When Is Form 1120 H Due

When Is Form 1120 H Due - Web 4 months ago deadlines + extensions what are the due dates for returns? An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Income tax return for homeowners associations keywords: Form 7004 extensions for c. This form is for income earned in tax year 2022, with tax returns due in april. Be sure to confirm our posted dates with the irs in the event changes occur that. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Form 1040 form 706 form 709 form 1041 form 1120,.

Form 7004 extensions for c. Income tax return for homeowners associations keywords: An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Web form 1120 is the corporate form that regular corporations would file. Form 1040 form 706 form 709 form 1041 form 1120,. Choose the federal return type for details: Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. This form is for income earned in tax year 2022, with tax returns due in april.

Web 4 months ago deadlines + extensions what are the due dates for returns? Be sure to confirm our posted dates with the irs in the event changes occur that. Income tax return for homeowners associations keywords: Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. Form 7004 extensions for c. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. Form 1040 form 706 form 709 form 1041 form 1120,. Web form 1120 is the corporate form that regular corporations would file. An hoa with a fiscal year ending june 30 should file by the 15th day of the third. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return.

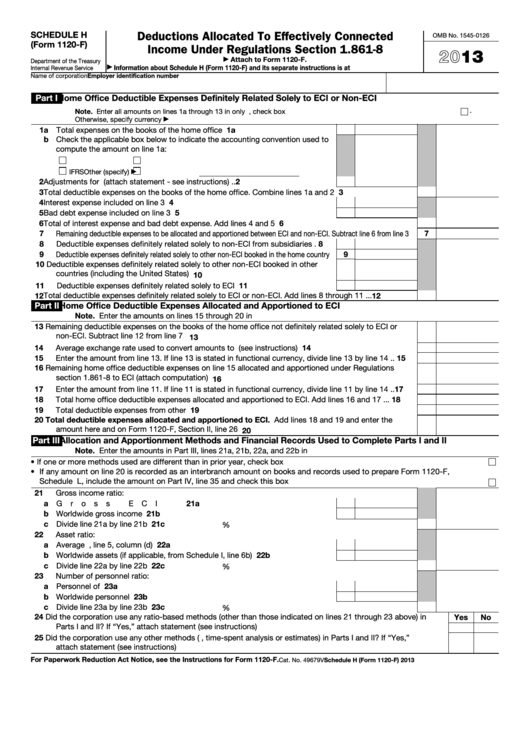

Fillable Schedule H (Form 1120F) Deductions Allocated To Effectively

Be sure to confirm our posted dates with the irs in the event changes occur that. Form 7004 extensions for c. Web 4 months ago deadlines + extensions what are the due dates for returns? However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. Form 1040 form 706 form.

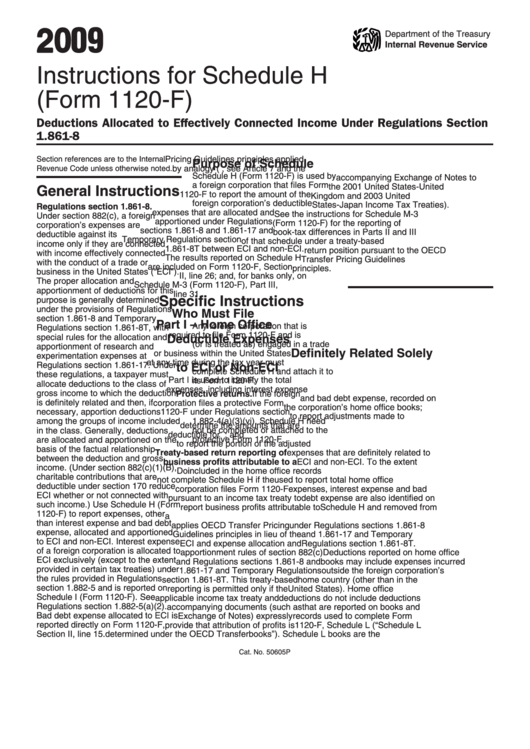

Instructions For Schedule H (Form 1120F) 2009 printable pdf download

Form 7004 extensions for c. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Web the internal revenue service usually releases income tax forms for the current tax year between october.

What You Need to Know About Form 1120h HOA Management Software

An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Be sure to confirm our posted dates with the irs in the event changes.

