What Is Form 2210 Penalty

What Is Form 2210 Penalty - Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web you may owe a penalty. No you may owe a penalty. Does any box in part ii below apply? Web when estimated tax payments are late, filing tax form 2210 is mandatory. Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the. Web step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web if you owe a penalty for estimated taxes, you may have to fill out irs form 2210. Web what is irs form 2210?

Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web you must figure the penalty using schedule al and file form 2210. Web yes you mustfile form 2210. You are notrequired to figure your penalty because the irs will figure it and send you a bill for any unpaid. The form’s primary purpose is. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. If you’re wondering, w hat is form 2210, y ou are not alone. Does any box in part ii below apply? Web when estimated tax payments are late, filing tax form 2210 is mandatory.

Why isn't form 2210 generating for a form. If you’re wondering, w hat is form 2210, y ou are not alone. Web when estimated tax payments are late, filing tax form 2210 is mandatory. This penalty is different from the penalty for. If you pay 90% or more of your total tax. Does any box in part ii below apply? You are notrequired to figure your penalty because the irs will figure it and send you a bill for any unpaid. The form doesn't always have to be. No you may owe a penalty. Web you may owe a penalty.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Go to irs instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts for more. Does any box in part ii below apply? Web the “ estimated tax safe harbor ” rule means that if you paid enough in tax, you won’t owe the estimated tax penalty. The form doesn't always have to be. Web if you.

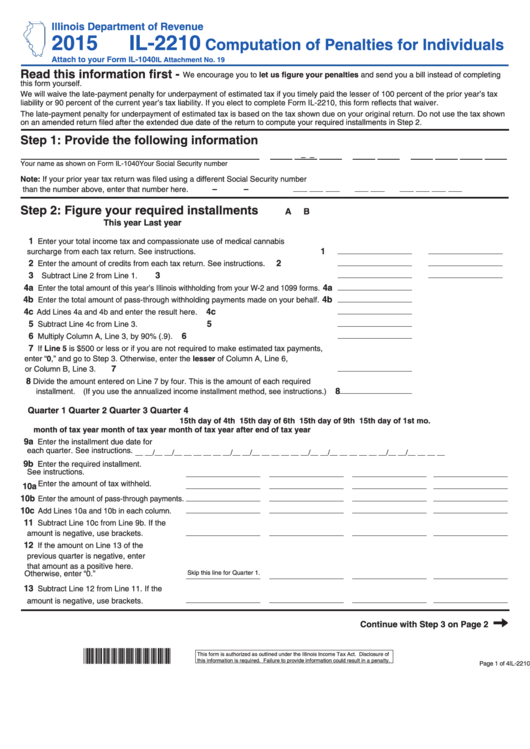

Form Il2210 Computation Of Penalties For Individuals 2015

Web below are solutions to frequently asked questions about entering form 2210 underpayment penalty information in the fiduciary return. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take,.

