What Is Form 8915

What Is Form 8915 - You have a $35,000 excess repayment for 2022. For example, one files form 3115 it one finds it more advantageous to begin to use the. If that does not apply to. The qualified 2020 disaster distributions for. Qualified 2020 disaster retirement plan distributions and repayments. Last year, taxpayers were permitted to. Department of the treasury internal revenue service. Web a form that a company files with the irs to apply for a change in accounting method. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Solved•by intuit•594•updated january 17, 2023.

You have a $35,000 excess repayment for 2022. Department of the treasury internal revenue service. Web updated january 13, 2023. Web a form that a company files with the irs to apply for a change in accounting method. Web generating form 8915 in proseries. The qualified 2020 disaster distributions for. Qualified 2020 disaster retirement plan distributions and repayments. Web 46 rows purpose of form. Solved•by intuit•594•updated january 17, 2023. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the.

Department of the treasury internal revenue service. In prior tax years, form 8915. Qualified 2020 disaster retirement plan distributions and repayments. For example, one files form 3115 it one finds it more advantageous to begin to use the. You have a $35,000 excess repayment for 2022. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web generating form 8915 in proseries. Web a form that a company files with the irs to apply for a change in accounting method. Web updated january 13, 2023. Last year, taxpayers were permitted to.

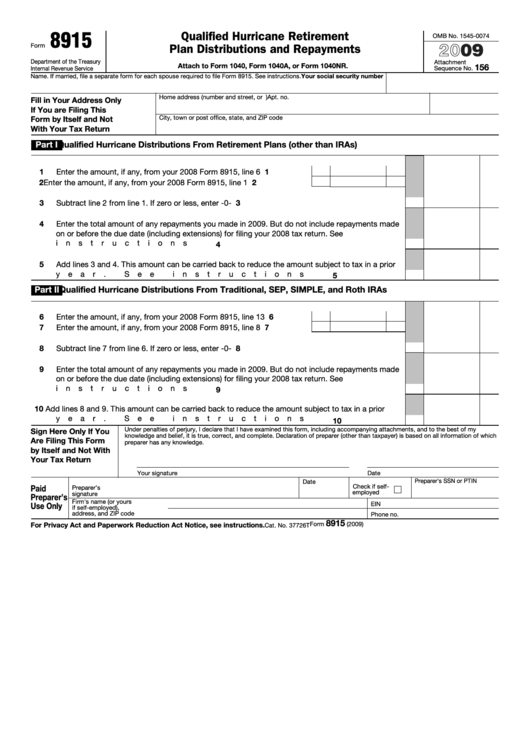

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

Last year, taxpayers were permitted to. In prior tax years, form 8915. You have a $35,000 excess repayment for 2022. Web updated january 13, 2023. For example, one files form 3115 it one finds it more advantageous to begin to use the.

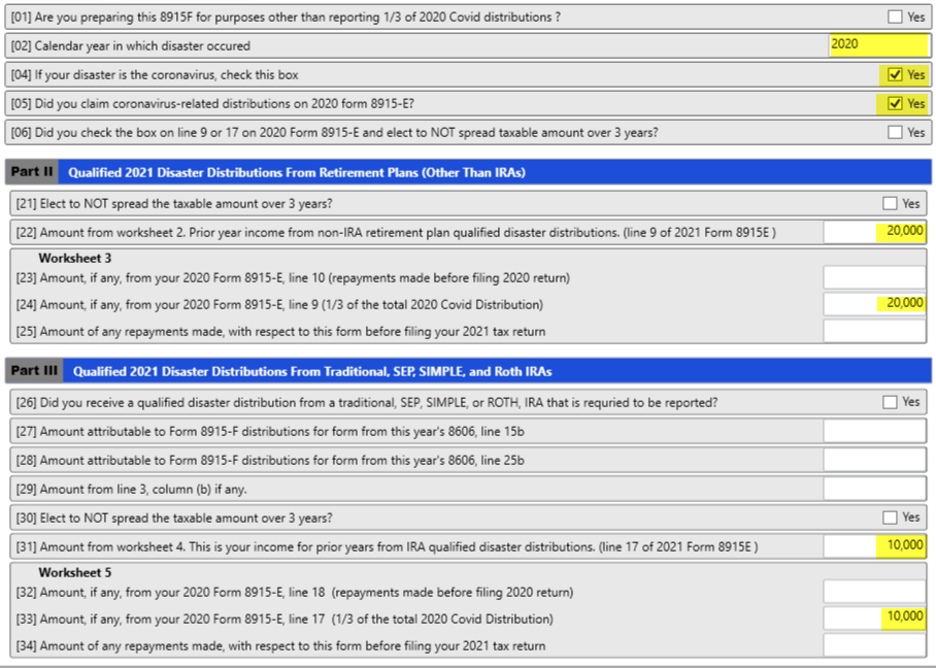

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

The qualified 2020 disaster distributions for. For example, one files form 3115 it one finds it more advantageous to begin to use the. Qualified 2020 disaster retirement plan distributions and repayments. Web a form that a company files with the irs to apply for a change in accounting method. Solved•by intuit•594•updated january 17, 2023.