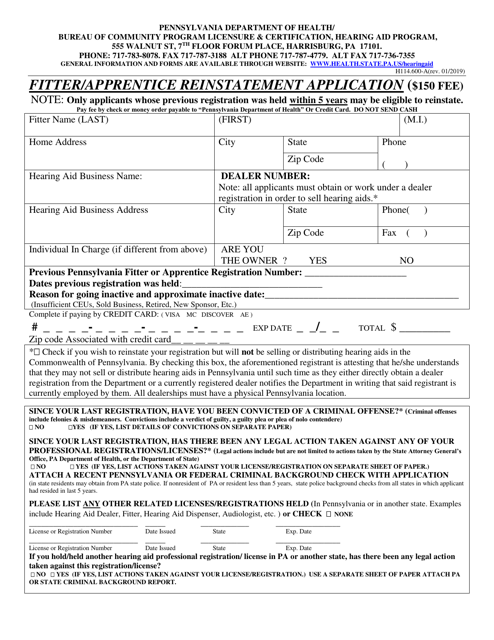

Form H114.600A Download Printable PDF or Fill Online Fitter/Apprentice

Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web form 1120 is the corporate form that regular corporations would file. Income tax return for an s corporation by the 15th day of the third month after the end of its.

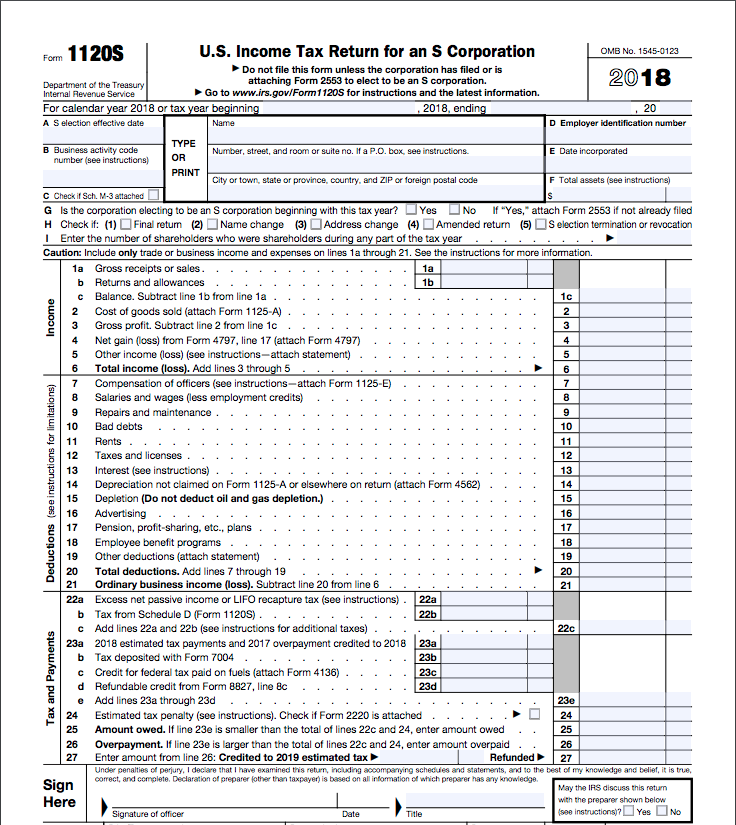

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

Web 4 months ago deadlines + extensions what are the due dates for returns? Income tax return for homeowners associations keywords: However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. The election is made separately for each tax year and must generally be made by the due date, including.

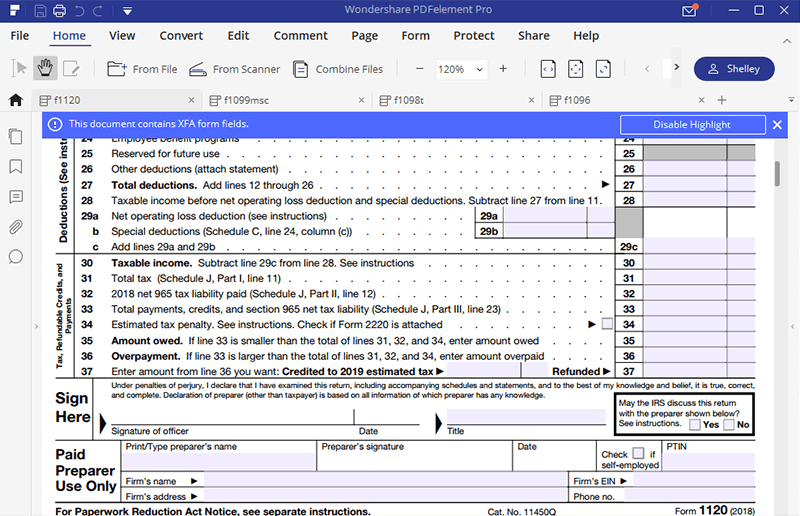

IRS Form 1120 Complete this Form with PDFelement

Be sure to confirm our posted dates with the irs in the event changes occur that. This form is for income earned in tax year 2022, with tax returns due in april. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month. An hoa with a fiscal year ending june.

