What Is Nr4 Form

What Is Nr4 Form - An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. To report this information to. Web senior tax advisor 4 vocational, technical or tra. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. Web the nr4 form is for canadian tax purposes. Web 10 cfr part 20. Web what is the nr4 form for canada tax? However, if you paid less. It should be issued to any nonresident of canada who has received income from a canadian source. This form is a 2022 nr4 form.this form is for reference only:

Web what is the nr4 form for canada tax? This form is a 2022 nr4 form.this form is for reference only: An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Enter the total canadian cpp and oas payments you received. You have to report amounts on an nr4 slip if the gross income paid or credited during the year is $50 or more. To report this information to. Web the nr4 form is for canadian tax purposes. Web 10 cfr part 20. However, if you paid less. It should be issued to any nonresident of canada who has received income from a canadian source.

Upon termination of the hap contract, any remaining. This form is a 2022 nr4 form.this form is for reference only: Web the nr4 form is for canadian tax purposes. An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. It should be issued to any nonresident of canada who has received income from a canadian source. You have to report amounts on an nr4 slip if the gross income paid or credited during the year is $50 or more. Instructions and additional information pertinent to the. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. Web who needs to file nr4? To report this information to.

Section 216 Checklist (With NR4) Madan CA

Enter the total canadian cpp and oas payments you received. Web what is the nr4 form for canada tax? However, if you paid less. An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. It should be issued to any nonresident of canada who has received.

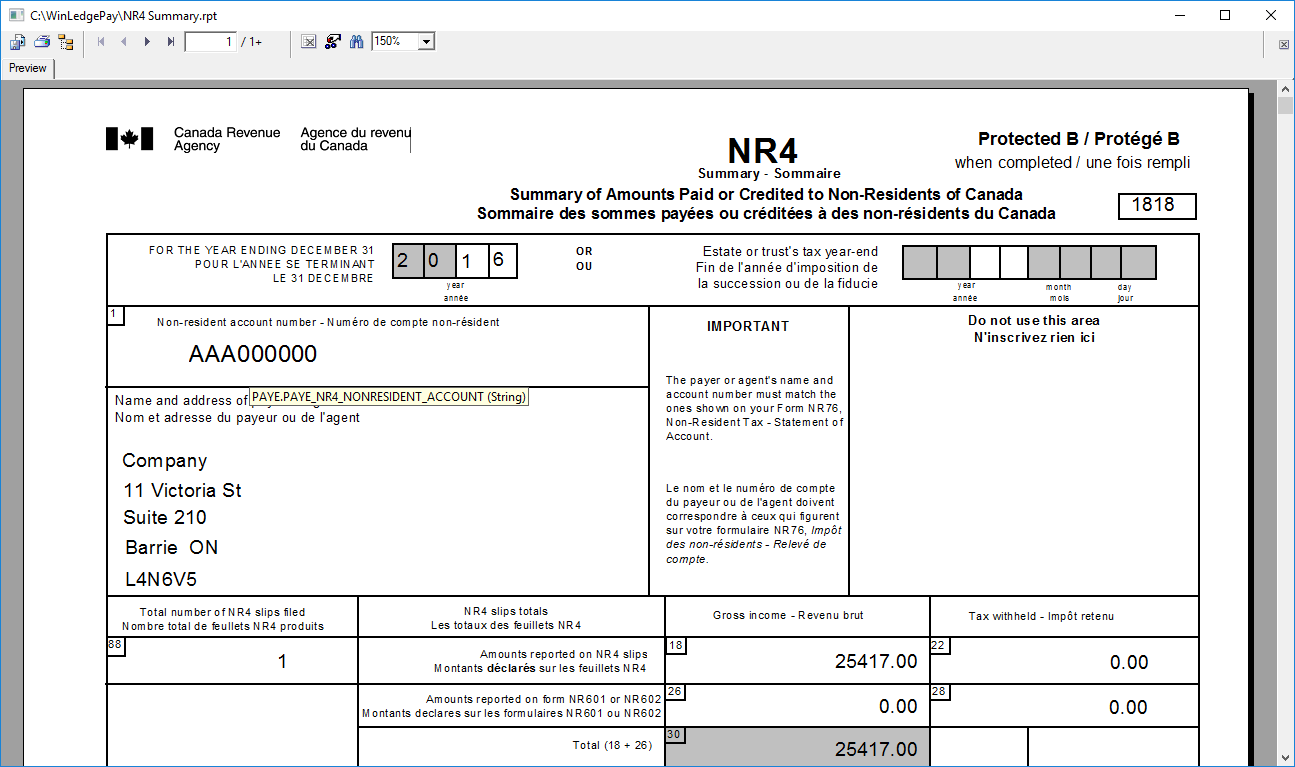

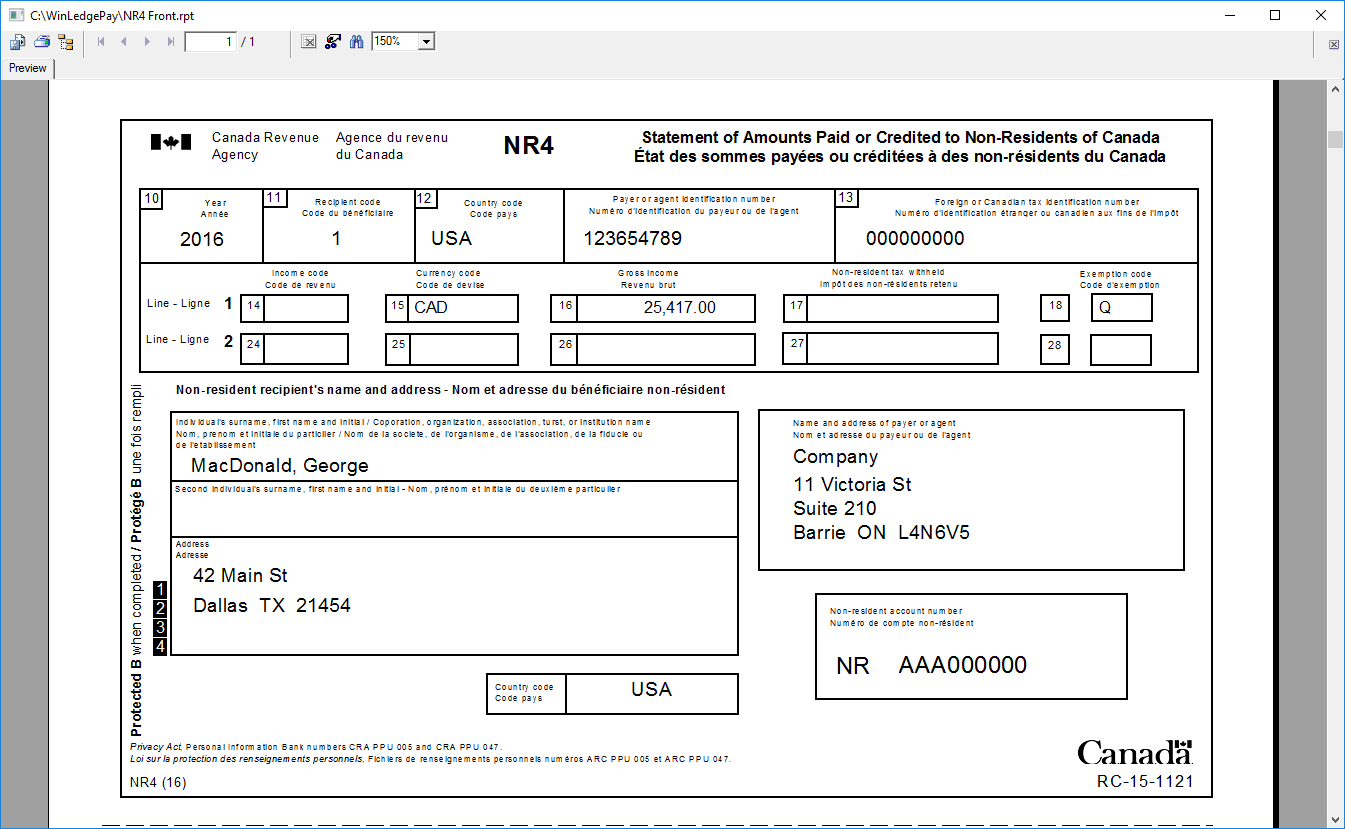

Classic Software

Web senior tax advisor 4 vocational, technical or tra. It should be issued to any nonresident of canada who has received income from a canadian source. Web who needs to file nr4? An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. To report this information.

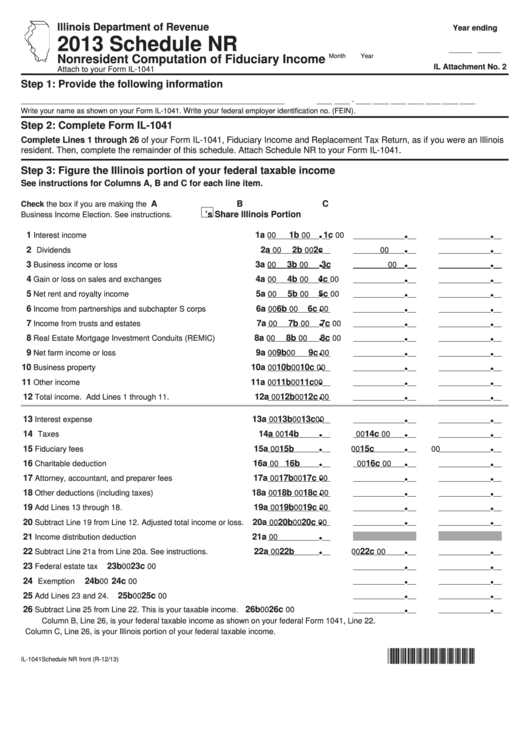

Fillable Schedule Nr Nonresident Computation Of Fiduciary

Instructions and additional information pertinent to the. Web the nr4 form is for canadian tax purposes. An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. Web 10 cfr.

Sample Forms

However, if you paid less. Web the nr4 form is for canadian tax purposes. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Instructions and additional information pertinent to the. Web who needs to file nr4?

NR4 Pro Forma Letter Checklist Madan CA

You have to report amounts on an nr4 slip if the gross income paid or credited during the year is $50 or more. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. It should be issued to any nonresident of canada who has received.

