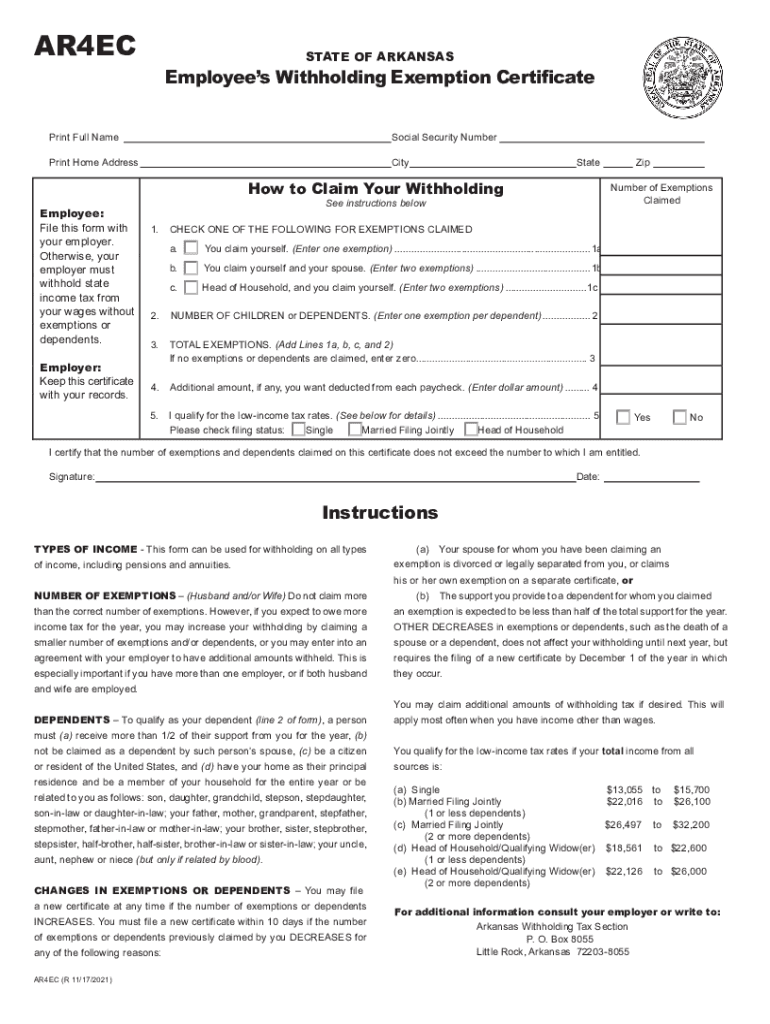

Arkansas State Withholding Form 2022

Arkansas State Withholding Form 2022 - Download or email ar ar4ec & more fillable forms, register and subscribe now! Quarterly payroll and excise tax returns normally due on may 1. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. Web handy tips for filling out arkansas employee withholding online. Web you can download pdfs of the new forms from the following links: Web amount of withholding rather than use the withholding tables. Web however, when the clock strikes midnight, january 1, 2022 will mark the first day of the new tax legislation. Download or email ar1000f & more fillable forms, register and subscribe now! This will close your withholding account with the state of arkansas until you re. The new state laws will reduce the top income tax rate for.

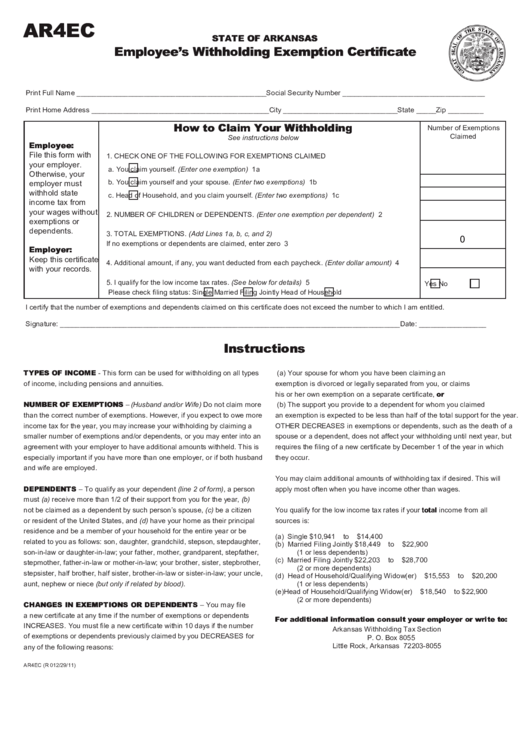

Web to change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Enter the date the business closed or stopped withholding arkansas taxes. The new state laws will reduce the top income tax rate for. Complete, edit or print tax forms instantly. Web handy tips for filling out arkansas employee withholding online. In addition to the federal income tax withholding form, w4, each employee needs. There is a very simple form to help each employer determine that. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Ar1155 extension of time to file request:

This will close your withholding account with the state of arkansas until you re. The new state laws will reduce the top income tax rate for. Complete, edit or print tax forms instantly. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Download or email ar1000f & more fillable forms, register and subscribe now! If too little is withheld, you will generally owe tax when. Web 42 rows name/address change, penalty waiver request, and request for copies of. There is a very simple form to help each employer determine that. Quarterly payroll and excise tax returns normally due on may 1. Web you can download pdfs of the new forms from the following links:

Arkansas Employee Withholding Form Fill Out and Sign Printable PDF

The new state laws will reduce the top income tax rate for. Web to change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Download or email ar1000f & more fillable forms, register and subscribe now! Updated versions of arkansas’ withholding certificates, which make annual adjustments to the thresholds used for exemption.

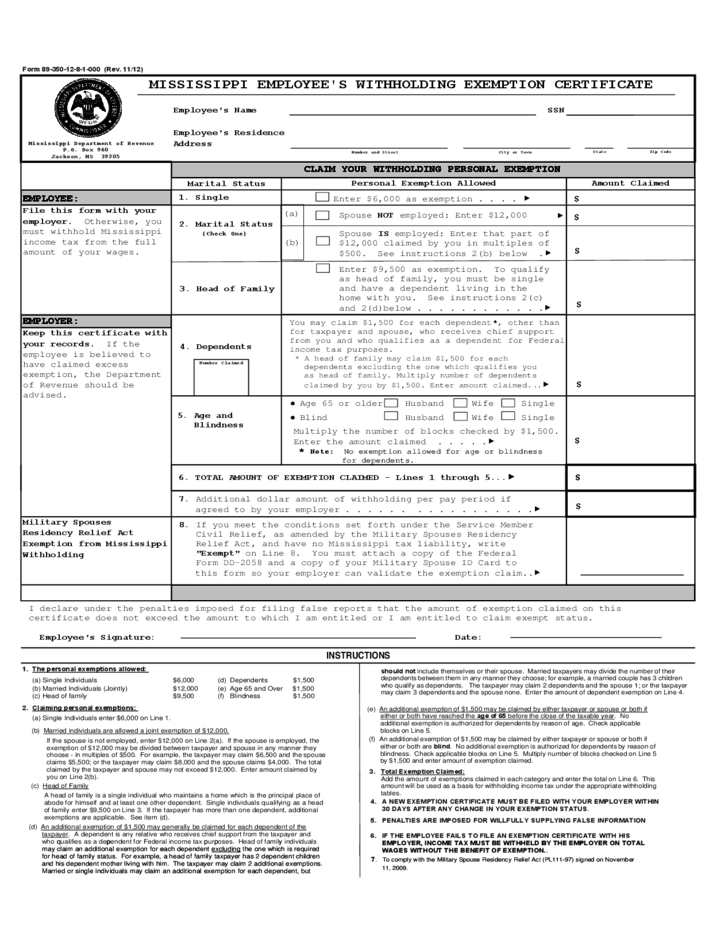

Mississippi Employee Withholding Form 2021 2022 W4 Form

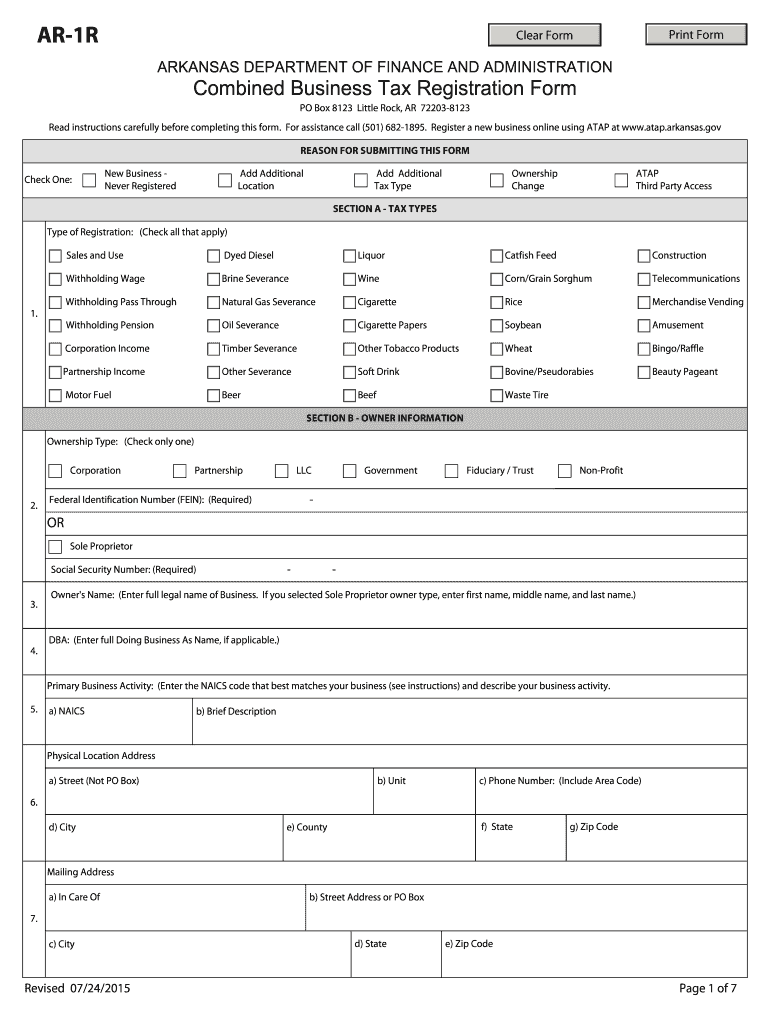

Quarterly payroll and excise tax returns normally due on may 1. These forms can be found on our. Web to change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Web you can download pdfs of the new forms from the following links: Enter the date the business closed or stopped withholding.

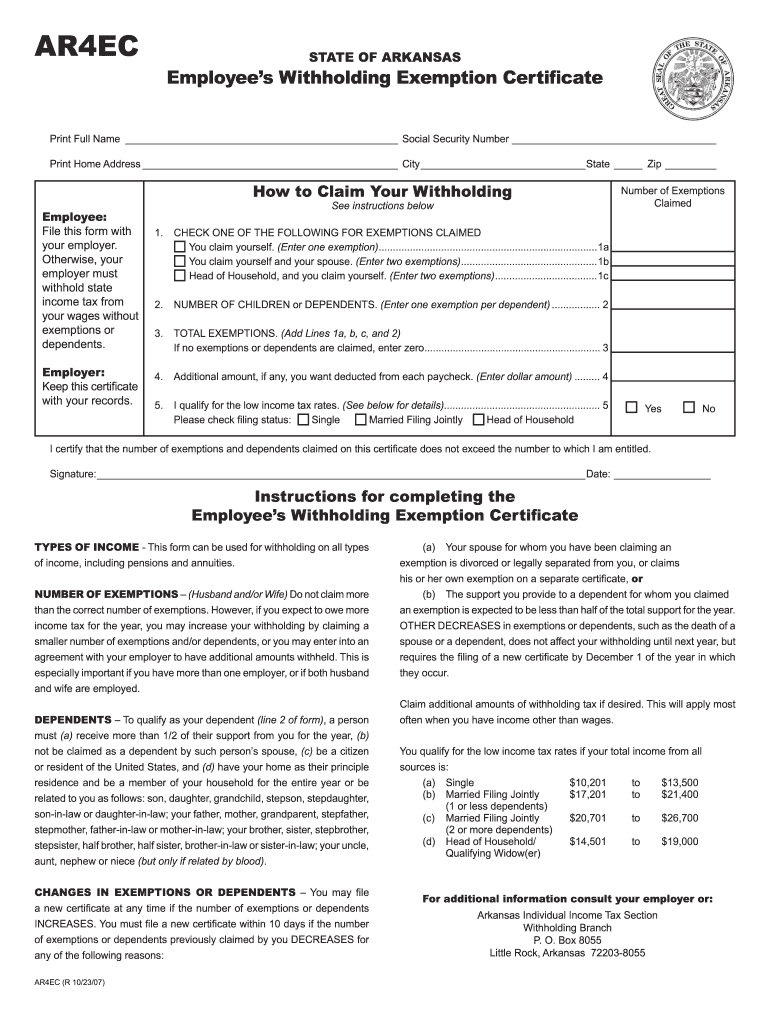

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

These forms can be found on our. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. If too little is withheld, you will generally owe tax when. Web amount of withholding rather than use the withholding tables.

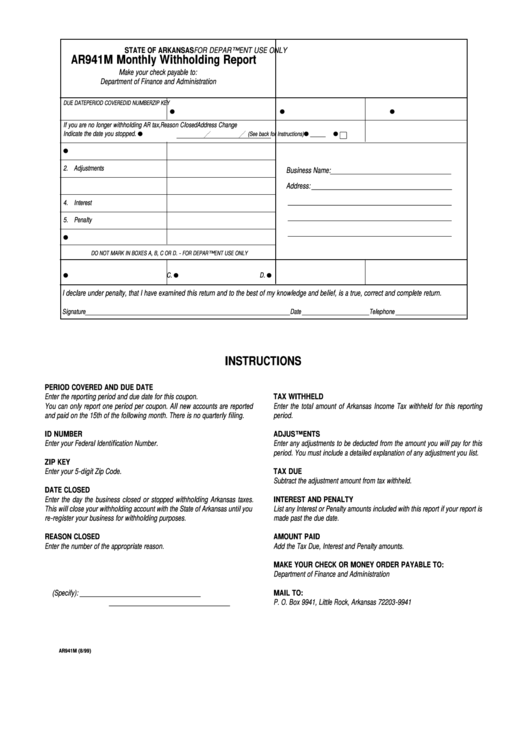

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Multiply the period gross pay by the number of periods per year to arrive at annual gross pay. There is a very simple form to help each employer determine that. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Download or email ar ar4ec & more fillable forms, register and subscribe now! Web $5 (& 67$7( 2) $5.$16$6.

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

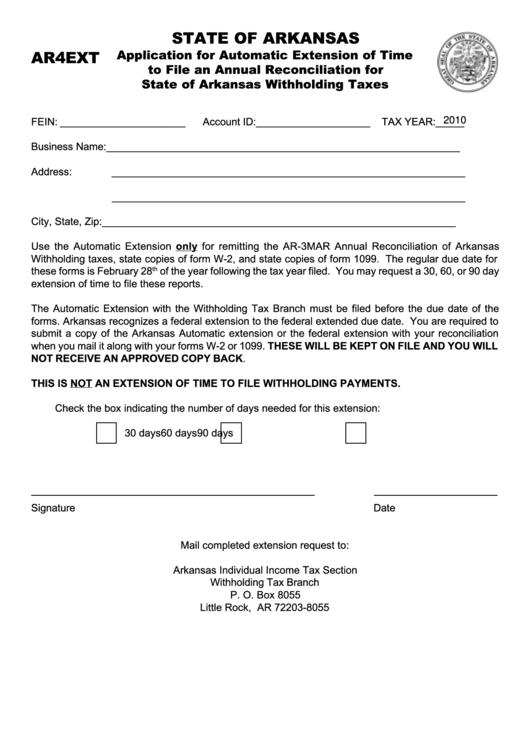

If too little is withheld, you will generally owe tax when. If you make $70,000 a year living in arkansas you will be taxed $11,683. Ar1155 extension of time to file request: Complete, edit or print tax forms instantly. Quarterly payroll and excise tax returns normally due on may 1.

20152022 Form AR DFA AR1R Fill Online, Printable, Fillable, Blank

Download or email ar1000f & more fillable forms, register and subscribe now! Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Download or email ar ar4ec & more fillable.

