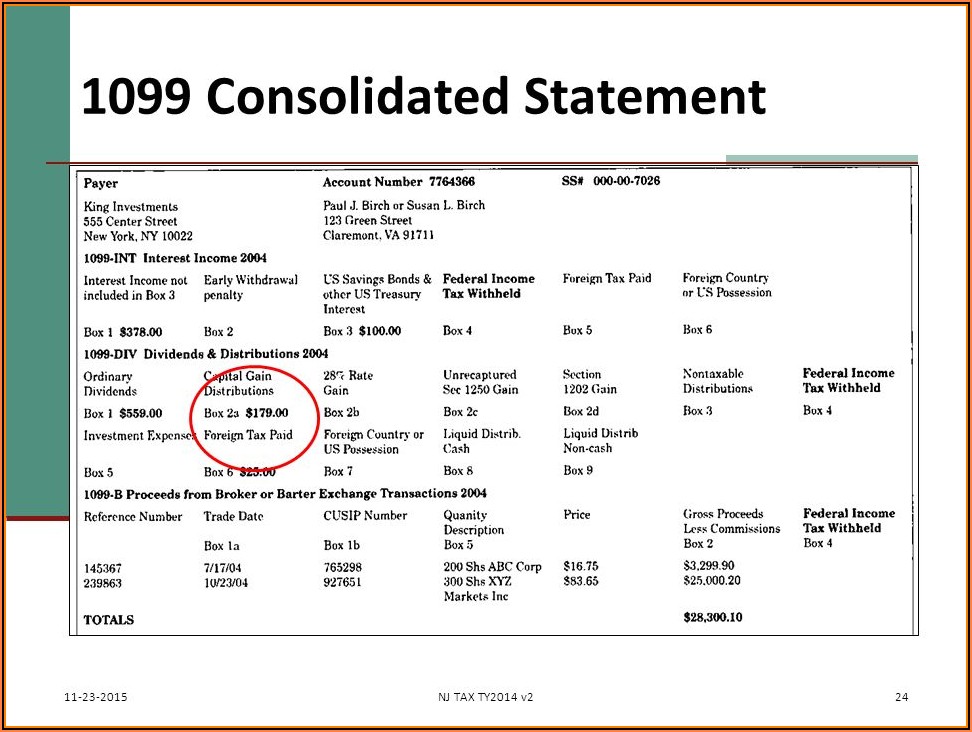

What Is Consolidated Form 1099

What Is Consolidated Form 1099 - Payments made to someone not your employee for services in the course of your trade or business. Web what is a consolidated 1099 tax statement? Web for the most recent version, go to irs.gov/form1099int. A consolidated form 1099 combines five separate 1099 forms into one tax reporting document. Web the consolidated 1099 form contains several tax reports that you may use for your tax filing: Web 1 best answer. In most situations, you must report the income shown on form 1099 when. Web learn 8 key things to look for on your consolidated 1099 tax statement. It shows whether any taxes. Web what is a 1099 consolidated tax statement?

In most situations, you must report the income shown on form 1099 when. Web the consolidated 1099 form contains several tax reports that you may use for your tax filing: Web 1 best answer. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Web for the most recent version, go to irs.gov/form1099int. The tax forms you might see in. Web consolidated form 1099, and will not be held liable for any fees incurred for the refiling of a tax form. Td ameritrade does not provide tax advice. The following guides take you. You owned real estate mortgage investment.

The consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on. In some cases, exempt recipients will. A consolidated form 1099 combines five separate 1099 forms into one tax reporting document. The following guides take you. Web consolidated form 1099, and will not be held liable for any fees incurred for the refiling of a tax form. Depending on what’s happened in your financial life during the year, you could get one or. Web all individuals receive a consolidated 1099 if they are united states citizens or legal residents and have had reportable tax activity. You owned real estate mortgage investment. Web for the most recent version, go to irs.gov/form1099int. To whom you paid amounts reportable in boxes 1, 3, or 8 of at.

