When Is Form 56 Required

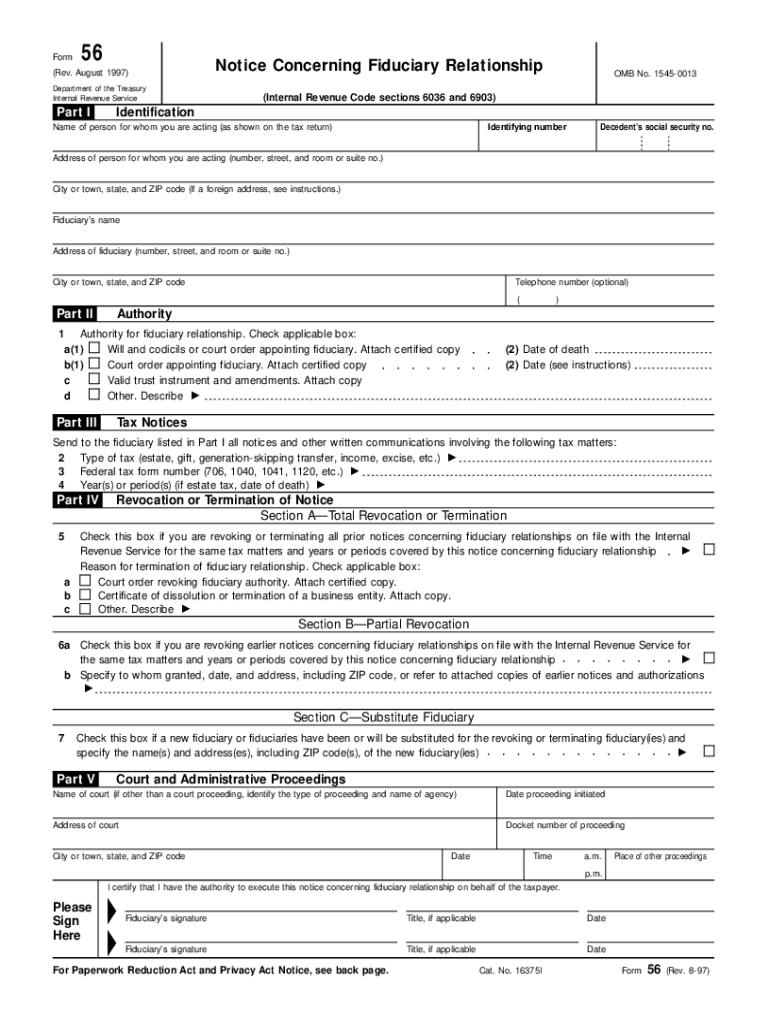

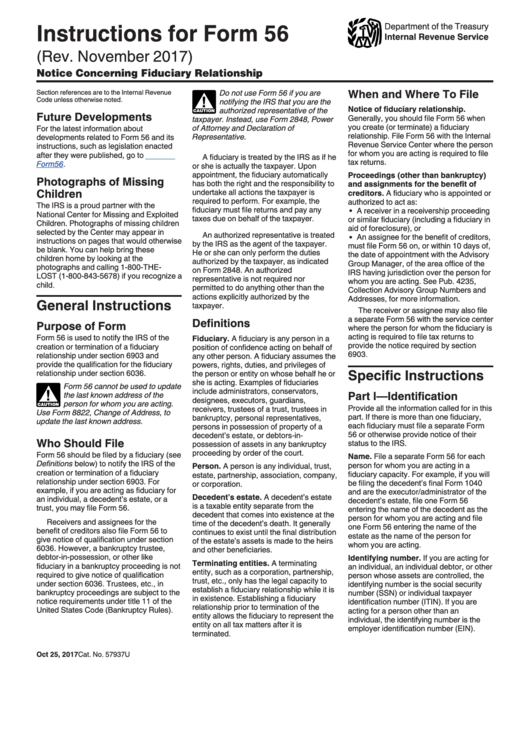

When Is Form 56 Required - Web updated jan 28, 2022 notifying the irs about any changes in a fiduciary relationship. Web form 56 filing the final tax returns for my late father. 14742 form 56 must be attached as pdf solved • by intuit • 48 • updated february 09, 2023 when preparing a fiduciary return. Web when and where to file. Form 56 should be filed by a fiduciary to notify the irs of the creation or termination of a fiduciary relationship under section. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Web resolving lacerte diagnostic ref. Web form 56 should be filed with each return. July 2004) notice concerning fiduciary relationship omb no.

Web resolving lacerte diagnostic ref. Web form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Form 56 should be filed by a fiduciary to notify the irs of the creation or termination of a fiduciary relationship under section. Web form 56 filing the final tax returns for my late father. 14742 form 56 must be attached as pdf solved • by intuit • 48 • updated february 09, 2023 when preparing a fiduciary return. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. Web from the form's instructions: For example, if you are.

Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Estate tax return used for estates that are greater than the estate tax exemption. For example, if you are. Form 56 should be filed by a fiduciary to notify the irs of the creation or termination of a fiduciary relationship under section. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. July 2004) notice concerning fiduciary relationship omb no. If you wish to receive tax notices for more. Web when and where to file. 14742 form 56 must be attached as pdf solved • by intuit • 48 • updated february 09, 2023 when preparing a fiduciary return.

Form 56 Fill Online, Printable, Fillable, Blank pdfFiller

Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. If you wish to receive tax notices for more. Estate tax return used for estates that are greater than the estate tax exemption. Web form 56 should be filed by a fiduciary (see definitions below) to notify.

Fillable IRS Form 56 2017 2019 Online PDF Template

Web form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. Web updated jan 28, 2022 notifying the irs about any changes in a fiduciary relationship. Web when and where to file. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs.

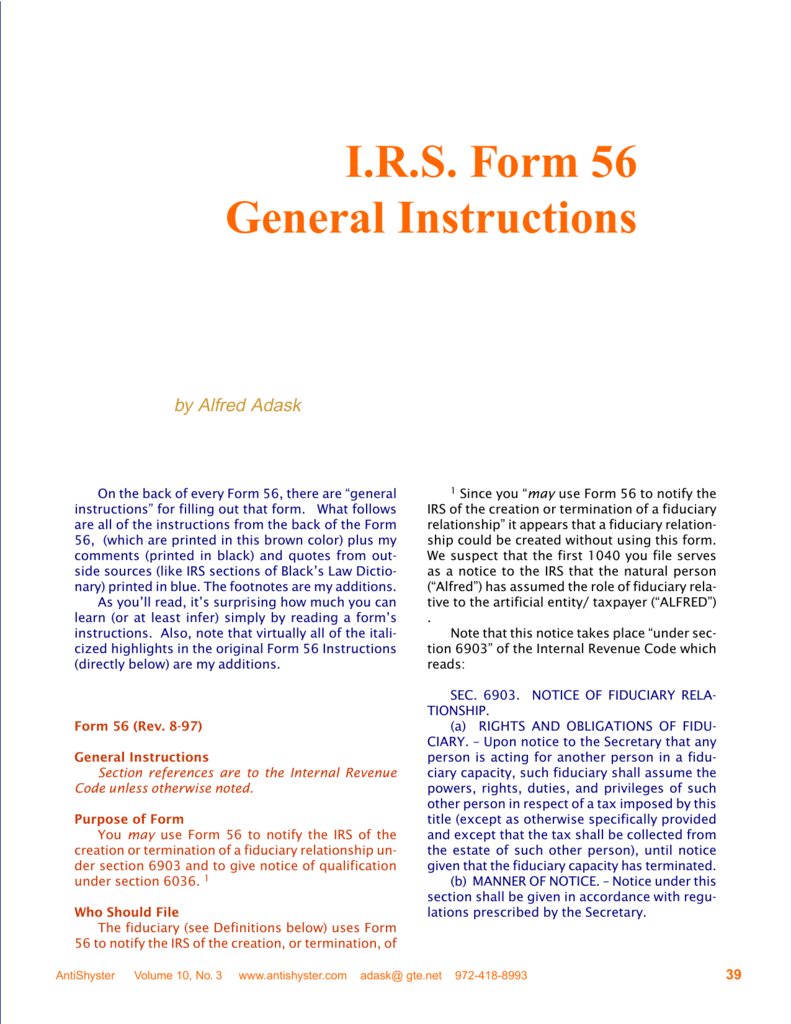

I.R.S. Form 56 General Instructions

Web resolving lacerte diagnostic ref. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Estate tax return used for estates that are greater than the estate tax exemption. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service.

FREE 14+ Sample Corrective Action Plan Templates in MS Word PDF

Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. Web form 56 should be filed by a fiduciary.

PHP Tutorial 56 Required Form Fields YouTube

Web when and where to file. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. Web form 56 filing the final tax returns for my late father. Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. Estate tax.

Irs Form 56 Fill Out and Sign Printable PDF Template signNow

August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. July 2004) notice concerning fiduciary relationship omb no. Web from the form's instructions: Web resolving lacerte diagnostic ref. Web when and where to file.

Top 7 Irs Form 56 Templates free to download in PDF format

Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. 14742 form 56 must be attached as pdf solved.

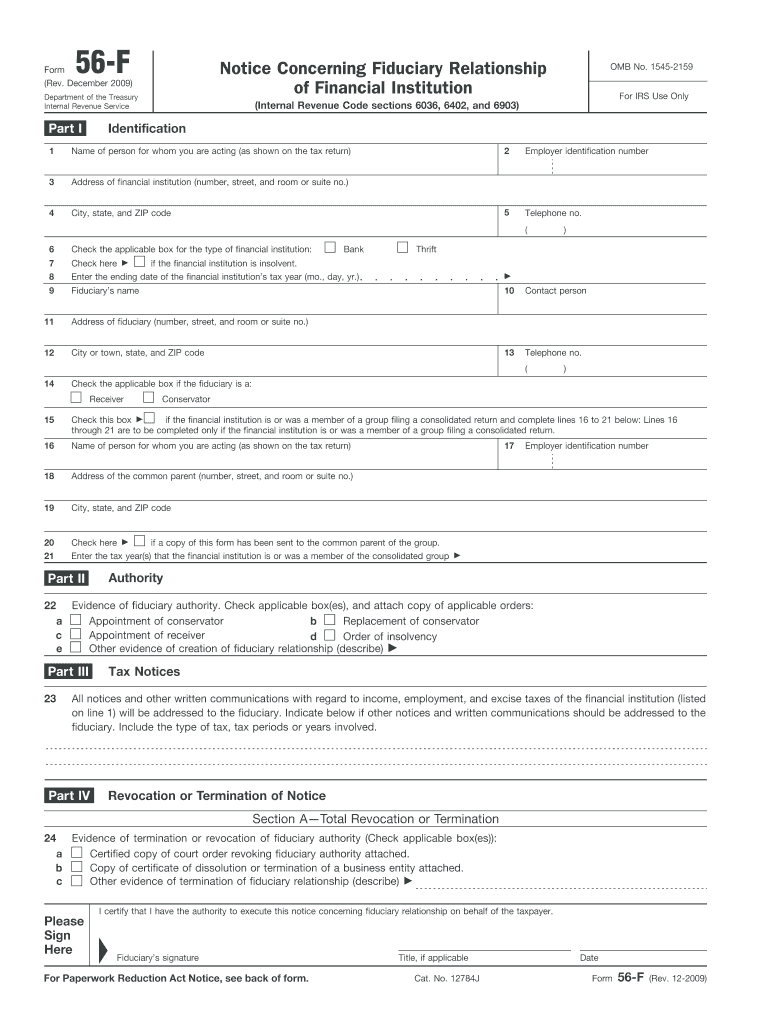

Form 56 F Fill Out and Sign Printable PDF Template signNow

August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections. For example, if you are. Web from the form's instructions: July 2004) notice concerning fiduciary relationship omb no. Estate tax return used for estates that are greater than the estate tax exemption.

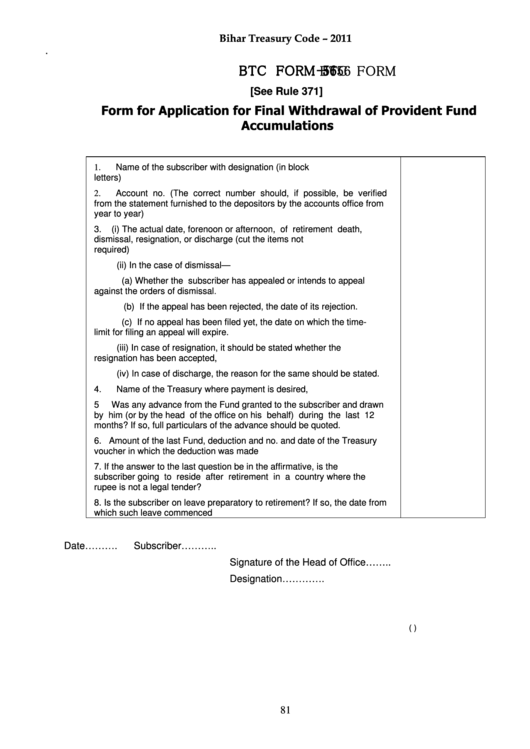

Btc Form56 Form For Application For Final Withdrawal Of Provident

If you wish to receive tax notices for more. 14742 form 56 must be attached as pdf solved • by intuit • 48 • updated february 09, 2023 when preparing a fiduciary return. Web from the form's instructions: July 2004) notice concerning fiduciary relationship omb no. A fiduciary files form 56 to notify the irs about any changes in a.

Form 56 ™ WESLEY KEITH MULLINGS TRUST

Web form 56 should be filed with each return. Web resolving lacerte diagnostic ref. Web form 56 filing the final tax returns for my late father. Web when and where to file. Form 56 should be filed by a fiduciary to notify the irs of the creation or termination of a fiduciary relationship under section.

Form 56 Should Be Filed By A Fiduciary To Notify The Irs Of The Creation Or Termination Of A Fiduciary Relationship Under Section.

Web resolving lacerte diagnostic ref. For example, if you are. Web irs form 56, notice concerning fiduciary relationship, is used to notify the internal revenue service and state taxing authorities of either the initiation or termination of a. August 1997) notice concerning fiduciary relationship department of the treasury internal revenue service (internal revenue code sections.

14742 Form 56 Must Be Attached As Pdf Solved • By Intuit • 48 • Updated February 09, 2023 When Preparing A Fiduciary Return.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Web form 56 filing the final tax returns for my late father. Estate tax return used for estates that are greater than the estate tax exemption. Web when and where to file.

Web Updated Jan 28, 2022 Notifying The Irs About Any Changes In A Fiduciary Relationship.

If you wish to receive tax notices for more. A fiduciary files form 56 to notify the irs about any changes in a fiduciary. Web form 56 should be filed by a fiduciary (see definitions below) to notify the irs of the creation or termination of a fiduciary relationship under section 6903. Web from the form's instructions:

July 2004) Notice Concerning Fiduciary Relationship Omb No.

Web form 56 cannot be used to update the last known address of the person, business, or entity for whom you are acting. Web form 56 should be filed with each return. Web form 56 omb no. Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns.