Farm Tax Exempt Form Nc

Farm Tax Exempt Form Nc - A farm sales tax exemption certificate issued by the department of revenue. The ein will now serve as your farm tax id number. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. The application form is available from the county tax administration office. Web for complete details, read this guide. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. Web when you register the farm with north carolina, use the correct ein on the forms. Sales tax on purchases of farm. A “qualifying farmer” is a farmer who has an annual gross income for the. Web application for qualifying farmer exemption certificate number.

Sales tax on purchases of farm. Get ready for tax season deadlines by completing any required tax forms today. A “qualifying farmer” is a farmer who has an annual gross income for the. Web when you register the farm with north carolina, use the correct ein on the forms. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. A copy of the property tax listing showing that the property is eligible for. Web a qualifying farmer includes a dairy operator, a poultry farmer, an egg producer, a livestock farmer, a farmer of crops, and a farmer of an aquatic species. Complete, edit or print tax forms instantly. The ein will now serve as your farm tax id number. Web for complete details, read this guide.

Web when you register the farm with north carolina, use the correct ein on the forms. Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web the registry of direct pay permits and exemption certificate numbers contains the names and numbers of taxpayers that have been issued either a direct pay permit or an. The application form is available from the county tax administration office. The ein will now serve as your farm tax id number. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable.

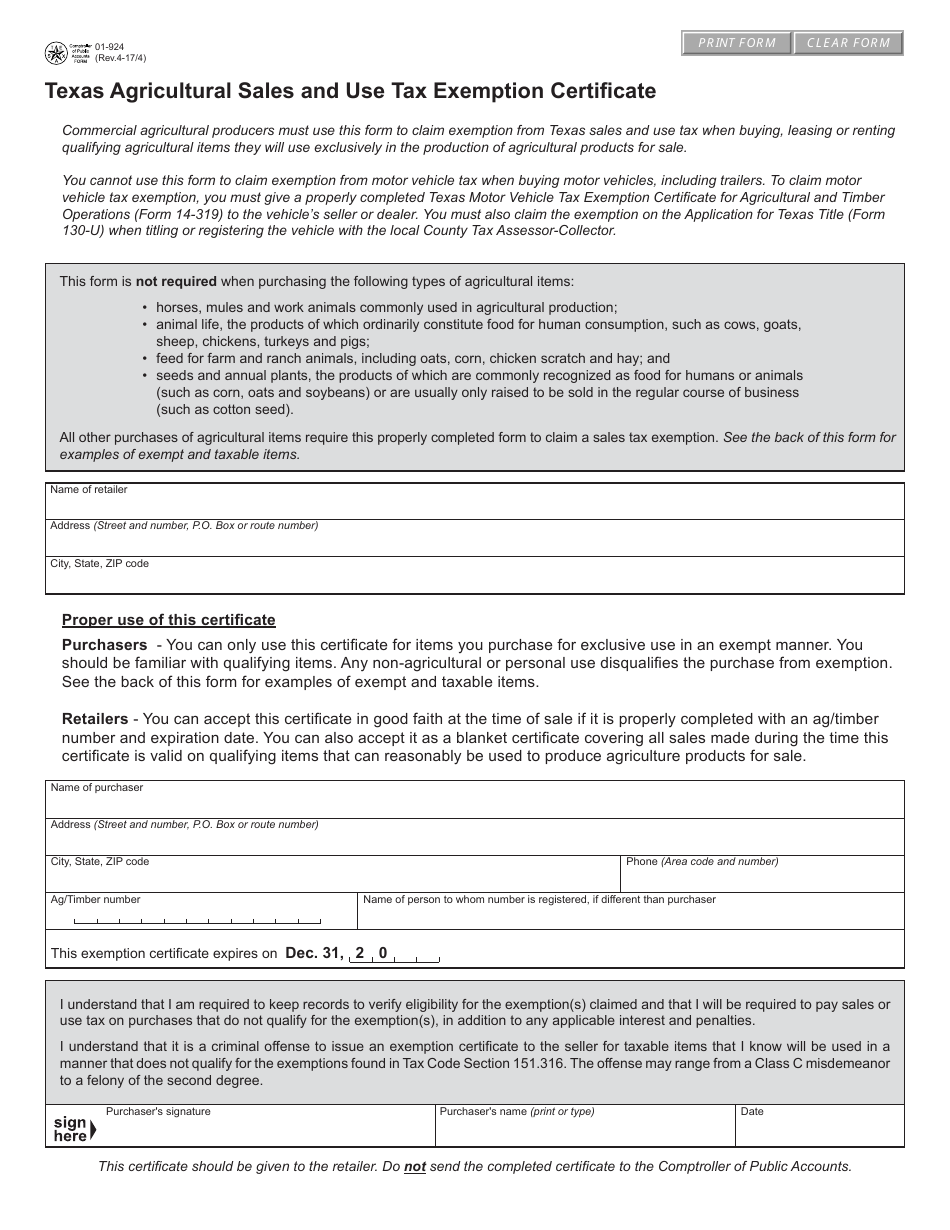

Form 01924 Download Fillable PDF or Fill Online Texas Agricultural

Web application for qualifying farmer exemption certificate number. The application form is available from the county tax administration office. Complete, edit or print tax forms instantly. The criteria are set by nc state law, but. Sales tax on purchases of farm.

Farm Tax Exempt form Ny Lovely Tax Exemption form ]

Web when you register the farm with north carolina, use the correct ein on the forms. The criteria are set by nc state law, but. Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. Web enter agricultural exemption certificate number issued to applicant prior to july 1, 2014, if applicable. A “qualifying.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Web annual gross income for the three preceding income tax years of ten thousand dollars ($10,000) or more from farming operations. A farm sales tax exemption certificate issued by the department of revenue. A “qualifying farmer” is a farmer who has an annual gross income for the. The application form is available from the county tax administration office. Web application.

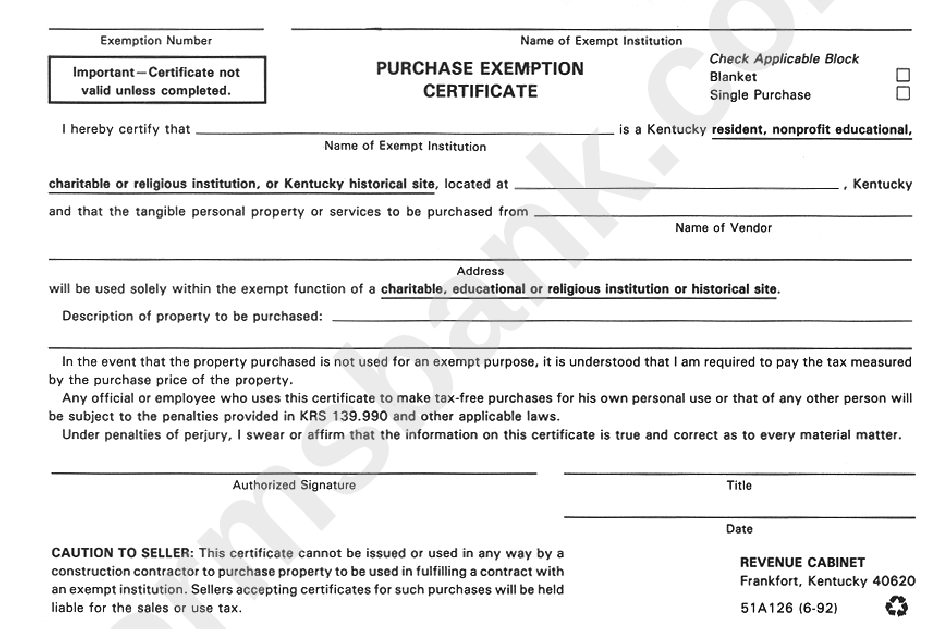

Form 51a126 Purchase Exemption Certificate printable pdf download

The application form is available from the county tax administration office. Complete, edit or print tax forms instantly. Web the registry of direct pay permits and exemption certificate numbers contains the names and numbers of taxpayers that have been issued either a direct pay permit or an. The criteria are set by nc state law, but. Web the term farmer.

20182022 Form NC E595CF Fill Online, Printable, Fillable, Blank

The criteria are set by nc state law, but. Web annual gross income for the three preceding income tax years of ten thousand dollars ($10,000) or more from farming operations. Web a qualifying farmer includes a dairy operator, a poultry farmer, an egg producer, a livestock farmer, a farmer of crops, and a farmer of an aquatic species. A copy.

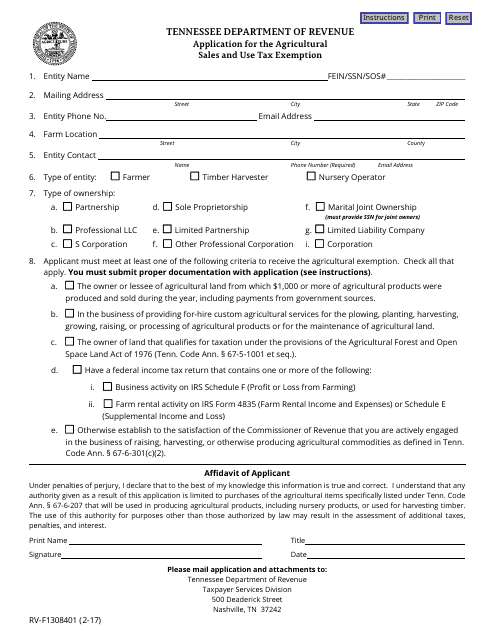

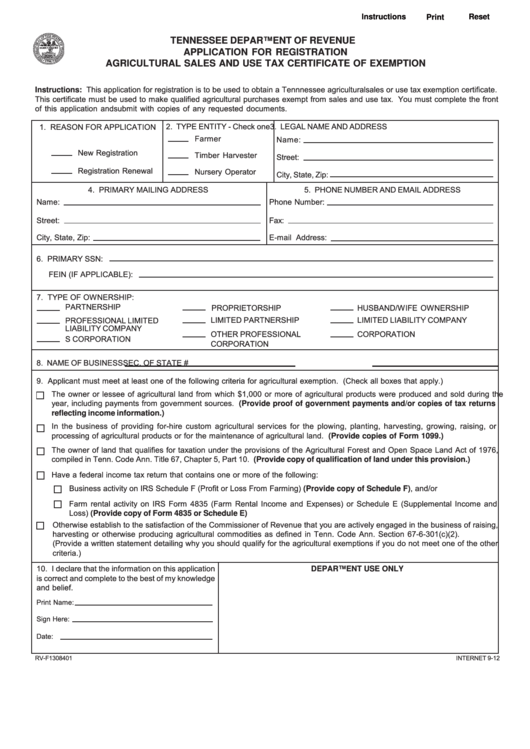

How To Get A Farm Tax Id Number In Tennessee Gallery Wallpaper

The application form is available from the county tax administration office. Web this document serves as notice that effective july 1, 2014, n.c. Web when you register the farm with north carolina, use the correct ein on the forms. Web application for qualifying farmer exemption certificate number. A copy of the property tax listing showing that the property is eligible.

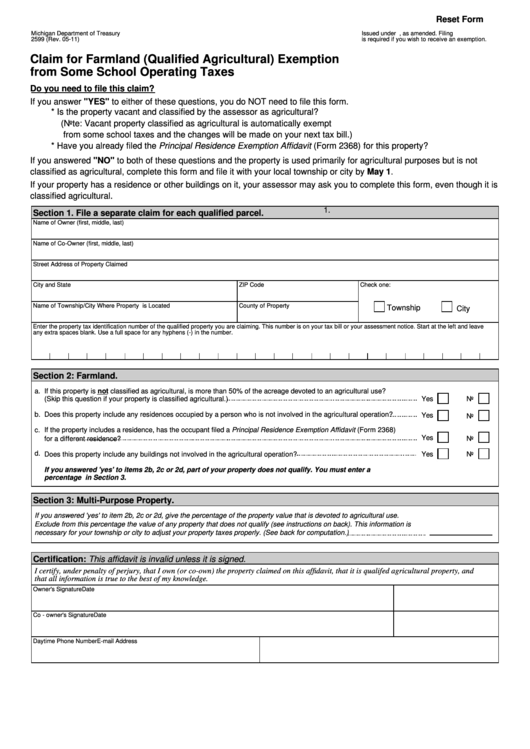

Fillable Form 2599 Claim For Farmland (Qualified Agricultural

Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or. A “qualifying farmer” is a farmer who has an annual gross income for the. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina.

