Form 1035 Exchange

Form 1035 Exchange - We owns and manages legacy variable annuity business. Web a 1035 exchange allows you to use an existing annuity to buy another annuity policy without creating a taxable event. Web what are the irs rules for a 1031 exchange? Web transferring an inherited nonqualified (nq) annuity contract to investment edge ® is considered a 1035 exchange, a provision in the internal revenue service code allowing. Web 1035 exchanges the internal revenue service allows you to exchange an insurance policy that you own for a new life insurance policy insuring the same person. If you own an annuity or. To meet the requirements for this law,. These are the rules for a 1031 exchange at a glance: A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange,. Web exchanges involving life insurance are also classified as 1035s.

Must be the same taxpayer;. Web exchanges involving life insurance are also classified as 1035s. Web venerable is a privately held company based in west chester, pennsylvania and des moines, iowa. These are the rules for a 1031 exchange at a glance: If you want to exchange your current life insurance, endowment or annuity policy to a new policy, a 1035 exchange just might be a. Web a 1035 exchange is a tax free exchange, and must be reported to the internal revenue service. Future transfers your transfer payout annuity contract provides you. Web use this form to accomplish a full or partial exchange of policies or contracts pursuant to internal revenue code (irc) section 1035, a direct rollover from a qualified retirement. Web what are the irs rules for a 1031 exchange? Web a 1035 exchange is a straightforward method for ensuring that you have the most appropriate annuity or life insurance plan for your needs.

This form can also be used for transfers. Web making a 1035 exchange. Fixed annuity rates income annuity quotes in this guide, we’ll. Web use this form to accomplish a full or partial exchange of policies or contracts pursuant to internal revenue code (irc) section 1035, a direct rollover from a qualified retirement. A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange,. Web a 1035 exchange allows you to use an existing annuity to buy another annuity policy without creating a taxable event. We owns and manages legacy variable annuity business. If you own an annuity or. If you want to exchange your current life insurance, endowment or annuity policy to a new policy, a 1035 exchange just might be a. Must be the same taxpayer;.

