Az 140 Tax Form

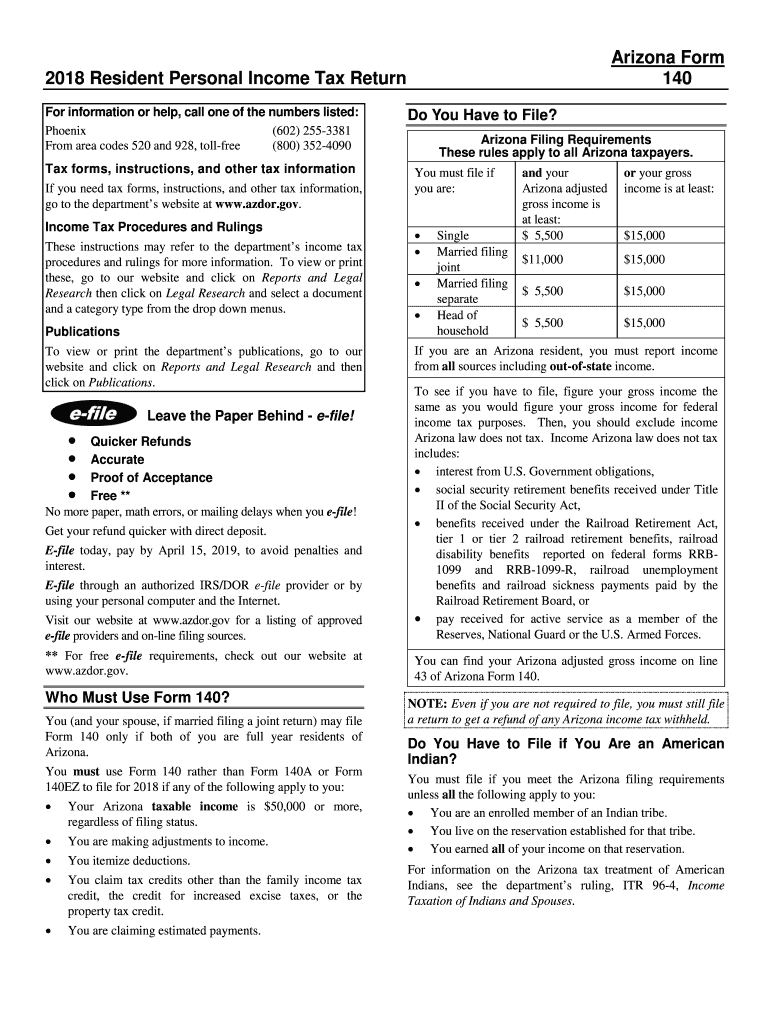

Az 140 Tax Form - If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Web report error it appears you don't have a pdf plugin for this browser. Web 26 rows 140 : Also, find mailing addresses for other returns, including corporation,. This form is used by residents who file an individual income tax return. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: If your taxable income is $50,000 or more, you. Mail to arizona department of revenue, po box 29085, phoenix, az 85038. Web personal income tax return filed by resident taxpayers. This form should be completed after.

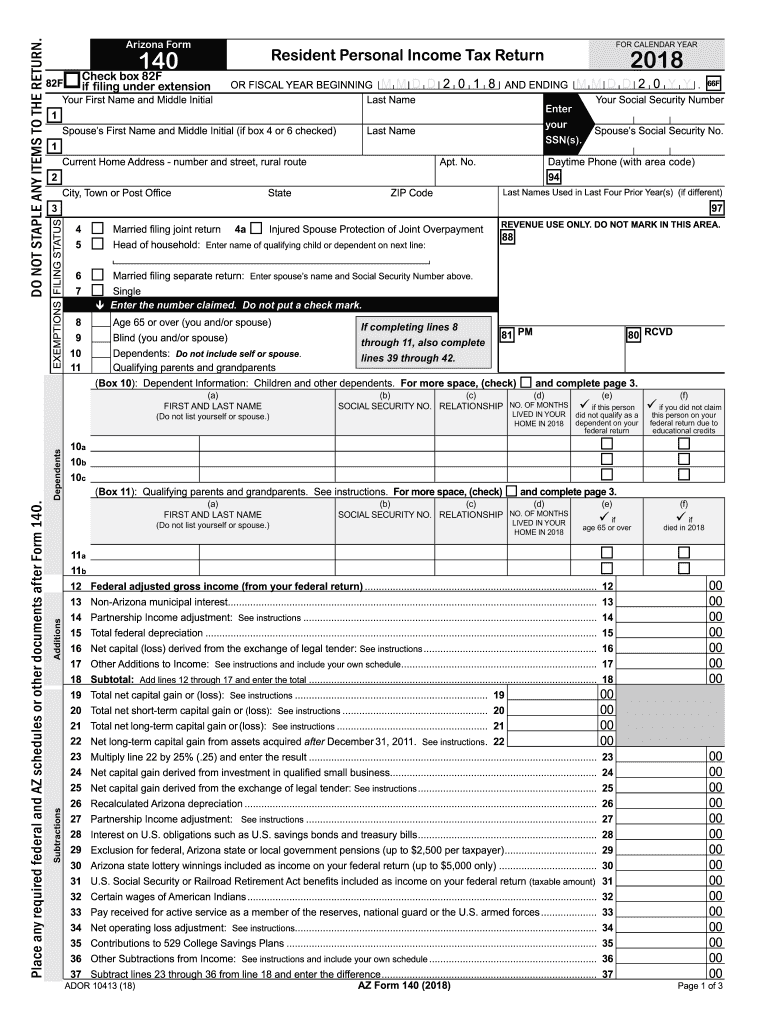

Web search by state and form number the mailing address to file paper individual tax returns and payments. Arizona form 140 check box 82f if filing under extension 82f. Web 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0. Include your payment with this form. Web resident personal income tax return. If your taxable income is $50,000 or more, you. This form is for income earned in tax year 2022, with. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Easily fill out pdf blank, edit, and sign them. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

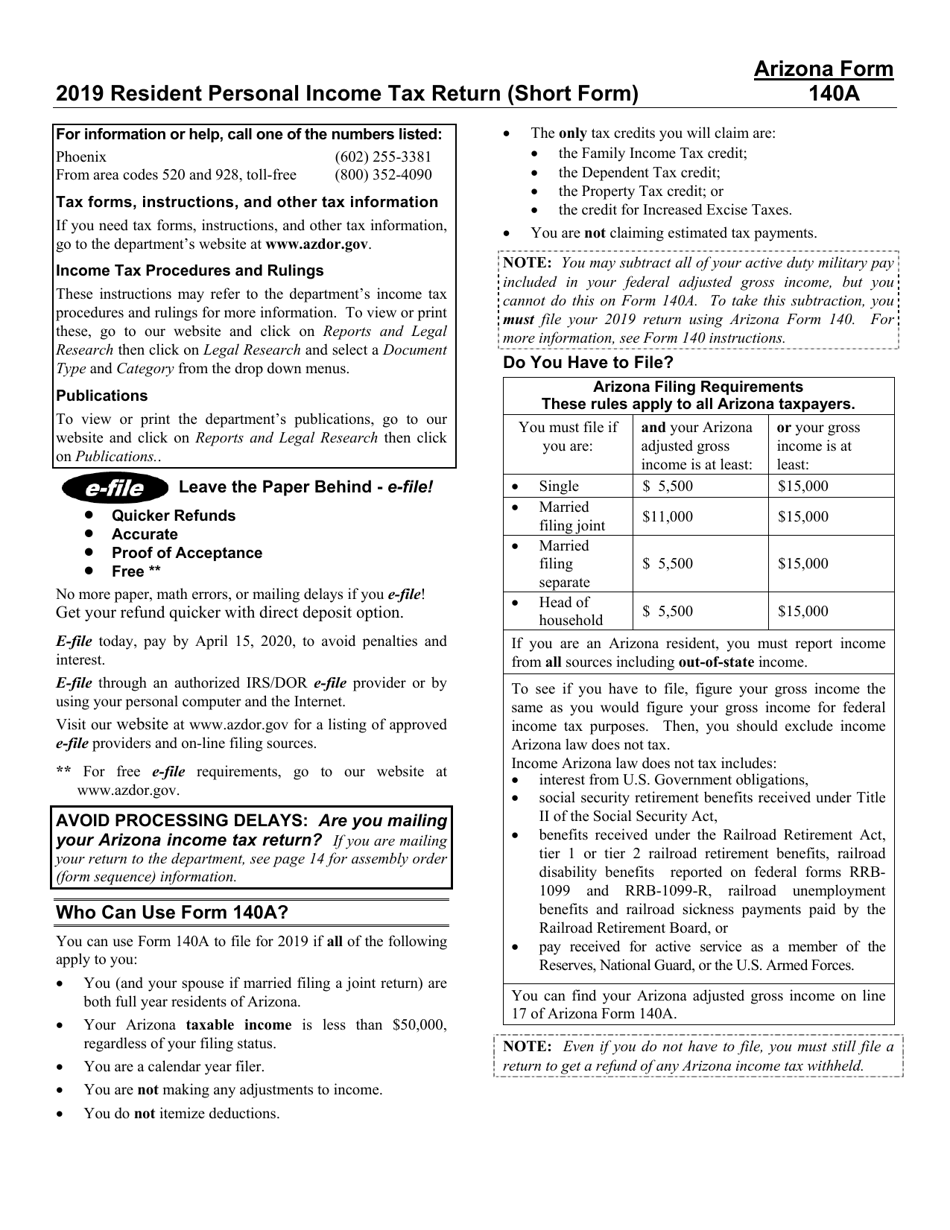

Web personal income tax return filed by resident taxpayers. Arizona form 140 check box 82f if filing under extension 82f. This form is used by residents who file an individual income tax return. Also, find mailing addresses for other returns, including corporation,. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: Mail to arizona department of revenue, po box 29085, phoenix, az 85038. Save or instantly send your ready documents. Web search by state and form number the mailing address to file paper individual tax returns and payments. Form 140a arizona resident personal income tax booklet. • your arizona taxable income is $50,000 or more.

AZ Form 5000A 2017 Fill out Tax Template Online US Legal Forms

Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed: This form is used by residents who file an individual income tax return. Web search by state and form number the mailing address to file paper individual tax returns and payments. Web resident personal income tax return. Also, find mailing.

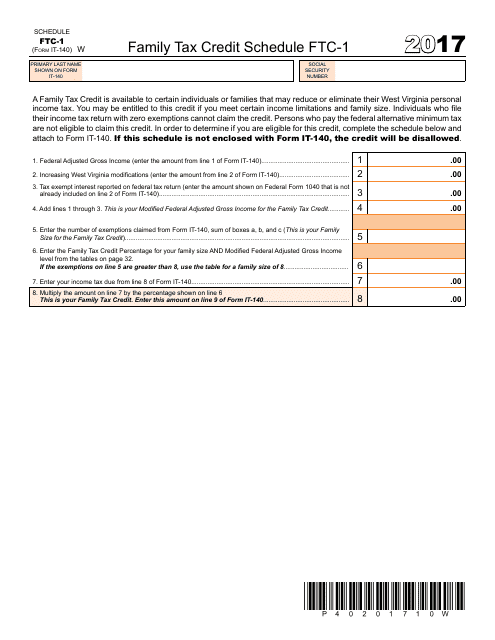

Form IT140 Schedule FTC1 Download Printable PDF or Fill Online Family

This form is used by residents who file an individual income tax return. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Save or instantly send your ready documents. Also, find mailing addresses for other returns, including corporation,. Web arizona form 2020 resident personal income tax return 140 for information or help,.

