What Is Form W-8Ben

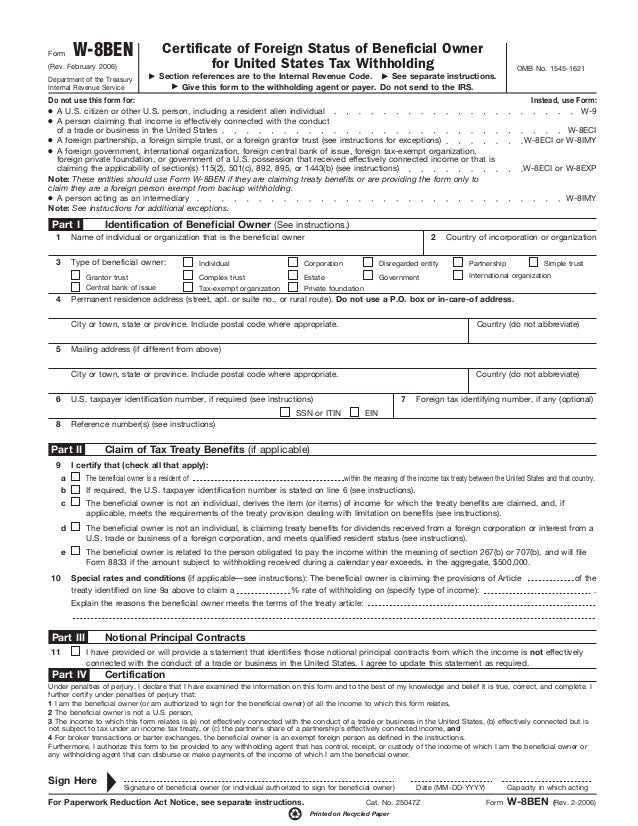

What Is Form W-8Ben - Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Citizen or resident alien is entitled to certain benefits under the internal revenue code. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. • this form relates to: • the person named on line 1 of this form is not a u.s. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. This covers dividends from u.s. Income you may receive in your account. Key takeaways individuals or entities outside the u.s. Client in order to avoid.

• the person named on line 1 of this form is not a u.s. Tax withholding for income earned in the u.s. • this form relates to: Companies or interest income from u.s. Key takeaways individuals or entities outside the u.s. Citizen or resident alien is entitled to certain benefits under the internal revenue code. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes; Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. What's new guidance under section 1446 (f). October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted.

Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes; Client in order to avoid. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Key takeaways individuals or entities outside the u.s. October 2021) department of the treasury internal revenue service do not use this form if: This covers dividends from u.s. These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. To claim an exemption from withholding taxes from income earned or derived in the u.s. Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi).

Form W8BENE Certificate of Entities Status of Beneficial Owner for

Companies or interest income from u.s. Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which.

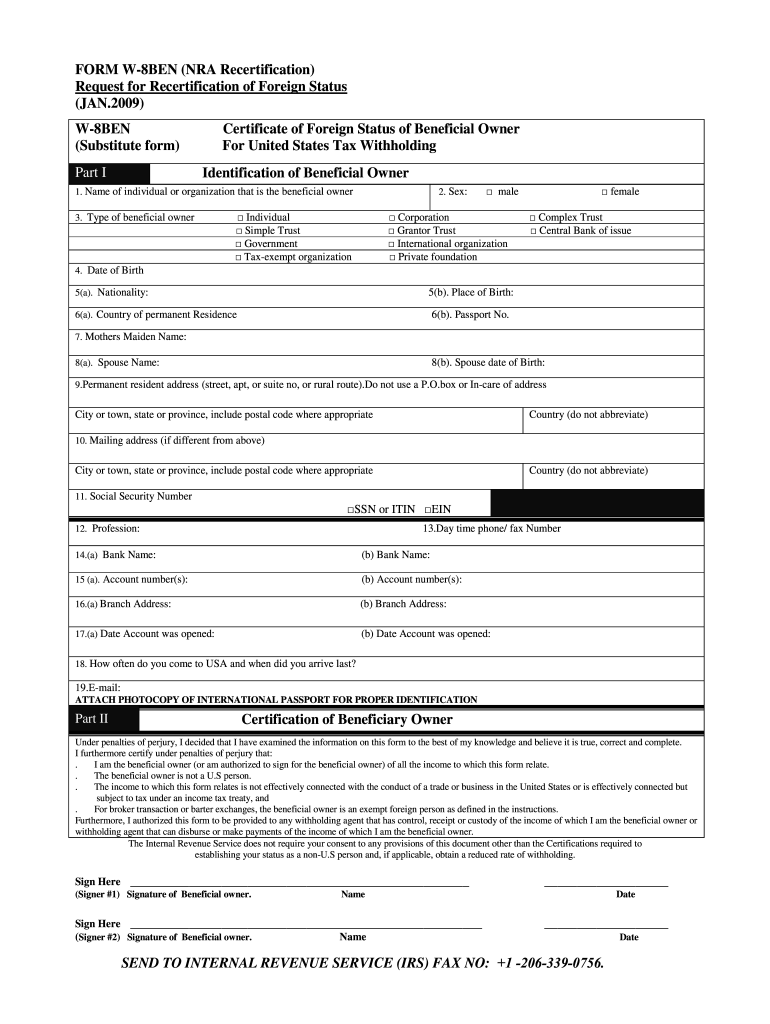

W8BEN Form

These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. Companies or interest income from u.s. Tax withholding for income earned in the u.s. Key takeaways individuals or entities outside the u.s. Income you may receive in your account.

IRS W8BEN Form Template Fill & Download Online [+ Free PDF]

Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. Citizen or resident alien is entitled.

Form W 8ben Fill Online, Printable, Fillable, Blank pdfFiller

This covers dividends from u.s. Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi). October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted. • this form relates to: Certificate of foreign status of.

How To Fill Up W8BEN Form For US Manulife REIT My Sweet Retirement

• the person named on line 1 of this form is not a u.s. Companies or interest income from u.s. Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country. • this form relates to: October 2021) certificate of.

How do I submit the W8BEN form for Saxotrader? Seedly

• this form relates to: Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the.

Form W8BEN Retroactive Statement existing vendors Fill and Sign

Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. • this form relates.

W8BENE

Income you may receive in your account. Tax withholding for income earned in the u.s. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are to the internal revenue code unless otherwise noted. This covers dividends from u.s. Web i am the individual that is the beneficial owner (or am.

W 8ben India Fill Online, Printable, Fillable, Blank PDFfiller

Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. Income you may receive in your account. October 2021) certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) section references are.

W 8ben Instructions Create A Digital Sample in PDF

Once complete, it is effective starting on the date signed and it expires on the last day of the third following calendar year. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. Tax withholding for income.

• The Person Named On Line 1 Of This Form Is Not A U.s.

Companies or interest income from u.s. Web i am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes; What's new guidance under section 1446 (f). • this form relates to:

Tax Withholding For Income Earned In The U.s.

Key takeaways individuals or entities outside the u.s. Citizen or resident alien is entitled to certain benefits under the internal revenue code. October 2021) department of the treasury internal revenue service do not use this form if: Client in order to avoid.

Once Complete, It Is Effective Starting On The Date Signed And It Expires On The Last Day Of The Third Following Calendar Year.

Income you may receive in your account. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) for use by individuals. To claim an exemption from withholding taxes from income earned or derived in the u.s. This covers dividends from u.s.

October 2021) Certificate Of Foreign Status Of Beneficial Owner For United States Tax Withholding And Reporting (Individuals) Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi). These forms document taxpayer information that the irs requires us to collect for people and businesses receiving payments through our platform. Tax withholding is used by a foreign person to establish both foreign status and beneficial ownership, and to claim income tax treaty benefits with respect to income other than compensation for personal services. Any individual who provides a service or product for the us market, but does not live there, needs to know the complexities of paying income tax in more than one country.

![IRS W8BEN Form Template Fill & Download Online [+ Free PDF]](https://www.pandadoc.com/app/uploads/form-w-8ben.png)