Wr 30 Form Nj

Wr 30 Form Nj - Penalties range from $5.00 to $25.00 per employee record error. You may file the forms online here. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Nj division of revenue and. Web companies must get approval from the new jersey division of revenue if they develop: Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s):

This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. You may file the forms online here. Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and. Web employer payroll tax electronic filing and reporting options. Web companies must get approval from the new jersey division of revenue if they develop: Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Use this option to fill in and electronically file the following form (s):

Nj division of revenue and. Penalties range from $5.00 to $25.00 per employee record error. Use this option to fill in and electronically file the following form (s): Web companies must get approval from the new jersey division of revenue if they develop: Web employer payroll tax electronic filing and reporting options. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. You may file the forms online here. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes:

NJ MVCTransferring Vehicle Ownership Form Fill Out and Sign Printable

Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Penalties range from $5.00 to $25.00 per employee record error. Web companies must get approval from the new jersey division of revenue if they.

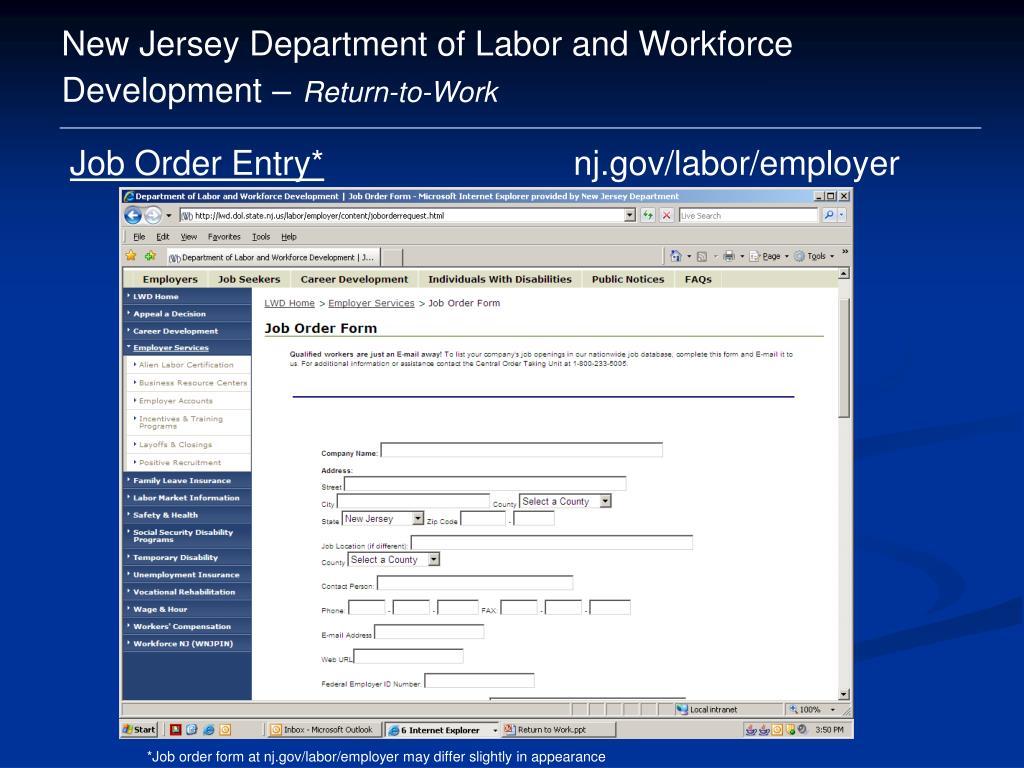

PPT New Jersey Department of Labor and Workforce Development Return

Penalties range from $5.00 to $25.00 per employee record error. Web employer payroll tax electronic filing and reporting options. Web companies must get approval from the new jersey division of revenue if they develop: Use this option to fill in and electronically file the following form (s): Web file new jersey payroll tax returns, submit wage reports, and pay withholding.

Form Nj 165 Download Fillable Pdf Or Fill Online Employee S Certificate

Web companies must get approval from the new jersey division of revenue if they develop: Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Use this option to.

Nj Wr 30 Form Fill Out and Sign Printable PDF Template signNow

Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. You may file the forms online here. Web companies must get approval from the new jersey.

New Jersey Wr 30 Form Fill Online, Printable, Fillable, Blank pdfFiller

You may file the forms online here. Penalties range from $5.00 to $25.00 per employee record error. Use this option to fill in and electronically file the following form (s): Web companies must get approval from the new jersey division of revenue if they develop: Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes:

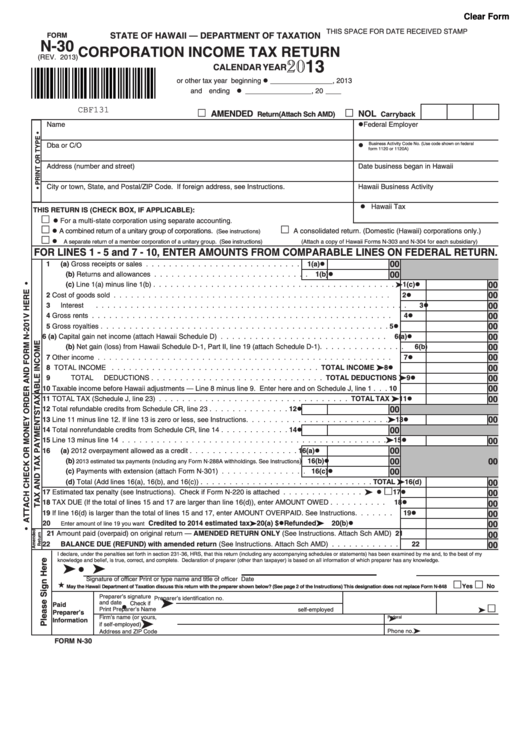

Fillable Form N30 Corporation Tax Return 2013 printable pdf

This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Nj division of revenue and. Web employer payroll tax electronic filing and reporting options. Penalties range from $5.00 to $25.00 per employee record error. You may file the forms online here.

2008 Playoff Absolute Memorabilia War Room WR30 Matt Ryan /250

Use this option to fill in and electronically file the following form (s): You may file the forms online here. Penalties range from $5.00 to $25.00 per employee record error. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Nj division of revenue and.

NWBreaks Largent Blue Jersey Razz 7/1/2017 YouTube

Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and. You may file the forms online here. Use this option to fill in and electronically file the following form (s): This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following.

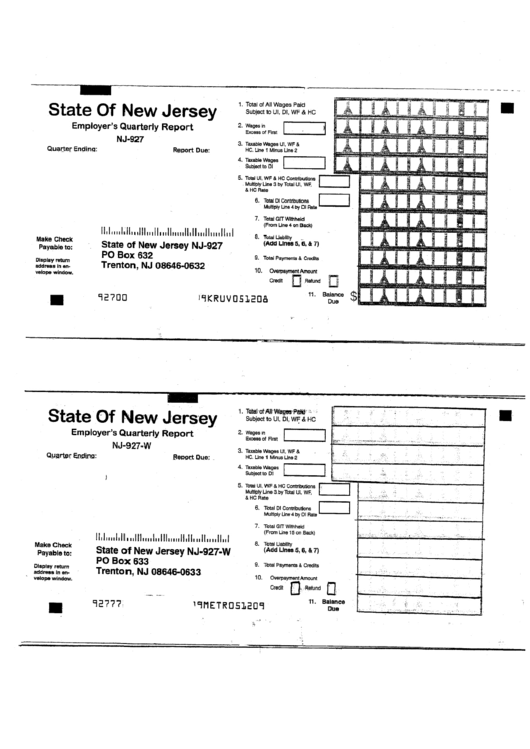

Form Nj927 Employer'S Quarterly Report Form printable pdf download

Penalties range from $5.00 to $25.00 per employee record error. Nj division of revenue and. Web employer payroll tax electronic filing and reporting options. Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: You may file the forms online here.

PPT New Jersey Department of Labor and Workforce Development Return

This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Web companies must get approval from the new jersey division of revenue if they develop: Web file new jersey payroll tax returns, submit wage reports, and pay withholding taxes: Penalties range from $5.00 to $25.00 per employee record.

Penalties Range From $5.00 To $25.00 Per Employee Record Error.

Web employer payroll tax electronic filing and reporting options. Nj division of revenue and. This report, which lists all people who were employed and/or paid by your company during the specified time period, contains the following. Use this option to fill in and electronically file the following form (s):

Web File New Jersey Payroll Tax Returns, Submit Wage Reports, And Pay Withholding Taxes:

Web companies must get approval from the new jersey division of revenue if they develop: You may file the forms online here.