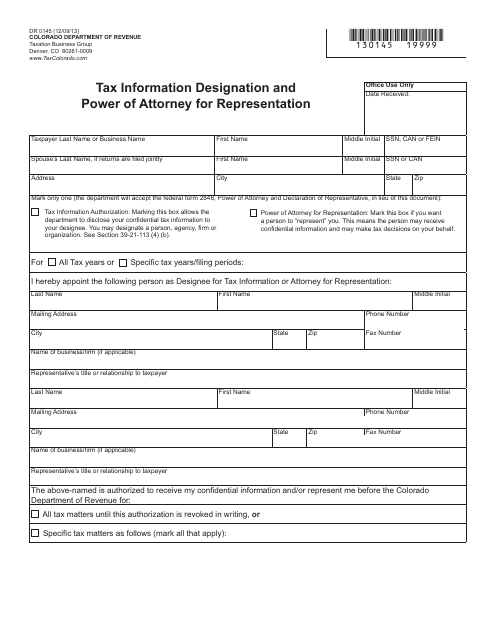

Form 2848 Pdf

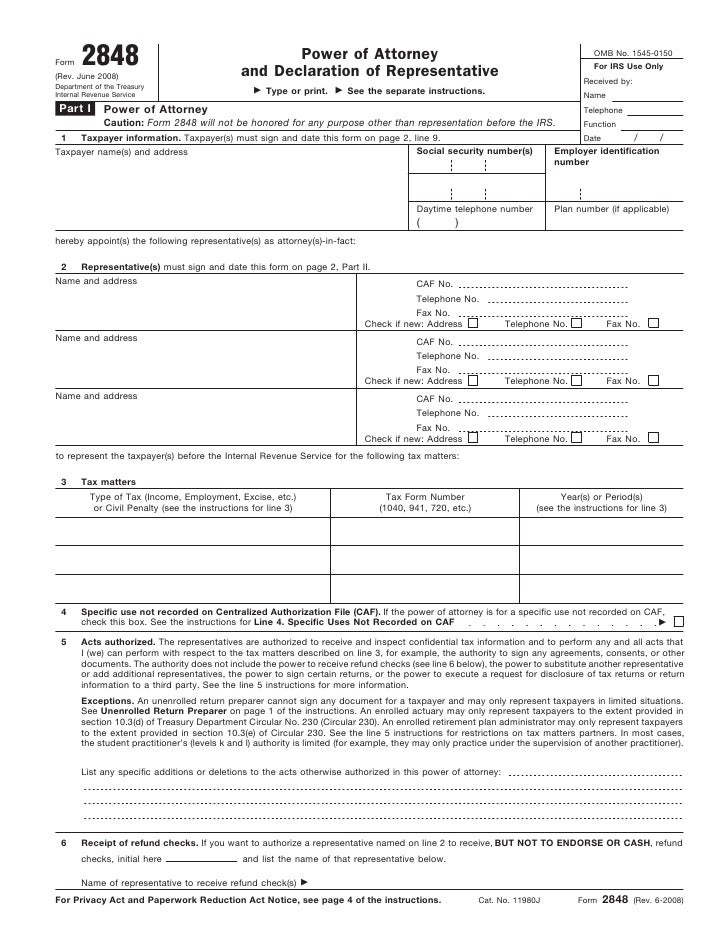

Form 2848 Pdf - Power of attorney and declaration of representative. Employer identification number taxpayer name(s) and address social security number(s) Web form 2848 power of attorney omb no. Mail your form 2848 directly to the irs address in. Web the irs form 2848, used to grant power of attorney, does not have a specific due date, as it can be filed as needed throughout the year. For more information on secure access, go to irs.gov/secureaccess. Ensure you have authenticated the identity of your client. Failing to file form 2848 on time or providing false information may result in penalties. Make sure the form is signed by all parties either electronically or with an ink signature. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney 1 taxpayer information.

