What Is The Account Number On A 1099 Form

What Is The Account Number On A 1099 Form - The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Items in quotes are from the irs general instructions. For your protection, this form will show. Web what is a 1099 form? This is an informational only field and does not. Web the maximum length of the account number field is 20 alpha or numeric characters. Prior to tax year 2020,. Web you have in your account.

Web who should receive a 1099 form? There are several types of 1099s used for different purposes, and form 1099. Web you have in your account. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. Form 1099 is a type of tax form that records payments received that don't come from salary or wages. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Prior to tax year 2020,.

Web definition and examples of form 1099. Web who should receive a 1099 form? The consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Employment authorization document issued by the department of homeland. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. For your protection, this form will show. This is an informational only field and does not. Web what is a 1099 form? Web the maximum length of the account number field is 20 alpha or numeric characters. Form 1099 is a type of tax form that records payments received that don't come from salary or wages.

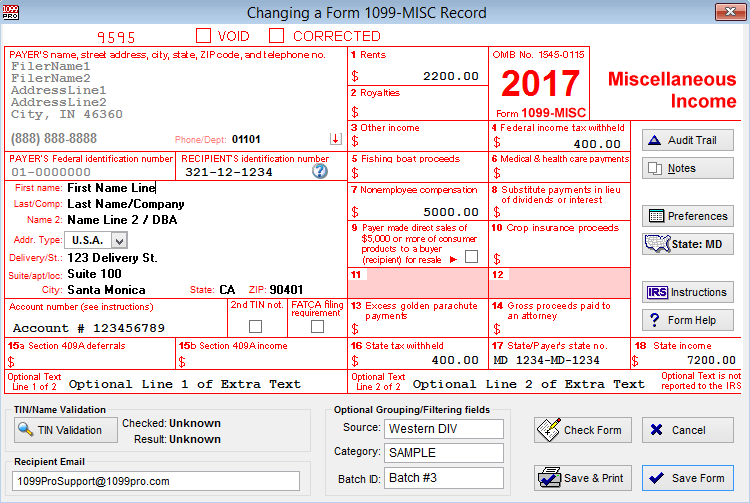

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Prior to tax year 2020,. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Tax form that reports distributions made from a.

Form 1099INT Interest Definition

Web the maximum length of the account number field is 20 alpha or numeric characters. Web definition and examples of form 1099. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. Web you have in your account. For your protection, this form will show.

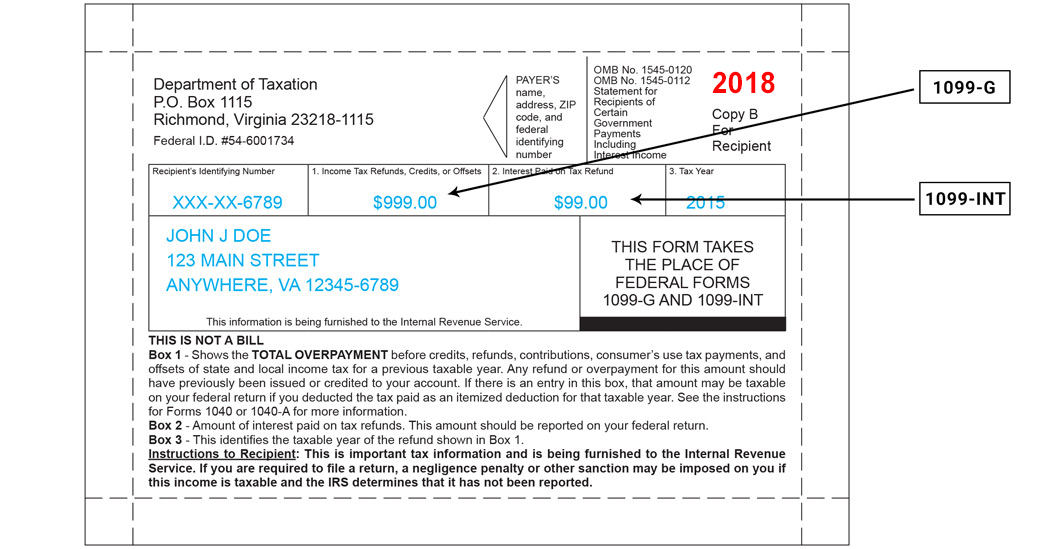

Your 1099G/1099INT What You Need to Know Virginia Tax

use the account number box, when. Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. The account number is also required if. Form 1099 is a type of tax form that records payments received that don't come from salary or wages. There are several types of 1099s used for different purposes, and.

Understanding your 1099 Robinhood

For your protection, this form will show. Web the maximum length of the account number field is 20 alpha or numeric characters. Prior to tax year 2020,. The account number is also required if. This is an informational only field and does not.

1099 Int Form Bank Of America Universal Network

Web the maximum length of the account number field is 20 alpha or numeric characters. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs). This is an informational only field and does not..

1099NEC Software Print & eFile 1099NEC Forms

Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web the maximum length of the account number field is 20 alpha or numeric characters. Web definition and examples of form 1099. Employment authorization document issued by the department of homeland. The irs 1099 form is a collection of tax forms.

What is the Account Number on a 1099MISC form? Workful Blog

This is an informational only field and does not. Web what is a 1099 form? The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web contractors are.

How To File Form 1099 Misc Without Social Security Number Form

Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. Web the maximum length of the account number field is 20 alpha or numeric characters. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs)..

What is the Account Number on a 1099MISC form? Workful

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. This is an informational only field and does not. use the account number box, when. For your protection, this form will show. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs).

For Your Protection, This Form Will Show.

Web the maximum length of the account number field is 20 alpha or numeric characters. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. use the account number box, when. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer msa), or.

Web What Is A 1099 Form?

Form 1099 is a type of tax form that records payments received that don't come from salary or wages. Web you have in your account. Web who should receive a 1099 form? Employment authorization document issued by the department of homeland.

There Are Several Types Of 1099S Used For Different Purposes, And Form 1099.

Web september 2, 2022 a 1099 is a tax form that is used to record nonemployee income. The account number is also required if. The consolidated form 1099 reflects information that is reported to the internal revenue service (irs). Web definition and examples of form 1099.

Prior To Tax Year 2020,.

Items in quotes are from the irs general instructions. Web contractors are often known as 1099 employees, as businesses use the 1099 tax form to report payments to the internal revenue service (irs).² contractors use the. Web a form 1099 will have your social security number or taxpayer identification number on it, which means the irs will know you’ve received money — and it will know. This is an informational only field and does not.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)