Ca Form 540Ez

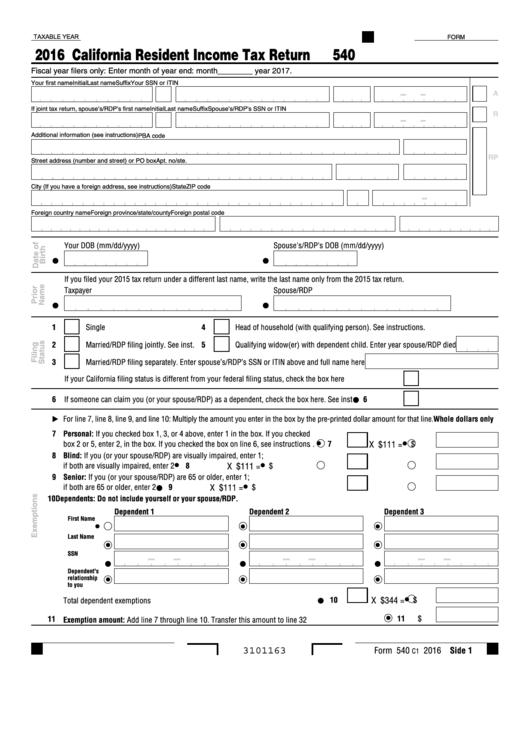

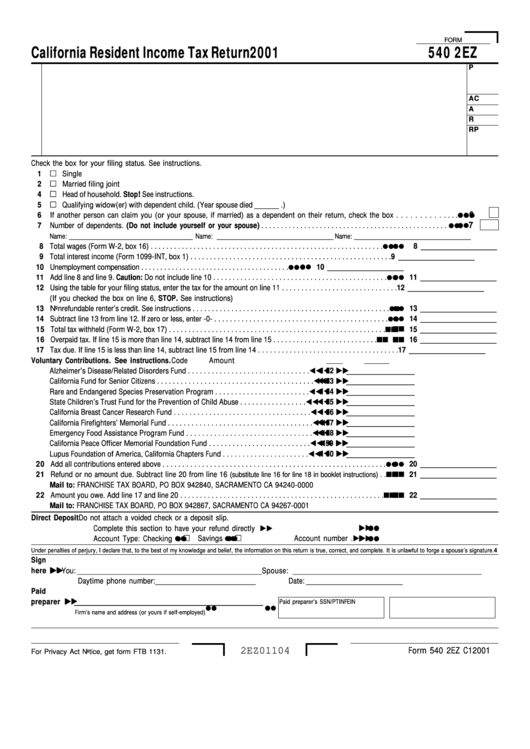

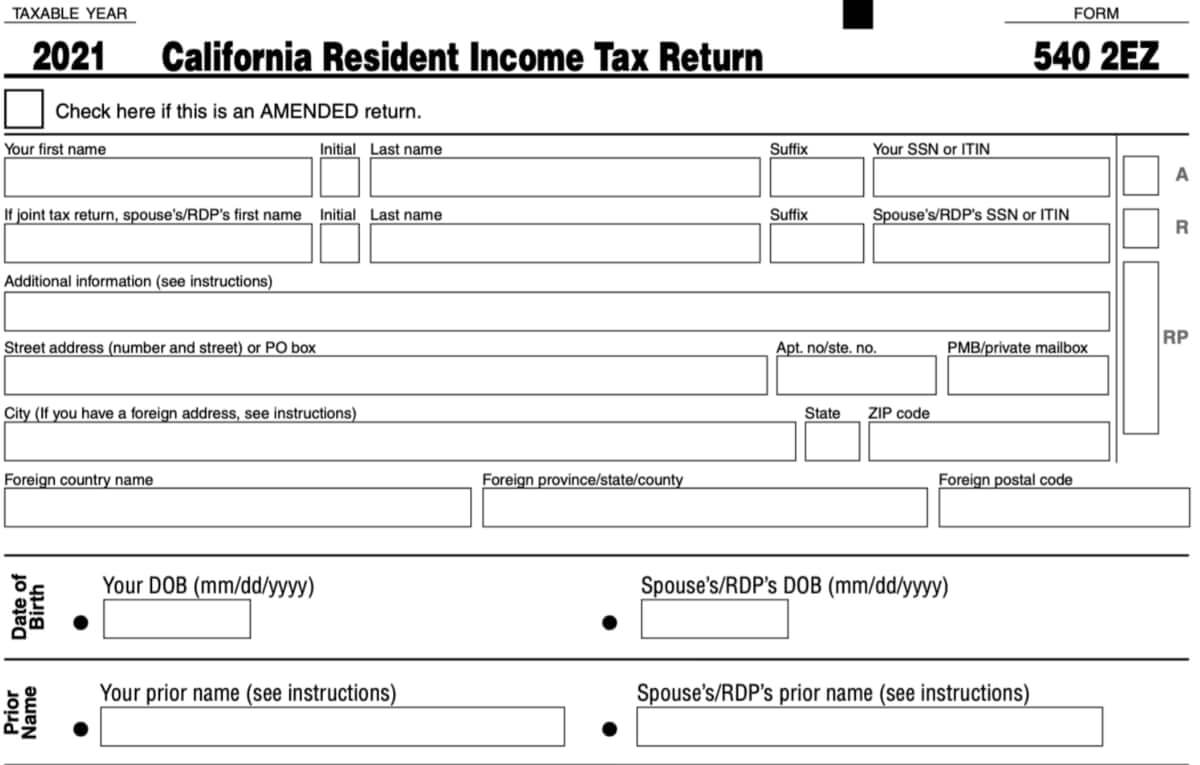

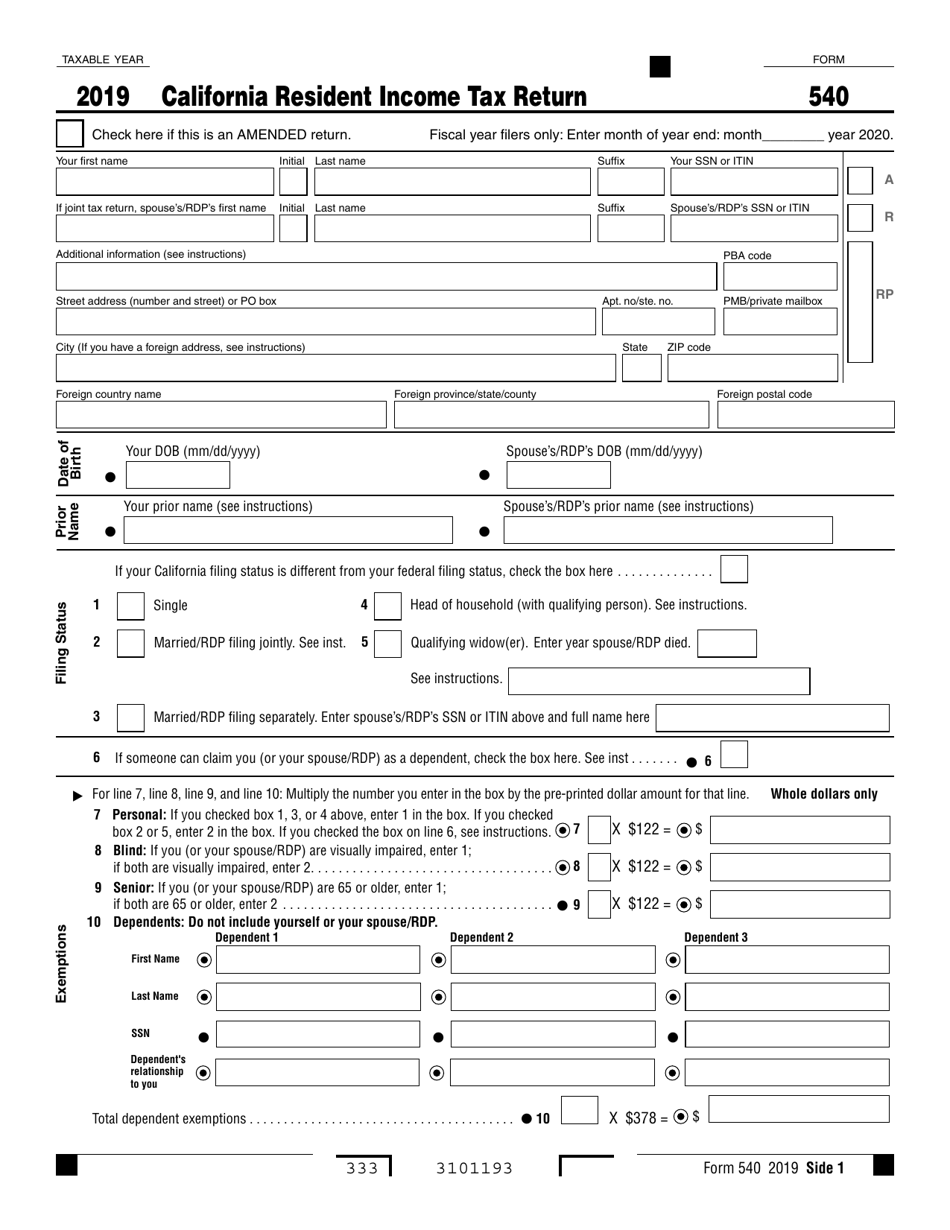

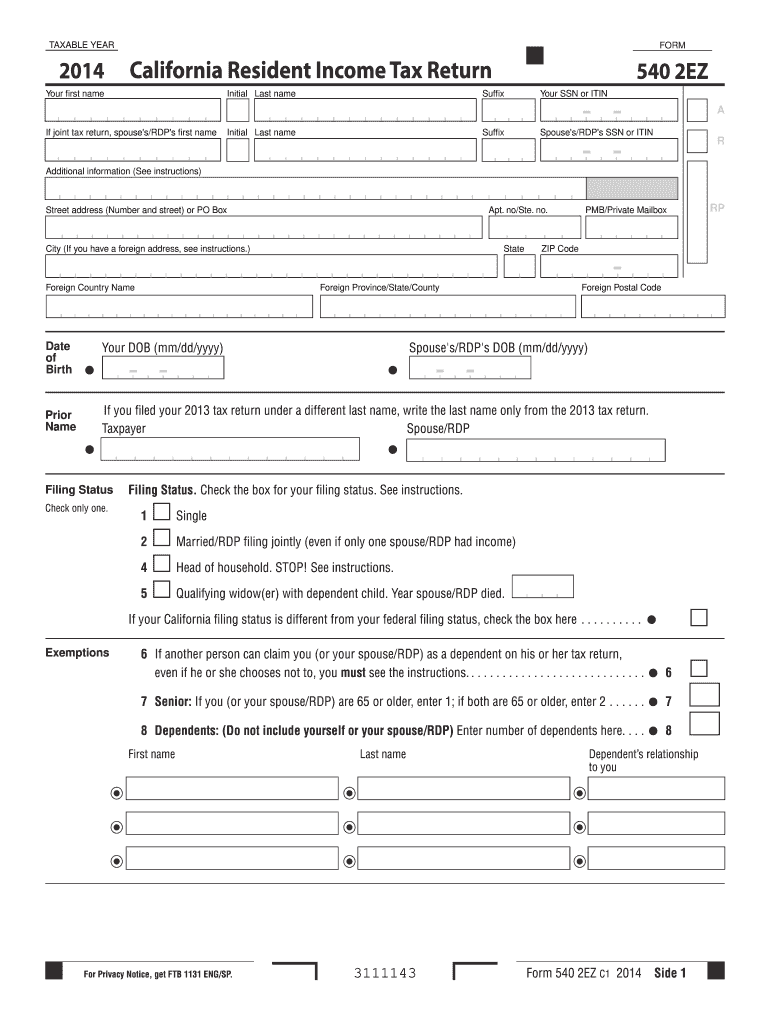

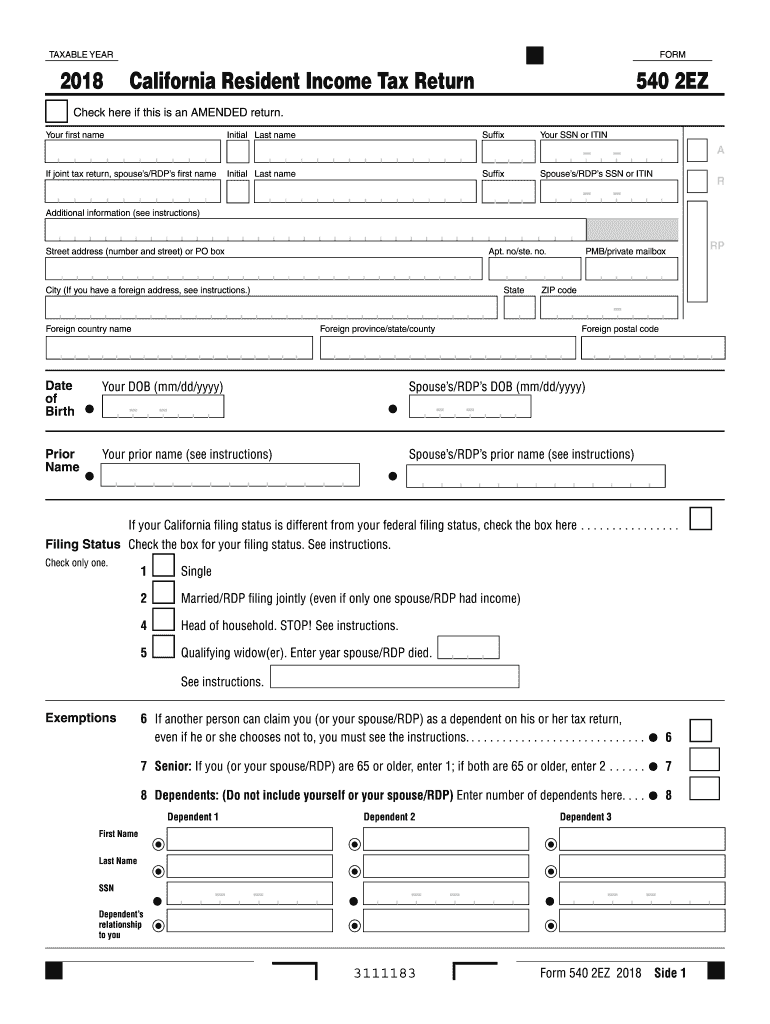

Ca Form 540Ez - This table gives you credit of $4,803 for your standard deduction, $129 for your. This table gives you credit of $4,601 for your standard deduction, $124 for your. We last updated the california resident income tax return in january 2023, so this is the latest. Please use the link below to. Do not use these tables for form 540 or form 540nr. Add line 29, line 31, line 33, and line 34. Web use form 540 2ez to amend your original california resident income tax return. Download this form print this form more about the. Web form 540 is used by california residents to file their state income tax every april. Web california resident income tax return form 540 2ez check here if this is an amended return.

Download this form print this form more about the. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Please use the link below to. This form is for income earned in tax year 2022, with tax returns due in april. Web handy tips for filling out form 540 2ez online. Go digital and save time with signnow, the best solution for. Web use form 540 2ez to amend your original california resident income tax return. Do not use these tables for form 540 or form 540nr. Web form 540 is used by california residents to file their state income tax every april. Do not use these tables for form 540 or form 540nr.

Printing and scanning is no longer the best way to manage documents. Download this form print this form more about the. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Web form 540 is used by california residents to file their state income tax every april. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Do not use these tables for form 540 or form 540nr. Web 2021 california 2ez table single caution: Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. This form should be completed after filing your federal taxes, such as form 1040, form 1040a, or. Web handy tips for filling out form 540 2ez online.