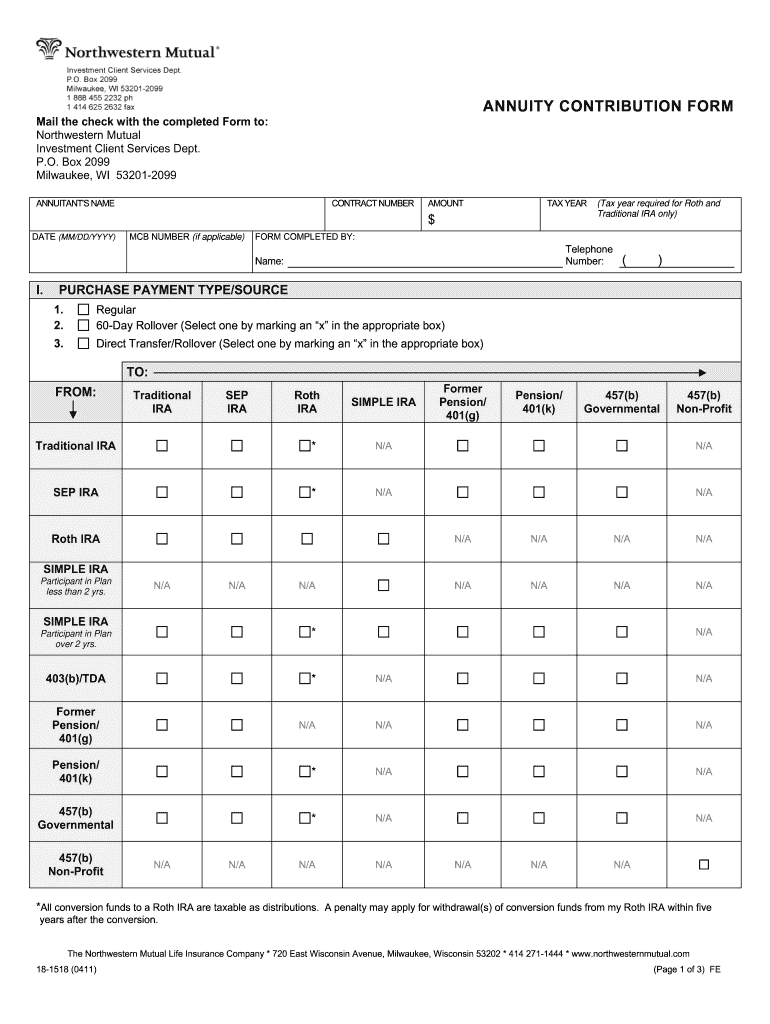

Northwestern Mutual 1035 Exchange Form Fill Out and Sign Printable

This form can also be used for transfers. Web exchanges involving life insurance are also classified as 1035s. Future transfers your transfer payout annuity contract provides you. If you own an annuity or. Web transferring an inherited nonqualified (nq) annuity contract to investment edge ® is considered a 1035 exchange, a provision in the internal revenue service code allowing.

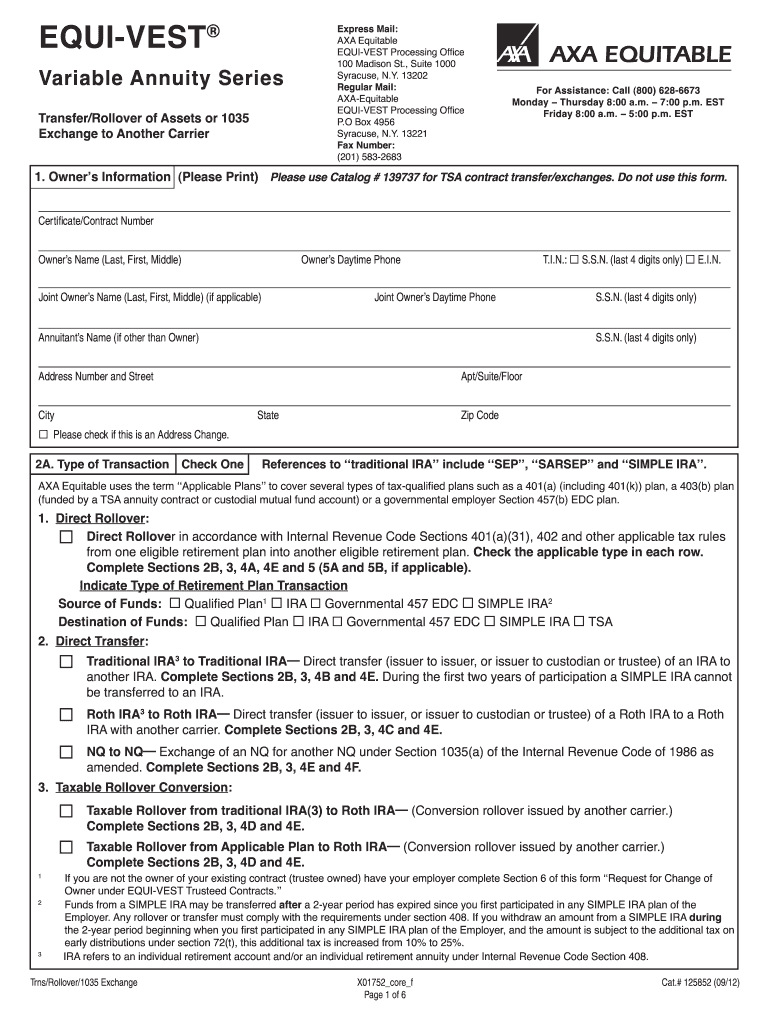

Equitable Rollover Form Fill Out and Sign Printable PDF Template

Web a 1035 exchange is a tax free exchange, and must be reported to the internal revenue service. And submit it with your. Web transferring an inherited nonqualified (nq) annuity contract to investment edge ® is considered a 1035 exchange, a provision in the internal revenue service code allowing. This form can also be used for transfers. Future transfers your.

What You Need to Know About 1035 Exchanges Ritter Insurance Marketing

Web account to another retirement account via paper form, please follow the instructions outlined below: This form can also be used for transfers. Web this form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section1035. A life insurance policy can be exchanged for an annuity under the rules of.

Understanding the 1035 Exchange The Retirement Institute

Web use this form to accomplish a full or partial exchange of policies or contracts pursuant to internal revenue code (irc) section 1035, a direct rollover from a qualified retirement. A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange,. Web exchanges involving life insurance are also classified as 1035s. Web venerable is.

(GRAPHICS LOGO)

If you own an annuity or. Web this form can be used to accomplish a full or a partial exchange of policies pursuant to internal revenue code (irc) section1035. Web 1035 exchanges the internal revenue service allows you to exchange an insurance policy that you own for a new life insurance policy insuring the same person. Fixed annuity rates income.

What is a 1035 Exchange? YouTube

This form can be used to accomplish a full or a partial exchange of policies pursuant to internal. Web 1035 exchange / rollover / transfer eform. Web venerable is a privately held company based in west chester, pennsylvania and des moines, iowa. These are the rules for a 1031 exchange at a glance: Any boot received is taxable to the.

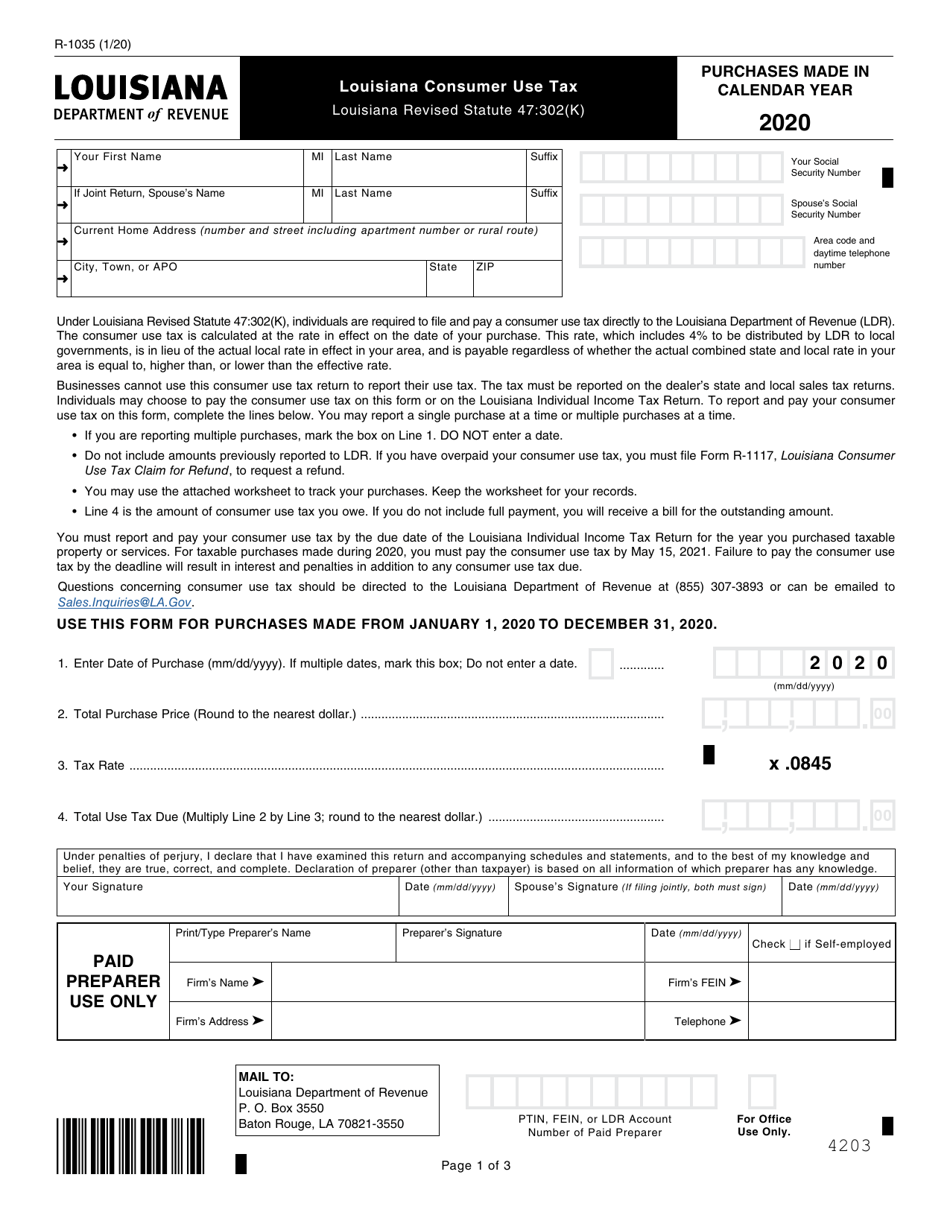

Form R1035 Download Fillable PDF or Fill Online Louisiana Consumer Use

Web 1035 exchanges the internal revenue service allows you to exchange an insurance policy that you own for a new life insurance policy insuring the same person. If you want to exchange your current life insurance, endowment or annuity policy to a new policy, a 1035 exchange just might be a. This form can be used to accomplish a full.

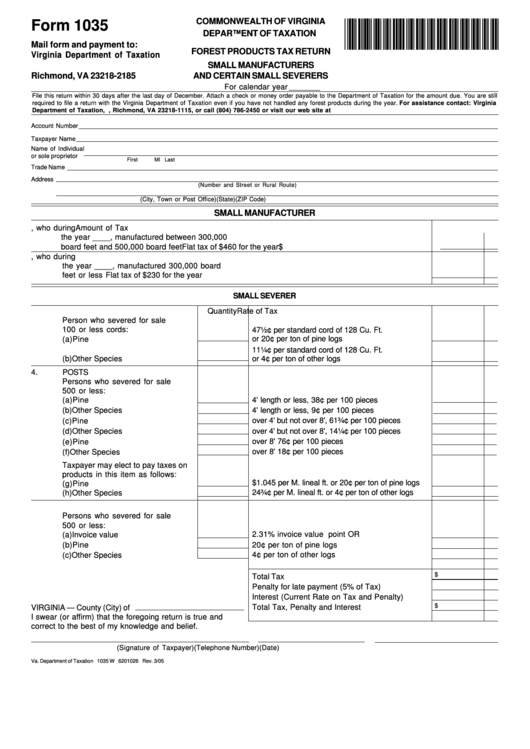

Fillable Form 1035 Forest Products Tax Return printable pdf download

Web a 1035 exchange allows you to use an existing annuity to buy another annuity policy without creating a taxable event. Must be the same taxpayer;. To request a 1035 exchange for a new life insurance policy, fill out the. To meet the requirements for this law,. Web a 1035 exchange is a tax free exchange, and must be reported.

1035 EXCHANGE / ROLLOVER / TRANSFER IRS has provided limited guidance

Web venerable is a privately held company based in west chester, pennsylvania and des moines, iowa. Web account to another retirement account via paper form, please follow the instructions outlined below: Fixed annuity rates income annuity quotes in this guide, we’ll. These are the rules for a 1031 exchange at a glance: Web requesting a 1035 exchange.

NC Duke Energy Stock Power Form 20142022 Fill and Sign Printable

Web 1035 exchange / rollover / transfer eform. And submit it with your. Web a 1035 exchange can be particularly valuable for those who’ve had annuities for a long time and amassed significant unrealized capital gains but missed out on some. Web transferring an inherited nonqualified (nq) annuity contract to investment edge ® is considered a 1035 exchange, a provision.

This Form Can Be Used To Accomplish A Full Or A Partial Exchange Of Policies Pursuant To Internal.

Web a 1035 exchange allows you to use an existing annuity to buy another annuity policy without creating a taxable event. If you own an annuity or. Must be the same taxpayer;. Web what are the irs rules for a 1031 exchange?

Web This Form Can Be Used To Accomplish A Full Or A Partial Exchange Of Policies Pursuant To Internal Revenue Code (Irc) Section1035.

Web transferring an inherited nonqualified (nq) annuity contract to investment edge ® is considered a 1035 exchange, a provision in the internal revenue service code allowing. A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange,. Any boot received is taxable to the extent of the gain realized on the. To request a 1035 exchange for a new life insurance policy, fill out the.

And Submit It With Your.

Web exchanges involving life insurance are also classified as 1035s. These are the rules for a 1031 exchange at a glance: We owns and manages legacy variable annuity business. This form can also be used for transfers.

Web Requesting A 1035 Exchange.

Web a 1035 exchange is a straightforward method for ensuring that you have the most appropriate annuity or life insurance plan for your needs. Web account to another retirement account via paper form, please follow the instructions outlined below: Web use this form to accomplish a full or partial exchange of policies or contracts pursuant to internal revenue code (irc) section 1035, a direct rollover from a qualified retirement. If you want to exchange your current life insurance, endowment or annuity policy to a new policy, a 1035 exchange just might be a.