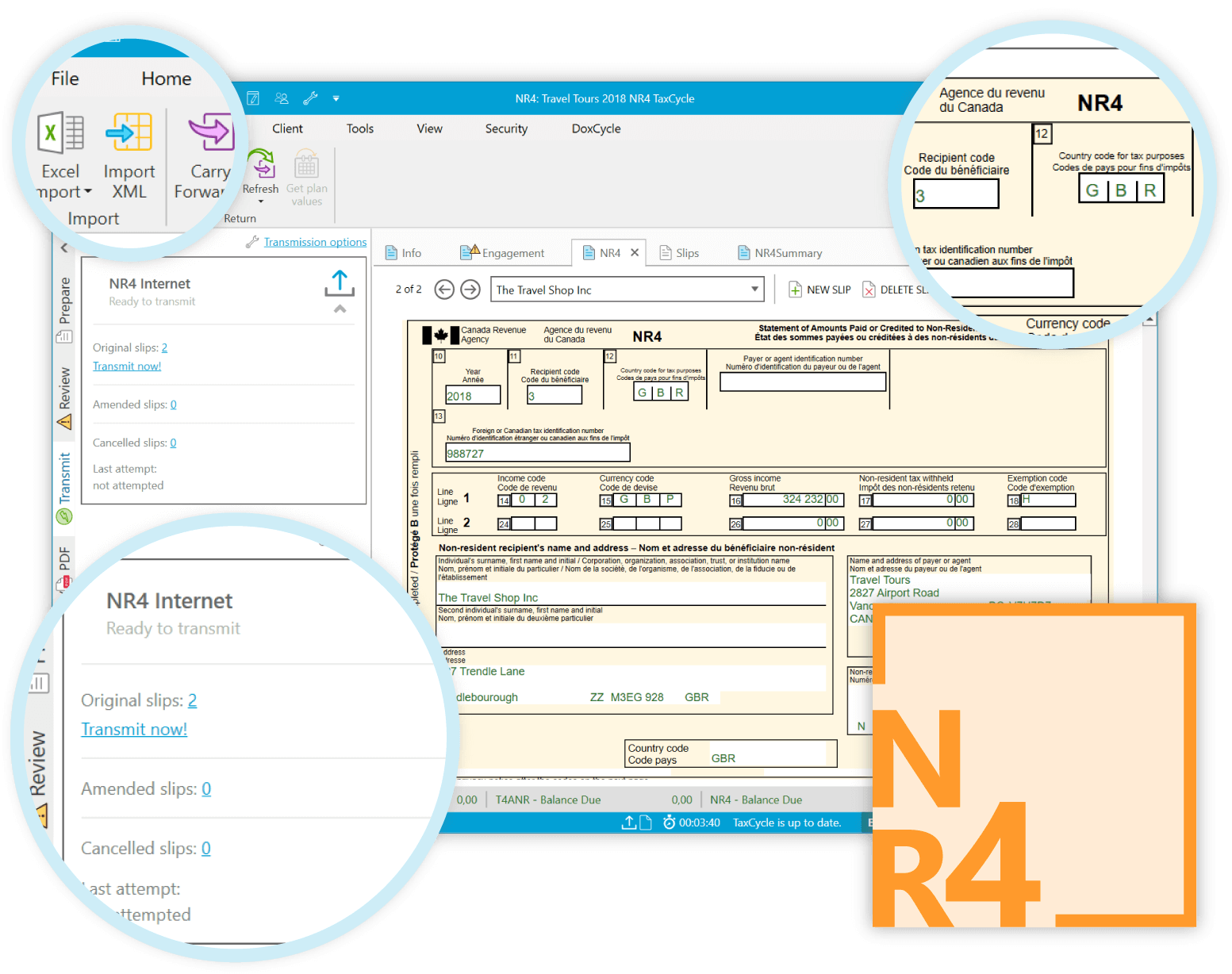

TaxCycle NR4 TaxCycle

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. This form is a 2022 nr4 form.this form is for reference only: Instructions and additional information pertinent to.

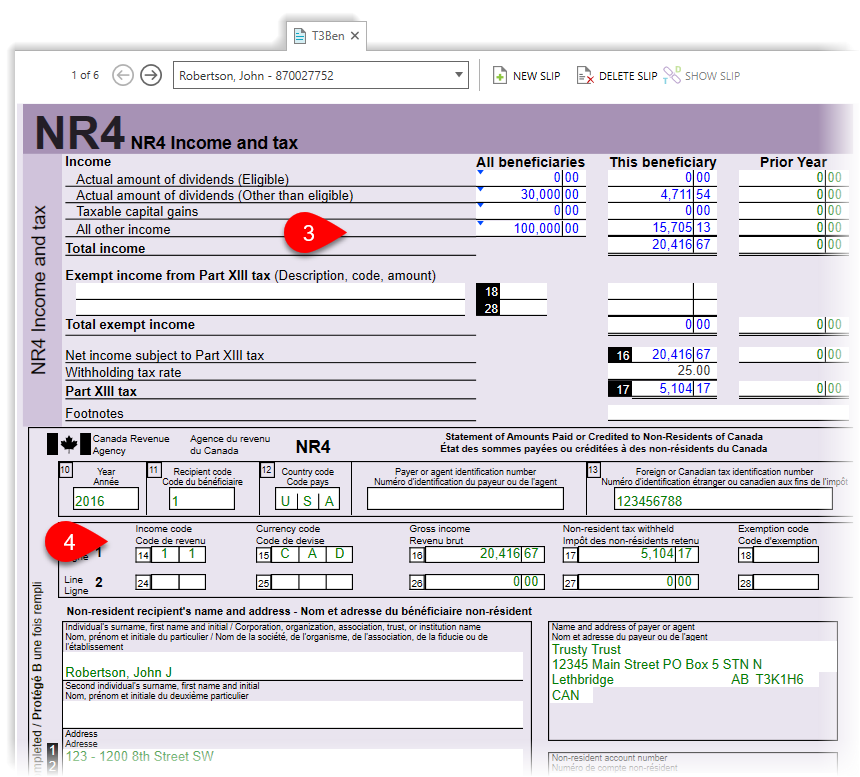

NR4 slips for nonresident trust beneficiaries TaxCycle

An nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. Upon termination of the hap contract, any remaining. Instructions and additional information pertinent to the. To report this information.

Sample Forms

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Web senior tax advisor 4 vocational, technical or tra. This form is a 2022 nr4 form.this form is for reference only: Enter the total canadian cpp and oas payments you received. Web 10 cfr part.

T1 module does not have a form related to NR4 (NonResident)

Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Web who needs to file nr4? You have to report amounts on an nr4 slip if the gross income paid or credited during the year is $50 or more. Enter the total canadian cpp and.

Classic Software

24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. Web who needs to file nr4? Instructions and additional information pertinent to the. Web senior tax advisor 4.

An Nr4 Slip Is Issued By Residents Of Canada (And In Some Cases By Nonresidents) Who Have Paid Certain Amounts To A Canadian Nonresident.

You have to report amounts on an nr4 slip if the gross income paid or credited during the year is $50 or more. To report this information to. This form is a 2022 nr4 form.this form is for reference only: Upon termination of the hap contract, any remaining.

Web Who Needs To File Nr4?

It should be issued to any nonresident of canada who has received income from a canadian source. Enter the total canadian cpp and oas payments you received. However, if you paid less. Web 10 cfr part 20.

Instructions And Additional Information Pertinent To The.

Web senior tax advisor 4 vocational, technical or tra. Web the nr4 form is for canadian tax purposes. Web an nr4 slip is issued by residents of canada (and in some cases by nonresidents) who have paid certain amounts to a canadian nonresident. 24,939 satisfied customers my client received a form nr4 from canada with the box 16 my client.