What Is A Consolidated 1099 Tax Form Form Resume Examples Wk9yMaO93D

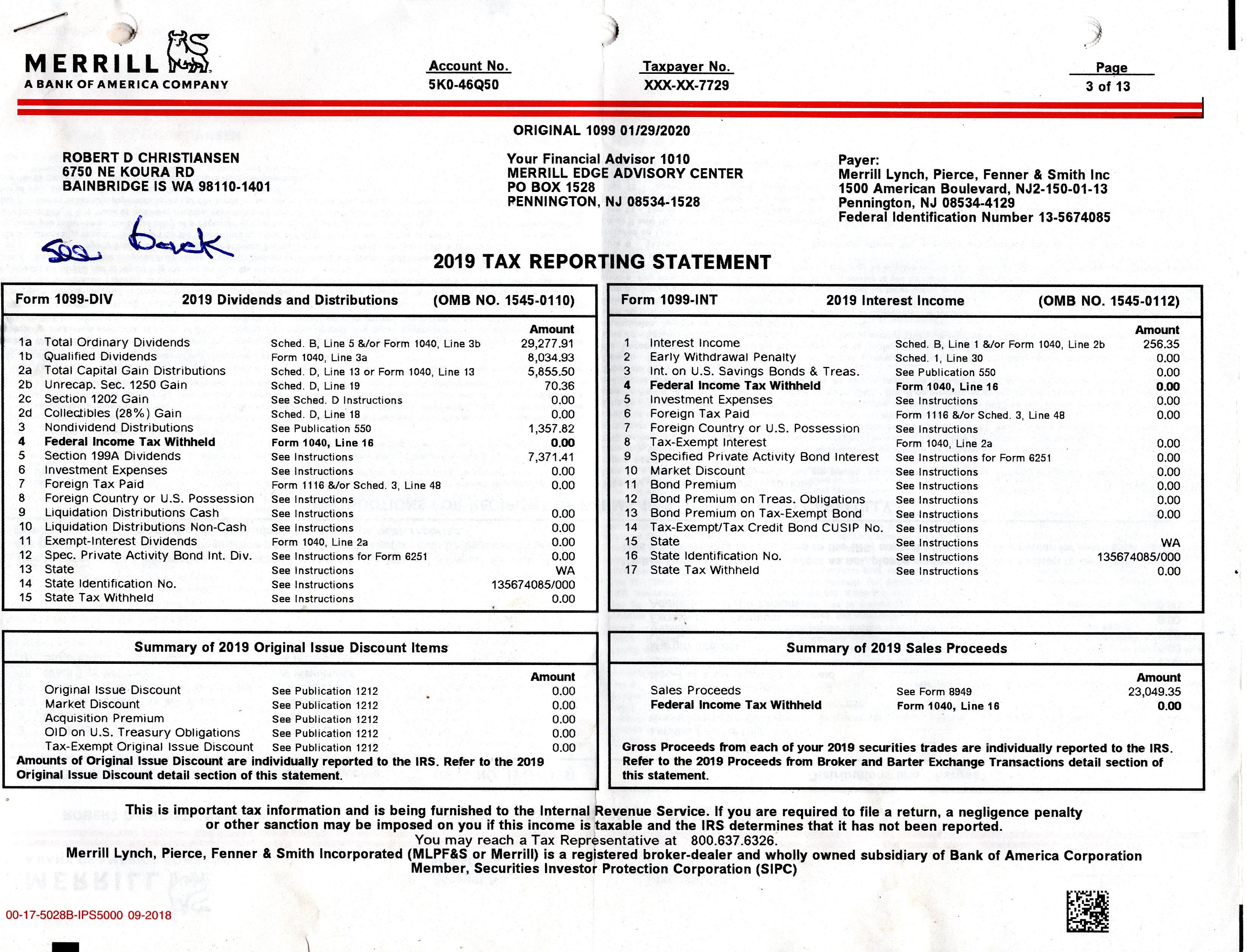

The following guides take you. Due to internal revenue service (irs) regulatory changes that have been phased in. Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Web what is a 1099 consolidated tax statement? Td ameritrade does not provide tax advice.

1099 Form Tax Id Form Resume Examples kLYrPX726a

The consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on. The tax forms you might see in. Web the consolidated 1099 form contains several tax reports that you may use for your tax filing: In some cases, exempt recipients will. Web learn 8 key things to look for on your consolidated 1099.

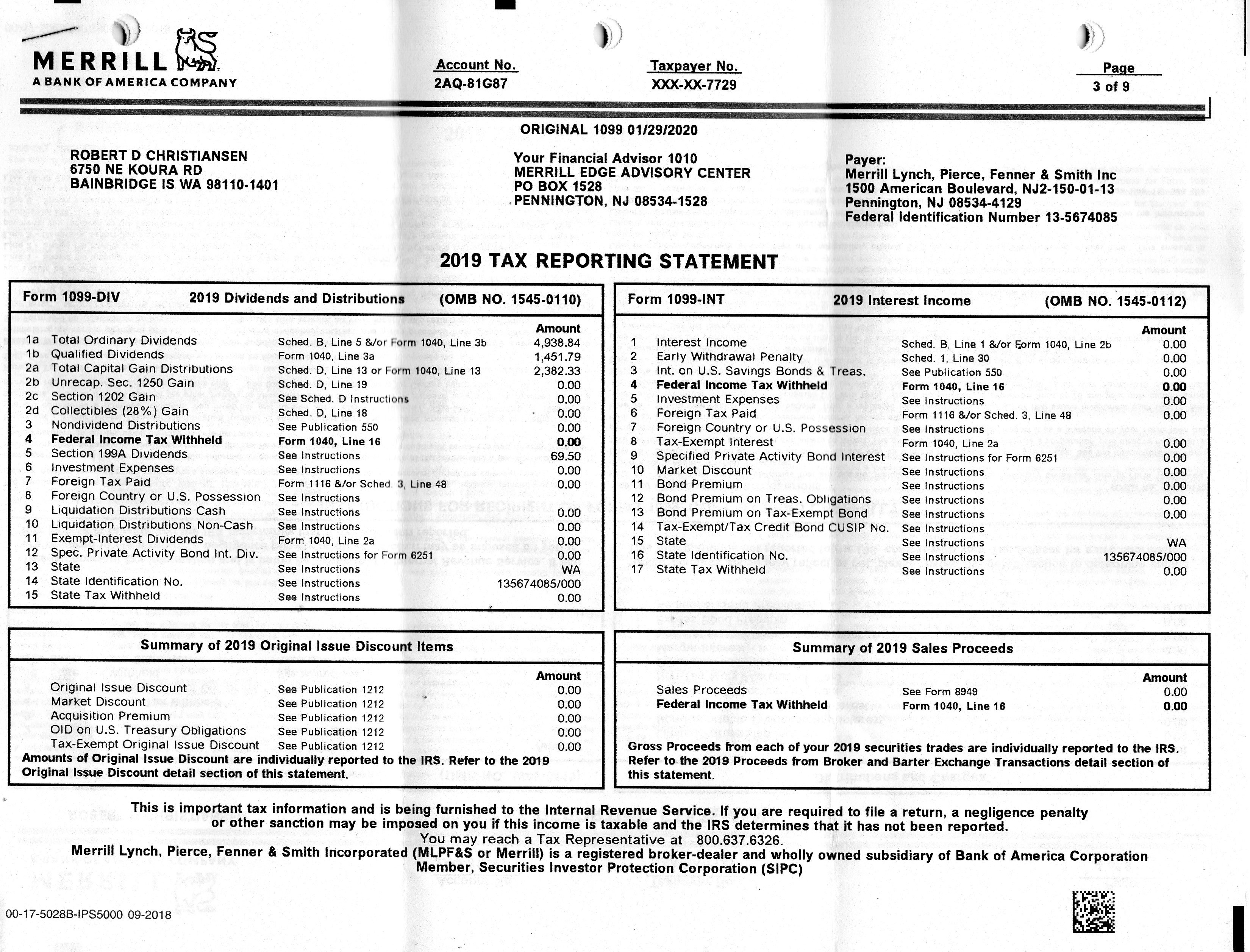

tax 2019

Web 1 best answer. You owned real estate mortgage investment. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Due to internal revenue service (irs) regulatory changes that have been phased in. A consolidated form 1099 combines five separate 1099 forms into one tax reporting document.

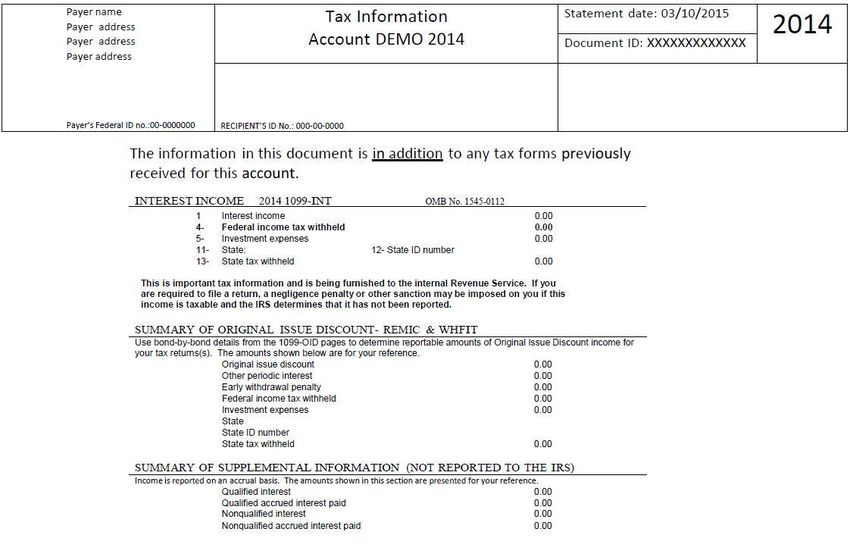

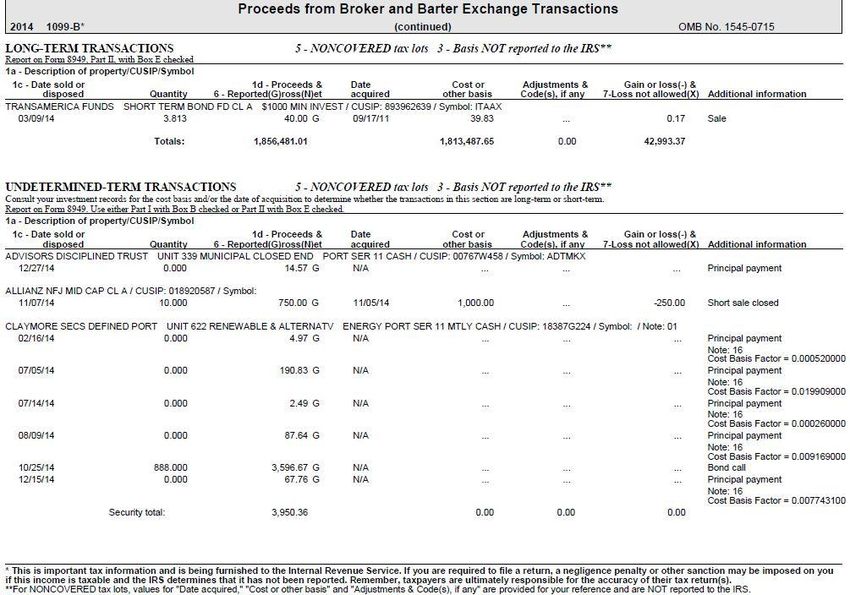

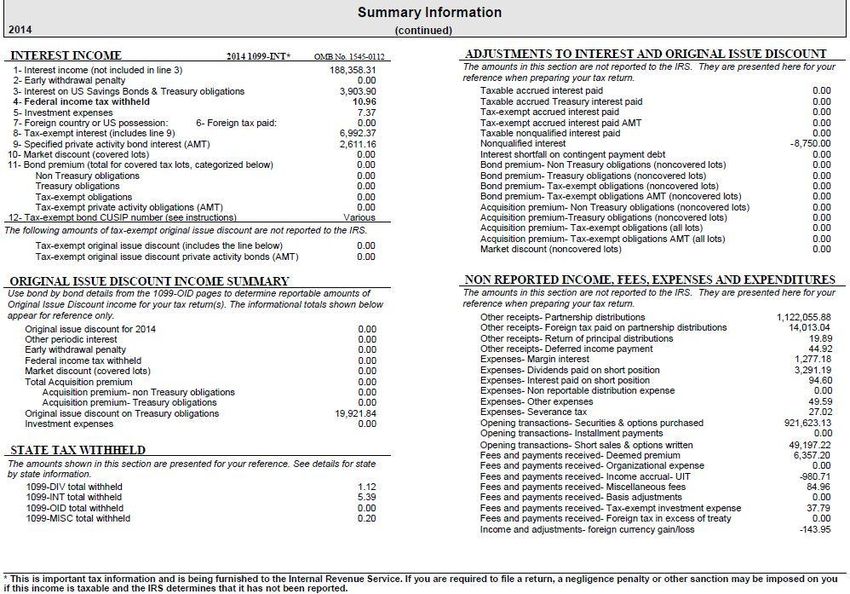

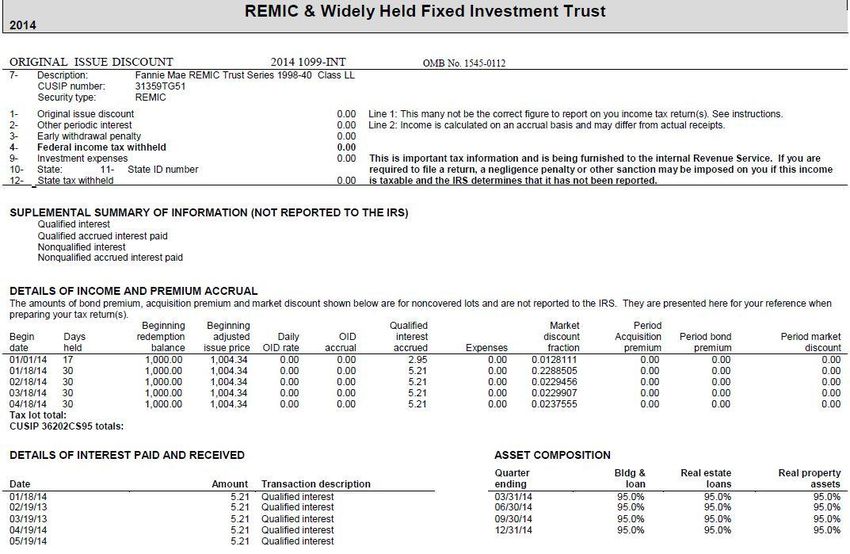

A guide to your 2014 Consolidated IRS Form 1099

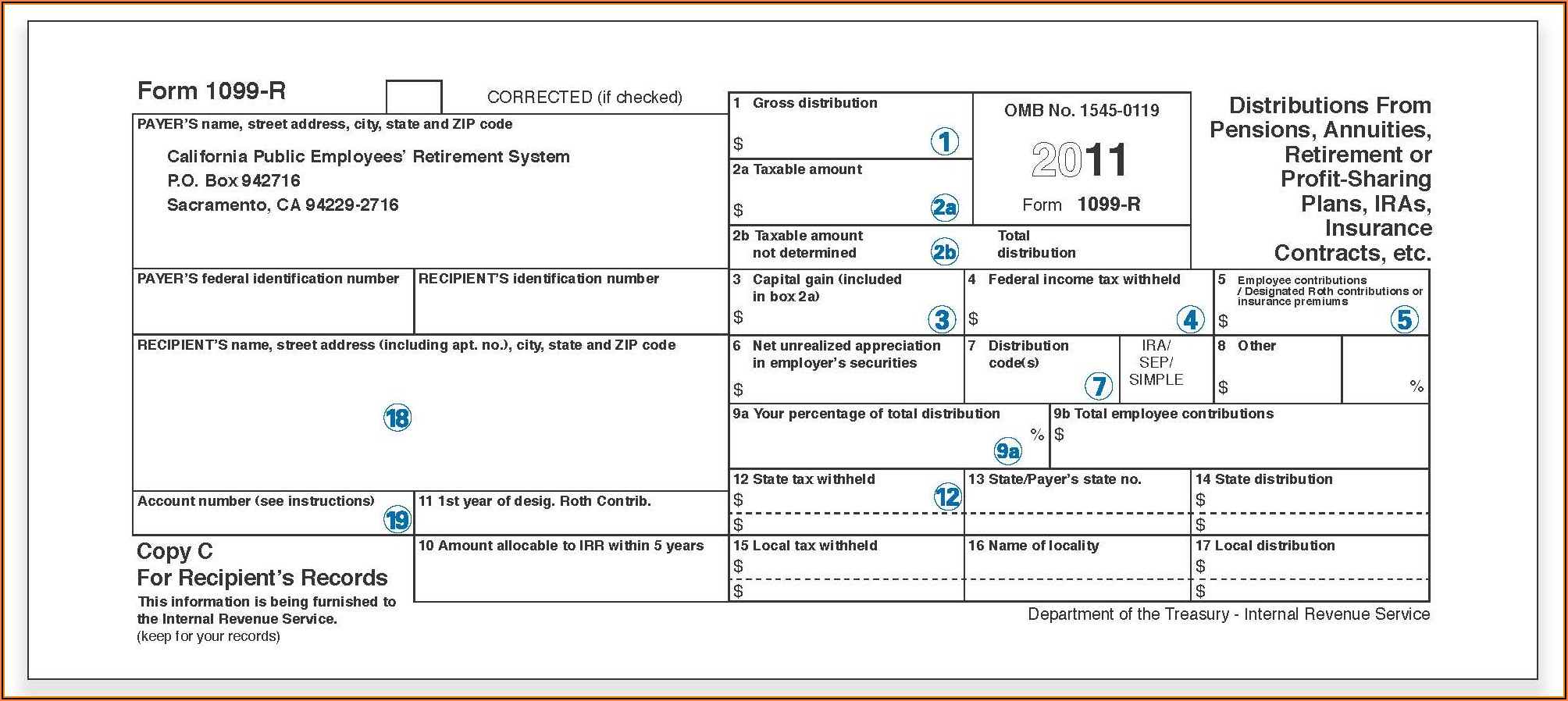

Web the 1099 form is a common one that covers several types of situations. Td ameritrade does not provide tax advice. The tax forms you might see in. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income.

A guide to your 2014 Consolidated IRS Form 1099

The consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on. The following guides take you. Web what is a 1099 consolidated tax statement? Web all individuals receive a consolidated 1099 if they are united states citizens or legal residents and have had reportable tax activity. Web consolidated form 1099, and will not.

tax 2019

Web the consolidated 1099 form contains several tax reports that you may use for your tax filing: Web what is a consolidated 1099 tax statement? Td ameritrade does not provide tax advice. Web learn 8 key things to look for on your consolidated 1099 tax statement. Web 1 best answer.

A guide to your 2014 Consolidated IRS Form 1099

Depending on what’s happened in your financial life during the year, you could get one or. Web consolidated form 1099, and will not be held liable for any fees incurred for the refiling of a tax form. The following guides take you. Web learn 8 key things to look for on your consolidated 1099 tax statement. Solved • by turbotax.

