401K Withdrawal Form

401K Withdrawal Form - Use get form or simply click on the template preview to open it in the editor. The formula to calculate the tax is complicated. Roth ira withdrawal rules are also more flexible. Create professional documents with signnow. Get your fillable template and complete it online using the instructions provided. Your penalty alone will eat up $5,000 of your. If your combined income is less than. Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years old. You can also complete many of these transactions online. Ira inherit an ira from a spouse or non.

Let’s say you take an early 401 (k) withdrawal of $50,000. Web how to calculate early withdrawal penalties on a 401 (k) account. Start completing the fillable fields and carefully type in required information. Your penalty alone will eat up $5,000 of your. The formula to calculate the tax is complicated. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Web a guaranteed lifetime withdrawal benefit: Use get form or simply click on the template preview to open it in the editor. Ira inherit an ira from a spouse or non.

You can also complete many of these transactions online. Get ready for the ouch: Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Think of deferred annuities like a private form of social security. If your combined income is less than. Web a guaranteed lifetime withdrawal benefit: The formula to calculate the tax is complicated. Web how to calculate early withdrawal penalties on a 401 (k) account. Start completing the fillable fields and carefully type in required information. Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years old.

Sentry 401k Plan Withdrawal Request Form 20152022 Fill and Sign

Create professional documents with signnow. Get your fillable template and complete it online using the instructions provided. Start completing the fillable fields and carefully type in required information. Your penalty alone will eat up $5,000 of your. Think of deferred annuities like a private form of social security.

Massmutual 401 K

Get ready for the ouch: Use get form or simply click on the template preview to open it in the editor. The formula to calculate the tax is complicated. Ira inherit an ira from a spouse or non. Your penalty alone will eat up $5,000 of your.

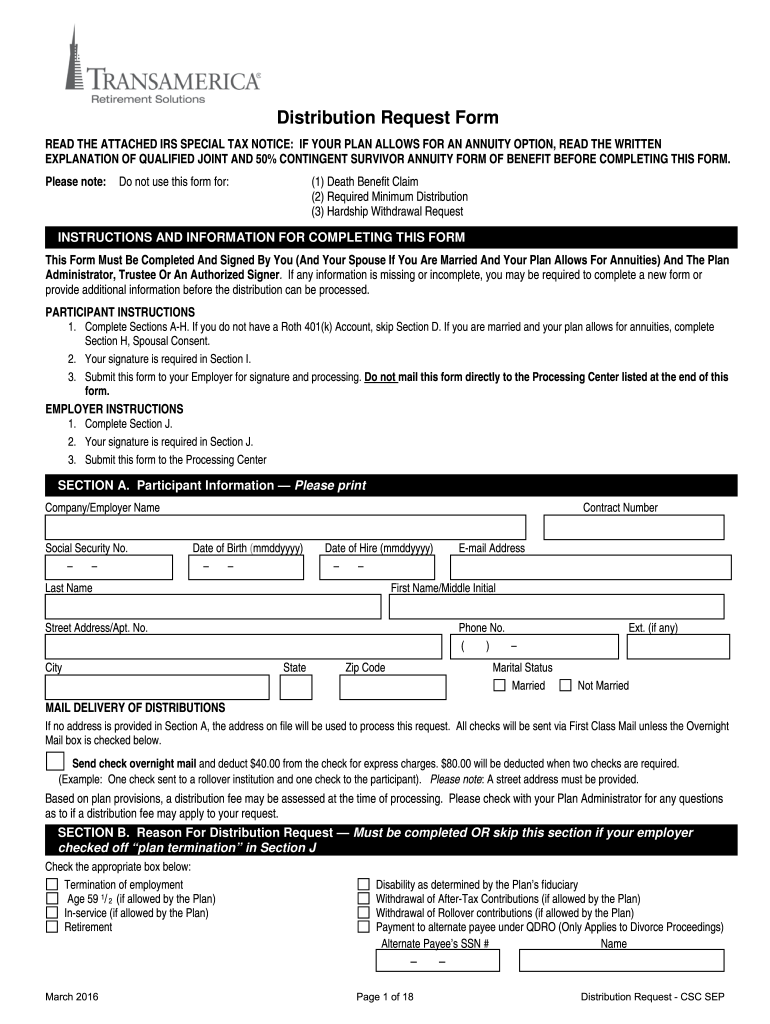

Fillable Online transamerica 401k withdrawal form Fax Email Print

Think of deferred annuities like a private form of social security. Start completing the fillable fields and carefully type in required information. Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years old. Your penalty alone will eat up $5,000 of.

401k Withdrawal Form For Taxes Universal Network

Start completing the fillable fields and carefully type in required information. Get ready for the ouch: Once you have figured out your combined income, there are three different categories you can fall into: Ira inherit an ira from a spouse or non. Get your fillable template and complete it online using the instructions provided.

Sentry 401k Withdrawal Form Universal Network

Think of deferred annuities like a private form of social security. Roth ira withdrawal rules are also more flexible. Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Create professional documents with signnow.

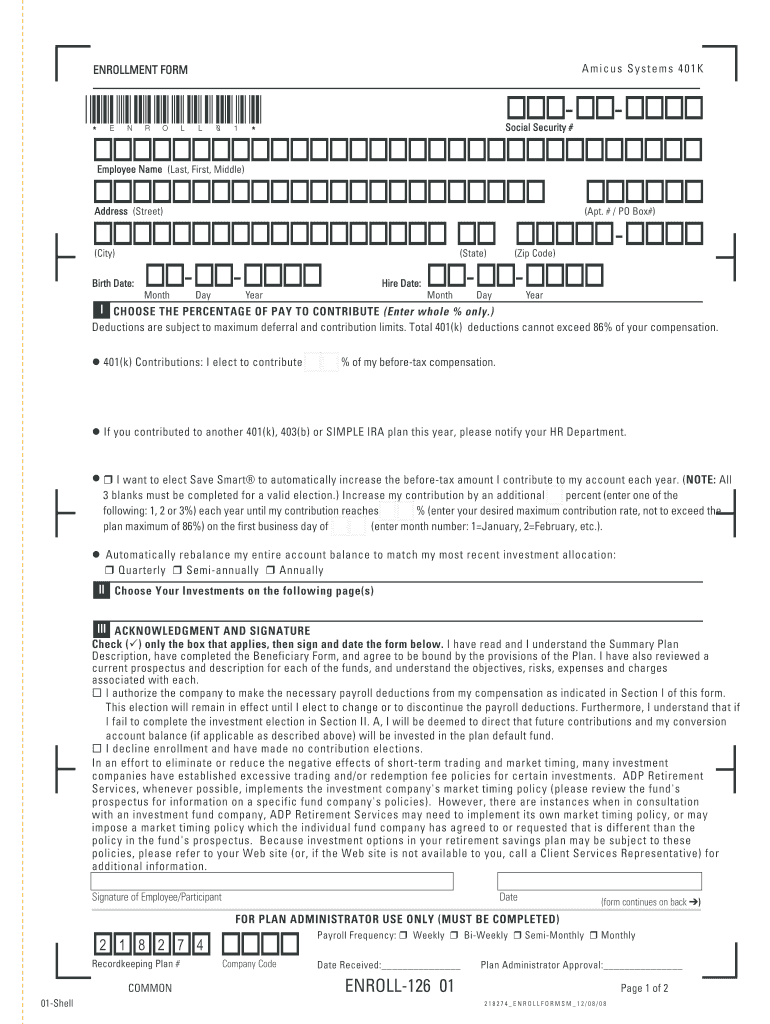

Adp 401K Login Fill Out and Sign Printable PDF Template signNow

Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years old. Roth ira withdrawal rules are also more flexible. To make a qualified withdrawal, you must have contributed to the account for five years or more and be 59½ or older..

Paychex 401k Withdrawal Form Universal Network

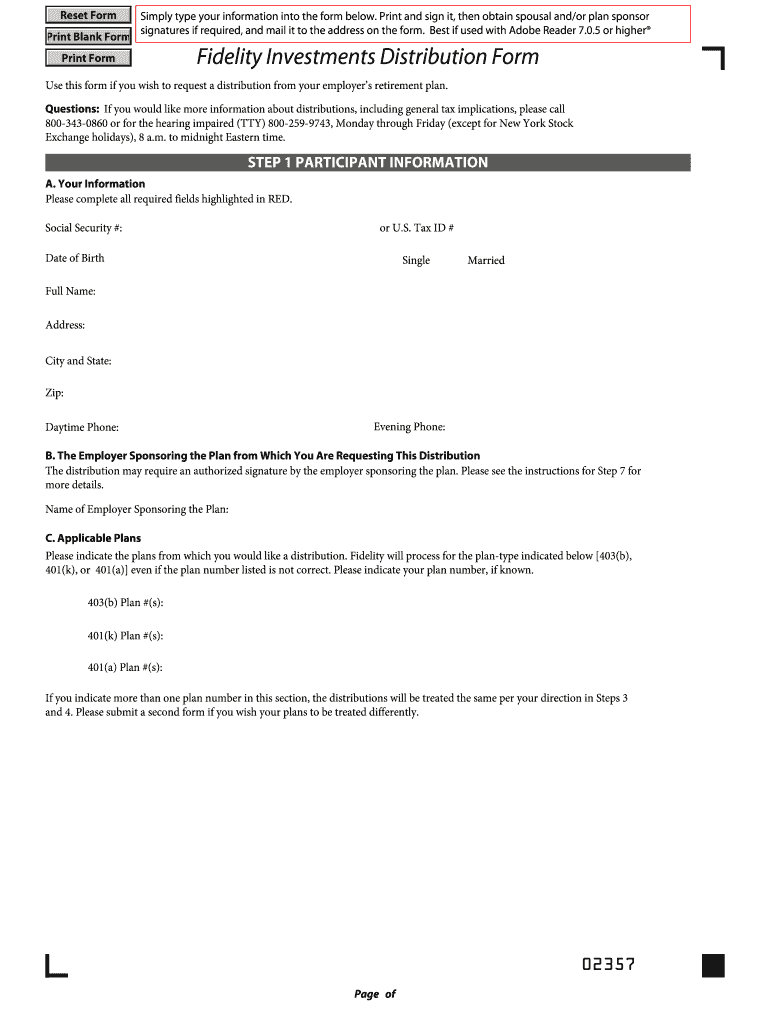

Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. The formula to calculate the tax is complicated. Web how to calculate early withdrawal penalties on a 401 (k) account. Roth ira withdrawal rules are also more flexible. Get ready for the ouch:

401k Withdrawal Form Fill Out and Sign Printable PDF Template signNow

Let’s say you take an early 401 (k) withdrawal of $50,000. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Use get form or simply click on the template preview to open it in the editor. Once you have figured out your combined income,.

