Form 1065 Us Return Of Partnership Income

Form 1065 Us Return Of Partnership Income - Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web form 1065 2019 u.s. Web irs form 1065 is the u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the. It simply reports this information to the irs. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc.,. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. First, the partnership reports total net income and all other relevant financial information for the. Web form 1065 2019 u.s.

Or getting income from u.s. Tax liability is passed through to the members who then pay taxes on the income on their personal returns. Beginning in tax year 2022, partnerships with individual retirement account (ira) partners receiving allocations of unrelated trade or business taxable. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc.,. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the. Washington — the irs released today an early draft of the instructions to form 1065, u.s. Web in addition to filing annual partnership tax returns (form 1065, u.s. This code will let you know if you should. Download, print or email irs 1065 tax form on pdffiller for free.

Beginning in tax year 2022, partnerships with individual retirement account (ira) partners receiving allocations of unrelated trade or business taxable. Washington — the irs released today an early draft of the instructions to form 1065, u.s. First, the partnership reports total net income and all other relevant financial information for the. Which generally provides that every domestic partnership must file a return of partnership income. Web solved•by turbotax•1930•updated january 13, 2023. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web form 1065 is the u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. It simply reports this information to the irs. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership.

Form 1065 U.S. Return of Partnership Explained Part 3 Business

Web there are two major steps involved in reporting taxes this way. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Or getting income from u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the.

Form 1065BU.S. Return of for Electing Large Partnerships

Web in addition to filing annual partnership tax returns (form 1065, u.s. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income is an informational tax form used to report the income, gains, losses, deductions, and credits of a partnership or llc. Web there.

Form 1065 U.S. Return of Partnership Definition

Tax liability is passed through to the members who then pay taxes on the income on their personal returns. Web there are two major steps involved in reporting taxes this way. Download, print or email irs 1065 tax form on pdffiller for free. Web form 1065 is the u.s. Web form 1065 is used to report the income of every.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

It’s a tax form filed by partnerships—including llcs taxed as partnerships—with the irs. Download, print or email irs 1065 tax form on pdffiller for free. Web in addition to filing annual partnership tax returns (form 1065, u.s. Complete, edit or print tax forms instantly. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc.,.

Form 9 Charitable Contributions Why You Must Experience Form 9

Web an official website of the united states government. Web in addition to filing annual partnership tax returns (form 1065, u.s. Return of partnership income), partnerships could be responsible for other tax issues, such as firpta. Web solved•by turbotax•1930•updated january 13, 2023. No tax is calculated from or paid on form 1065.

Inst 1065Instructions for Form 1065, U.S. Return of Partnership Inco…

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Web included in.

Form 1065 U.S. Return of Partnership (2014) Free Download

Web form 1065 2019 u.s. Ad taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web in addition to filing annual partnership tax returns (form 1065, u.s. Web form 1065.

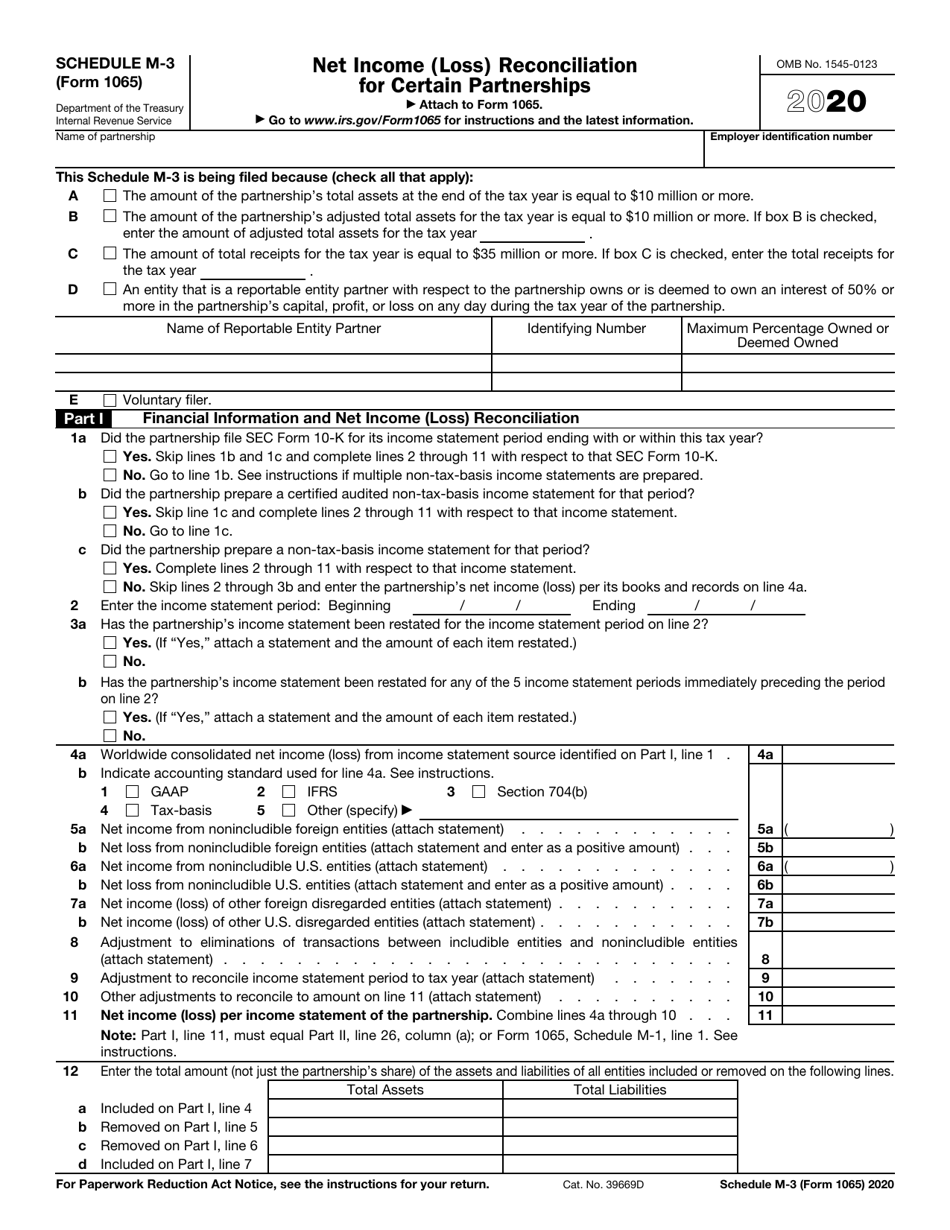

IRS Form 1065 Schedule M3 Download Fillable PDF or Fill Online Net

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web in addition to filing annual partnership tax returns (form 1065, u.s. Web form 1065 is the u.s. Web an official website of the united states government. Web form 1065 2022 u.s.

Learn How to Fill the Form 1065 Return of Partnership YouTube

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Ad taxact® business 1065 (2022 online edition) is the easiest way to file a 1065! First, the partnership reports total net income and all other relevant financial information for the. This code will let you know if you should. Web.

Form 1065 U.S. Return of Partnership (2014) Free Download

Web irs form 1065 is the u.s. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web it has gross income effectively connected with the conduct of a trade or business within the united states, it has gross income derived from sources in the. Return of partnership.

Web Included In Form 1065, U.s.

Washington — the irs released today an early draft of the instructions to form 1065, u.s. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web form 1065 2019 u.s.

Complete, Edit Or Print Tax Forms Instantly.

Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Beginning in tax year 2022, partnerships with individual retirement account (ira) partners receiving allocations of unrelated trade or business taxable. Return of partnership income), partnerships could be responsible for other tax issues, such as firpta. Return of partnership income is an informational tax form used to report the income, gains, losses, deductions, and credits of a partnership or llc.

Return Of Partnership Income Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form1065 For Instructions And The Latest.

Ad get ready for tax season deadlines by completing any required tax forms today. No tax is calculated from or paid on form 1065. Return of partnership income (to which the instructions for form 8865, return of u.s. This code will let you know if you should.

Download, Print Or Email Irs 1065 Tax Form On Pdffiller For Free.

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income used to report each partners' share of income or loss of the business. Which generally provides that every domestic partnership must file a return of partnership income. It’s a tax form filed by partnerships—including llcs taxed as partnerships—with the irs.

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)