What Is Form 8839

What Is Form 8839 - If the adopted person is older, they must be unable to. You may be able to take this credit in 2022 if any of the following statements are true. Below are the most popular resources associated with form 8839: The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements. The adoption credit and the adoption benefits exclusion. Web taxpayers should complete form 8839, qualified adoption expenses. To enter information for the adoption. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: An eligible child must be younger than 18. Enter “sne” on the dotted line next to the entry line.}.

The adoption credit and the adoption benefits exclusion. More questions can be found below. If the adopted person is older, they must be unable to. 38 name(s) shown on return your social. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: Enter the result on line 7 of form 1040 or line 8 of form 1040nr. Web we still encourage families who don’t think they have tax liability to file for the credit (form 8839) as long as they would otherwise file taxes, in case their tax liability changes in future years (see more below under “carry forward”). The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements. Web the total you would enter on line 1 of form 1040 or line 8 of form 1040nr by the amount on form 8839, line 29. Enter “sne” on the dotted line next to the entry line.}.

Download past year versions of this tax form as pdfs here: Web what is irs form 8839 as long as you meet certain qualifying standards, the internal revenue service enables you to use a credit for your qualified adoption expenses as a way to reduce your tax obligation. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements. The adoption credit and the adoption benefits exclusion. Solved • by intuit • 7 • updated february 23, 2023. Go to www.irs.gov/form8839 for instructions and the latest information. Web the credit adjusts for inflation and amounts to $14,890 in 2022. Entering information for form 8839 qualified adoption expenses. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified adjusted gross (magi) limits. Web generally, a taxpayer may qualify for the adoption credit if they paid qualified expenses relating to the adoption of an eligible child.

Form 8839 Qualified Adoption Expenses (2015) Free Download

Enter the result on line 1 of form 1040 or line 8 of form 1040nr. Enter the result on line 7 of form 1040 or line 8 of form 1040nr. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements. To report your.

Form 8839 Edit, Fill, Sign Online Handypdf

Below are the most popular resources associated with form 8839: You paid qualified adoption expenses in connection. To enter information for the adoption. To claim the adoption credit you must complete form 8839 for the year you. Forms and instructions are subject to omb approval before they can be.

How to Take Adoption Tax Credit for Failed Adoption Pocket Sense

Web new draft of the form to alert users that changes were made to the previously posted draft. To claim the adoption credit you must complete form 8839 for the year you. If the adopted person is older, they must be unable to. Web taxpayers should complete form 8839, qualified adoption expenses. Solved • by intuit • 7 • updated.

