What Is The Difference In Chapter 7 11 13

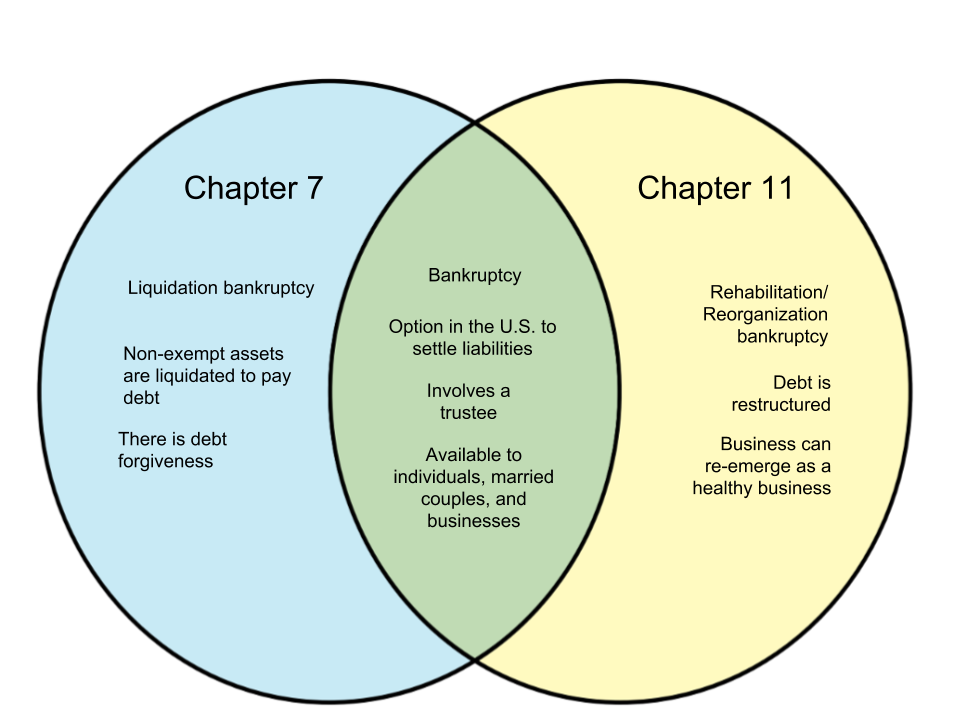

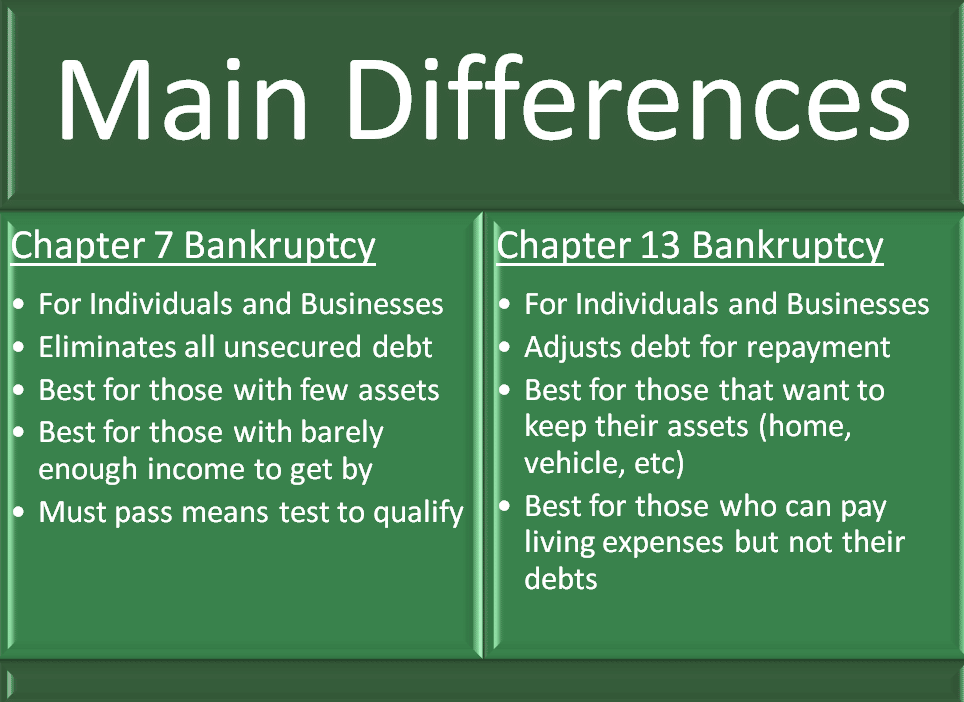

What Is The Difference In Chapter 7 11 13 - Web a chapter 7 bankruptcy trustee can only liquidate nonexempt assets owned by the debtor. Web a debtor may also propose a plan of liquidation and cease doing business. Produced by michael simon johnson , rob szypko , asthaa chaturvedi and alex stern. If a chapter 7 bankruptcy is filed, corporations, partnerships, and llcs cannot use chapter 13 to reorganize and must cease business operations. The lander is in an elliptical orbit of the moon. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts. People in business or individuals can also seek relief in chapter 11.) chapter 13: A reorganization and restructuring of debt. Web what is the difference between chapters 7, 11, 12, & 13? Eastern time (it will be 6:04 p.m.

Web the critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. A reorganization and restructuring of debt. If you are running a sole proprietorship, however, chapter 13. Web what is the difference between chapter 7, 11, 12 & 13 cases? Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Rarely businesses — sell their. People in business or individuals can also seek relief in chapter 11.) chapter 13: This chapter of the u.s. There are very few law firms that handle chapter 11. Businesses or individuals are required to sell off their property so that they could repay their debts.