2018 Form AZ DoR 140 Instructions Fill Online, Printable, Fillable

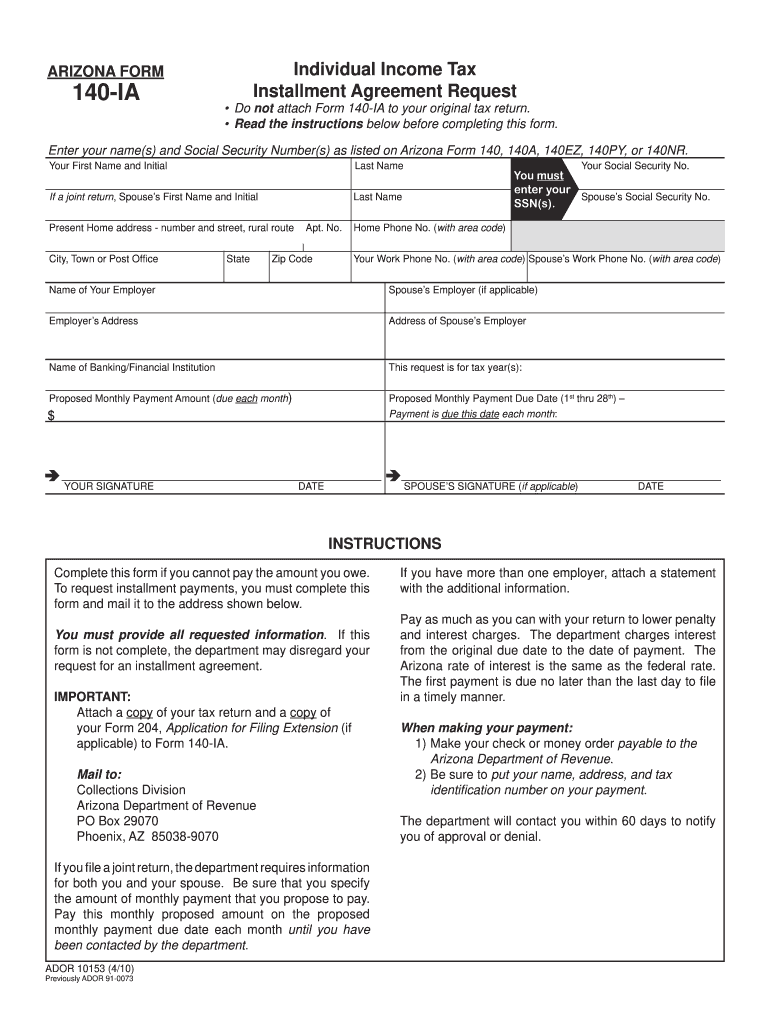

Web you must use form 140 rather than form 140a or form 140ez to file for 2019 if any of the following apply to you. Include your payment with this form. Web resident personal income tax return. Web report error it appears you don't have a pdf plugin for this browser. Save or instantly send your ready documents.

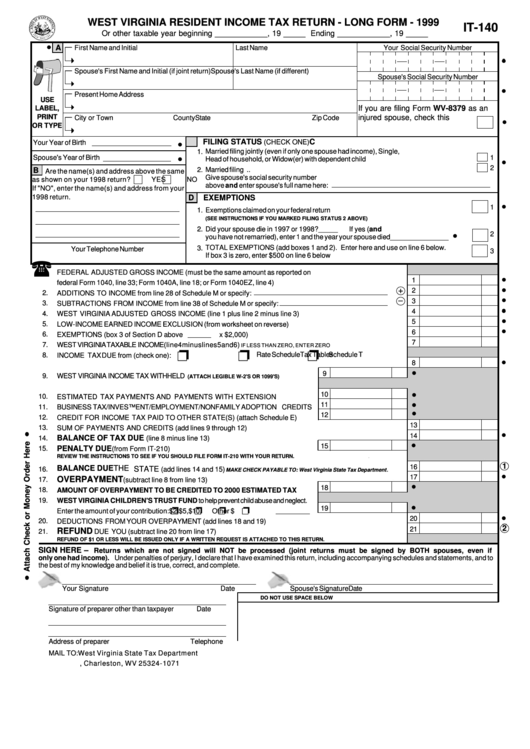

Form It140 West Virginia Resident Tax Return Long Form

Include your payment with this form. Arizona form 140 check box 82f if filing under extension 82f. If your taxable income is $50,000 or more, you. Web individual income tax forms. This form should be completed after.

Az 140 Instructions Form Fill Out and Sign Printable PDF Template

This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web the most common arizona income tax form is the arizona form 140. Web.

Download Instructions for Arizona Form 140A, ADOR10414 Resident

Web the most common arizona income tax form is the arizona form 140. Web file now with turbotax we last updated arizona form 140 in february 2023 from the arizona department of revenue. This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form. If your taxable income.

Printable Az 140 Tax Form Printable Form 2022

This form is for income earned in tax year 2022, with. Mail to arizona department of revenue, po box 29085, phoenix, az 85038. Form 140a arizona resident personal income tax booklet. Web resident personal income tax return arizona form 140 do not staple any items to the return. You may file form 140 only if you (and your spouse, if.

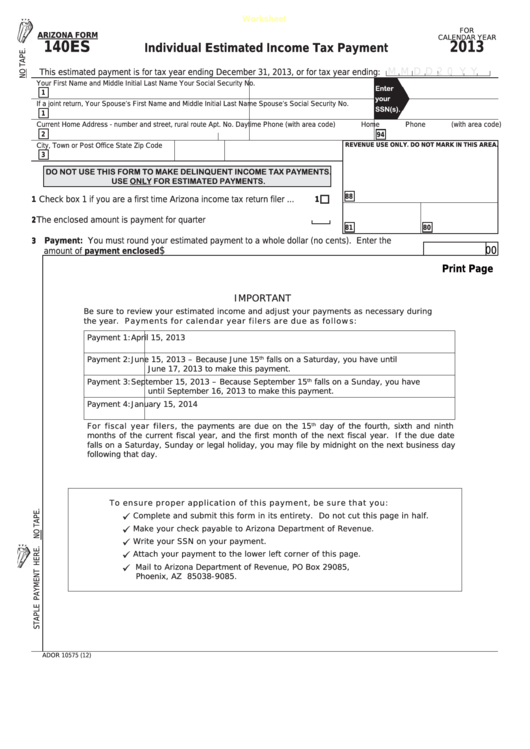

Fillable Arizona Form 140es Individual Estimated Tax Payment

Also, find mailing addresses for other returns, including corporation,. This form is used by residents who file an individual income tax return. Web the most common arizona income tax form is the arizona form 140. Web search by state and form number the mailing address to file paper individual tax returns and payments. This version is for taxpayers who need.

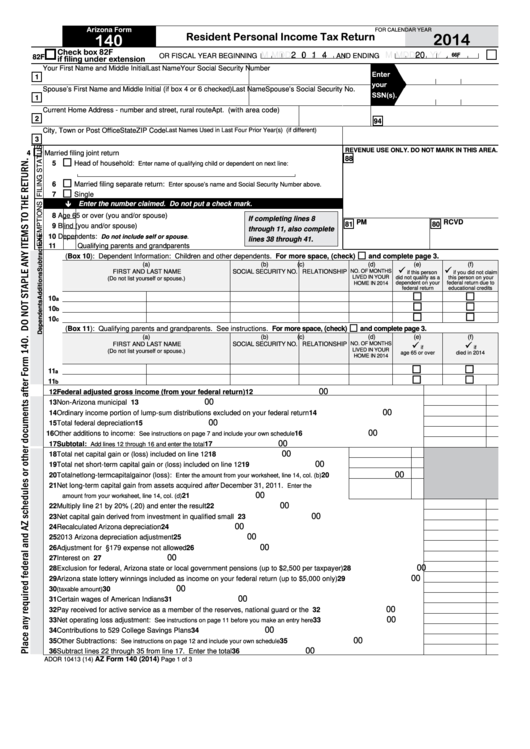

Fillable Arizona Form 140 Resident Personal Tax Return 2014

This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form. Save or instantly send your ready documents. Web 82f check box 82f if filing under extension arizona form 140resident personal income tax return for calendar year 2021 or fiscal year beginning m m d d 2 0..

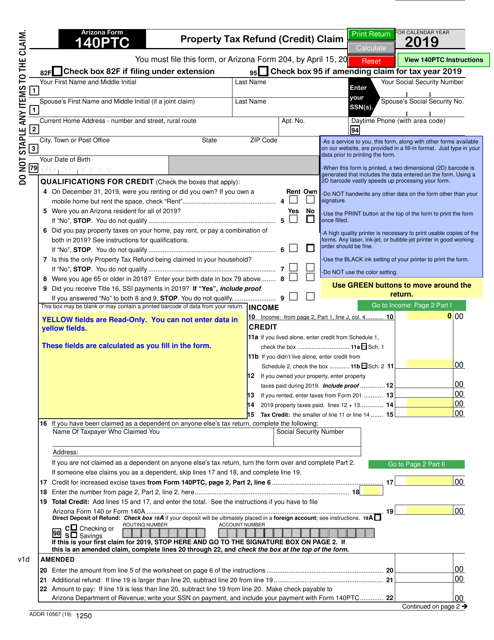

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Form 140a arizona resident personal income tax booklet. This form should be completed after. If your taxable income is $50,000 or more, you. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Web arizona form 2020 resident personal income tax return 140 for information or help, call one of the numbers listed:

Web Personal Income Tax Return Filed By Resident Taxpayers.

Web individual income tax forms. Web resident personal income tax return arizona form 140 do not staple any items to the return. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web resident personal income tax return.

If Your Taxable Income Is $50,000 Or More, You.

Form 140a arizona resident personal income tax booklet. Web report error it appears you don't have a pdf plugin for this browser. Mail to arizona department of revenue, po box 29085, phoenix, az 85038. This form is for income earned in tax year 2022, with.

Web Arizona Form 2020 Resident Personal Income Tax Return 140 For Information Or Help, Call One Of The Numbers Listed:

Include your payment with this form. Also, find mailing addresses for other returns, including corporation,. Web the most common arizona income tax form is the arizona form 140. Web you must use form 140 rather than form 140a or form 140ez to file for 2019 if any of the following apply to you.

Web File Now With Turbotax We Last Updated Arizona Form 140 In February 2023 From The Arizona Department Of Revenue.

Web 26 rows 140 : Easily fill out pdf blank, edit, and sign them. This form should be completed after. This form is used by residents who file an individual income tax return.