When Is Form 2290 Due

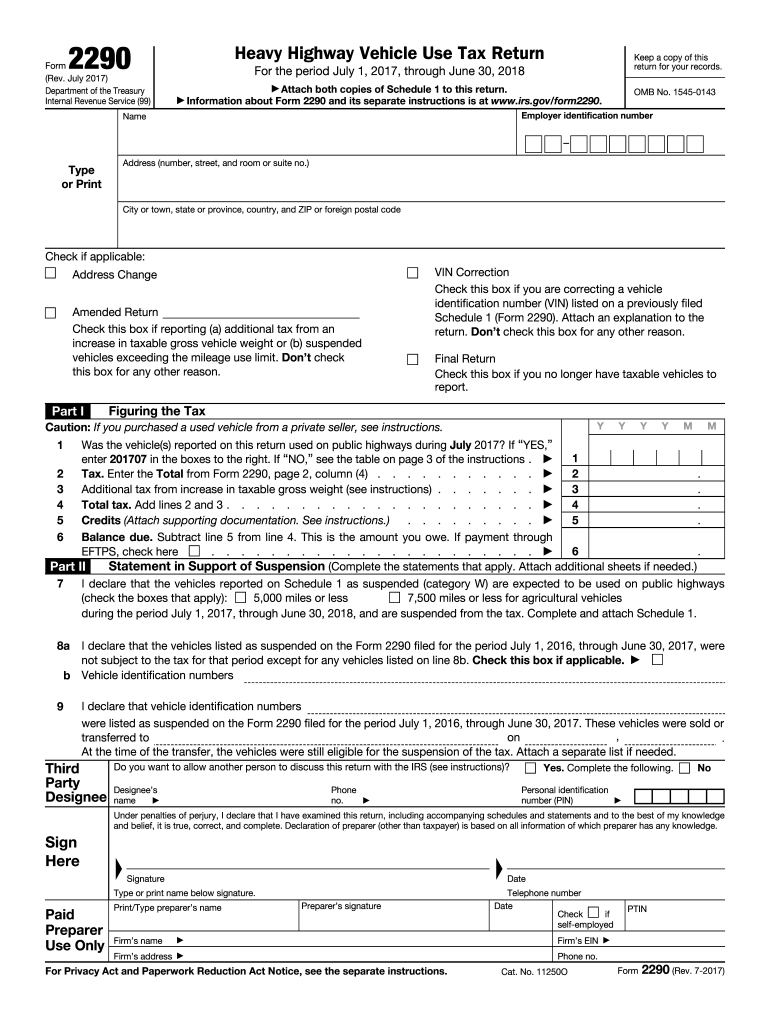

When Is Form 2290 Due - Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; The tax period runs from july 1 to june 30 of the following year, and the form is usually due by the last day of the month following the first month of use. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period; The current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. The current period begins july 1, 2023, and ends june 30, 2024. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. These due date rules apply whether you are paying the tax or reporting the suspension of tax. A monthly penalty of 4.5% of the total tax due is assessed up to five months for not filing form 2290 by the deadline. Web the irs will impose a penalty for not filing your form 2290 return or paying the required taxes within the deadline.the penalties and interest rates are as follows. Web month form 2290 must be filed;

Web the irs will impose a penalty for not filing your form 2290 return or paying the required taxes within the deadline.the penalties and interest rates are as follows. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; These due date rules apply whether you are paying the tax or reporting the suspension of tax. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period; Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. A monthly penalty of 0.5% of the total tax due is assessed for the. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period; Web if you first used a taxable vehicle on a public highway in july 2023, your form 2290 would be due by august 31, 2023. Web when is the due date for form 2290 to irs?

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Web the irs will impose a penalty for not filing your form 2290 return or paying the required taxes within the deadline.the penalties and interest rates are as follows. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period; Web when is the due date for form 2290 to irs? Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period; A monthly penalty of 4.5% of the total tax due is assessed up to five months for not filing form 2290 by the deadline. These due date rules apply whether you are paying the tax or reporting the suspension of tax. Web month form 2290 must be filed;

Renew your Form 2290 for 2017 2018 Today, its Due in a Fortnight!

Web when is the due date for form 2290 to irs? Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period; The current period begins july 1, 2023, and ends june 30, 2024. Web the irs will impose a penalty for not filing your form 2290 return or paying.

Irs 8962 form 2018 Brilliant 50 Beautiful Printable 2290 form Wallpaper

These due date rules apply whether you are paying the tax or reporting the suspension of tax. Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. A monthly penalty of 4.5% of the total tax due is assessed up to.

Irs Form 2290 Due Date Form Resume Examples

This is to avoid paying penalty for the late filing to the irs. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web month form 2290 must.

Irs Form 2290 Printable Form Resume Examples

Use the table below to determine your filing deadline. The current period begins july 1, 2023, and ends june 30, 2024. Web month form 2290 must be filed; A monthly penalty of 0.5% of the total tax due is assessed for the. Web the irs will impose a penalty for not filing your form 2290 return or paying the required.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

A monthly penalty of 0.5% of the total tax due is assessed for the. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the.

Form 2290 Due Now! Use Code “FREEDOM” to avail a 10 discount Tax

Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. The tax period runs from july 1 to june 30 of the following year, and the form is usually due by the last day of the month following the first month of use. The current tax period for heavy highway.

Tax Form 2290 Due Date Form Resume Examples wRYPmOEV4a

Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. Web use form 2290 to: Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. These due date rules.

Irs 1096 Form Due Date Form Resume Examples vq1PVr5q3k

The current period begins july 1, 2023, and ends june 30, 2024. A monthly penalty of 0.5% of the total tax due is assessed for the. Web if you first used a taxable vehicle on a public highway in july 2023, your form 2290 would be due by august 31, 2023. Web the irs form 2290 due date for heavy.

EFile Form 2290 File 2290 Online Lowest Price 14.90

Web the irs will impose a penalty for not filing your form 2290 return or paying the required taxes within the deadline.the penalties and interest rates are as follows. Use the table below to determine your filing deadline. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web when is the due date for form 2290 to irs? Web if you first used a taxable vehicle on a public highway in july 2023, your form 2290 would be due by.

Use The Table Below To Determine Your Filing Deadline.

A monthly penalty of 4.5% of the total tax due is assessed up to five months for not filing form 2290 by the deadline. The current period begins july 1, 2023, and ends june 30, 2024. The tax period runs from july 1 to june 30 of the following year, and the form is usually due by the last day of the month following the first month of use. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more;

These Due Date Rules Apply Whether You Are Paying The Tax Or Reporting The Suspension Of Tax.

Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web month form 2290 must be filed; Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. A monthly penalty of 0.5% of the total tax due is assessed for the.

Figure And Pay The Tax Due On A Vehicle For Which You Completed The Suspension Statement On Another Form 2290 If That Vehicle Later Exceeded The Mileage Use Limit During The Period;

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web the irs will impose a penalty for not filing your form 2290 return or paying the required taxes within the deadline.the penalties and interest rates are as follows. Web use form 2290 to: Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year.

Web If You First Used A Taxable Vehicle On A Public Highway In July 2023, Your Form 2290 Would Be Due By August 31, 2023.

The current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period; Web when is the due date for form 2290 to irs? Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period.