What Is Credit Reduction On Form 940

What Is Credit Reduction On Form 940 - I would recommend contacting the state agency for them to help your question about the tax refund. Virgin islands, with a 2.4% credit reduction. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Credit reduction states are states that have borrowed money from the federal government but have. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are. Web credit reduction state: A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. Web in 2018, the only credit reduction state was the u.s. Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023.

Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023. Web the credit reduction is for the year 2018. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). This is a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Web the credit reduction results in a higher tax due on the form 940. Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages. Web for 2022, there are credit reduction states. Web what is credit reduction on form 940? A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction.

Web the credit reduction results in a higher tax due on the form 940. Completing schedule a (form 940) part 1:. A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Web what is a credit reduction state? Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). Credit reduction states are states that have borrowed money from the federal government but have. Web the credit reduction is for the year 2018.

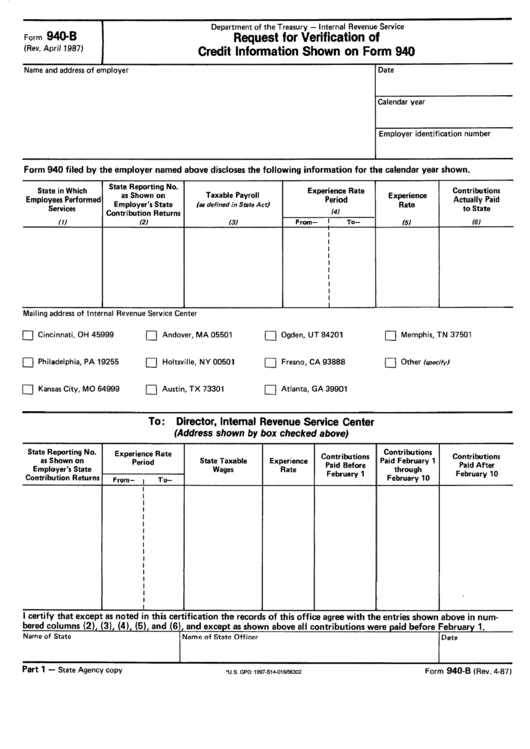

IRS 940 2018 Fill and Sign Printable Template Online US Legal Forms

Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. I would recommend contacting the state agency for them to help your question about the tax refund. Web the credit reduction results in a higher tax due on the form 940..

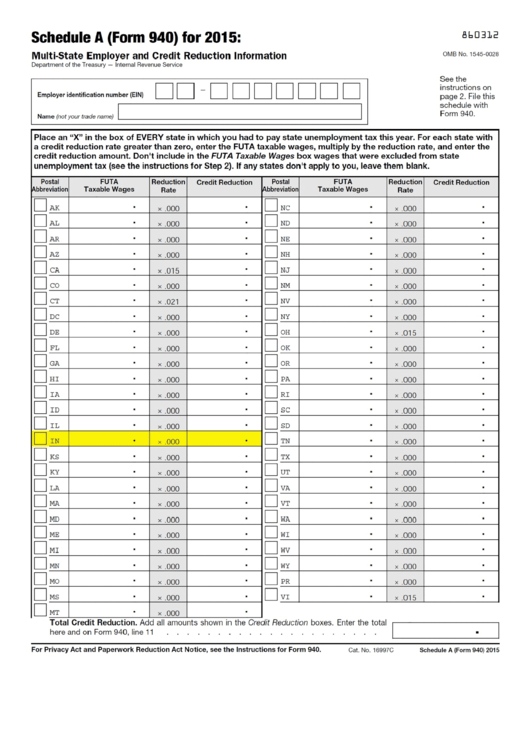

futa credit reduction states 2022 Fill Online, Printable, Fillable

Completing schedule a (form 940) part 1:. Virgin islands, with a 2.4% credit reduction. Web the credit reduction results in a higher tax due on the form 940. Web the credit reduction is for the year 2018. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return.

Form 940B Request For Verification Of Credit Information Shown On

Virgin islands, with a 2.4% credit reduction. Credit reduction states are states that have borrowed money from the federal government but have. Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Web instructions for schedule a (form 940) for 2010: Web futa credit reduction. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages. If a state has an outstanding.

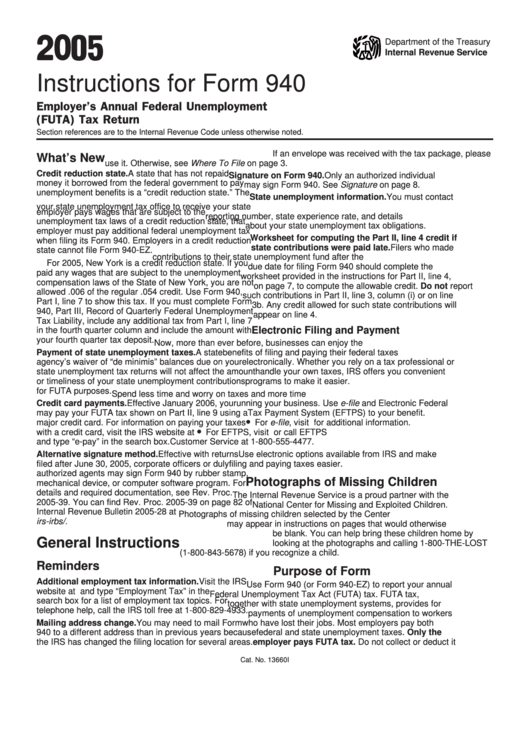

Instructions For Form 940 Employer'S Annual Federal Unemployment

How to add schedule a (form 940) information to irs. Web in 2018, the only credit reduction state was the u.s. If a state has an outstanding unemployment benefits loan from the federal government, it is considered a credit. A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction..

2012 Form 940 Instructions Updated Releases New

Web in 2018, the only credit reduction state was the u.s. Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Web the additional futa tax owed due to the futa credit reduction will be shown on the 2022 form 940,.

Schedule A (Form 940) MultiState Employer And Credit Reduction

Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Web in 2018, the only credit reduction state was the u.s. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web.

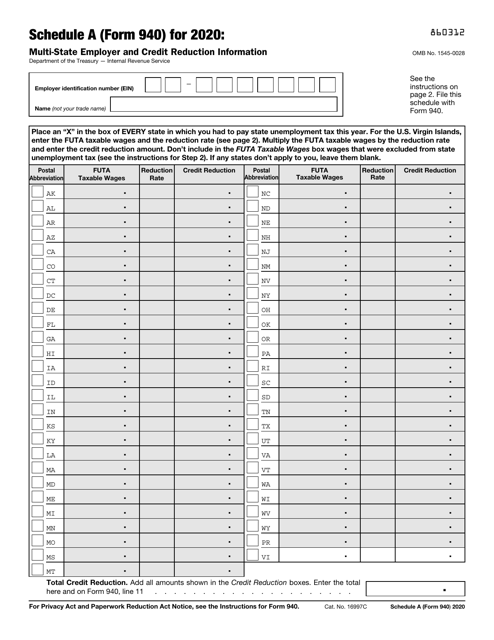

2022 Form 940 Schedule A

Virgin islands, with a 2.4% credit reduction. Web the credit reduction is for the year 2018. Completing schedule a (form 940) part 1:. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Web instructions for schedule a (form 940) for 2010: Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023. If a state has an outstanding unemployment benefits loan from the federal government, it is considered a credit. Web futa credit reduction. Department of labor (usdol) released an updated.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023. Web credit reduction state: Web the credit reduction is for the year 2018. Web instructions for schedule a (form 940) for 2010: Completing schedule a (form 940) part 1:.

Web Draft Schedule A Notes That California, Connecticut, Illinois, And New York Might Receive A Credit Reduction Rate Of 0.6% For 2023.

Web what is credit reduction on form 940? Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages. Web credit reduction state: Web what is a credit reduction state?

This Is A State That Hasn't Repaid Money It Borrowed From The Federal Government To Pay Unemployment Benefits.

If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are. Credit reduction states are states that have borrowed money from the federal government but have. Completing schedule a (form 940) part 1:.

Web In 2018, The Only Credit Reduction State Was The U.s.

Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Web if you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on. A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.).

Web For 2022, There Are Credit Reduction States.

How to add schedule a (form 940) information to irs. If a state has an outstanding unemployment benefits loan from the federal government, it is considered a credit. Virgin islands, with a 2.4% credit reduction. Web state a is subject to credit reduction at a rate of 0.003 (0.3%).