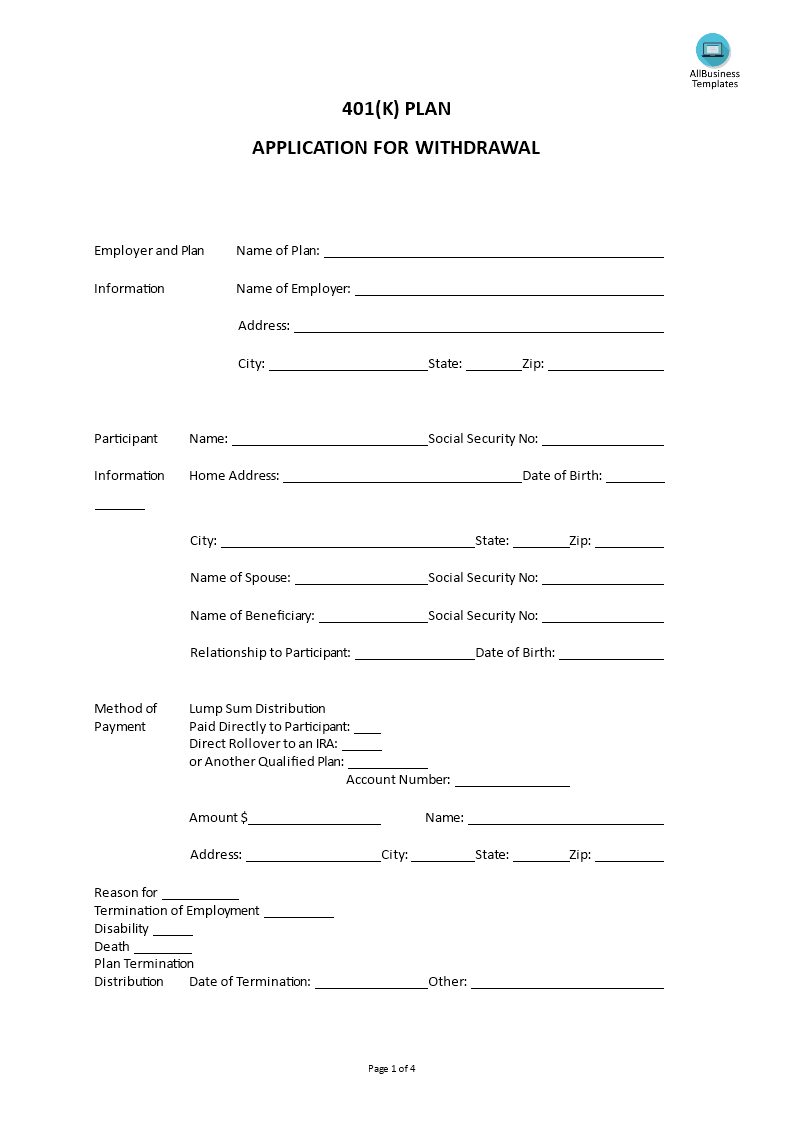

401K Application For Withdrawal Templates at

Your penalty alone will eat up $5,000 of your. Ira inherit an ira from a spouse or non. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Let’s say you take an early 401 (k) withdrawal of $50,000. Use the cross or check marks in the top toolbar to.

Principal Financial Group 401k Withdrawal Form Form Resume Examples

Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Web the internal revenue service (irs) allows you to begin taking distributions from your 401 (k) without a 10% early withdrawal penalty as soon as you are 59½ years old. Use get form or simply click on the template preview.

Web The Internal Revenue Service (Irs) Allows You To Begin Taking Distributions From Your 401 (K) Without A 10% Early Withdrawal Penalty As Soon As You Are 59½ Years Old.

Web a guaranteed lifetime withdrawal benefit: You can also complete many of these transactions online. Your penalty alone will eat up $5,000 of your. Let’s say you take an early 401 (k) withdrawal of $50,000.

To Make A Qualified Withdrawal, You Must Have Contributed To The Account For Five Years Or More And Be 59½ Or Older.

Start completing the fillable fields and carefully type in required information. Get ready for the ouch: Web how to calculate early withdrawal penalties on a 401 (k) account. Get your fillable template and complete it online using the instructions provided.

Create Professional Documents With Signnow.

Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Roth ira withdrawal rules are also more flexible. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account.

If Your Combined Income Is Less Than.

Use get form or simply click on the template preview to open it in the editor. Think of deferred annuities like a private form of social security. Once you have figured out your combined income, there are three different categories you can fall into: The formula to calculate the tax is complicated.