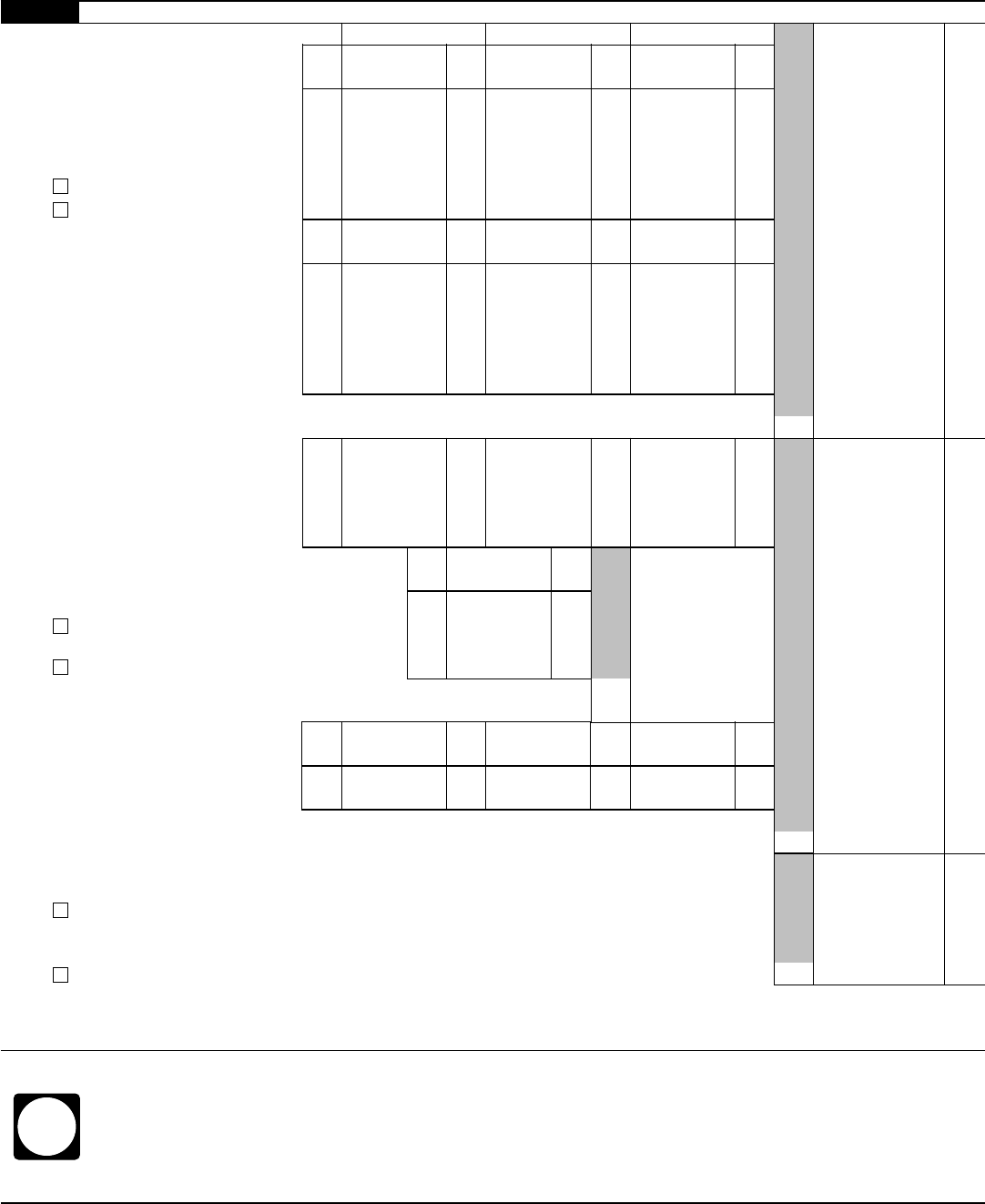

Download Instructions for IRS Form 8839 Qualified Adoption Expenses PDF

Enter the result on line 7 of form 1040 or line 8 of form 1040nr. An eligible child must be younger than 18. You may be able to take this credit in 2022 if any of the following statements are true. Thus, there are never any changes to the last posted draft of a form and the final revision of.

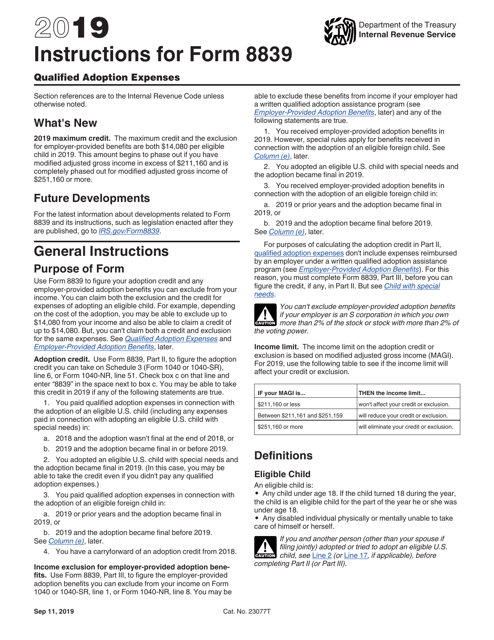

2016 Instructions For Form 8839 printable pdf download

To report your qualified adoption expenses, you'll use irs form 8839. Your credit phases out between magis of $223,410 and. To claim the credit, you have to file form 8839, qualified adoption expenses and meet the modified adjusted gross (magi) limits. You may be able to take this credit in 2022 if any of the following statements are true. Web.

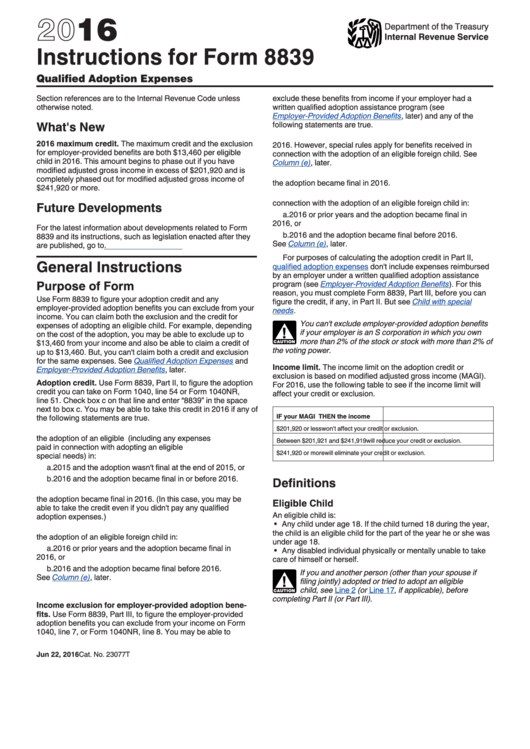

Instructions For Form 8839 2010 printable pdf download

Web what is irs form 8839 as long as you meet certain qualifying standards, the internal revenue service enables you to use a credit for your qualified adoption expenses as a way to reduce your tax obligation. If the adopted person is older, they must be unable to. Web new draft of the form to alert users that changes were.

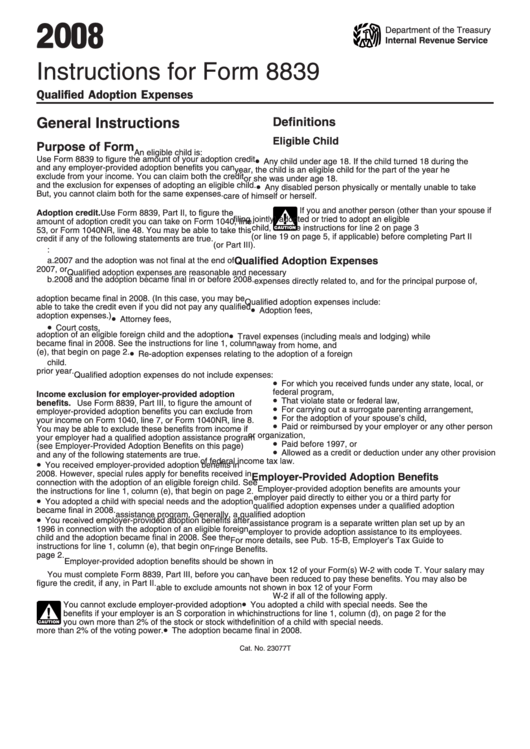

Instructions For Form 8839 2008 printable pdf download

Forms and instructions are subject to omb approval before they can be. Enter “sne” on the dotted line next to the entry line.}. Web the credit adjusts for inflation and amounts to $14,890 in 2022. Enter the result on line 1 of form 1040 or line 8 of form 1040nr. To claim the adoption credit you must complete form 8839.

Online Tax What Is The Best Online Tax Service To Use

If the adopted person is older, they must be unable to. Web taxpayers should complete form 8839, qualified adoption expenses. The following articles address frequently asked questions about the adoption credit, form 8839. Entering information for form 8839 qualified adoption expenses. An eligible child must be younger than 18.

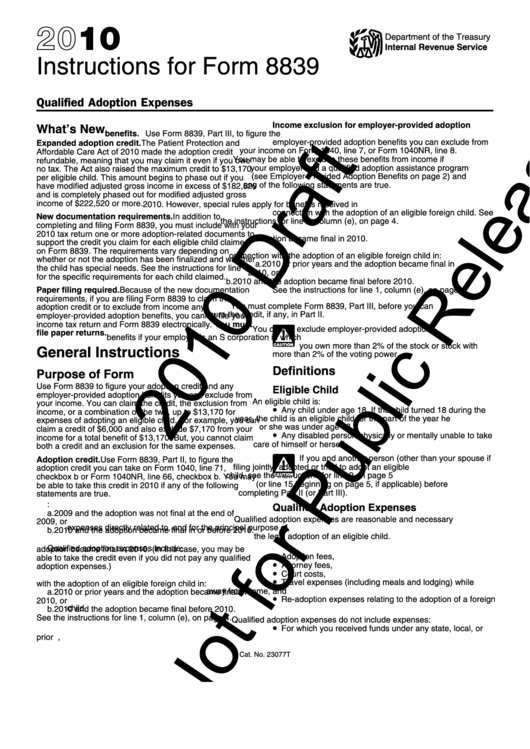

Draft Instructions For Form 8839 Qualified Adoption Expenses 2010

Web the credit adjusts for inflation and amounts to $14,890 in 2022. Adoption credit if you paid adoption expenses in 2022, you might qualify for a credit of up to $14,890 for each child. You must submit irs form 8839 in order to. 38 name(s) shown on return your social. Thus, there are never any changes to the last posted.

Form 8839Qualified Adoption Expenses

The adoption credit and the adoption benefits exclusion. Your credit phases out between magis of $223,410 and. Web generally, a taxpayer may qualify for the adoption credit if they paid qualified expenses relating to the adoption of an eligible child. They use this form to figure how much credit they can claim on their tax return. Web the credit adjusts.

To Claim The Adoption Credit You Must Complete Form 8839 For The Year You.

Enter the result on line 1 of form 1040 or line 8 of form 1040nr. Web june 14, 2017 h&r block two tax benefits are available to adoptive parents: To report your qualified adoption expenses, you'll use irs form 8839. Web the total you would enter on line 1 of form 1040 or line 8 of form 1040nr by the amount on form 8839, line 29.

An Eligible Child Must Be Younger Than 18.

Solved • by intuit • 7 • updated february 23, 2023. Forms and instructions are subject to omb approval before they can be. Enter “sne” on the dotted line next to the entry line.}. You may be able to take this credit in 2022 if any of the following statements are true.

If The Adopted Person Is Older, They Must Be Unable To.

You can claim both the credit and the exclusion for expenses of adopting an eligible child. Enter the result on line 7 of form 1040 or line 8 of form 1040nr. Go to www.irs.gov/form8839 for instructions and the latest information. Download past year versions of this tax form as pdfs here:

Your Credit Phases Out Between Magis Of $223,410 And.

Enter “sne” on the dotted line next to the entry line.}. The internal revenue service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements. Web the credit adjusts for inflation and amounts to $14,890 in 2022. Web we still encourage families who don’t think they have tax liability to file for the credit (form 8839) as long as they would otherwise file taxes, in case their tax liability changes in future years (see more below under “carry forward”).