What Is Form 8886

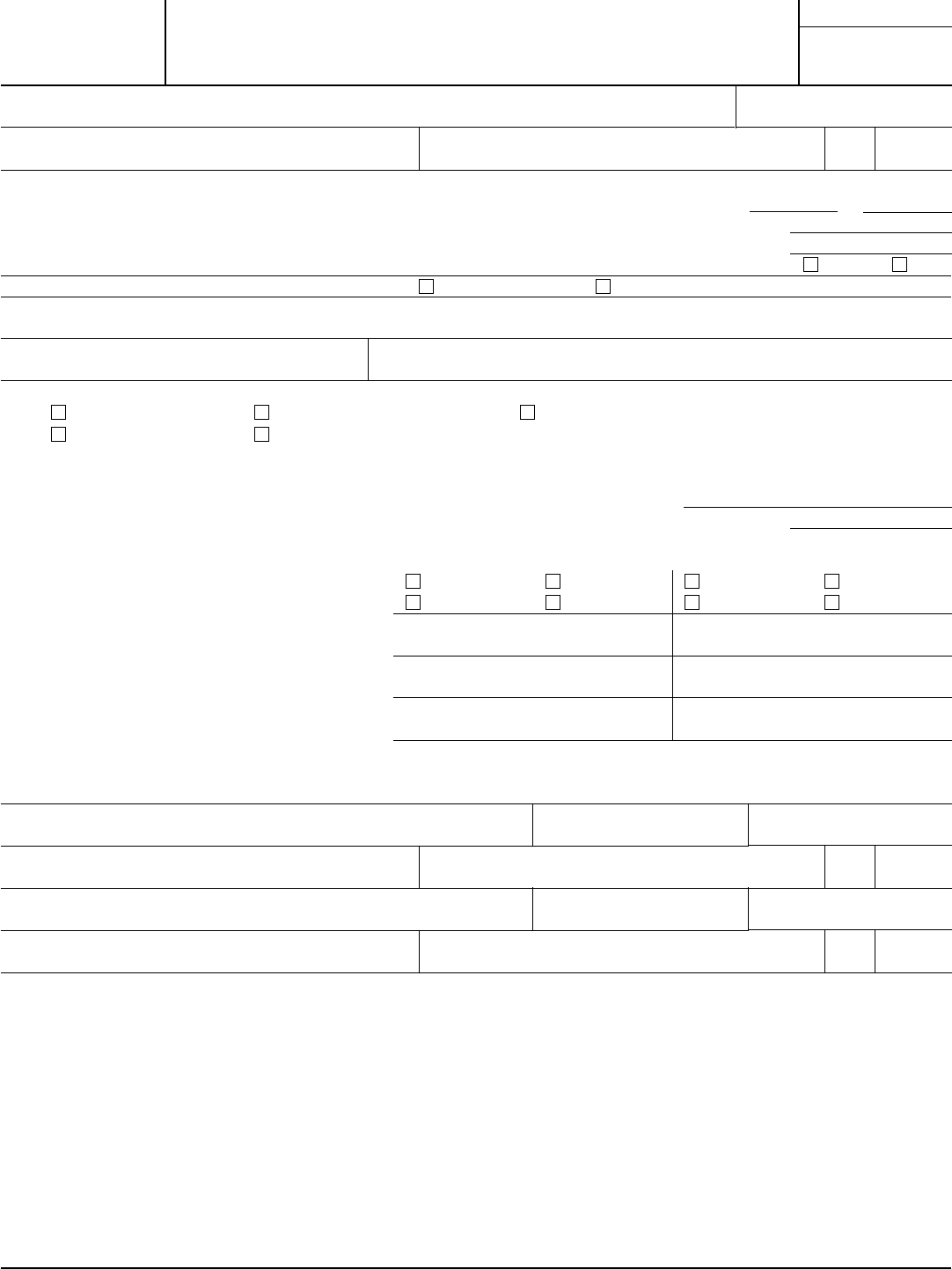

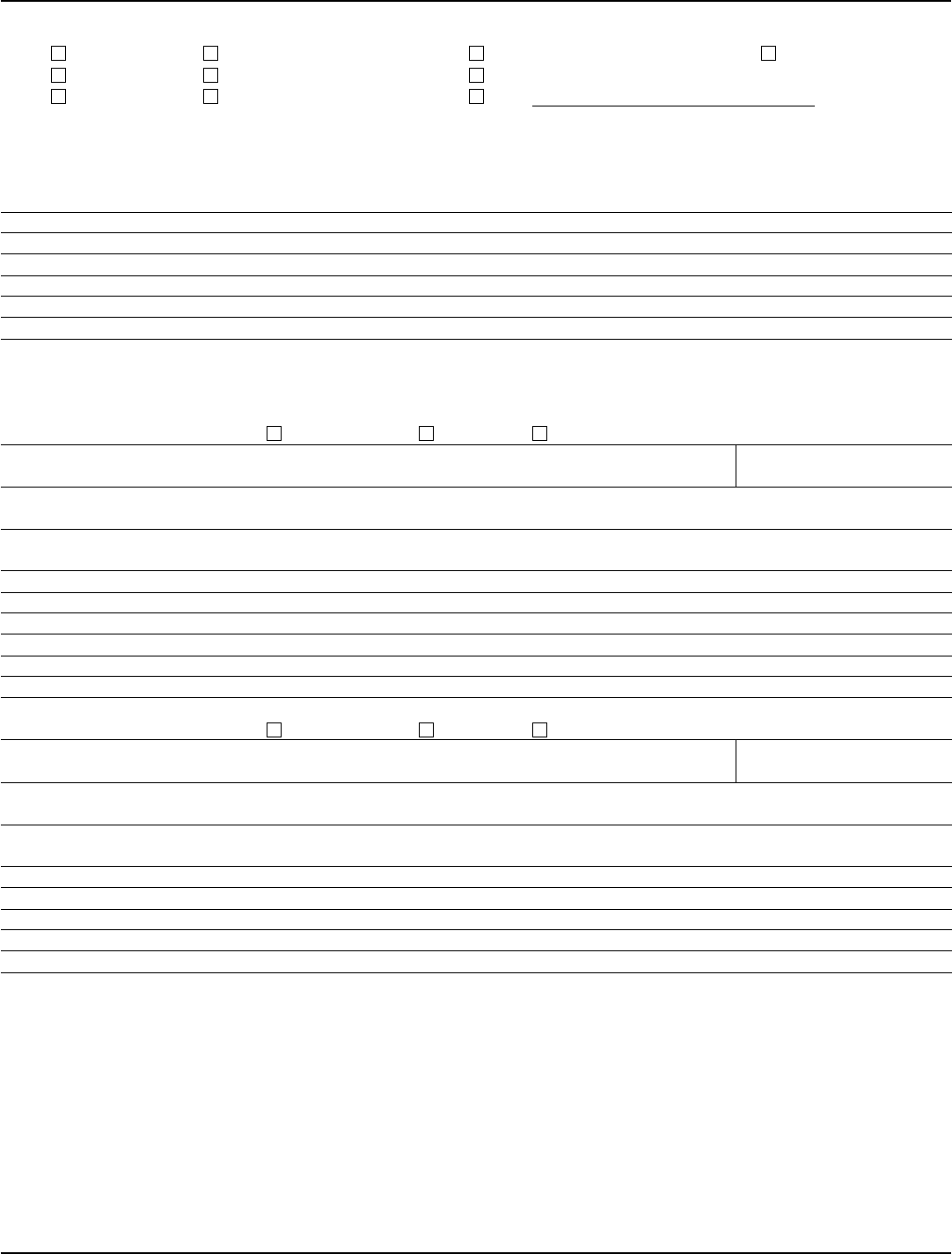

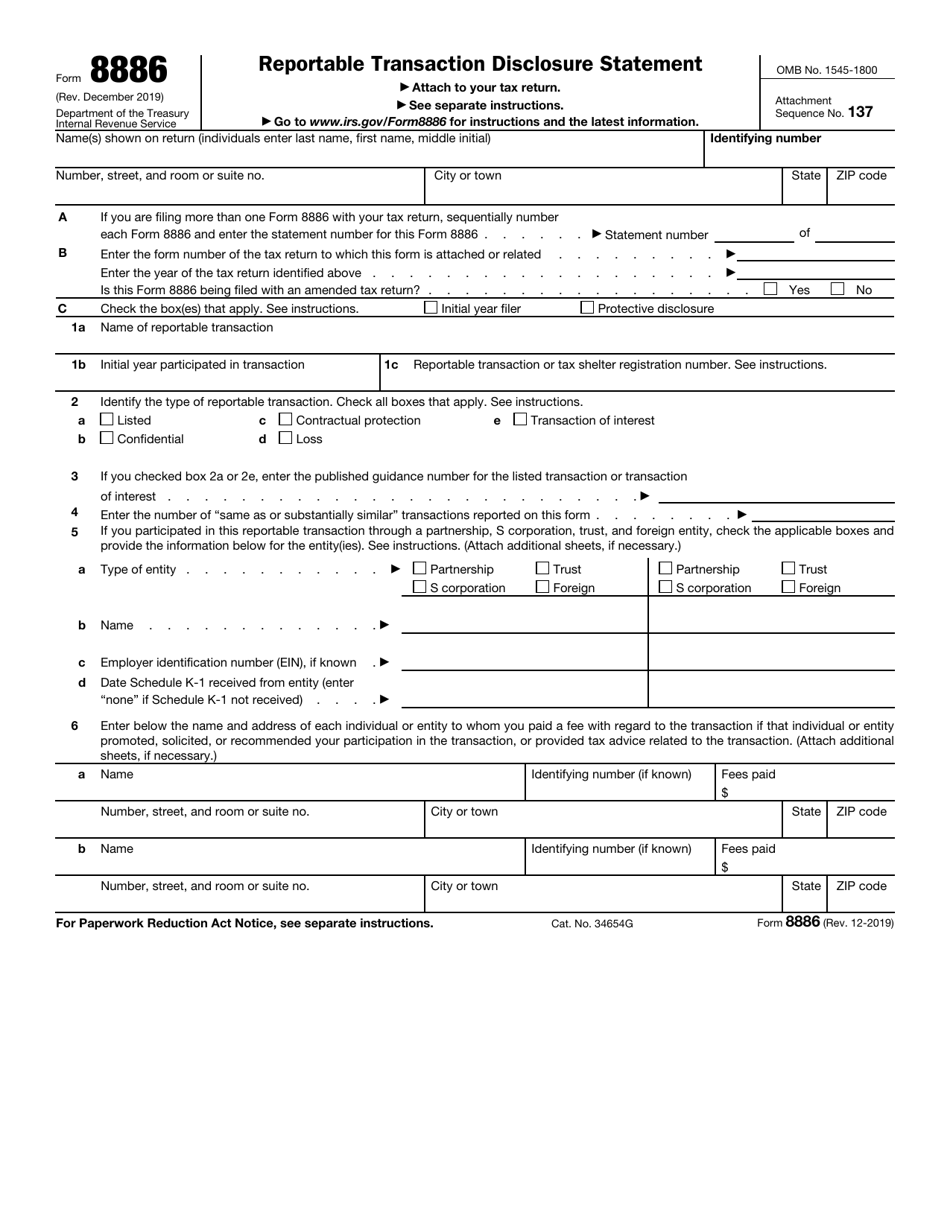

What Is Form 8886 - Use form 8886 to disclose information for each reportable transaction in which you participated. Attach to your tax return. However, you may report nonrecognition of gain, tax credits, revenue bulletin. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Irc 831(b) captive insurance is considered a listed transaction, requiring form 8886, reportable transaction disclosure statement, to be prepared each year. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. December 2019) department of the treasury internal revenue service. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction (see item 2 below) and is required to file a federal tax return or information return must file form 8886. Web in addition, a report of foreign bank and financial accounts under the bank secrecy act, fincen form 114, must be filed. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction;

To be considered complete, the information provided on form 8886 must: Generally, form 8886 must be attached to the tax return for each tax year in which participation in a reportable transaction has occurred. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. December 2019) department of the treasury internal revenue service. Web who must file form 8886? Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the taxpayer may have. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Attach to your tax return. Does this change affect me? Web use form 8886 to disclose information for each reportable transaction in which participation has occurred.

Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction (see item 2 below) and is required to file a federal tax return or information return must file form 8886. Irc 831(b) captive insurance is considered a listed transaction, requiring form 8886, reportable transaction disclosure statement, to be prepared each year. Use form 8886 to disclose information for each reportable transaction in which you participated. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Does this change affect me? However, you may report nonrecognition of gain, tax credits, revenue bulletin. Web in addition, a report of foreign bank and financial accounts under the bank secrecy act, fincen form 114, must be filed. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the taxpayer may have. To be considered complete, the information provided on form 8886 must:

Authority for Disallowance of Tax Benefits Restricted Property Trusts

December 2019) department of the treasury internal revenue service. For instructions and the latest information. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Irc 831(b) captive insurance is considered a listed transaction, requiring form 8886, reportable.

Instructions For Form 8886T Disclosure By TaxExempt Entity

Web who must file form 8886? Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the taxpayer may have. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation,.

Form 8886T Disclosure by Tax Exempt Entity Regarding Prohibited Tax

Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Generally, form 8886 must be attached to the tax.

Section 79 Plans and Captive Insurance Form 8886

Web who must file form 8886? Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. However, you may report nonrecognition of gain, tax credits, revenue bulletin. Web in addition, a report of foreign bank and.

Form 8886 Instructions Fill Out and Sign Printable PDF Template signNow

Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the taxpayer may have. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Irc 831(b) captive.

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

Irc 831(b) captive insurance is considered a listed transaction, requiring form 8886, reportable transaction disclosure statement, to be prepared each year. Use form 8886 to disclose information for each reportable transaction in which you participated. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. To be considered complete, the information provided.

Form 8886 Edit, Fill, Sign Online Handypdf

Web the form 8886 must reflect either tax consequences or a tax strategy described in the published guidance listing the transaction or designating the transaction as a toi. Attach to your tax return. For instructions and the latest information. Generally, form 8886 must be attached to the tax return for each tax year in which participation in a reportable transaction.

Form 8886 Edit, Fill, Sign Online Handypdf

Does this change affect me? Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Web the form 8886 must reflect either tax consequences or a tax strategy described in the published guidance listing the transaction.

Form 8886T Disclosure by Tax Exempt Entity Regarding Prohibited Tax

For instructions and the latest information. Web use form 8886 to disclose information for each reportable transaction in which participation has occurred. Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Generally, form 8886 must be attached to the tax return for each tax year in which participation in a reportable transaction has occurred. If a taxpayer entered into a transaction after august 2, 2007, and it later becomes a listed or toi transaction, the taxpayer must file a disclosure with otsa within 90 days. For instructions and the latest information..

Web Use Form 8886 To Disclose Information For Each Reportable Transaction In Which Participation Has Occurred.

Web the form 8886 must reflect either tax consequences or a tax strategy described in the published guidance listing the transaction or designating the transaction as a toi. Generally, form 8886 must be attached to the tax return for each tax year in which participation in a reportable transaction has occurred. Irc 831(b) captive insurance is considered a listed transaction, requiring form 8886, reportable transaction disclosure statement, to be prepared each year. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction (see item 2 below) and is required to file a federal tax return or information return must file form 8886.

However, You May Report Nonrecognition Of Gain, Tax Credits, Revenue Bulletin.

Web form 8886 when a taxpayer participates in certain transactions in which the irs has deemed the type of transaction prone to illegal tax avoidance — it is is referred to as a reportable transaction — and the taxpayer may have. Web form 8886 for each reportable exclusions from gross income, updated in future issues of the internal transaction. Web who must file form 8886? Use form 8886 to disclose information for each reportable transaction in which you participated.

Describe The Expected Tax Treatment And All Potential Tax Benefits Expected To Result From The Transaction;

Attach to your tax return. December 2019) department of the treasury internal revenue service. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is required to file a federal tax return or information return must file form 8886. To be considered complete, the information provided on form 8886 must:

For Instructions And The Latest Information.

Does this change affect me? If a taxpayer entered into a transaction after august 2, 2007, and it later becomes a listed or toi transaction, the taxpayer must file a disclosure with otsa within 90 days. Web in addition, a report of foreign bank and financial accounts under the bank secrecy act, fincen form 114, must be filed.