Ensure you have authenticated the identity of your client. For instructions and the latest information. When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney 1 taxpayer information. Form 8821, tax information authorization pdf; Employer identification number taxpayer name(s) and address social security number(s) Make sure the form is signed by all parties either electronically or with an ink signature. For more information on secure access, go to irs.gov/secureaccess. Mail your form 2848 directly to the irs address in. Date / / part i power of attorney.

You will need to have a secure access account to submit your form 2848 online. Ensure you have authenticated the identity of your client. The individual you authorize must be a person eligible to practice before the irs. Date / / part i power of attorney. Form 8821, tax information authorization pdf; Taxpayer(s) must sign and date this form on page 2, line 9. Failing to file form 2848 on time or providing false information may result in penalties. Web form 2848 is used to authorize an eligible individual to represent another person before the irs. March 2004) and declaration of representative department of the treasury internal revenue service power of attorney 1 taxpayer information. When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies.

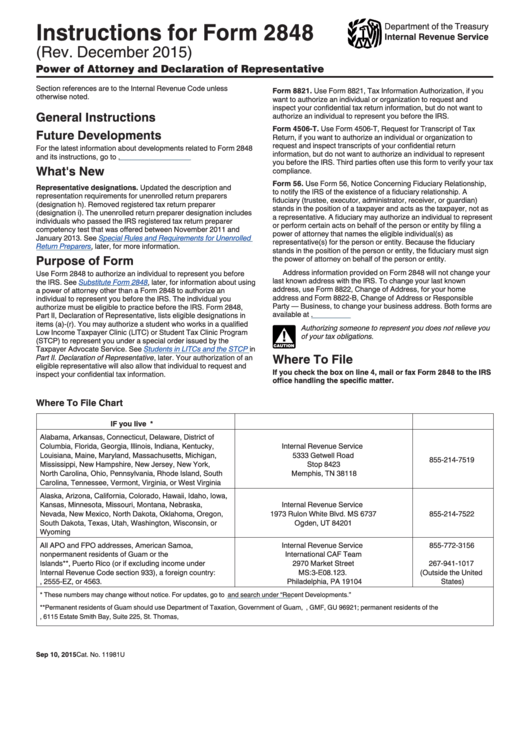

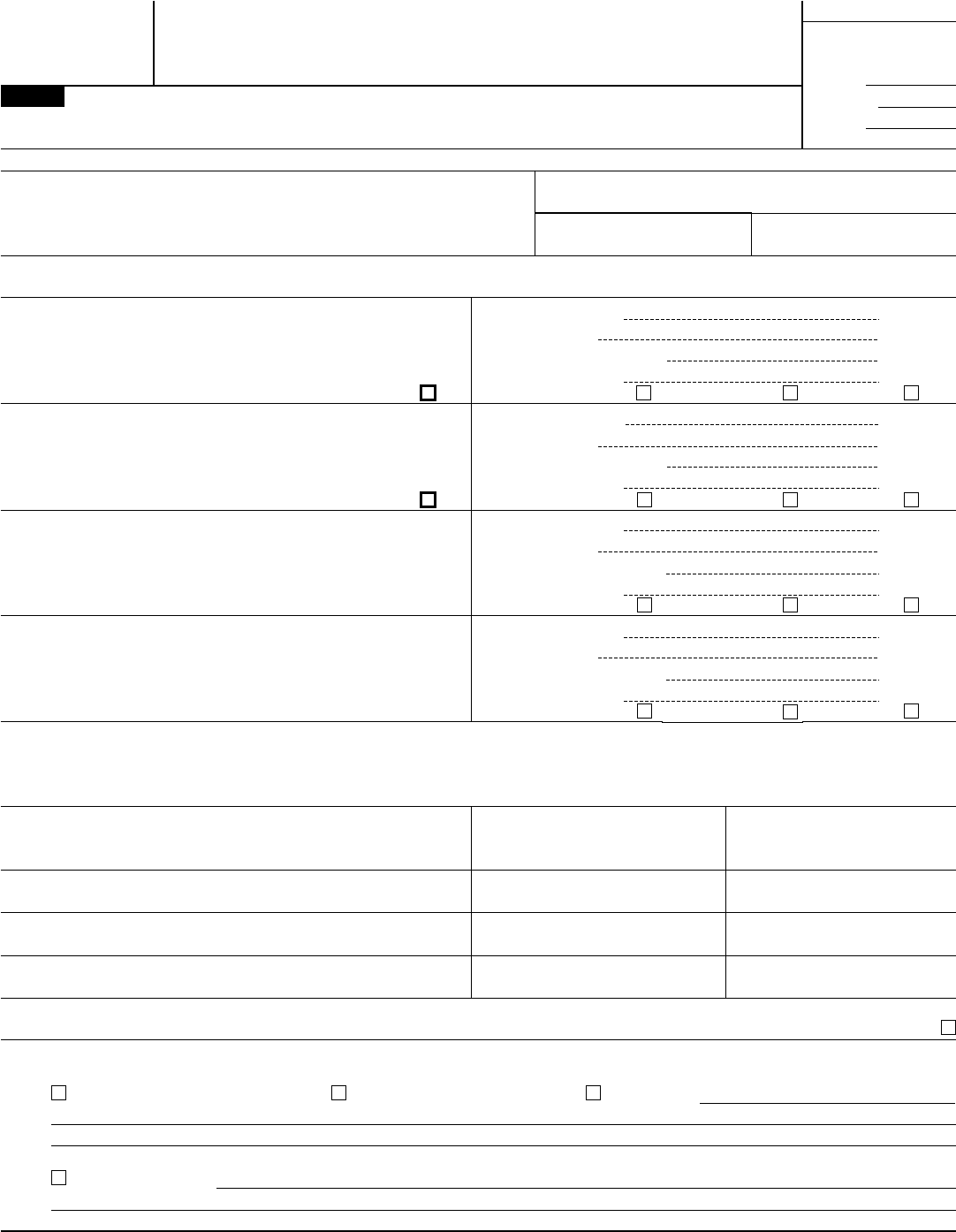

Instructions For Form 2848 (Rev. 2015) printable pdf download

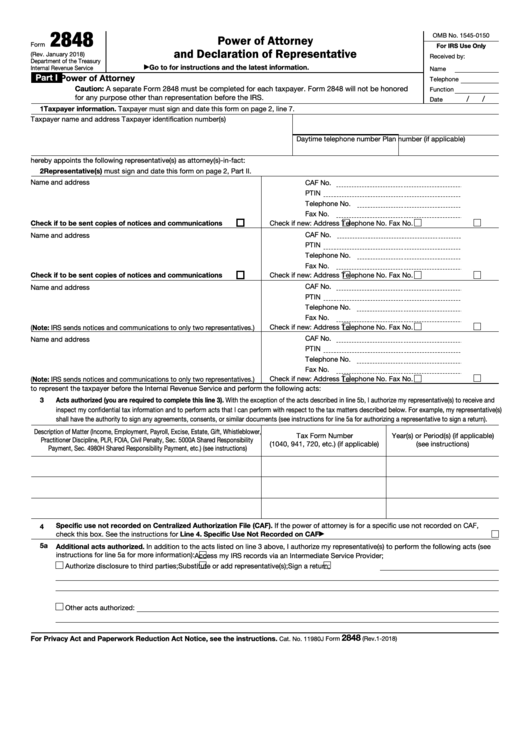

Power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. Date / / part i power of attorney. Ensure you have authenticated the identity of your client. Power of attorney and declaration of representative.

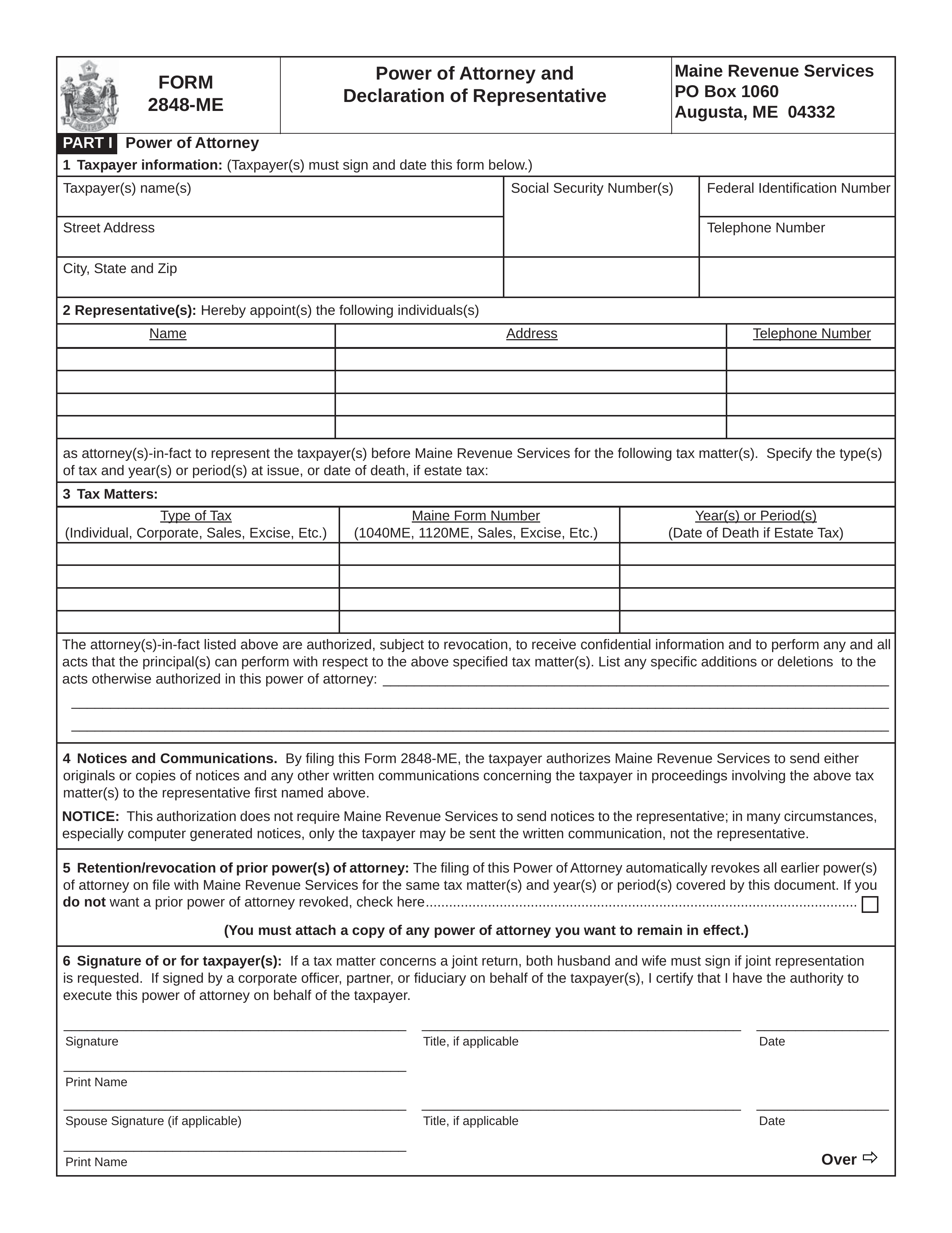

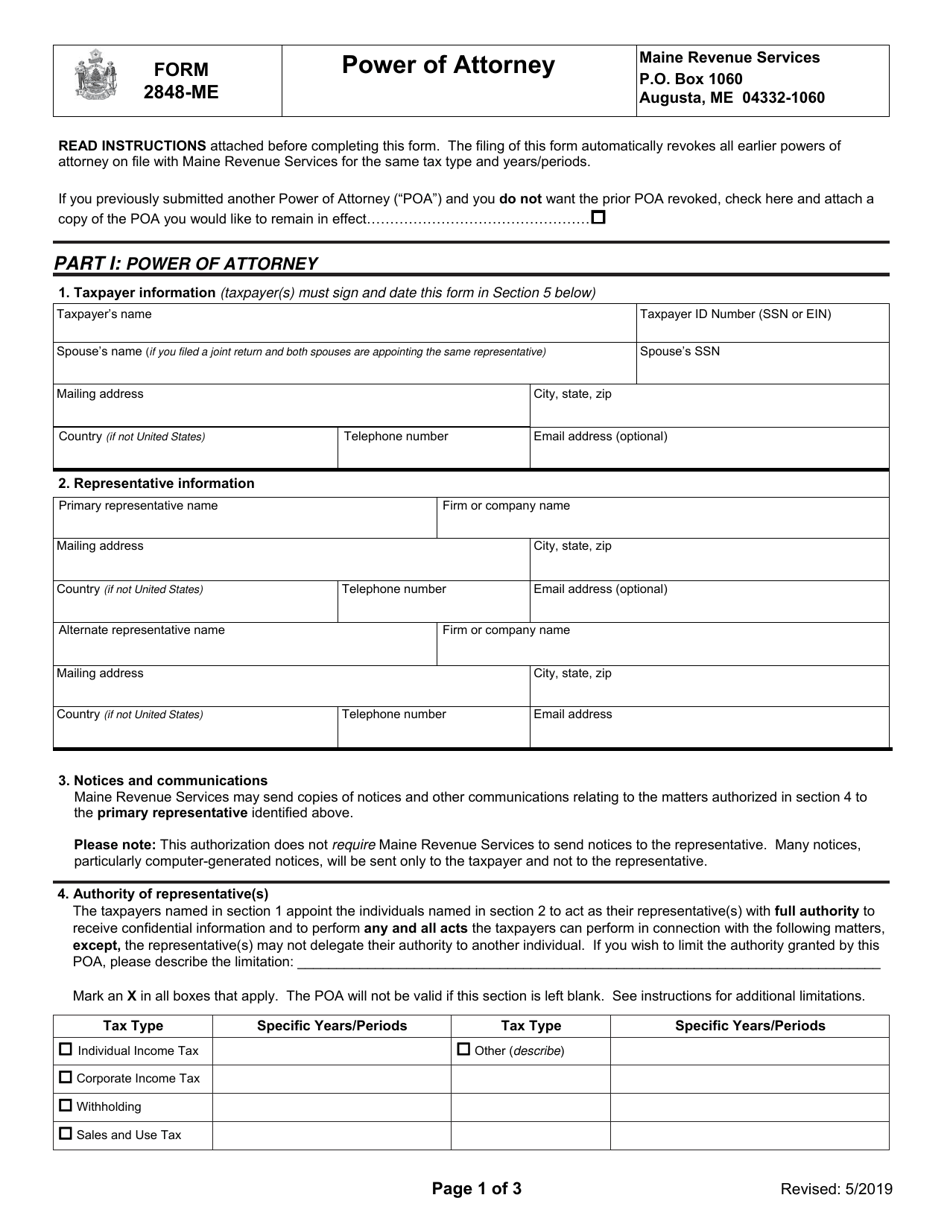

Free Maine Tax Power of Attorney Form ME2848 PDF eForms

March 2012) department of the treasury internal revenue service. Use form 2848 to authorize an individual to represent you before the irs. Employer identification number taxpayer name(s) and address social security number(s) Web submit your form 2848 securely at irs.gov/ submit2848. Failing to file form 2848 on time or providing false information may result in penalties.

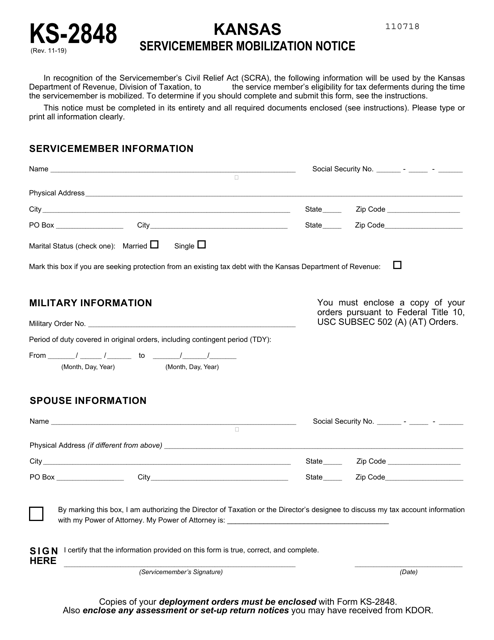

Form KS2848 Download Fillable PDF or Fill Online Servicemember

Make sure the form is signed by all parties either electronically or with an ink signature. For instructions and the latest information. Ensure you have authenticated the identity of your client. Date / / part i power of attorney. In cases where the issuance of power(s) to communicate, act, or sign is unnecessary, but approved disclosure of confidential tax information.