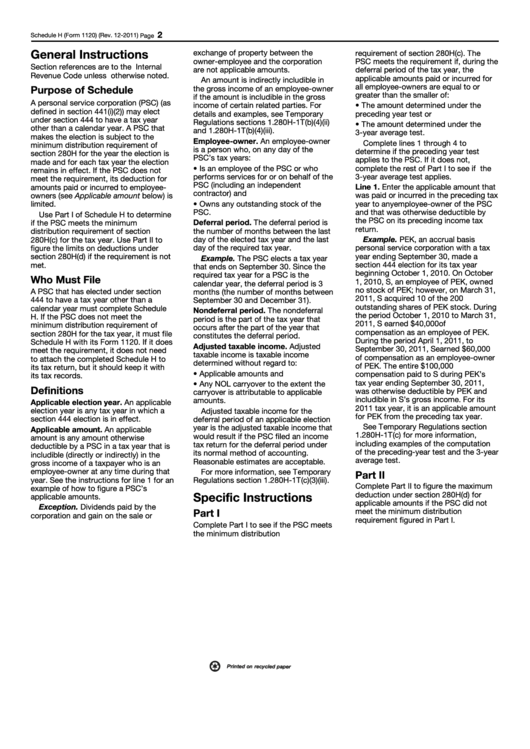

Form 1120 Schedule H General Instructions printable pdf download

Web 4 months ago deadlines + extensions what are the due dates for returns? Income tax return for homeowners associations keywords: Be sure to confirm our posted dates with the irs in the event changes occur that. This form is for income earned in tax year 2022, with tax returns due in april. Income tax return for an s corporation.

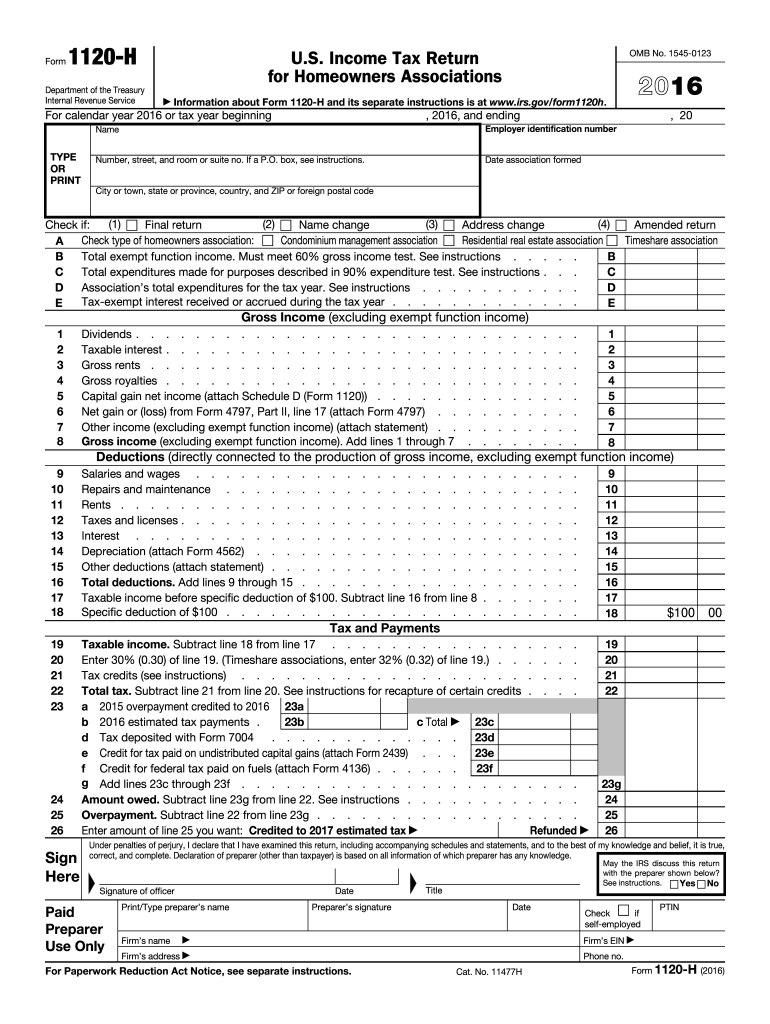

2016 Form IRS 1120H Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for homeowners associations keywords: An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Web form 1120 is the corporate form that regular corporations would file. Web known due dates at this posting are below for the 2021 tax year (due in 2022). However, an association with a fiscal.

Corporation return due date is March 16, 2015Cary NC CPA

Form 1040 form 706 form 709 form 1041 form 1120,. An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. Income tax return for homeowners associations keywords: Form 7004 extensions.

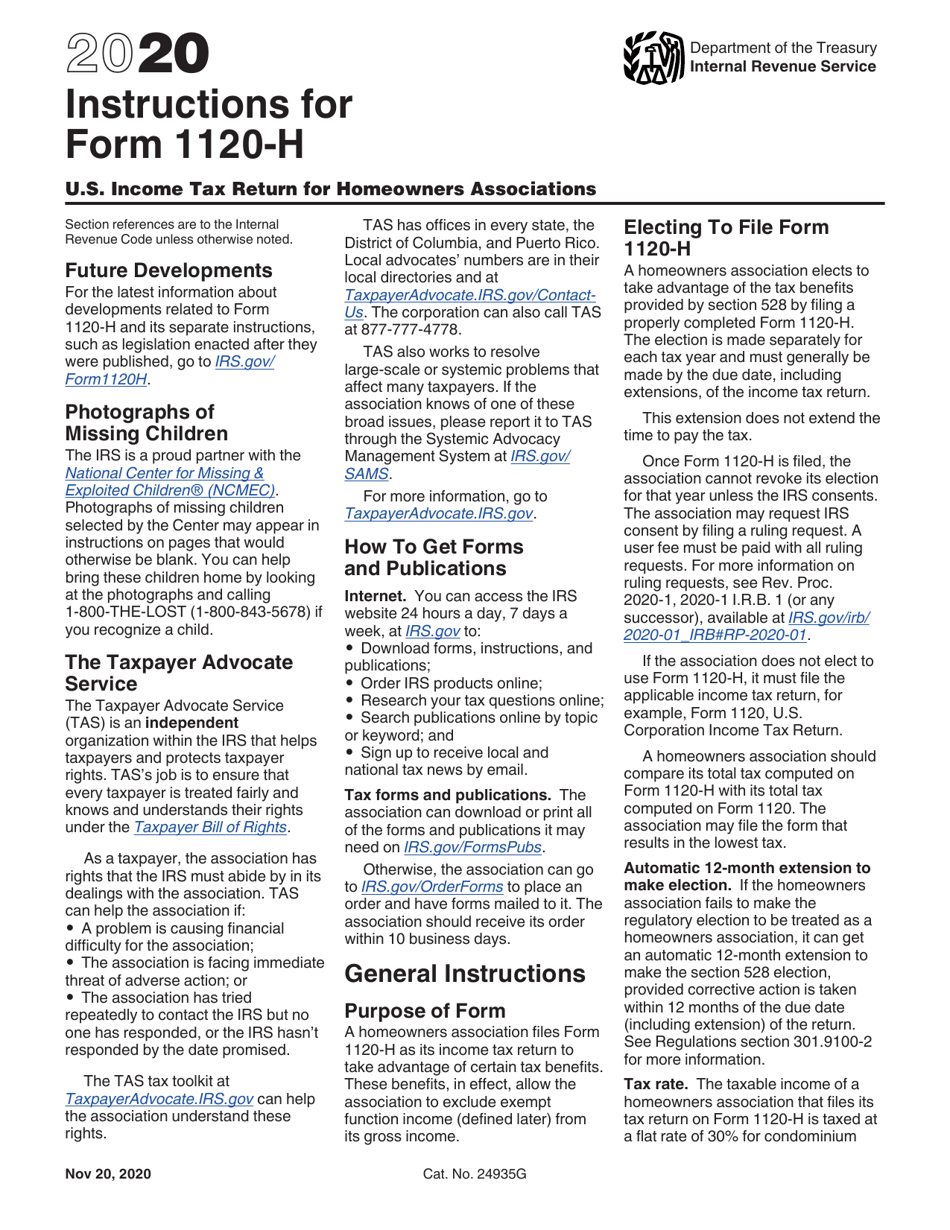

Download Instructions for IRS Form 1120H U.S. Tax Return for

Form 1040 form 706 form 709 form 1041 form 1120,. The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. This form is for income earned in tax year 2022, with tax returns due in april. An hoa with a fiscal year ending june 30.

However, An Association With A Fiscal Year Ending June 30 Must File By The 15Th Day Of The 3Rd Month.

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Web 4 months ago deadlines + extensions what are the due dates for returns? This form is for income earned in tax year 2022, with tax returns due in april. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later.

Form 1040 Form 706 Form 709 Form 1041 Form 1120,.

Choose the federal return type for details: Be sure to confirm our posted dates with the irs in the event changes occur that. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web form 1120 is the corporate form that regular corporations would file.

Web Known Due Dates At This Posting Are Below For The 2021 Tax Year (Due In 2022).

Income tax return for an s corporation by the 15th day of the third month after the end of its tax year. An hoa with a fiscal year ending june 30 should file by the 15th day of the third. Form 7004 extensions for c. Income tax return for homeowners associations keywords: