California Form 3893

California Form 3893 - Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. The provisions of assembly bill 150 do not require the. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Any remitter (individual, business entity, trust, estate, or reep) who. We anticipate the revised form 3893 will be available march 7, 2022. This form is for income earned in tax year.

Web the california franchise tax board dec. We anticipate the revised form 3893 will be available march 7, 2022. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. The provisions of assembly bill 150 do not require the. Can i calculate late payment. Web find california form 593 instructions at esmart tax today. This form is for income earned in tax year. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Any remitter (individual, business entity, trust, estate, or reep) who.

The provisions of assembly bill 150 do not require the. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: We anticipate the revised form 3893 will be available march 7, 2022. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. This form is for income earned in tax year. Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web find california form 593 instructions at esmart tax today. Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. If an entity does not make that first.

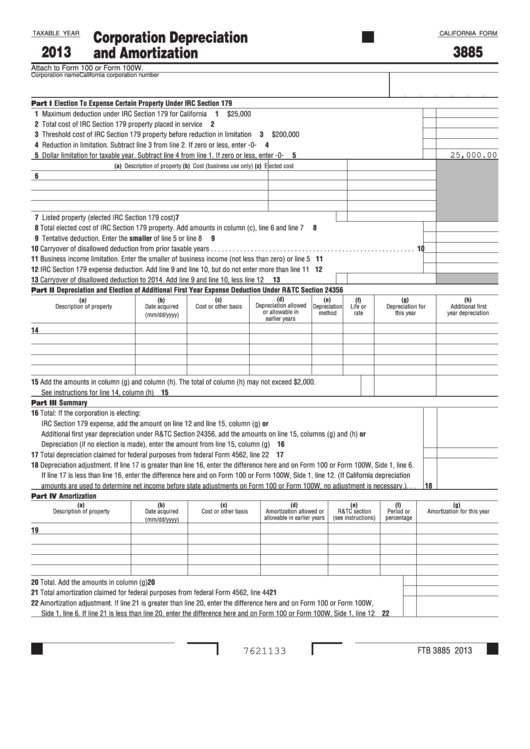

Fillable California Form 3885 Corporation Depreciation And

Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. This form is for income earned in tax year. The provisions of assembly bill 150 do not require the. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web partnerships and s corporations may use ftb 3893 to make a.

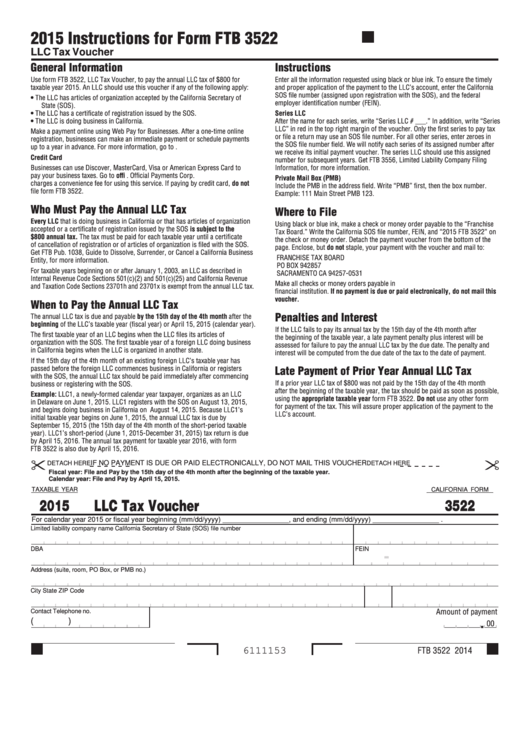

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web find california form 593 instructions at esmart tax today. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. If an entity does not make that first. Any remitter (individual, business entity, trust, estate, or reep) who. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin.

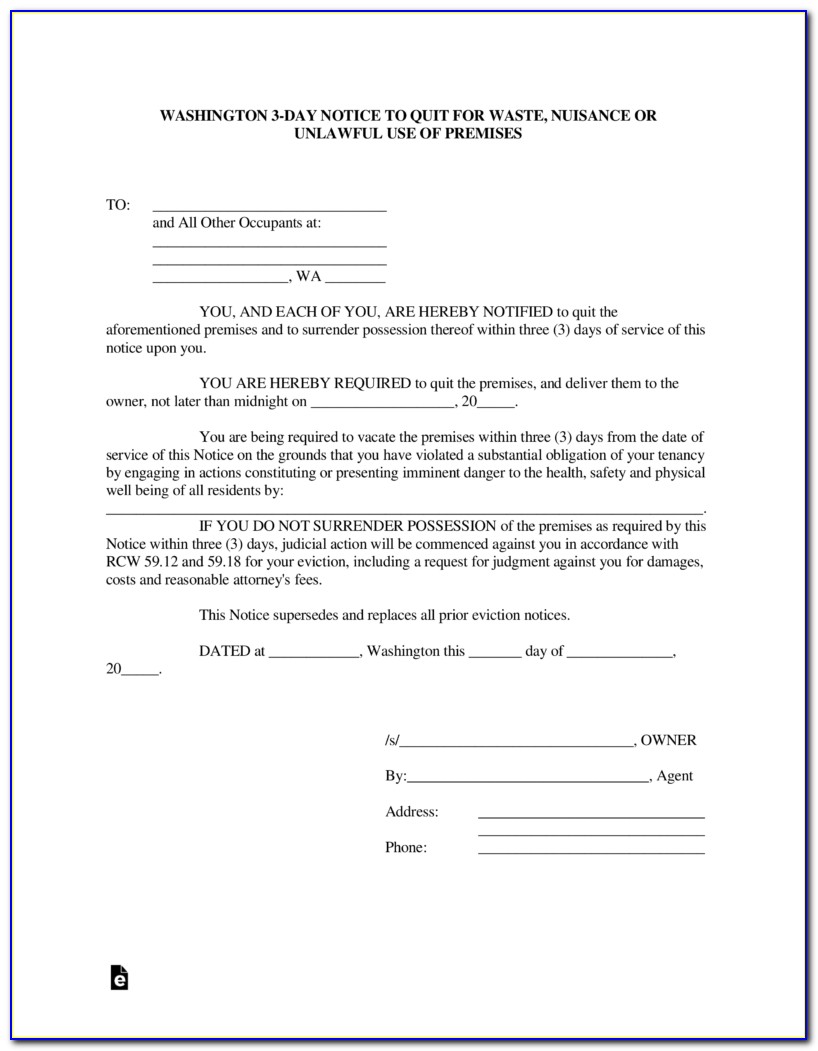

24 Hour Notice To Vacate Form California Form Resume Examples

Any remitter (individual, business entity, trust, estate, or reep) who. Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. If an entity does not make that first. We anticipate the revised form 3893 will be available march 7, 2022. Web march 31, 2023.

3893 California St UNIT 11 Rancho Photos

Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. This form is for income earned in tax year. Web find california form 593 instructions at esmart tax today. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Web use form ftb 3893 to pay an.

3893 California St Rancho Photos

We anticipate the revised form 3893 will be available march 7, 2022. Can i calculate late payment. Web march 31, 2023. If an entity does not make that first. This form is for income earned in tax year.

California Form 3893 Passthrough Entity Tax Problems Windes

Web march 31, 2023. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. If an entity does not make that first. Can i calculate late payment. Web find california form 593 instructions at esmart tax today.

Texas 3 Day Notice To Vacate Form Form Resume Examples jP8JGb61Vd

The provisions of assembly bill 150 do not require the. We anticipate the revised form 3893 will be available march 7, 2022. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893. Web california form 3893 (pte) for.

3893 California St UNIT 11 Rancho Photos

Web the california franchise tax board dec. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web find california form 593 instructions at esmart tax today. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593. Taxable year.

3893 California St UNIT 11 Rancho Photos

Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web form 3893 procedure tax software 2022.

3893 California St UNIT 11 Rancho Photos

Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web the california franchise tax board dec. Any remitter (individual, business entity, trust, estate, or reep) who. The provisions of.

This Form Is For Income Earned In Tax Year.

Web form 3893 procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. We anticipate the revised form 3893 will be available march 7, 2022. Web find california form 593 instructions at esmart tax today. A seller/transferor that qualifies for a full, partial, or no withholding exemption must file form 593.

Can I Calculate Late Payment.

Any remitter (individual, business entity, trust, estate, or reep) who. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Web march 31, 2023.

Web Answer Additional Information Cch Axcess™ Tax And Cch® Prosystem Fx® Tax:

Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. If an entity does not make that first. Web the california franchise tax board dec.

The Provisions Of Assembly Bill 150 Do Not Require The.

Web if the qualified entity makes a payment through electronic funds withdrawal, it will not file a form ftb 3893.