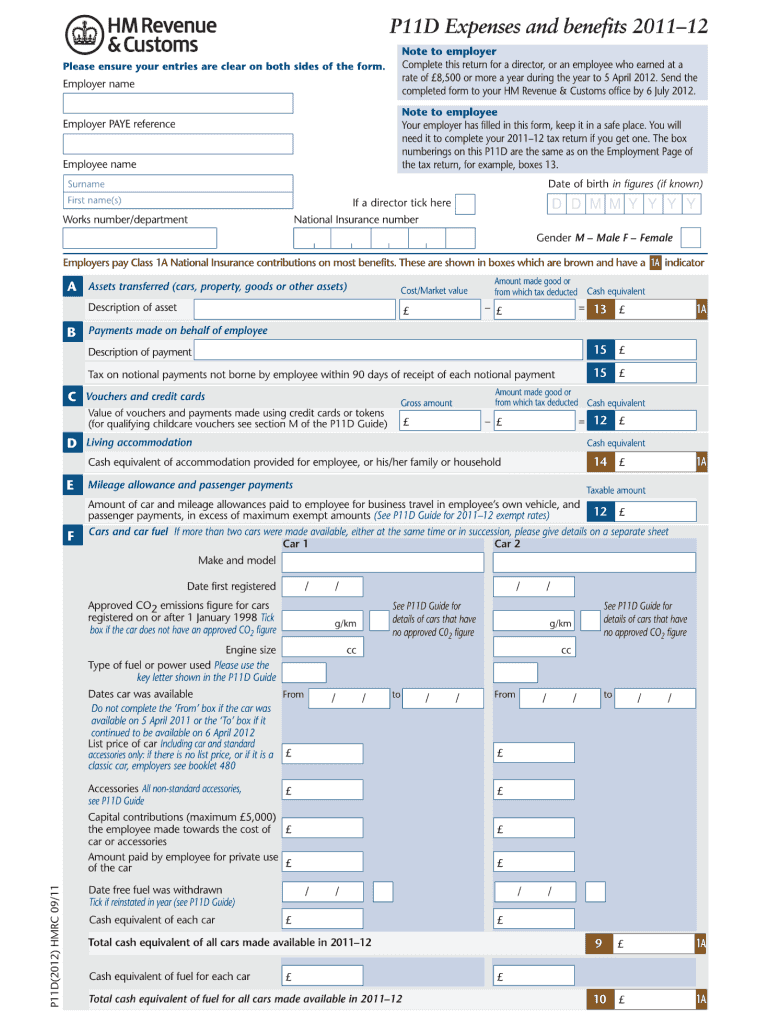

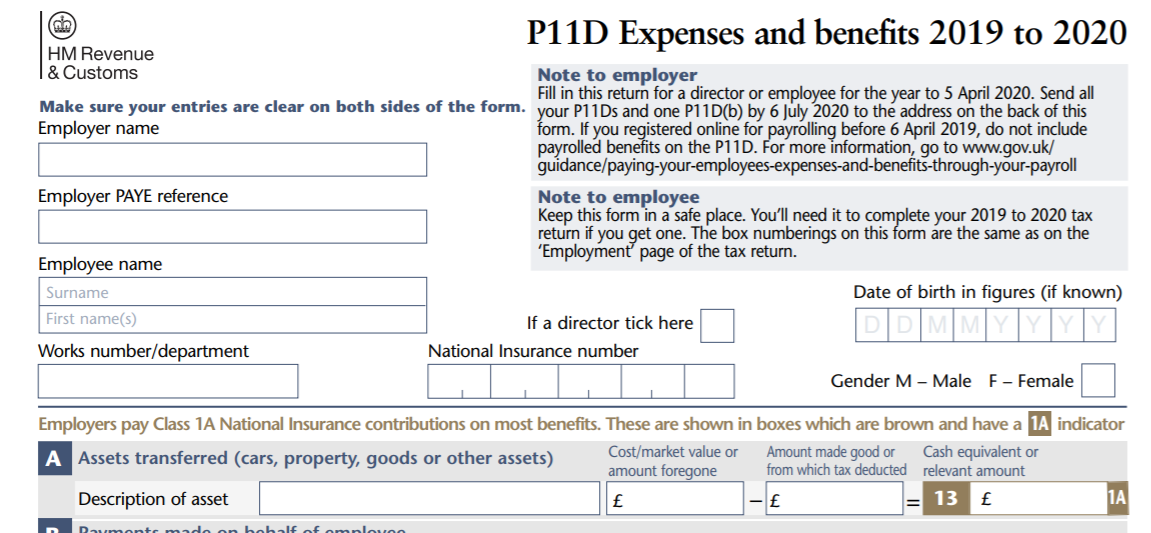

What Is A P11D Form

What Is A P11D Form - What is a p11d form? You can find out more. Web the p11d is an annual form you need to submit for each employee who received benefits or expenses from you, as an employer. Whether you employ people in your business, or you’ve received benefits in kind as a director, you’ll need to declare these benefits every year. Get free access to the best forms today! It’s issued by the employer after the end of each tax year. This guide explains how to complete the 2022 to 2023 p11d and p11d (b). Web what is a p11d form used for? Web in a nutshell, the p11d is a form which outlines all the expenses, payments and benefits that an employee or director pays tax on. Send all your p11ds and one p11d(b) by 6 july 2023.

Get free access to the best forms today! Whether you employ people in your business, or you’ve received benefits in kind as a director, you’ll need to declare these benefits every year. But what are benefits in kind? What is a p11d form? But what are benefits in kind? Web what is a p11d form used for? They're expenses or benefits that you've received through your company over and above your salary. A p11d is a mandatory tax return form filled out by employers and returned to the hm revenue and customs (hmrc) tax office. Web the p11d form is used to report benefits in kind. Web in a nutshell, the p11d is a form which outlines all the expenses, payments and benefits that an employee or director pays tax on.