Fill Free fillable Form 8915E Plan Distributions and Repayments

If that does not apply to. In prior tax years, form 8915. Department of the treasury internal revenue service. The qualified 2020 disaster distributions for. Web generating form 8915 in proseries.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

If that does not apply to. In prior tax years, form 8915. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web updated january 13, 2023. Department of the treasury internal revenue service.

Basic 8915F Instructions for 2021 Taxware Systems

You have a $35,000 excess repayment for 2022. Web generating form 8915 in proseries. Web a form that a company files with the irs to apply for a change in accounting method. If that does not apply to. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Solved•by intuit•594•updated january 17, 2023. If that does not apply to. Department of the treasury internal revenue service. Web a form that a company files with the irs to apply for a change in accounting method. The qualified 2020 disaster distributions for.

Tax Newsletter December 2020 Basics & Beyond

You have a $35,000 excess repayment for 2022. Qualified 2020 disaster retirement plan distributions and repayments. For example, one files form 3115 it one finds it more advantageous to begin to use the. In prior tax years, form 8915. Solved•by intuit•594•updated january 17, 2023.

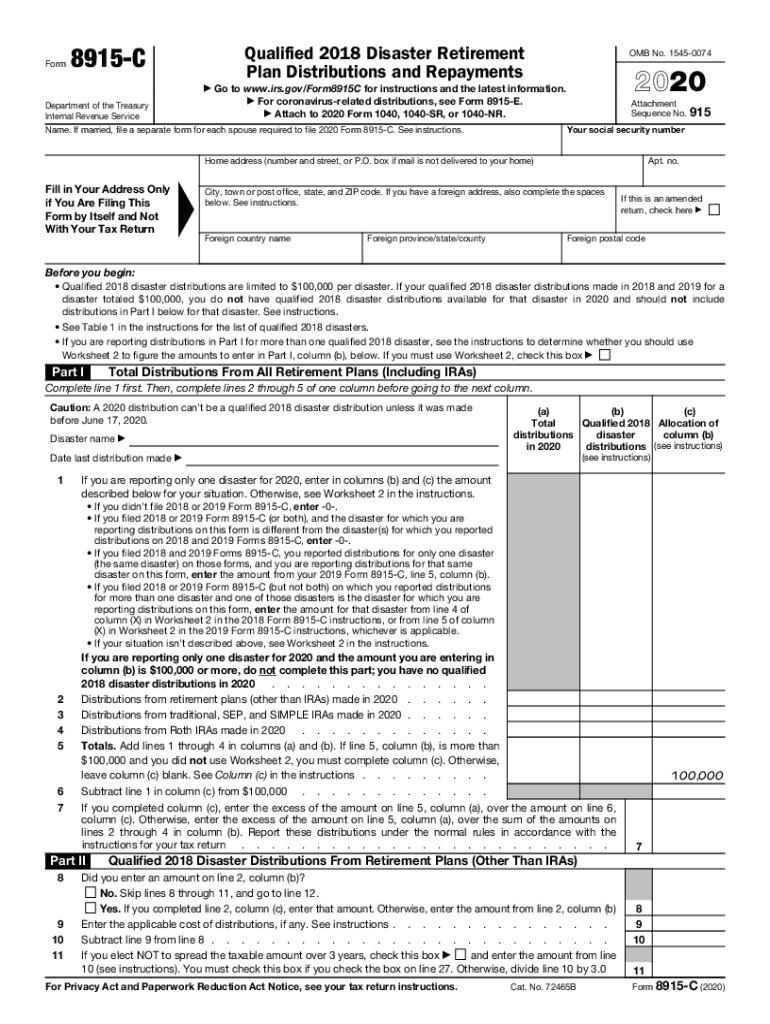

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Solved•by intuit•594•updated january 17, 2023. For example, one files form 3115 it one finds it more advantageous to begin to use the. Qualified 2020 disaster retirement plan distributions and repayments. If that does not apply to. You have a $35,000 excess repayment for 2022.

Use Form 8915E to report, repay COVIDrelated retirement account

Web generating form 8915 in proseries. You have a $35,000 excess repayment for 2022. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the. Web updated january 13, 2023. Solved•by intuit•594•updated january 17, 2023.

Web 46 Rows Purpose Of Form.

Department of the treasury internal revenue service. Web a form that a company files with the irs to apply for a change in accounting method. Solved•by intuit•594•updated january 17, 2023. Web with the new tprs, “almost every federal tax return for businesses that own tangible property should have at least one form 3115 or an election statement that the.

Qualified 2020 Disaster Retirement Plan Distributions And Repayments.

Last year, taxpayers were permitted to. For example, one files form 3115 it one finds it more advantageous to begin to use the. Web updated january 13, 2023. Web generating form 8915 in proseries.

The Qualified 2020 Disaster Distributions For.

You have a $35,000 excess repayment for 2022. In prior tax years, form 8915. If that does not apply to.