What Is Form 4684

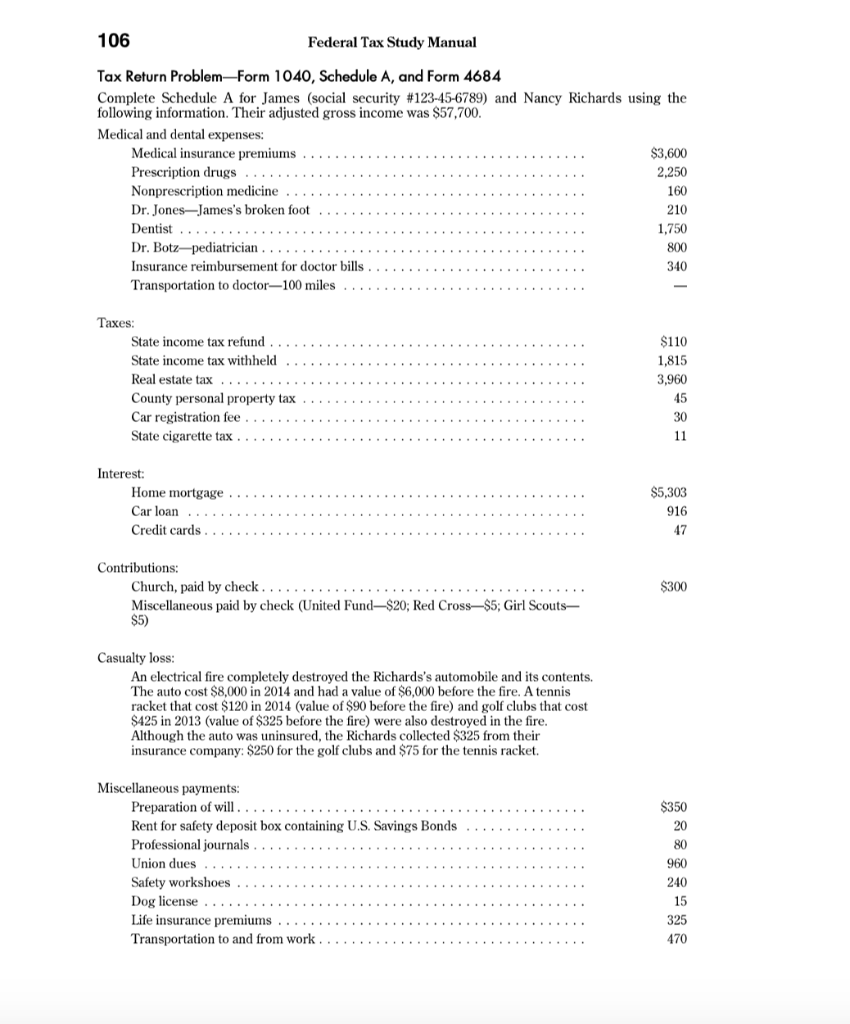

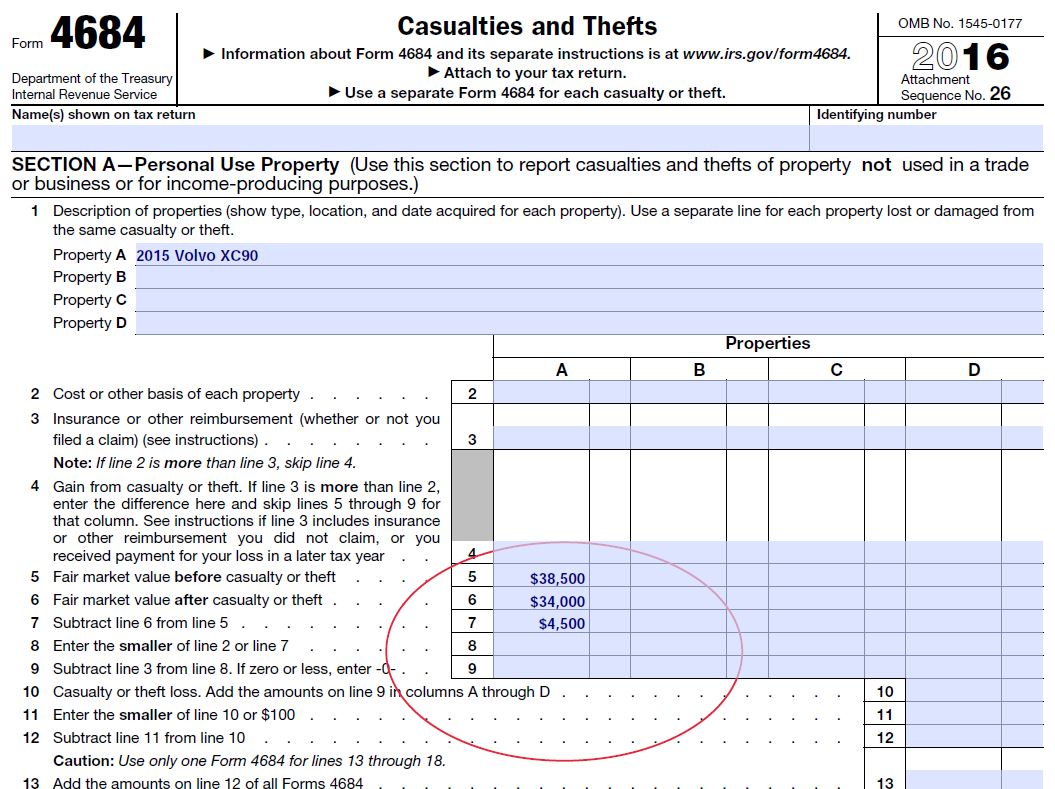

What Is Form 4684 - Name(s) shown on tax return identifying number. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Individual income tax return,” is a form that taxpayers can file with the irs if. Certain taxpayers affected by federally declared disasters. Web claiming the deduction requires you to complete irs form 4684. Losses you can deduct you can deduct losses of property from fire,. Attach form 4684 to your tax return. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes; Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. Web use form 4684 to report gains and losses from casualties and thefts.

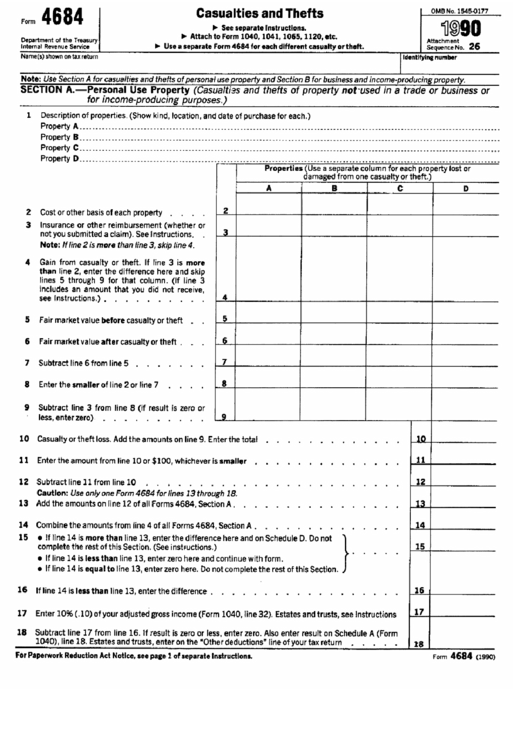

Purpose of form use form 4684 to report gains and losses from casualties and thefts. How the casualty and theft losses deduction works you can only deduct casualty and. See form 8949 for how to make the election. Attach form 4684 to your tax return. Solved•by intuit•updated july 19, 2022. Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. Web use form 4684 to report gains and losses from casualties and thefts. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web entering a casualty or theft for form 4684. Federal tax form, is utilized to provide a detailed account of any casualties or thefts and the corresponding financial losses that have occurred within a tax.

Car, boat, and other accidents;. Web form 4684, a u.s. Name(s) shown on tax return identifying number. This article will assist you with entering a casualty or theft for form 4684 in. Losses you can deduct you can deduct losses of property from fire,. Solved•by intuit•updated july 19, 2022. Individual income tax return,” is a form that taxpayers can file with the irs if. Purpose of form use form 4684 to report gains and losses from casualties and thefts. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes;

Form 4684 Casualties and Thefts (2015) Free Download

Beginning in 2018, the tax cuts and jobs act suspended the itemized deduction for personal. Certain taxpayers affected by federally declared disasters. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web use a separate form 4684 for each casualty or theft. Web the 2018 form 4684 is available at irs.gov/form4684.

Form 4684 Edit, Fill, Sign Online Handypdf

Web use form 4684 to report gains and losses from casualties and thefts. Web to compute and report casualty losses, you need to fill out irs form 4684. You must enter the fema disaster declaration number on that form. Certain taxpayers affected by federally declared disasters. Web form 4684 is a form provided by the internal revenue service (irs) that.

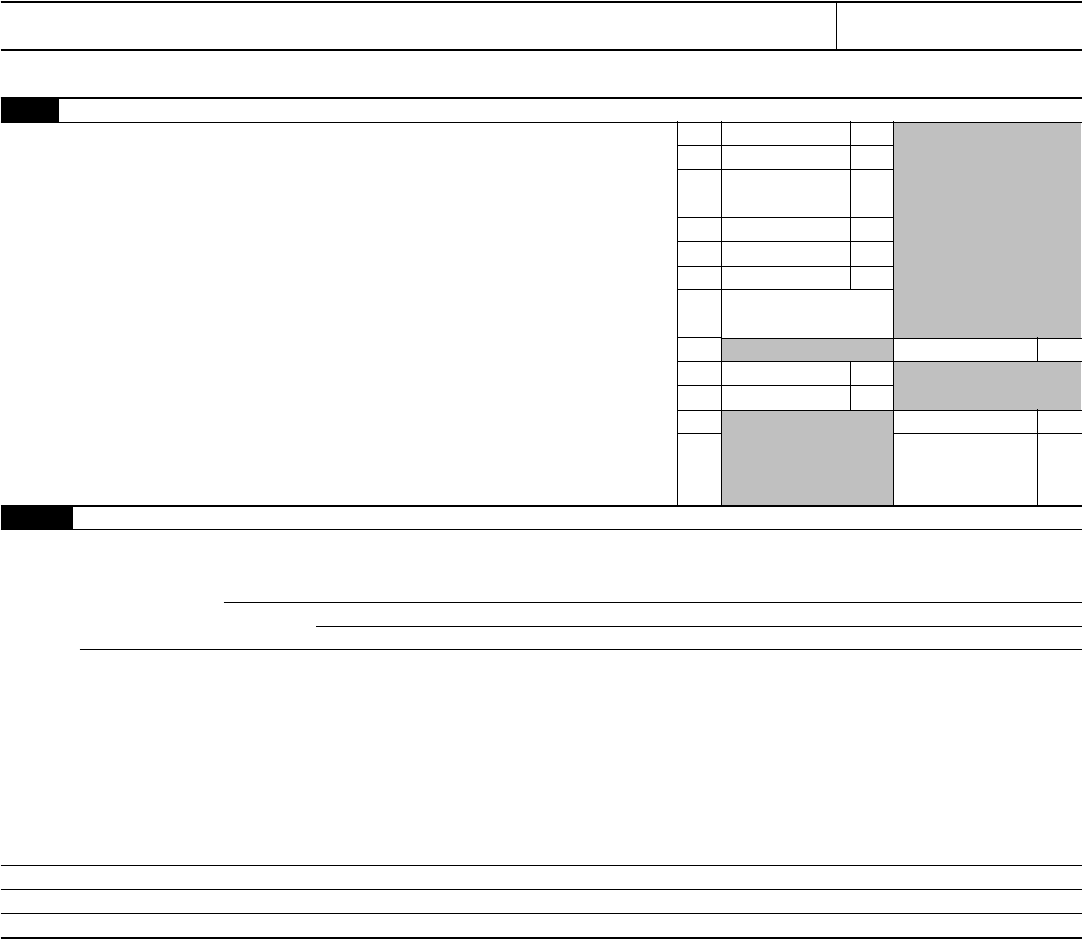

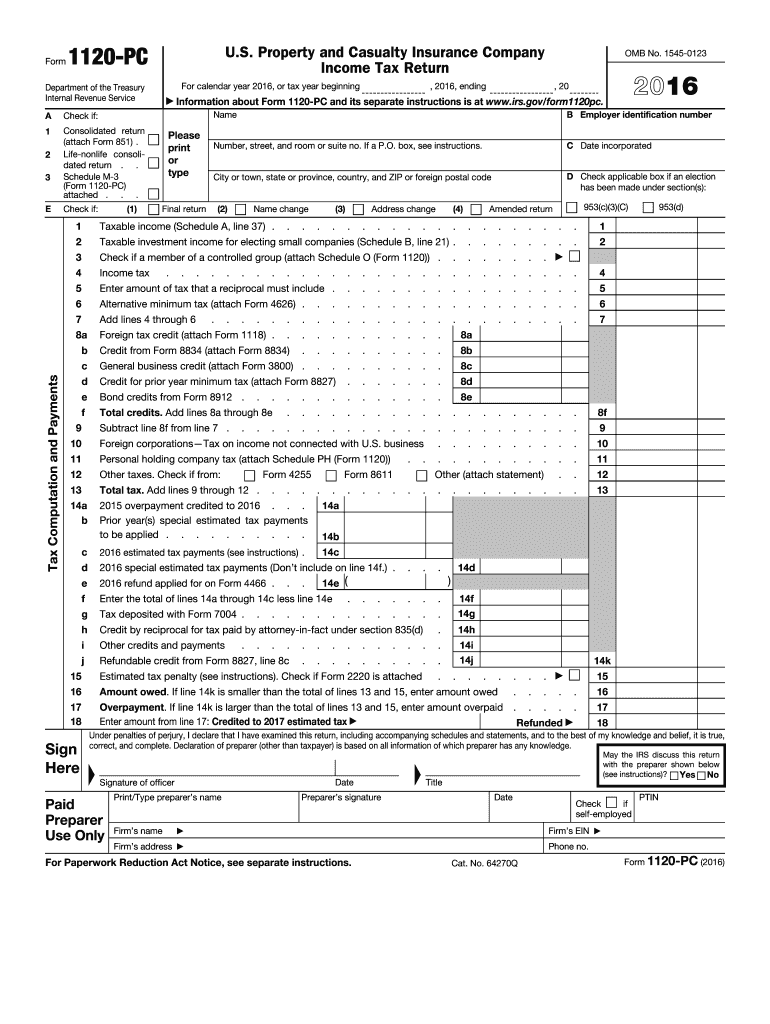

106 Federal Tax Study Manual Tax Return ProblemForm

Web to compute and report casualty losses, you need to fill out irs form 4684. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. You must enter the fema disaster declaration number on that form. You may be able to deduct part.

Diminished Value and Taxes, IRS form 4684 Diminished Value of

If reporting a qualified disaster loss, see the instructions for special rules that apply. Name(s) shown on tax return identifying number. Web entering a casualty or theft for form 4684. Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 4684 is for a casualty loss.

Form 4684 Fill Out and Sign Printable PDF Template signNow

Web use a separate form 4684 for each casualty or theft. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web use form 4684 to report.

File major disaster claims on Form 4684 Don't Mess With Taxes

You must enter the fema disaster declaration number on that form. How the casualty and theft losses deduction works you can only deduct casualty and. Web you can calculate and report casualty and theft losses on irs form 4684. See form 8949 for how to make the election. If reporting a qualified disaster loss, see the instructions for special rules.

Form 4684 Theft and Casualty Loss Deduction H&R Block

How the casualty and theft losses deduction works you can only deduct casualty and. Web taxslayer support what is considered a casualty loss deduction (form 4684)? Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. Attach form 4684 to your tax. Car,.

Form 4684 Casualties And Thefts 1990 printable pdf download

How the casualty and theft losses deduction works you can only deduct casualty and. Web you can calculate and report casualty and theft losses on irs form 4684. Web use form 4684 to report gains and losses from casualties and thefts. Web form 4868, also known as an “application for automatic extension of time to file u.s. Solved•by intuit•updated july.

