What Is Form 8822-B

What Is Form 8822-B - Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. If you are managing an estate, trust, gift, or other fiduciary tax matter, you. If you are married and file joint returns, you will be able to. Complete, edit or print tax forms instantly. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Ad get ready for tax season deadlines by completing any required tax forms today. Purpose of form you can use form 8822 to notify the internal revenue service if you.

Complete, edit or print tax forms instantly. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Purpose of form you can use form 8822 to notify the internal revenue service if you. Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. Ad get ready for tax season deadlines by completing any required tax forms today. If you are married and file joint returns, you will be able to.

Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Complete, edit or print tax forms instantly. If you are married and file joint returns, you will be able to. Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. Purpose of form you can use form 8822 to notify the internal revenue service if you. Ad get ready for tax season deadlines by completing any required tax forms today. If you are managing an estate, trust, gift, or other fiduciary tax matter, you.

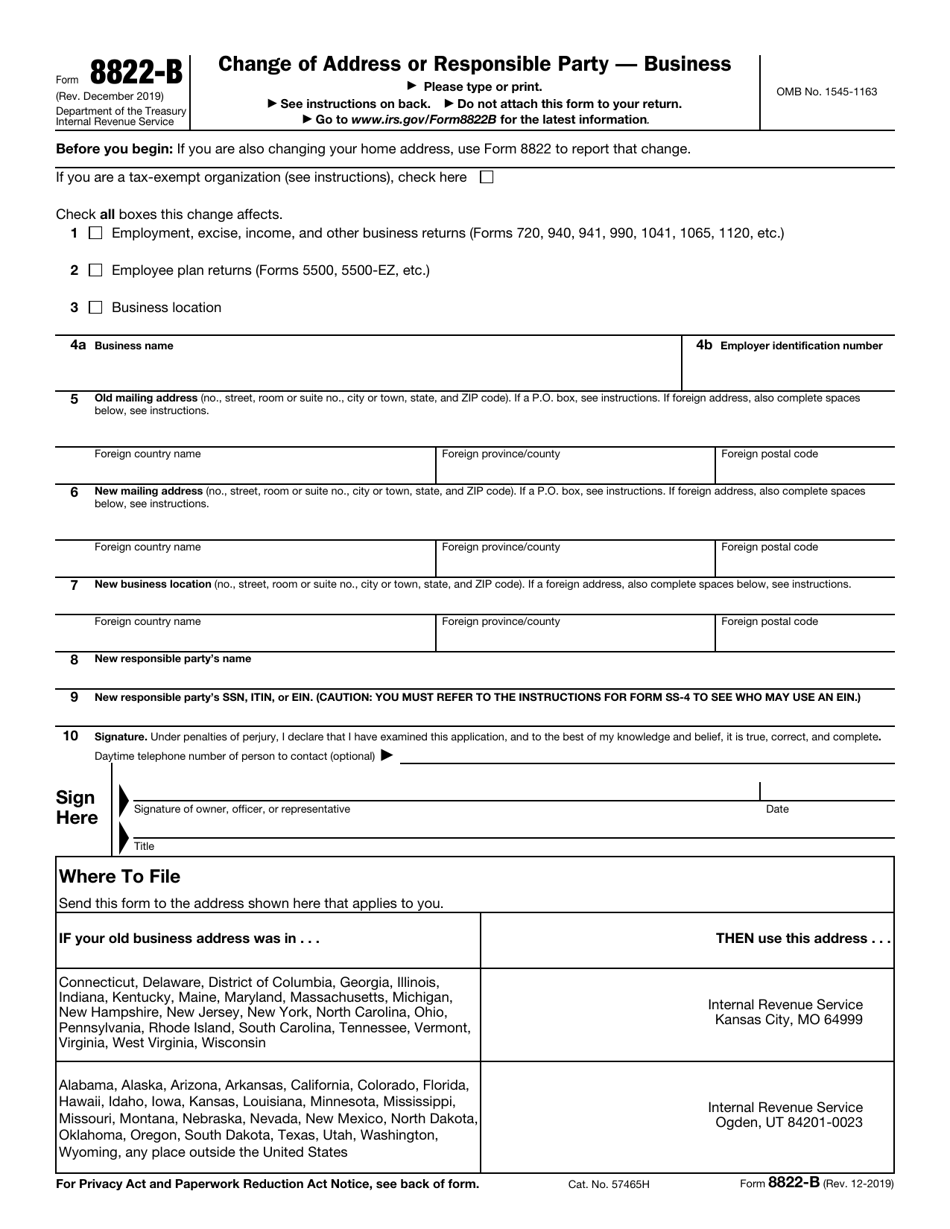

Irs form 8822 B 2017 Awesome 3 11 Individual In E Tax Returns Internal

Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. If you are married and file joint returns, you will be able to. Purpose of form you can use form.

How to fill out form 8822 B 2020 YouTube

Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Purpose of form you can use form 8822 to notify the internal revenue service if you. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. Web form 8822.

Form 8822 B 2019 Fillable and Editable PDF Template

Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. Purpose of form you can use form 8822 to notify the internal revenue service if you. Web this is quite.

IRS Form 8822B Download Fillable PDF or Fill Online Change of Address

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. If you are married and file joint returns, you will be able to. Web.

Form 8822 (Rev. October 2015) Internal Revenue Service Irs Tax

Complete, edit or print tax forms instantly. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Ad get ready for tax season deadlines by completing any required tax forms today. Purpose of form you can use form 8822 to notify the internal revenue service if you. Web this is quite dangerous.

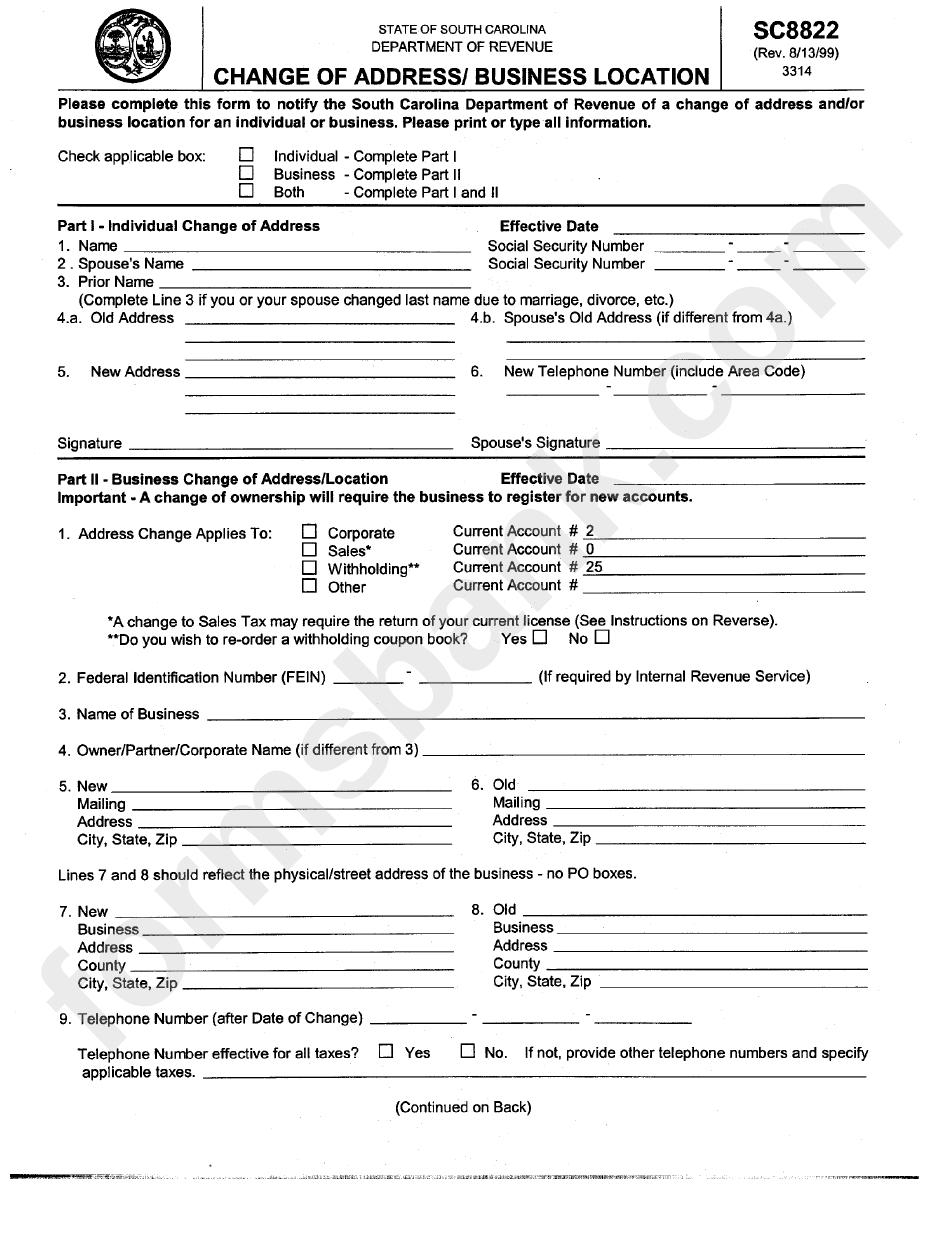

Form Sc 8822 Change Of Address / Business Location printable pdf download

Purpose of form you can use form 8822 to notify the internal revenue service if you. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web form 8822 requires basic info, the kind of tax return you.

Form 8822 Change of Address (2014) Free Download

Purpose of form you can use form 8822 to notify the internal revenue service if you. If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web form 8822 requires basic info, the kind of tax return you.

Fill Free fillable form 8822b change of address or responsible party

Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. Complete,.

Does your plan need IRS Form 8822B? Retirement Learning Center

If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey,. Web form 8822 requires basic info, the.

FORM 8822 AUTOFILL PDF

If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. If you are married and file joint returns, you will be able to. Web form 8822 (such as legislation enacted after we release it) is.

Web Connecticut, Delaware, District Of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey,.

Web form 8822 requires basic info, the kind of tax return you file, your previous mailing address, and your new mailing address. Web form 8822 (such as legislation enacted after we release it) is at www.irs.gov/form8822. Web this is quite dangerous since the irs can send you a notice or document to your llc’s “last known address” and it’s legally effective and enforceable. If you are married and file joint returns, you will be able to.

If You Are Managing An Estate, Trust, Gift, Or Other Fiduciary Tax Matter, You.

Complete, edit or print tax forms instantly. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Ad get ready for tax season deadlines by completing any required tax forms today. Purpose of form you can use form 8822 to notify the internal revenue service if you.