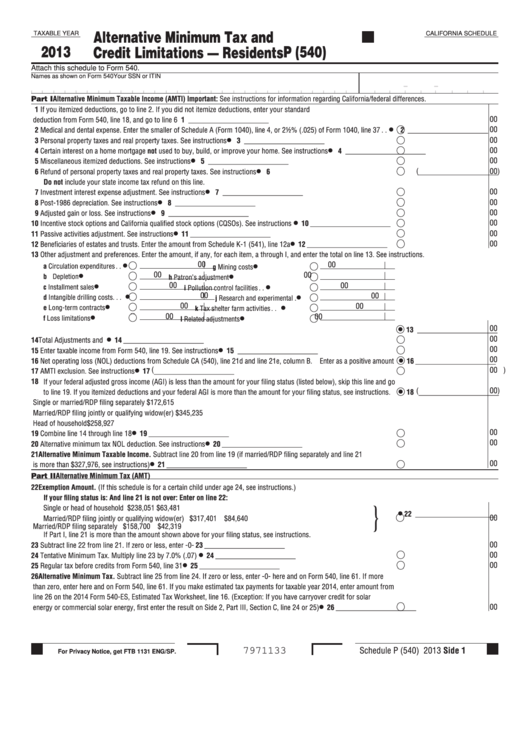

Form 540 California Adjustments Residence

Go digital and save time with signnow, the best solution for. Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. Web 2020 california 2ez table single caution: Web form 540 is used by california residents to file their state income tax every april. Do not use these tables for form 540 or form 540nr.

Ftb Form 540 Schedule 2022 State Schedule 2022

Web 2021 california 2ez table single caution: Printing and scanning is no longer the best way to manage documents. Web use form 540 2ez to amend your original california resident income tax return. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Download this form print this form more about the.

Form 540 2ez California Resident Tax Return 2001 printable

Web california resident income tax return form 540 2ez check here if this is an amended return. This table gives you credit of $4,803 for your standard deduction, $129 for your. Printing and scanning is no longer the best way to manage documents. Web use form 540 2ez to amend your original california resident income tax return. Web handy tips.

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

Check the box at the top of form 540 2ez indicating amended return. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web 2020 california 2ez table single caution: We last updated the california resident income tax return in january 2023, so this is.

Form 540 California Adjustments Residence

Web handy tips for filling out form 540 2ez online. This table gives you credit of $4,601 for your standard deduction, $124 for your. Your first name initial last name sufix your ssn or itin if joint tax return,. Web 540 2ez california resident income tax return. Go digital and save time with signnow, the best solution for.

20202022 Form CA FTB Schedule CA (540) Fill Online, Printable

Do not use these tables for form 540 or form 540nr. Check the box at the top of form 540 2ez indicating amended return. Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. This table gives you credit of $4,803 for your standard deduction, $129 for your. Web california resident income tax return form 540.

California 540ez Form Fill Out and Sign Printable PDF Template signNow

Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe. This table gives you credit of $4,601 for your standard deduction, $124 for your. We last updated the california resident income tax return in january 2023, so this is the latest. Web 2020 california 2ez table single caution: Do not use these tables for form 540.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

We last updated the california resident income tax return in january 2023, so this is the latest. Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Go digital and save time with signnow, the best solution for. Web form 540 is used by california residents to file their state income tax every april..

540Ez 2019 Fill Out and Sign Printable PDF Template signNow

Download this form print this form more about the. Web california resident income tax return form 540 2ez check here if this is an amended return. Web form 540 is used by california residents to file their state income tax every april. Printing and scanning is no longer the best way to manage documents. Add line 29, line 31, line.

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 540 2ez to amend your original california resident income tax return. Check the box at the top of form 540 2ez indicating amended return. Add line 29, line 31, line 33, and line 34. Download this form print this form more about the. Web form 540 2ez 2020 333 3114203 type type 35 36 amount you owe.

Please Use The Link Below To.

Web form 5402ez is a simplified tax form for individuals who do not have complex taxes. Printing and scanning is no longer the best way to manage documents. Web the schedule ca (540) form is a california resident income tax return form. Your first name initial last name sufix your ssn or itin if joint tax return,.

Add Line 29, Line 31, Line 33, And Line 34.

You use your federal information (forms 1040, 1040a or 1040ez) to fill out your 540 form in turbot ax. Download this form print this form more about the. We last updated the california resident income tax return in january 2023, so this is the latest. Check the box at the top of form 540 2ez indicating amended return.

This Table Gives You Credit Of $4,601 For Your Standard Deduction, $124 For Your.

Web california resident income tax return form 540 2ez check here if this is an amended return. This table gives you credit of $4,803 for your standard deduction, $129 for your. Web 540 2ez california resident income tax return. Web 2020 california 2ez table single caution:

Do Not Use These Tables For Form 540 Or Form 540Nr.

Web use form 540 2ez to amend your original california resident income tax return. Web 2021 california 2ez table single caution: This form should be completed after filing your federal taxes, such as form 1040, form 1040a, or. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: