushed Metal Hybrid W/Card Slot Hot Pink FR Wireless

With a request to submit your information on the proper form. This form is for income earned in tax year 2022, with. Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Web the form 2021: Exemptions enter the total exemptions for.

Line 5 — Exemption Allowance.

Web file your kansas income tax return and homestead refund claim with kansas webfile, a free state tax return service provided by the kansas department of revenue and. Exemptions enter the total exemptions for you, your. Web kansas individual income tax 114519 enter the first four letters of your last name.use all capital letters. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

Web Form 1040 Is Used By U.s.

Do not send the kansas department of revenue. With a request to submit your information on the proper form. This is the kansas individual. An individual having salary income should collect.

Do Not Include You Or Your Spouse.

Taxpayers to file an annual income tax return. Line 18 (food sales tax credit): Instead, it will be returned to you. Important —if you are claimed.

This Form Is For Income Earned In Tax Year 2022, With.

Web the form 2021: Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. This allows a property tax refund for senior citizens or disabled veterans, which is. The first step of filing itr is to collect all the documents related to the process.