Florida Hotel Tax Exemption Form

Florida Hotel Tax Exemption Form - See below for more information. And provide a copy of any changes submitted t. This exemption does not apply to other taxable sales or rentals at the camp or park. Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Legal name, mailing address, location address, and fein; Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Proper identification is required before this certificate may be accepted by the seller. The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Some states require government travelers to submit a form for this exemption. Web the state does allow hotels to require a certificate of exemption.

Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Web this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment state of florida. The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Proper identification is required before this certificate may be accepted by the seller. See below for more information. Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Ad valorem tax exemption application and return for multifamily project and affordable housing property: And provide a copy of any changes submitted t.

Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. Web attach a list of the following information for each subsidiary applying for exemption: And provide a copy of any changes submitted t. Some states require government travelers to submit a form for this exemption. Web the state does allow hotels to require a certificate of exemption.

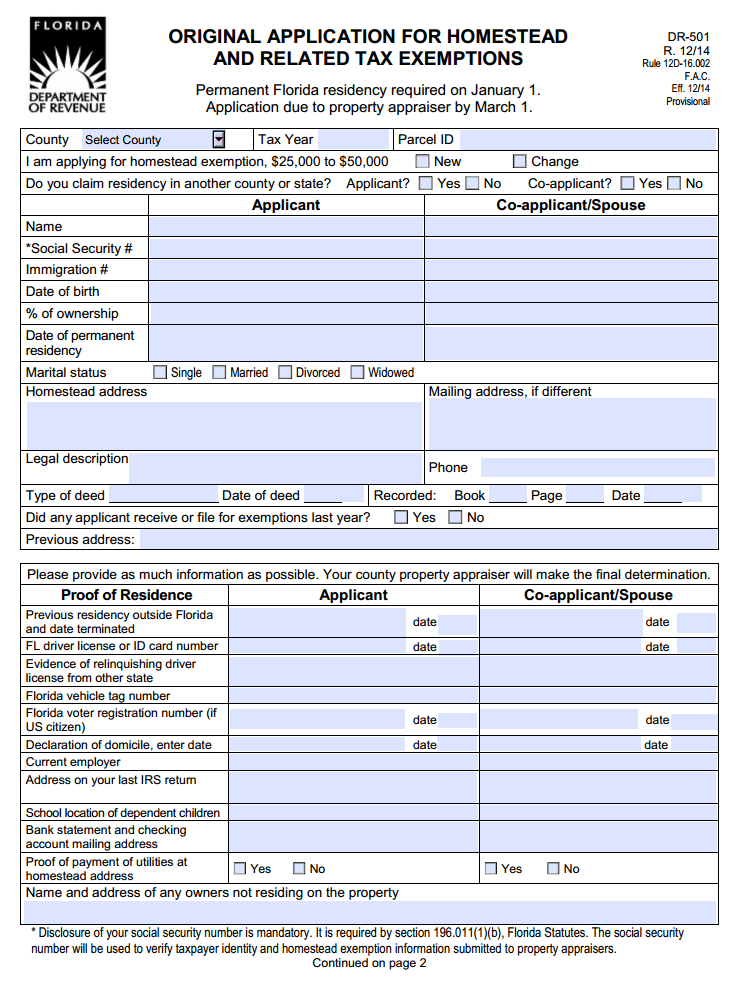

Top 77 Florida Tax Exempt Form Templates free to download in PDF format

Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. See below for more information. Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); Legal name, mailing address,.

Florida State Tax Exemption Form Hotel

Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from.

Federal Government Hotel Tax Exempt Form Virginia

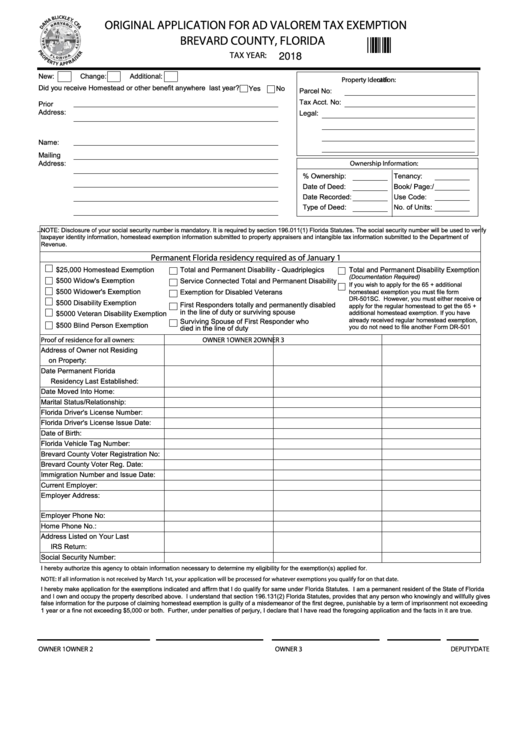

The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; This exemption does not apply to other taxable sales or rentals at the camp or park. Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: And provide.

FL DR14 2015 Fill out Tax Template Online US Legal Forms

Web attach a list of the following information for each subsidiary applying for exemption: Web the state does allow hotels to require a certificate of exemption. And provide a copy of any changes submitted t. Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); See below.

Bupa Tax Exemption Form / Printable Wyoming Sales Tax Exemption

Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Web tax exemptions when you use your.

What Is A Sales Tax Exemption Certificate In Florida Printable Form

Web the state does allow hotels to require a certificate of exemption. Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term.

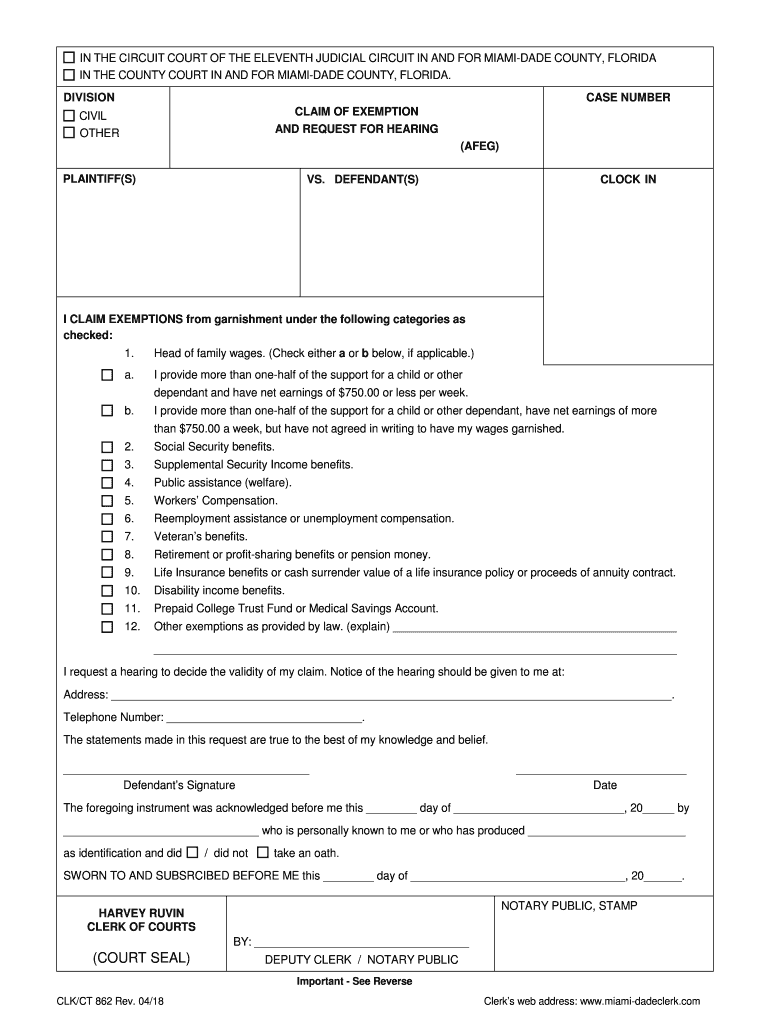

Florida Claim Exemption Form Fill Out And Sign Printable PDF Template

Proper identification is required before this certificate may be accepted by the seller. Ad valorem tax exemption application and return for multifamily project and affordable housing property: Some states require government travelers to submit a form for this exemption. And provide a copy of any changes submitted t. Web ad valorem tax exemption application return for charitable, religious, scientific, literary.

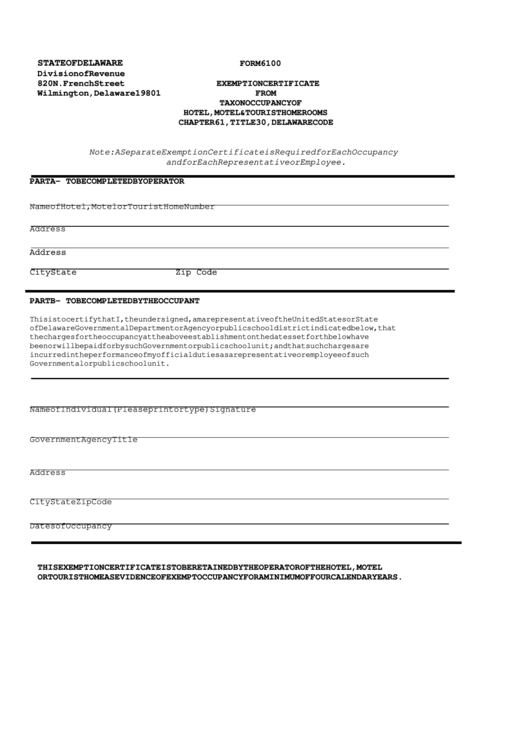

Fillable Form 6100 Form 6100 Exemption Certificate From Tax On

Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. See below for more information. Web the state does allow hotels to require a certificate of exemption. Web ad valorem tax exemption application return for charitable, religious, scientific,.