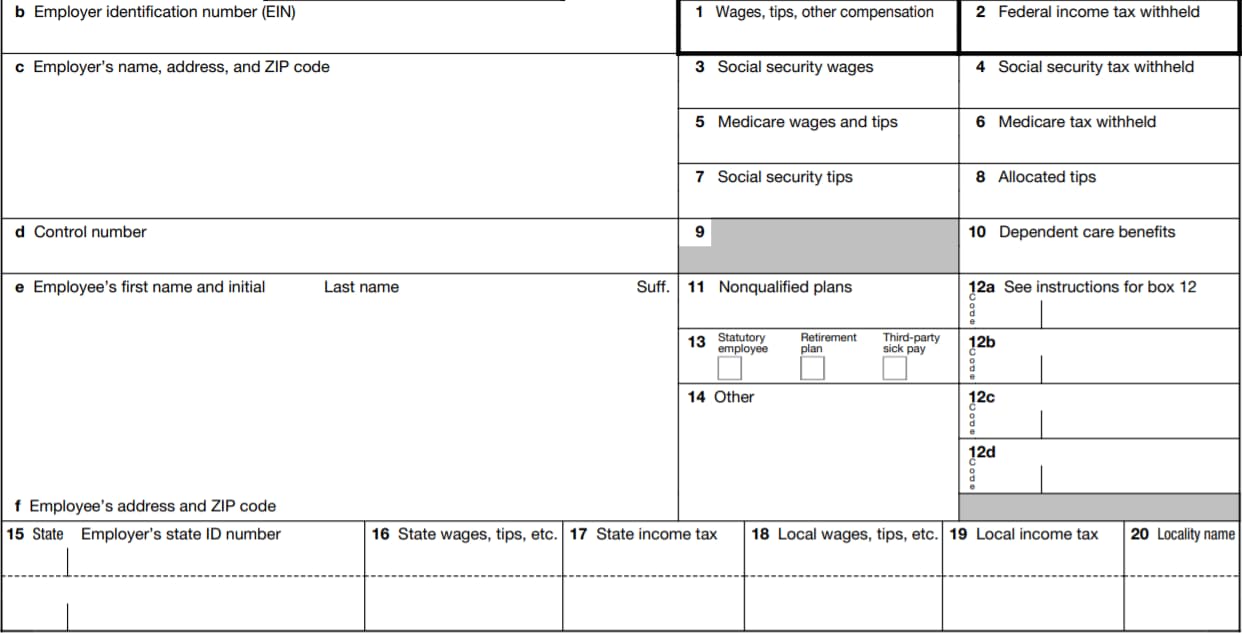

W2 Form 2022 Fillable PDF

Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Web 42 rows name/address change, penalty waiver request, and request for copies of. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Web you can download pdfs of the new forms from the following links:.

Fillable Form Ar4ext Application For Automatic Extension Of Time To

Complete, edit or print tax forms instantly. Enter the date the business closed or stopped withholding arkansas taxes. Complete, edit or print tax forms instantly. Printing and scanning is no longer the best way to manage documents. This will close your withholding account with the state of arkansas until you re.

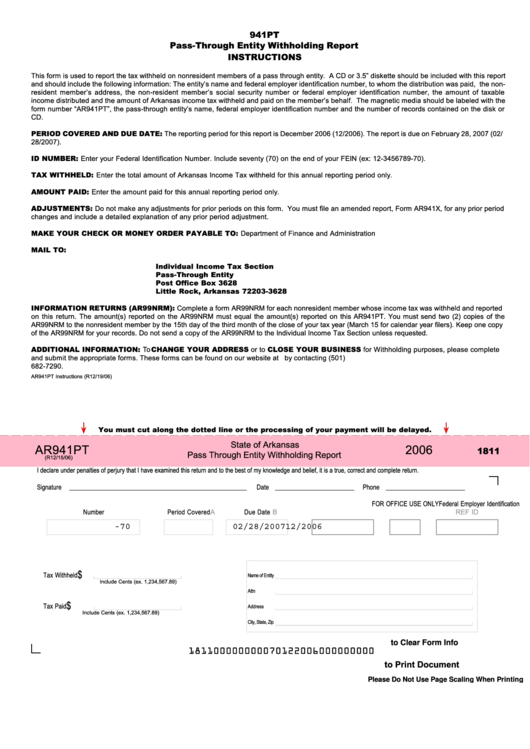

Fillable Form Ar941pt State Of Arkansas Pass Through Entity

Go digital and save time with signnow,. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Web however, when the clock strikes midnight, january 1, 2022 will mark the first day of the new tax legislation. The new state laws will reduce the top income tax.

Where Can I Find Tax Tables? mutualgreget

Quarterly payroll and excise tax returns normally due on may 1. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh In addition to the federal income tax withholding form, w4, each employee needs. Web however, when the clock strikes midnight, january 1, 2022 will mark the.

If Too Little Is Withheld, You Will Generally Owe Tax When.

Web 42 rows name/address change, penalty waiver request, and request for copies of. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Updated versions of arkansas’ withholding certificates, which make annual adjustments to the thresholds used for exemption from withholding.

Web Handy Tips For Filling Out Arkansas Employee Withholding Online.

Web however, when the clock strikes midnight, january 1, 2022 will mark the first day of the new tax legislation. Download or email ar1000f & more fillable forms, register and subscribe now! This will close your withholding account with the state of arkansas until you re. Complete, edit or print tax forms instantly.

Web Amount Of Withholding Rather Than Use The Withholding Tables.

Quarterly payroll and excise tax returns normally due on may 1. These forms can be found on our. Download or email ar ar4ec & more fillable forms, register and subscribe now! Multiply the period gross pay by the number of periods per year to arrive at annual gross pay.

Go Digital And Save Time With Signnow,.

Printing and scanning is no longer the best way to manage documents. Enter the date the business closed or stopped withholding arkansas taxes. If you make $70,000 a year living in arkansas you will be taxed $11,683. There is a very simple form to help each employer determine that.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)