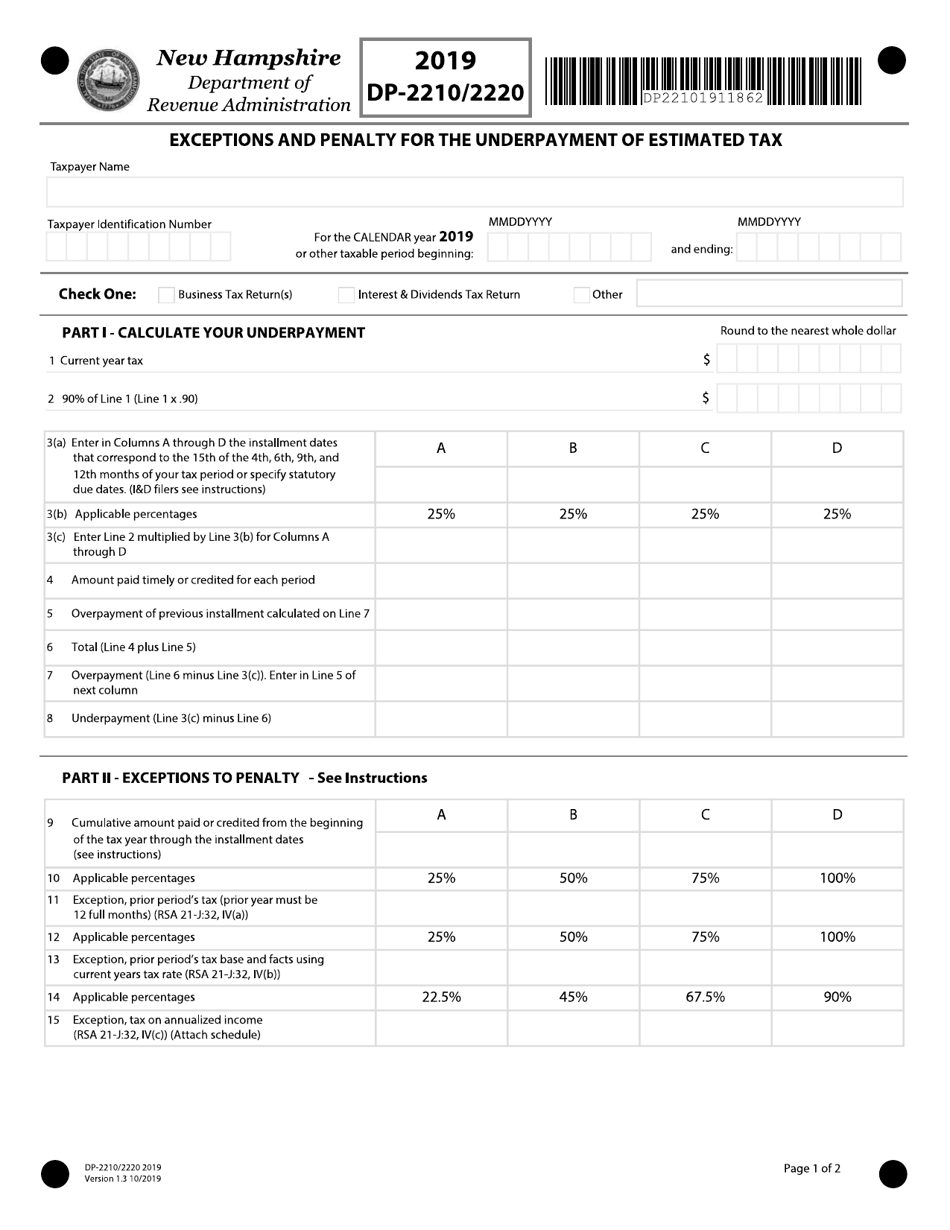

Form DP2210/2220 Download Fillable PDF or Fill Online Exceptions and

Web when estimated tax payments are late, filing tax form 2210 is mandatory. Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a. Does any box in part ii below apply? You are notrequired to figure your penalty.

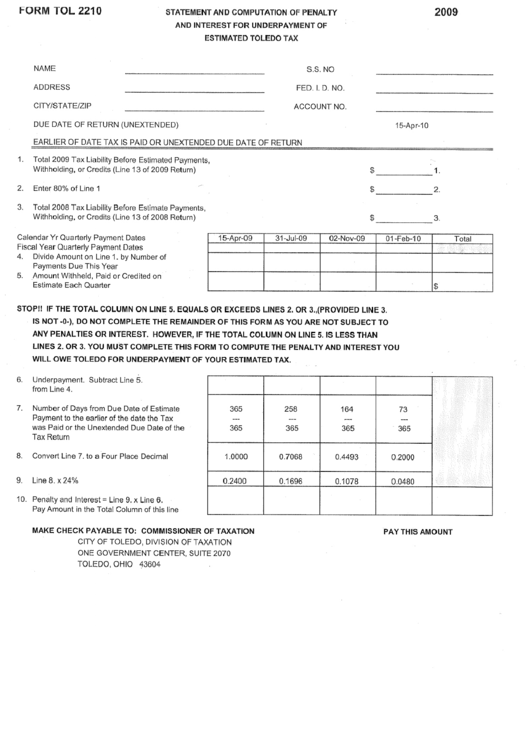

Form Tol 2210 Statement And Computation Of Penalty And Interest

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the. You are notrequired to figure your penalty because the irs will figure it and send you a bill for any unpaid. Why isn't form 2210 generating for a form. Go to irs instructions for form 2210 underpayment of estimated tax.