You can find out more. Web the p11d form is used to report benefits in kind. It's more relevant for employers, who must submit p11d forms every tax year to let hmrc know of any expenses payments, benefits and facilities given to each employee or director. Web in a nutshell, the p11d is a form which outlines all the expenses, payments and benefits that an employee or director pays tax on. But what are benefits in kind? Web the p11d is a form that is used to report ‘benefits in kind’. Do not include payrolled benefits on the p11d. Get free access to the best forms today! A p11d is a mandatory tax return form filled out by employers and returned to the hm revenue and customs (hmrc) tax office. This guide explains how to complete the 2022 to 2023 p11d and p11d (b).

A Simple Guide to Filing P11d Forms Online // Go SelfEmployed

Web what is a p11d form used for? Web the p11d is a form that is used to report ‘benefits in kind’. Whether you employ people in your business, or you’ve received benefits in kind as a director, you’ll need to declare these benefits every year. It's more relevant for employers, who must submit p11d forms every tax year to.

That P11D Time Of The Year Performance Accountancy

The best legal forms website, free for all! You use these forms to declare benefits, including taxable expenses and other payments you pay tax on as an employer. You can find out more. But what are benefits in kind? Web the p11d is an annual form you need to submit for each employee who received benefits or expenses from you,.

HMRC P11D FORM PDF

Get free access to the best forms today! You can find out more. This guide explains how to complete the 2022 to 2023 p11d and p11d (b). But what are benefits in kind? It’s issued by the employer after the end of each tax year.