Forms 1099 The Basics You Should Know Kelly CPA

The following guides take you. Depending on what’s happened in your financial life during the year, you could get one or. The tax forms you might see in. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income.

A guide to your 2014 Consolidated IRS Form 1099

Depending on what’s happened in your financial life during the year, you could get one or. Web the consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Web for the most recent version, go to irs.gov/form1099int. The following guides take you. Web the consolidated 1099 form contains several tax reports that you may use for.

A guide to your 2014 Consolidated IRS Form 1099

In most situations, you must report the income shown on form 1099 when. Web what is a consolidated 1099 tax statement? Web the consolidated 1099 form contains several tax reports that you may use for your tax filing: Web all individuals receive a consolidated 1099 if they are united states citizens or legal residents and have had reportable tax activity..

Web Form 1099 Is One Of Several Irs Tax Forms (See The Variants Section) Used In The United States To Prepare And File An Information Return To Report Various Types Of Income Other.

Depending on what’s happened in your financial life during the year, you could get one or. Due to internal revenue service (irs) regulatory changes that have been phased in. Future developments reminders where to send extension of time to furnish statements to recipients. The following guides take you.

Payments Made To Someone Not Your Employee For Services In The Course Of Your Trade Or Business.

Web your consolidated form 1099 is the authoritative document for tax reporting purposes. Td ameritrade does not provide tax advice. The consolidated form 1099 received from your broker may contain several parts, which should be clearly labeled on. Solved • by turbotax • duration :55 • 911 • updated march 13, 2023 what is a 1099 consolidated tax.

In Some Cases, Exempt Recipients Will.

Web the 1099 form is a common one that covers several types of situations. Web consolidated form 1099, and will not be held liable for any fees incurred for the refiling of a tax form. The tax forms you might see in. In most situations, you must report the income shown on form 1099 when.

A Consolidated Form 1099 Combines Five Separate 1099 Forms Into One Tax Reporting Document.

Web for the most recent version, go to irs.gov/form1099int. Web what is a consolidated 1099 tax statement? Web what is a 1099 consolidated tax statement? You owned real estate mortgage investment.