In mississippi, most consumer chapter 7 filings are what we call no asset cases because the debtor owns no. If a chapter 7 bankruptcy is filed, corporations, partnerships, and llcs cannot use chapter 13 to reorganize and must cease business operations. The lander is in an elliptical orbit of the moon. Eastern time (it will be 6:04 p.m. Web what is the difference between chapter 7, 11, 12 & 13 cases? At the same time, chapter 13 does not provide the same level of debt relief like chapter 7. Web the key differences essentially amount to liquidation vs. Chapter 7 bankruptcy is a liquidation proceeding available to consumers and businesses. Those assets of a debtor that are not. Chapter 7 bankruptcy revolves around “liquidation”.

The Differences Between Chapters 7, 11 and 13 Bankruptcy

Businesses or individuals are required to sell off their property so that they could repay their debts. However, a survey done by the american bankruptcy institute in 2018 showed that if you file exemption paperwork properly, 93% of. Web chapter 11 is the chapter usually used by large businesses to reorganize their debts and continue to stay afloat while they.

Chapter 7, 11, & 13 Bankruptcy; What Are the Differences? Weiner Law

Web chapter 7 requires you to sell property that isn’t exempt to pay off your debts. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. This chapter of the u.s. Highlights from liverpool’s win against newcastle in the premier league. Web the critical difference is that chapter.

45+ Difference Between Chapter 7 And Chapter 11

However, a survey done by the american bankruptcy institute in 2018 showed that if you file exemption paperwork properly, 93% of. A business may liquidate through the bankruptcy process by filing a petition under either chapter 7 or chapter 11. Web a debtor may also propose a plan of liquidation and cease doing business. Chapter 13 enables individuals with regular.

Personal Chapter 7 Bankruptcy versus Personal Chapter 13 Bankruptcy

At the same time, chapter 13 does not provide the same level of debt relief like chapter 7. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Web what is the difference between chapter 7, 11, 12 & 13 cases? A business may liquidate through the bankruptcy.

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

Web a debtor may also propose a plan of liquidation and cease doing business. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts. A business may liquidate through the bankruptcy process by filing a petition under either chapter 7 or chapter 11. Eastern time (it will be 6:04 p.m. Know.

Chapter 7 vs Chapter 13 Bankruptcy [Infographic]

Those assets of a debtor that are not. People in business or individuals can also seek relief in chapter 11.) chapter 13: This chapter of the u.s. If you are running a sole proprietorship, however, chapter 13. Web the key differences essentially amount to liquidation vs.

Web a debtor may also propose a plan of liquidation and cease doing business. Web chapter 11 is the chapter usually used by large businesses to reorganize their debts and continue to stay afloat while they reorganize their debts. Web there are some notable differences between chapter 11 and chapter 13 bankruptcy, including eligibility, cost, and the amount of time.

32+ How Does Bankruptcy Chapter 7 Work FaizulLawerence

There are very few law firms that handle chapter 11. Web there are some notable differences between chapter 11 and chapter 13 bankruptcy, including eligibility, cost, and the amount of time required to complete the process. Davis lin and michael benoist. A business may liquidate through the bankruptcy process by filing a petition under either chapter 7 or chapter 11..

Infographic Chapter 7 vs. Chapter 13 BankruptcyWeaver Bankruptcy Law Firm

Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Chapter 7 bankruptcy is available to both businesses and individuals, while chapter 13. Web its principal chapters (7, 11, 12, 13 and 15) are briefly outlined below: Eastern time (it will be 6:04 p.m. Davis lin and michael.

Chapter 7 or Chapter 13 Bankruptcy What’s the Difference? Freedom

Web a chapter 7 bankruptcy trustee can only liquidate nonexempt assets owned by the debtor. Produced by michael simon johnson , rob szypko , asthaa chaturvedi and alex stern. Those assets of a debtor that are not. Web chapter 7 requires you to sell property that isn’t exempt to pay off your debts. A business may liquidate through the bankruptcy.

A Reorganization And Restructuring Of Debt.

People in business or individuals can also seek relief in chapter 11.) chapter 13: Produced by michael simon johnson , rob szypko , asthaa chaturvedi and alex stern. Web its principal chapters (7, 11, 12, 13 and 15) are briefly outlined below: This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities.

Know The Difference One Involves Liquidating Assets, While The Other Reorganizes Them By Emily Norris Updated June 21, 2022 Reviewed By.

Chapter 7 bankruptcy revolves around “liquidation”. If you are running a sole proprietorship, however, chapter 13. Web there are some notable differences between chapter 11 and chapter 13 bankruptcy, including eligibility, cost, and the amount of time required to complete the process. In contrast, chapter 13 is a debt restructuring option that can make it easier to manage your outstanding debts.

Businesses Or Individuals Are Required To Sell Off Their Property So That They Could Repay Their Debts.

Web chapter 7 requires you to sell property that isn’t exempt to pay off your debts. The chapter of the bankruptcy code providing for liquidation, ( i.e., the sale of a debtor's nonexempt property and the distribution of the proceeds to creditors.). Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an.

Chapter 7 Bankruptcy Is Available To Both Businesses And Individuals, While Chapter 13.

In mississippi, most consumer chapter 7 filings are what we call no asset cases because the debtor owns no. Those assets of a debtor that are not. Chapter 7 bankruptcy is a liquidation proceeding available to consumers and businesses. Web what is the difference between chapter 7, 11, 12 & 13 cases?

![Chapter 7 vs Chapter 13 Bankruptcy [Infographic]](https://infographicjournal.com/wp-content/uploads/2020/07/Chapter-7-13-Comparison.jpg)