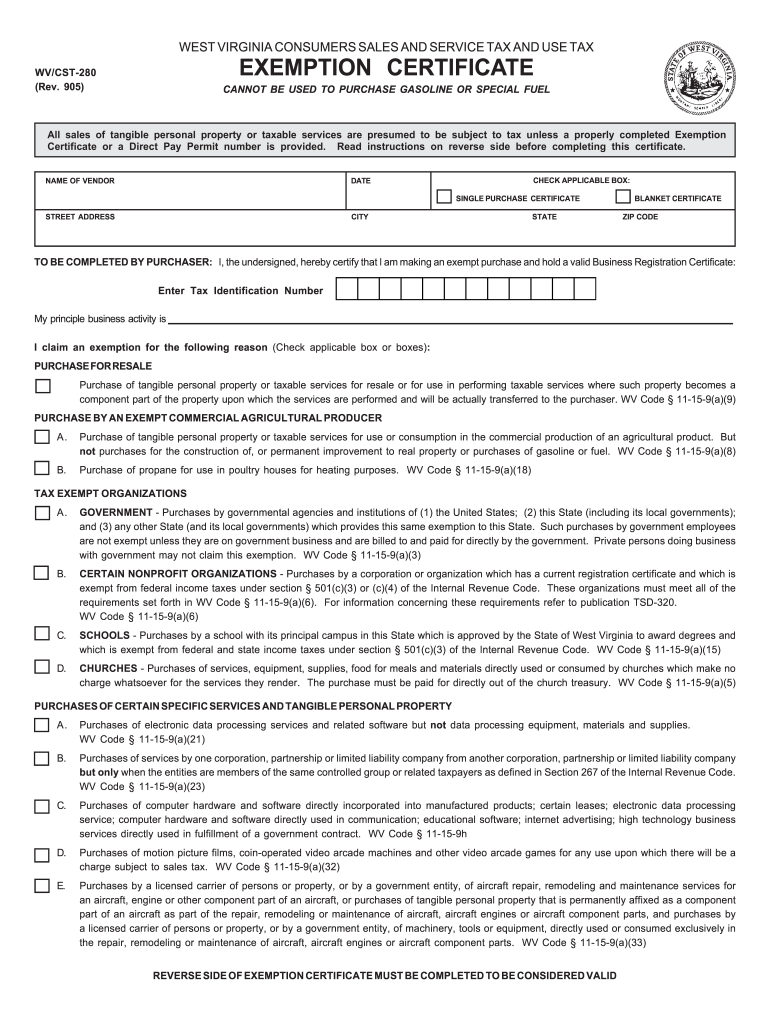

Wv Tax Exempt Form 20052022 Fill Out and Sign Printable PDF Template

Get ready for tax season deadlines by completing any required tax forms today. A farm sales tax exemption certificate issued by the department of revenue. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. A copy of the property tax.

How To Get A North Carolina Sales Tax Certificate of Exemption (Resale

Web the term farmer means any person engaged in the raising, growing and producing of farm products on a farm not less than 10 acres in area and located in north carolina and. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating,.

Fillable Agricultural Sales And Use Tax Certificate Of Exemption

The ein will now serve as your farm tax id number. Web the registry of direct pay permits and exemption certificate numbers contains the names and numbers of taxpayers that have been issued either a direct pay permit or an. Web for complete details, read this guide. Web annual gross income for the three preceding income tax years of ten.

Web Enter Agricultural Exemption Certificate Number Issued To Applicant Prior To July 1, 2014, If Applicable.

Web property taxes farms which meet certain acreage and income requirements qualify for reductions on property taxes. The criteria are set by nc state law, but. Sales tax on purchases of farm. Web for complete details, read this guide.

The Ein Will Now Serve As Your Farm Tax Id Number.

A farm sales tax exemption certificate issued by the department of revenue. A “qualifying farmer” includes a dairy. Web sep 5, 2022 4 min read north carolina farm property tax exemption if your north carolina property qualifies as a farm, you may be eligible for lower property. Web a qualifying farmer is allowed an exemption from paying sales and use tax on certain purchases of items used for farming purposes in the planting, cultivating, harvesting, or.

Web The Term Farmer Means Any Person Engaged In The Raising, Growing And Producing Of Farm Products On A Farm Not Less Than 10 Acres In Area And Located In North Carolina And.

Web annual gross income for the three preceding income tax years of ten thousand dollars ($10,000) or more from farming operations. Web when you register the farm with north carolina, use the correct ein on the forms. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web The Registry Of Direct Pay Permits And Exemption Certificate Numbers Contains The Names And Numbers Of Taxpayers That Have Been Issued Either A Direct Pay Permit Or An.

A copy of the property tax listing showing that the property is eligible for. A “qualifying farmer” is a farmer who has an annual gross income for the. Web application for qualifying farmer exemption certificate number. Web this document serves as notice that effective july 1, 2014, n.c.

![Farm Tax Exempt form Ny Lovely Tax Exemption form ]](https://www.flaminke.com/wp-content/uploads/2018/09/farm-tax-exempt-form-ny-lovely-tax-exemption-form-of-farm-tax-exempt-form-ny.jpg)