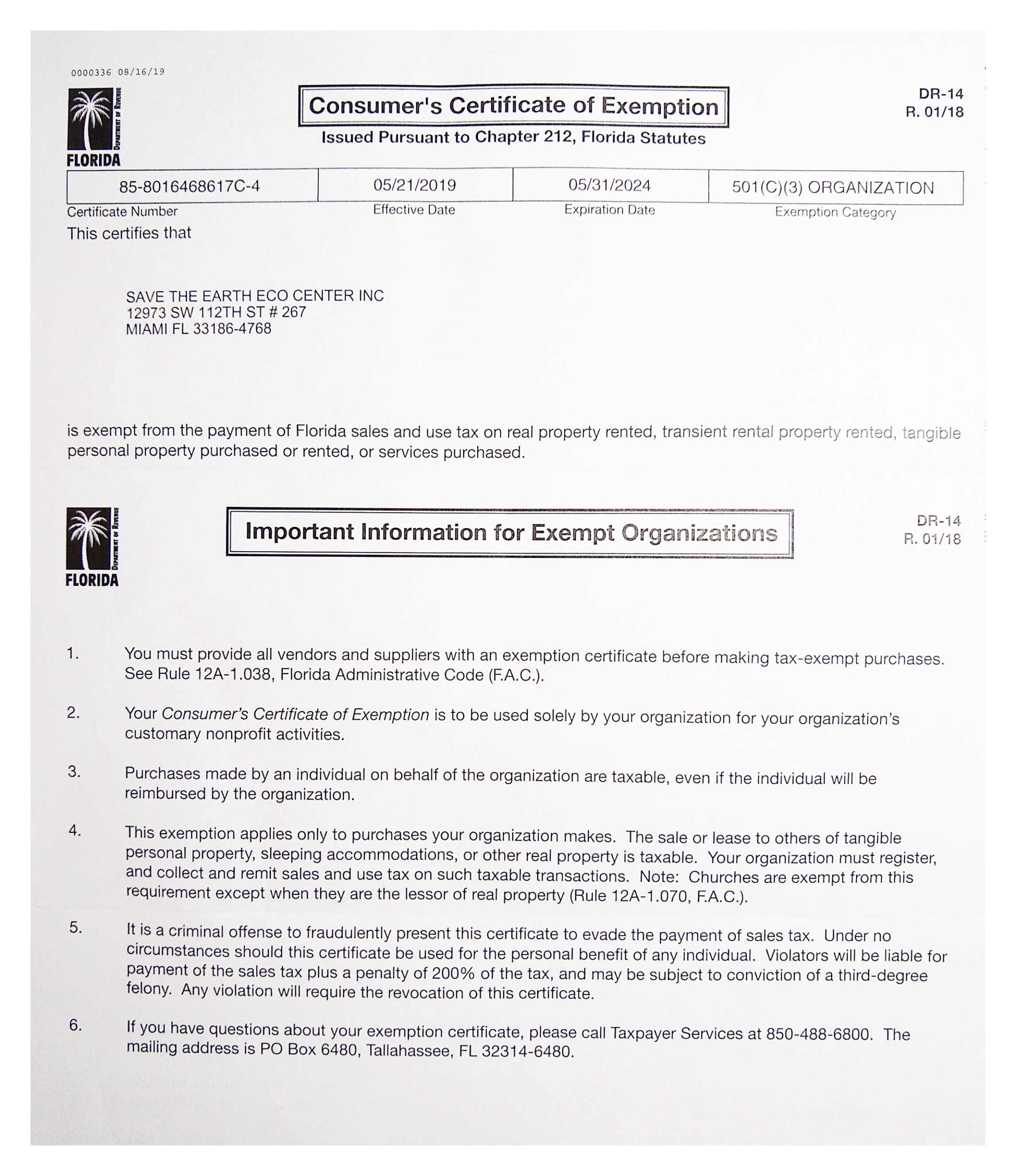

2019 Fla Sales Tax Exemption Certificate to 2024 STEEI EARTHSAVE FLORIDA

Proper identification is required before this certificate may be accepted by the seller. And provide a copy of any changes submitted t. The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Web this certificate may not be used to make exempt purchases or leases of tangible personal property.

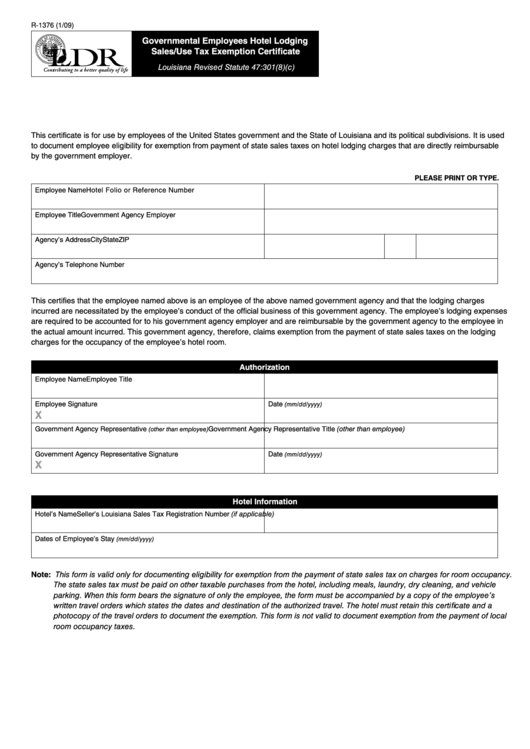

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Some.

Web This Form Should Only Be Used For State & Local Government And Exempt Nongovernment Organizations Exempt Organization’s Attestation Of Diret Illing And Payment State Of Florida.

This exemption does not apply to other taxable sales or rentals at the camp or park. Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Proper identification is required before this certificate may be accepted by the seller.

Some States Require Government Travelers To Submit A Form For This Exemption.

Web the state does allow hotels to require a certificate of exemption. Web attach a list of the following information for each subsidiary applying for exemption: See below for more information. Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency.

Provide A Copy Of The Determination Letter For 501(C)(3) Federal Tax Status Issued By The Irs (Including The List Of Qualified Subsidiary Organizations);

And provide a copy of any changes submitted t. Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax.

The United States Government Or Any (Of Its Federal Agencies) Is Not Required To Obtain A Florida Consumer’s Certificate Of Exemption;

Legal name, mailing address, location address, and fein;