IRS Form 4684 2018 2019 Fillable and Editable PDF Template

Losses you can deduct you can deduct losses of property from fire,. Web use a separate form 4684 for each casualty or theft. Purpose of form use form 4684 to report gains and losses from casualties and thefts. This article will assist you with entering a casualty or theft for form 4684 in. Attach form 4684 to your tax.

Please fill out an 2017 IRS Tax FORM 4684 Casualty

Car, boat, and other accidents;. Web form 4684 is for a casualty loss. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Solved•by intuit•updated july 19, 2022. Attach form 4684 to your tax.

Web Use A Separate Form 4684 For Each Casualty Or Theft.

This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes; Certain taxpayers affected by federally declared disasters.

Losses You Can Deduct You Can Deduct Losses Of Property From Fire,.

Purpose of form use form 4684 to report gains and losses from casualties and thefts. Web form 4684, a u.s. This article will assist you with entering a casualty or theft for form 4684 in. Web to compute and report casualty losses, you need to fill out irs form 4684.

Solved•By Intuit•Updated July 19, 2022.

Federal tax form, is utilized to provide a detailed account of any casualties or thefts and the corresponding financial losses that have occurred within a tax. Web taxslayer support what is considered a casualty loss deduction (form 4684)? If reporting a qualified disaster loss, see the instructions for special rules that apply. Web you can calculate and report casualty and theft losses on irs form 4684.

Web Form 4868, Also Known As An “Application For Automatic Extension Of Time To File U.s.

How the casualty and theft losses deduction works you can only deduct casualty and. Car, boat, and other accidents;. Attach form 4684 to your tax return. Web use a separate form 4684 for each casualty or theft.