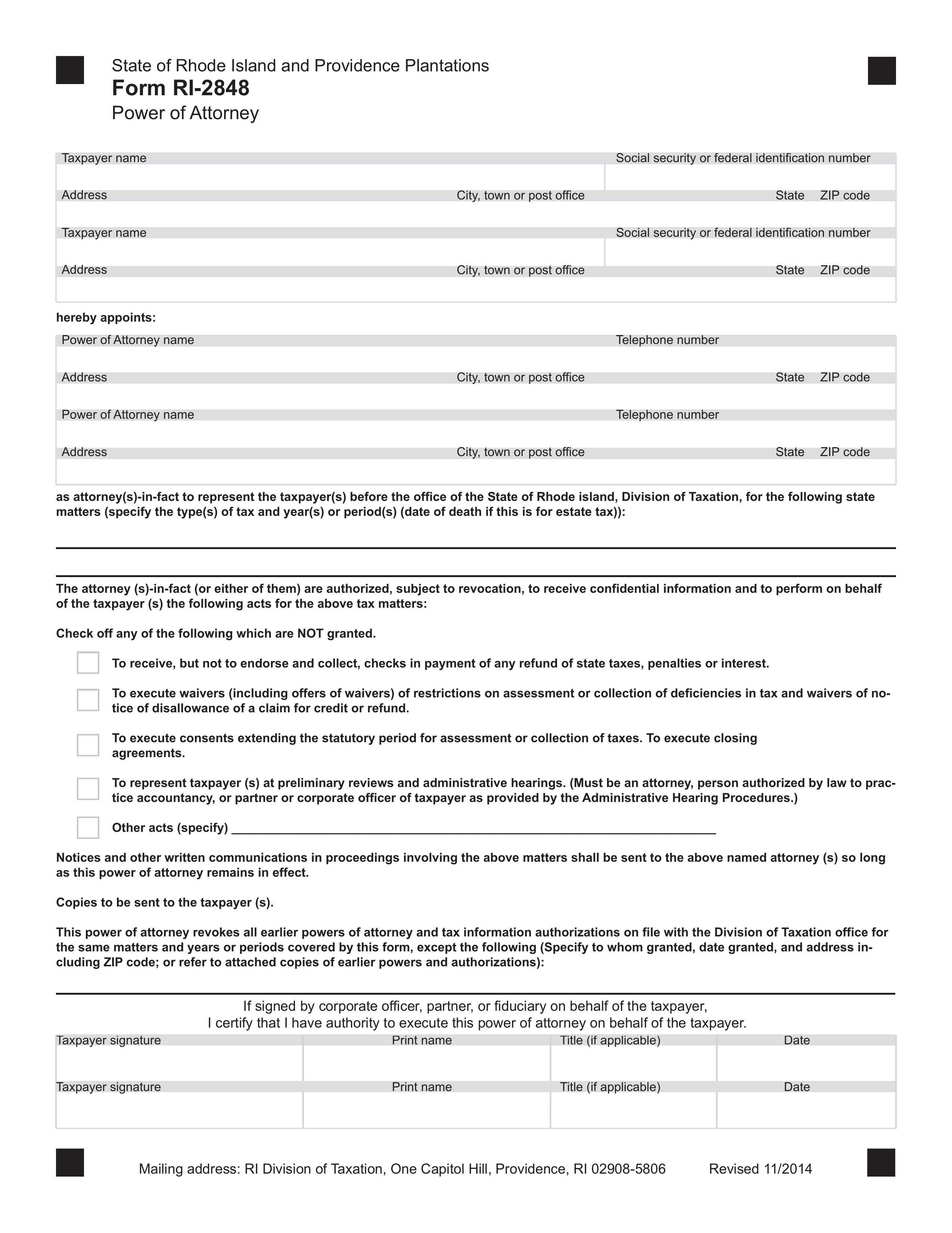

Free Rhode Island Tax Power of Attorney (Form RI2848) PDF eForms

Fax your form 2848 to the irs fax number in the where to file chart. March 2012) department of the treasury internal revenue service. Date / / part i power of attorney. In cases where the issuance of power(s) to communicate, act, or sign is unnecessary, but approved disclosure of confidential tax information is needed, form 8821 can be used.

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

January 2021) department of the treasury internal revenue service. Ensure you have authenticated the identity of your client. You will need to have a secure access account to submit your form 2848 online. Web form 2848 is used to authorize an eligible individual to represent another person before the irs. March 2004) and declaration of representative department of the treasury.

IRS 2848 2022 Form Printable Blank PDF Online

Make sure the form is signed by all parties either electronically or with an ink signature. Taxpayer(s) must sign and date this form on page 2, line 9. Use form 2848 to authorize an individual to represent you before the irs. Ensure you have authenticated the identity of your client. January 2021) department of the treasury internal revenue service.

How To File Ftb Power Of Attorney Declaration

You will need to have a secure access account to submit your form 2848 online. When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. Power of attorney and declaration of representative. For instructions and the latest information. March 2012) department of the treasury internal revenue.

Fillable Form 2848 Power Of Attorney And Declaration Of

Date / / part i power of attorney. For instructions and the latest information. January 2021) department of the treasury internal revenue service. The individual you authorize must be a person eligible to practice before the irs. Make sure the form is signed by all parties either electronically or with an ink signature.

Form 2848 Edit, Fill, Sign Online Handypdf

Power of attorney and declaration of representative. Web form 2848 also allows you to define the scope of authority you wish to give your representative, depending on how you fill out line 3 in part i. In cases where the issuance of power(s) to communicate, act, or sign is unnecessary, but approved disclosure of confidential tax information is needed, form.

Ensure You Have Authenticated The Identity Of Your Client.

Use form 2848 to authorize an individual to represent you before the irs. Failing to file form 2848 on time or providing false information may result in penalties. Power of attorney and declaration of representative. For instructions and the latest information.

In Cases Where The Issuance Of Power(S) To Communicate, Act, Or Sign Is Unnecessary, But Approved Disclosure Of Confidential Tax Information Is Needed, Form 8821 Can Be Used Instead.

Mail your form 2848 directly to the irs address in. Web form 2848, power of attorney and declaration of representative pdf; When completing this section, you need to provide the specific issue(s), the types of forms involved and the year(s) to which this authority applies. Employer identification number taxpayer name(s) and address social security number(s)

January 2021) Department Of The Treasury Internal Revenue Service.

Taxpayer(s) must sign and date this form on page 2, line 9. Date / / part i power of attorney. March 2012) department of the treasury internal revenue service. Fax your form 2848 to the irs fax number in the where to file chart.

Date / / Part I Power Of Attorney.

Web the irs form 2848, used to grant power of attorney, does not have a specific due date, as it can be filed as needed throughout the year. Web irs form 2848 conveys powers to an appointed agent to manage an individual’s (or business’s) federal taxes. Make sure the form is signed by all parties either electronically or with an ink signature. The individual you authorize must be a person eligible to practice before the irs.