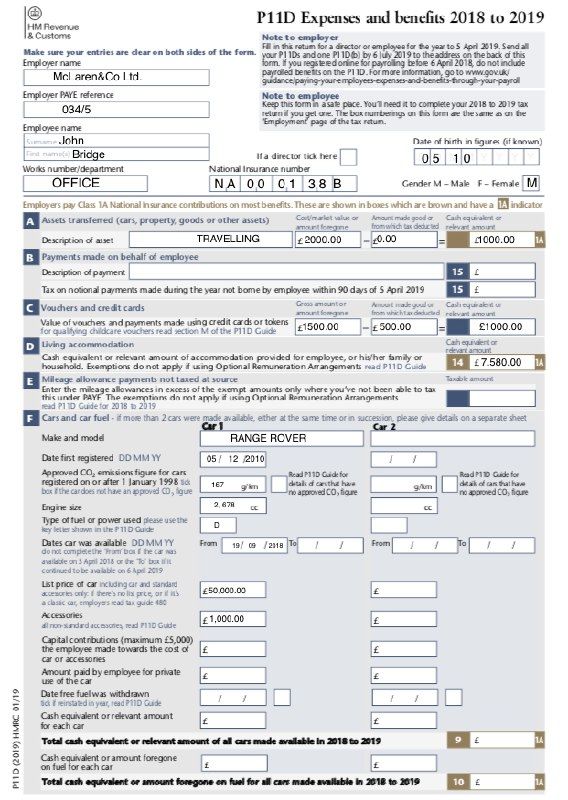

Section F Car Tax and Car Fuel P11d goselfemployed.co

You can find out more. A p11d is used to detail certain expenses and benefits that you are liable to pay tax on. You must submit your p11d and p11d (b) through: Web p11d expenses and benefits 2022 to 2023 note to employer fill in this return for a director or employee for the year to 5 april 2023. But.

P11d Form Fill Out and Sign Printable PDF Template signNow

It’s issued by the employer after the end of each tax year. A p11d is a mandatory tax return form filled out by employers and returned to the hm revenue and customs (hmrc) tax office. Get free access to the best forms today! Web the p11d is an annual form you need to submit for each employee who received benefits.

A guide to UK PAYE tax forms P45, P60 and P11D

But what are benefits in kind? A p11d is used to detail certain expenses and benefits that you are liable to pay tax on. It’s issued by the employer after the end of each tax year. Web p11d expenses and benefits 2022 to 2023 note to employer fill in this return for a director or employee for the year to.

p11d form What is a p11d tax form Swiftrefunds.co.uk

Send all your p11ds and one p11d(b) by 6 july 2023. You can find out more. Get free access to the best forms today! Web the p11d form is used to report benefits in kind. Web the p11d is a form that is used to report ‘benefits in kind’.

P11d Section M Other Items P11d Section M Other Items

Do not include payrolled benefits on the p11d. The best legal forms website, free for all! Web in a nutshell, the p11d is a form which outlines all the expenses, payments and benefits that an employee or director pays tax on. But what are benefits in kind? Web a p11d form is where employers and directors of companies have to.

What is a P11D and do I need to file one? Read our guide here

You can find out more. But what are benefits in kind? Get free access to the best forms today! It’s issued by the employer after the end of each tax year. Web the p11d form is used to report benefits in kind.

What is a P11D form?

Get free access to the best forms today! Web the p11d is an annual form you need to submit for each employee who received benefits or expenses from you, as an employer. A p11d is used to detail certain expenses and benefits that you are liable to pay tax on. They're expenses or benefits that you've received through your company.

You Must Submit Your P11D And P11D (B) Through:

Web what is a p11d form used for? A p11d is used to detail certain expenses and benefits that you are liable to pay tax on. Web the p11d is an annual form you need to submit for each employee who received benefits or expenses from you, as an employer. What is a p11d form?

Web P11D Expenses And Benefits 2022 To 2023 Note To Employer Fill In This Return For A Director Or Employee For The Year To 5 April 2023.

A p11d is a mandatory tax return form filled out by employers and returned to the hm revenue and customs (hmrc) tax office. Web a p11d form is where employers and directors of companies have to declare benefits in kind to hmrc. Whether you employ people in your business, or you’ve received benefits in kind as a director, you’ll need to declare these benefits every year. It's more relevant for employers, who must submit p11d forms every tax year to let hmrc know of any expenses payments, benefits and facilities given to each employee or director.

It’s Issued By The Employer After The End Of Each Tax Year.

Why do you need to report all these items to hmrc? But what are benefits in kind? Web the p11d form is used to report benefits in kind. They're expenses or benefits that you've received through your company over and above your salary.

Do Not Include Payrolled Benefits On The P11D.

This guide explains how to complete the 2022 to 2023 p11d and p11d (b). The best legal forms website, free for all! Web the p11d is a form that is used to report ‘benefits in kind’. Web in a nutshell, the p11d is a form which outlines all the expenses, payments and benefits that an employee or director pays tax on.