AR2210A Annualized Individual Underpayment of Estimated Tax Penalty…

No don’t file form 2210. Web to complete form 2210 within the program, please follow the steps listed below. Does any box in part ii below apply? The form doesn't always have to be. Web when estimated tax payments are late, filing tax form 2210 is mandatory.

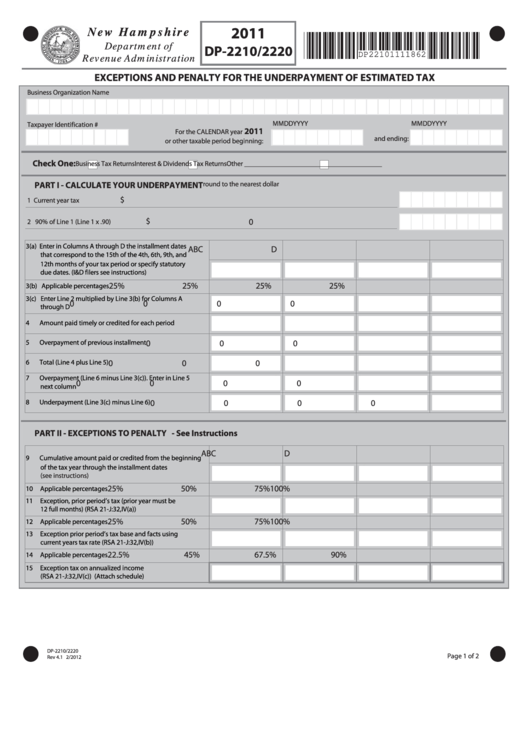

Form Dp2210/2220 Exceptions And Penalty For The Underpayment Of

Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a. If you’re wondering, w hat is form 2210, y ou are not alone. You are notrequired to figure your penalty because the irs will figure it and send.

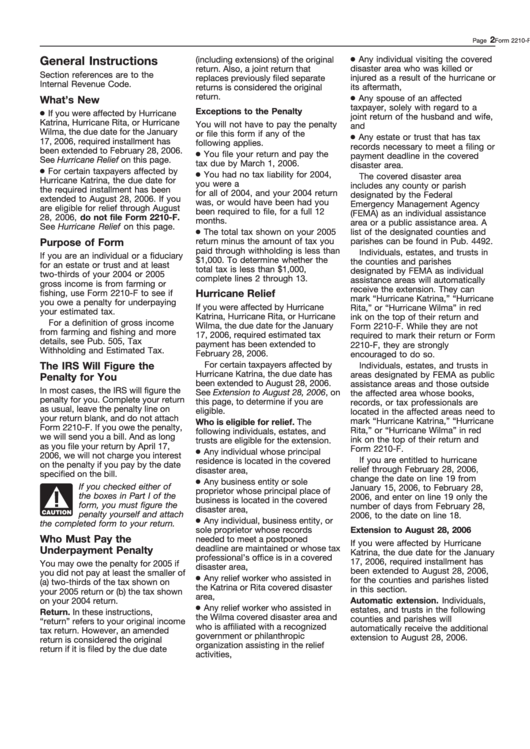

Instructions For Form 2210F Penalty For Underpaying Estimated Tax

If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and. Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the. Examine the form before completing it and use. Go to irs instructions for form 2210 underpayment of estimated tax by.

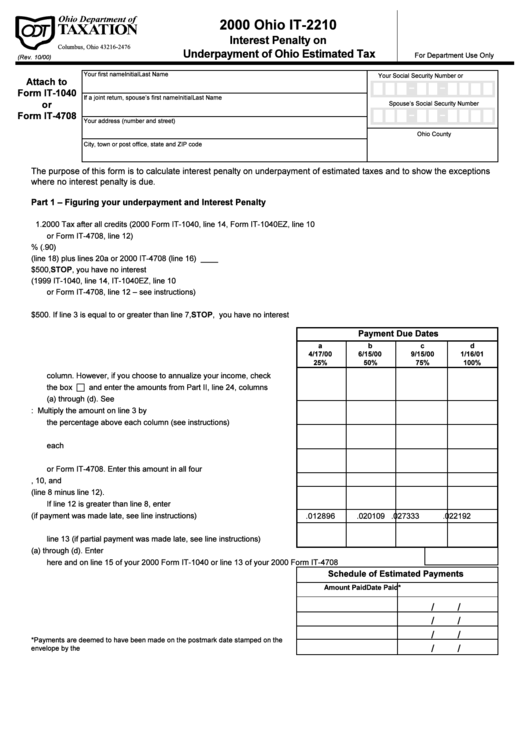

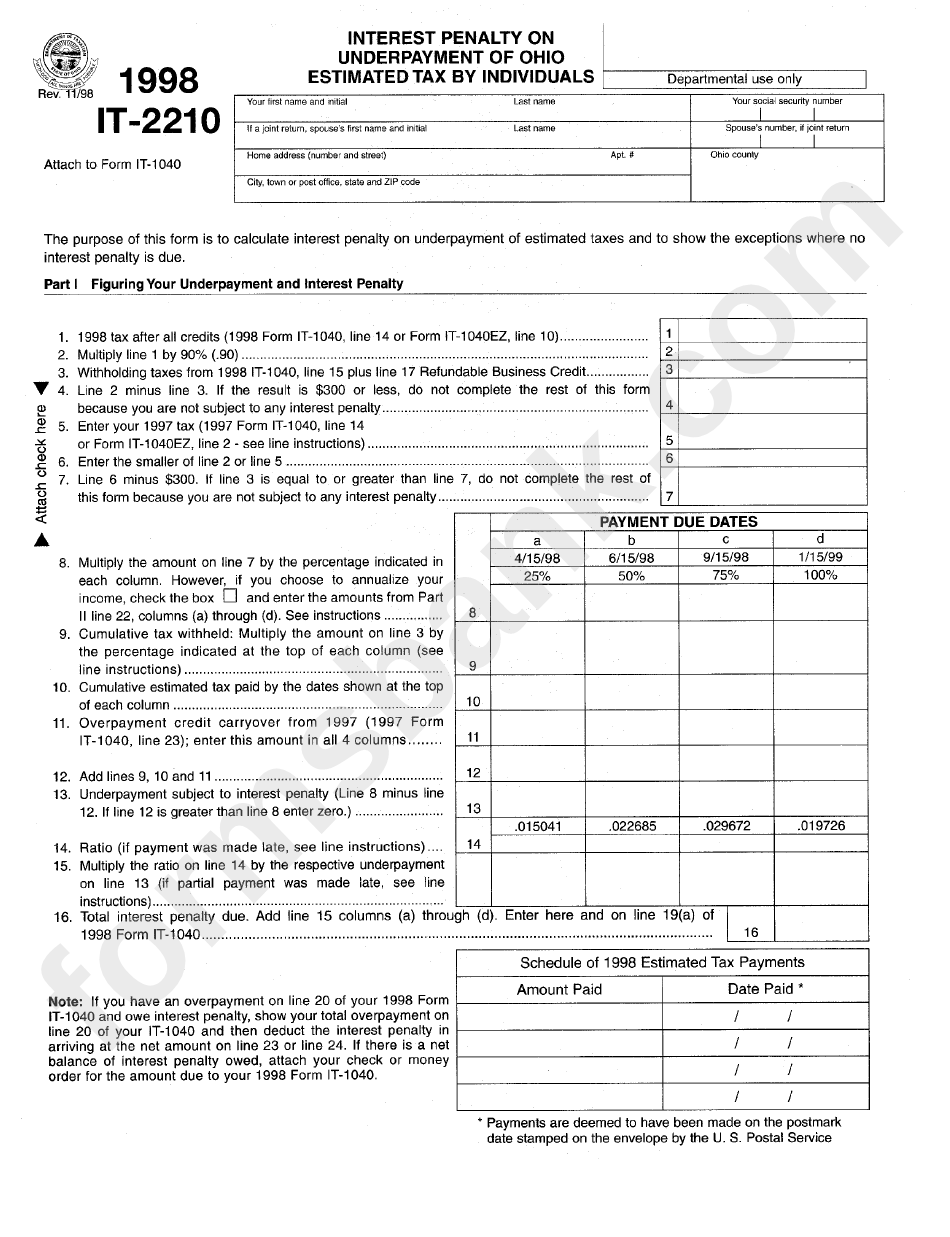

Form It2210 Interest Penalty On Underpayment Of Ohio Estimated Tax

Web when estimated tax payments are late, filing tax form 2210 is mandatory. Web below are solutions to frequently asked questions about entering form 2210 underpayment penalty information in the fiduciary return. Does any box in part ii below apply? Web you may owe a penalty. Your penalty is lower when figured by treating the federal income tax withheld from.

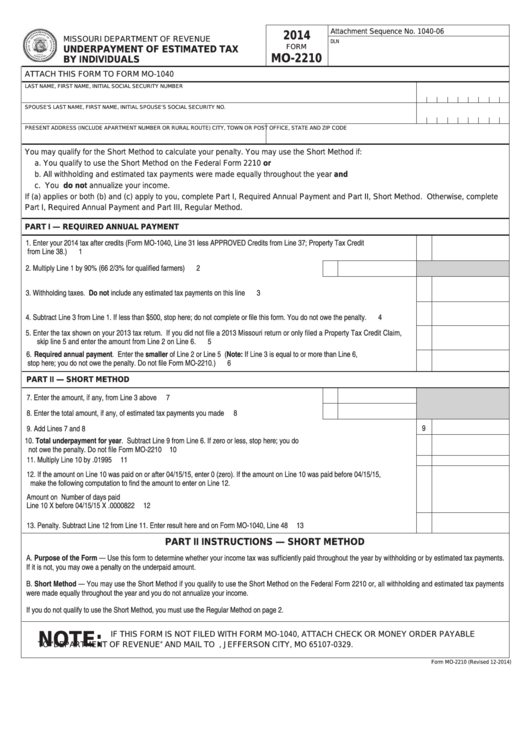

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

Web the “ estimated tax safe harbor ” rule means that if you paid enough in tax, you won’t owe the estimated tax penalty. Web when estimated tax payments are late, filing tax form 2210 is mandatory. You aren’t required to figure your penalty because the irs will figure it and send you a bill for. Dispute a penalty if.

Fillable Form It2210 Interest Penalty On Underpayment Of Ohio

Examine the form before completing it and use. Web yes you mustfile form 2210. Web step by step instructions if you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web taxact cannot calculate late filing nor late payment penalties. Web form 2210 is used to.

Your Penalty Is Lower When Figured By Treating The Federal Income Tax Withheld From Your Income As Paid On The.

The form doesn't always have to be. Web taxact cannot calculate late filing nor late payment penalties. Why isn't form 2210 generating for a form. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due.

Web What Is Irs Form 2210?

Web if you owe a penalty for estimated taxes, you may have to fill out irs form 2210. No don’t file form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. You aren’t required to figure your penalty because the irs will figure it and send you a bill for.

Dispute A Penalty If You Don’t Qualify For Penalty.

Web when estimated tax payments are late, filing tax form 2210 is mandatory. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web if you received premium assistance through advance payments of the ptc in 2022, and the amount advanced exceeded the amount of ptc you can take, you could be subject to a.

No You May Owe A Penalty.

Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. This penalty is different from the penalty for. If you pay 90% or more of your total tax. Does box b, c, or d in part ii apply?