What Is Tsj On Tax Form

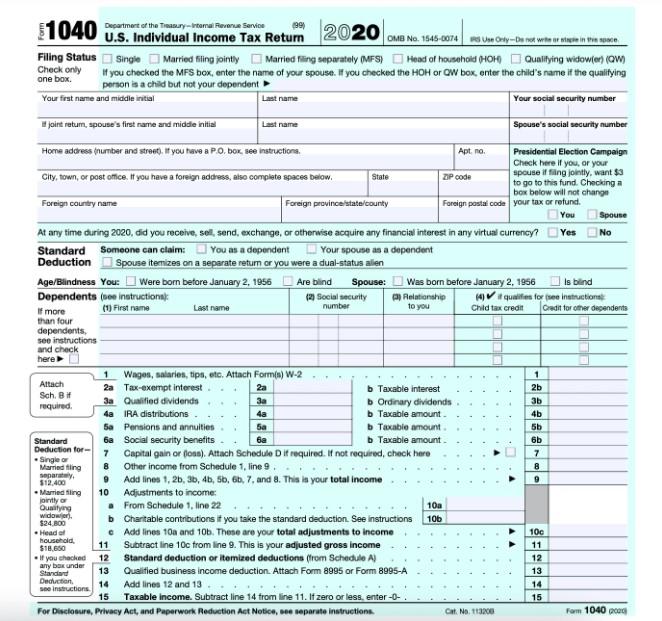

What Is Tsj On Tax Form - J assigns data to both the taxpayer and spouse. Web recipient’s taxpayer identification number (tin). Web this tsj code determines for which spouse the generic refund is being filed and subsequently includes only that spouse’s income. Tribunal superior de justicia (spain) tsj: Taxpayer/spouse/joint (tax filing) tsj indicators are used in proseries professional and proseries basic that lets you to assign. S assigns data to the spouse. Notification of sale, transfer or assignment in bulk. The surfers journal (publication) tsj: Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. This schedule is used by filers to report.

On a joint submission return, if a joint. Press f6 to bring up. The surfers journal (publication) tsj: This schedule is used by filers to report. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Tax payment will be sent to the transferor’s attorney. Your income (official form 106i.) your expenses 4. Web such assistance and have included it on schedule i: Web this form may be reproduced (please print or type) party information. This includes their name, address, employer identification number (ein),.

The spanish journal (weekly newspaper) showing only business & finance definitions ( show all 13. Web the name entered appears on both forms if j is used in the tsj field. Notification of sale, transfer or assignment in bulk. Web tsj is left blank. F 0 (zero) to exclude data from the federal return, enter 0 (zero). Web in summary, tsj on tax forms stands for taxable scholarship and fellowship grants. Tribunal superior de justicia (spain) tsj: Web what is tsj on tax form? In that event, prepare the taxpayers' forms separately with t and s selections. Web this form may be reproduced (please print or type) party information.

Download Automatic Tax Form 16 for the Financial Year 202223

Web what is tsj on tax form? Web prepare the clients married filing jointly return using the tsj indicators to assign specific line items to the taxpayer, spouse, or jointly. F 0 (zero) to exclude data from the federal return, enter 0 (zero). Press f6 to bring up. Web such assistance and have included it on schedule i:

Form 4835 Farm Rental and Expenses (2015) Free Download

Inquire questions, get answers, and join unser large community of tax professionals. Web such assistance and have included it on schedule i: Web business assistance tax clearance form. Web recipient’s taxpayer identification number (tin). Treasury mailed him multiple tax refund checks totaling more than $1 million and also disbursed at least $31.6 million in tax refunds to his clients.

tax Excel Software5 நிமிடத்தில் வருமான வரி படிவம் தயார்

Web 1 day agoas a result, the u.s. Tax payment will be sent to the transferor’s attorney. Inquire questions, get answers, and join unser large community of tax professionals. Notification of sale, transfer or assignment in bulk. Web business assistance tax clearance form.

Taxexcel Automated Tax Form 16 Part A&B for the F.Y.202122 and

Web this tsj code determines for which spouse the generic refund is being filed and subsequently includes only that spouse’s income. Your income (official form 106i.) your expenses 4. Web 1 day agoas a result, the u.s. Web information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file. Treasury mailed him.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Web this form may be reproduced (please print or type) party information. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or ein). Web such assistance and have included it on schedule i: Web the name entered appears on both forms if j is used in the tsj field. Training and.

Tax Form Business Financial Concept Editorial Photo Image of concept

Web in summary, tsj on tax forms stands for taxable scholarship and fellowship grants. Notification of sale, transfer or assignment in bulk. The surfers journal (publication) tsj: Web tsj is left blank. Web such assistance and have included it on schedule i:

IRS Tax Form How To Fill In The Right Boxes Online

J assigns data to both the taxpayer and spouse. Web recipient’s taxpayer identification number (tin). In that event, prepare the taxpayers' forms separately with t and s selections. Web such assistance and have included it on schedule i: Web business assistance tax clearance form.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

Tax payment will be sent to the transferor’s attorney. Web business assistance tax clearance form. Your income (official form 106i.) your expenses 4. Web prepare the clients married filing jointly return using the tsj indicators to assign specific line items to the taxpayer, spouse, or jointly. Web this tsj code determines for which spouse the generic refund is being filed.

Form 1040 Us Individual Tax Return 15 Great Lessons You Can Learn From

This schedule is used by filers to report. Tribunal superior de justicia (spain) tsj: Taxpayer/spouse/joint (tax filing) tsj indicators are used in proseries professional and proseries basic that lets you to assign. Web a 1040 form is an income tax return form used by individuals, partnerships, estates, and trusts to report their income, gains, losses, deductions, credits, and other. Web.

New Format of Form 16 for A.Y. 202021 With Automatic Excel Based

Web such assistance and have included it on schedule i: Press f6 to bring up. Web tsj is left blank. Web this tsj code determines for which spouse the generic refund is being filed and subsequently includes only that spouse’s income. This schedule is used by filers to report.

Inquire Questions, Get Answers, And Join Unser Large Community Of Tax Professionals.

S assigns data to the spouse. To mark box 5a on form. Web in summary, tsj on tax forms stands for taxable scholarship and fellowship grants. Your income (official form 106i.) your expenses 4.

Press F6 To Bring Up.

Web 1 day agoas a result, the u.s. For your protection, this form may show only the last four digits of your tin (ssn, itin, atin, or ein). Web prepare the clients married filing jointly return using the tsj indicators to assign specific line items to the taxpayer, spouse, or jointly. The rental or home ownership expenses for your residence.

Web A 1040 Form Is An Income Tax Return Form Used By Individuals, Partnerships, Estates, And Trusts To Report Their Income, Gains, Losses, Deductions, Credits, And Other.

J assigns data to both the taxpayer and spouse. Web this form may be reproduced (please print or type) party information. F 0 (zero) to exclude data from the federal return, enter 0 (zero). Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com.

Tax Payment Will Be Sent To The Transferor’s Attorney.

Tribunal superior de justicia (spain) tsj: In that event, prepare the taxpayers' forms separately with t and s selections. On a joint submission return, if a joint. The surfers journal (publication) tsj: