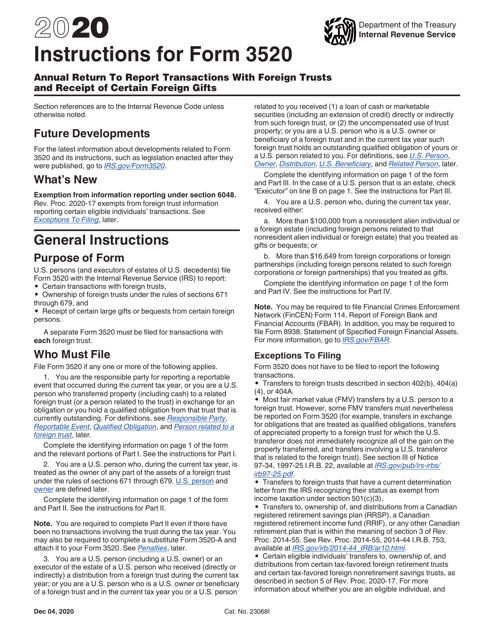

Form 3520 E File

Form 3520 E File - Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Ad talk to our skilled attorneys by scheduling a free consultation today. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 & instructions: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner files this form annually to provide information. File a separate form 3520 for each foreign trust. Form 3520 is due at the time of a timely filing of the u.s. If the due date for filing the tax. For calendar year 2019, or tax year beginning , 2019, ending , 20 a check appropriate.

Ad talk to our skilled attorneys by scheduling a free consultation today. File a separate form 3520 for each foreign trust. It does not have to be a “foreign gift.” rather, if a. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner a foreign trust with at least one u.s. Web form 3520 & instructions: The deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is. Web show all amounts in u.s. Send form 3520 to the.

Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. If the due date for filing the tax. Upload, modify or create forms. Web form 3520 filing requirements. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner a foreign trust with at least one u.s. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go. Owner files this form annually to provide information. Web form 3520 & instructions: Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Download Instructions for IRS Form 3520 Annual Return to Report

Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Form 3520 is technically referred to as the a nnual return.

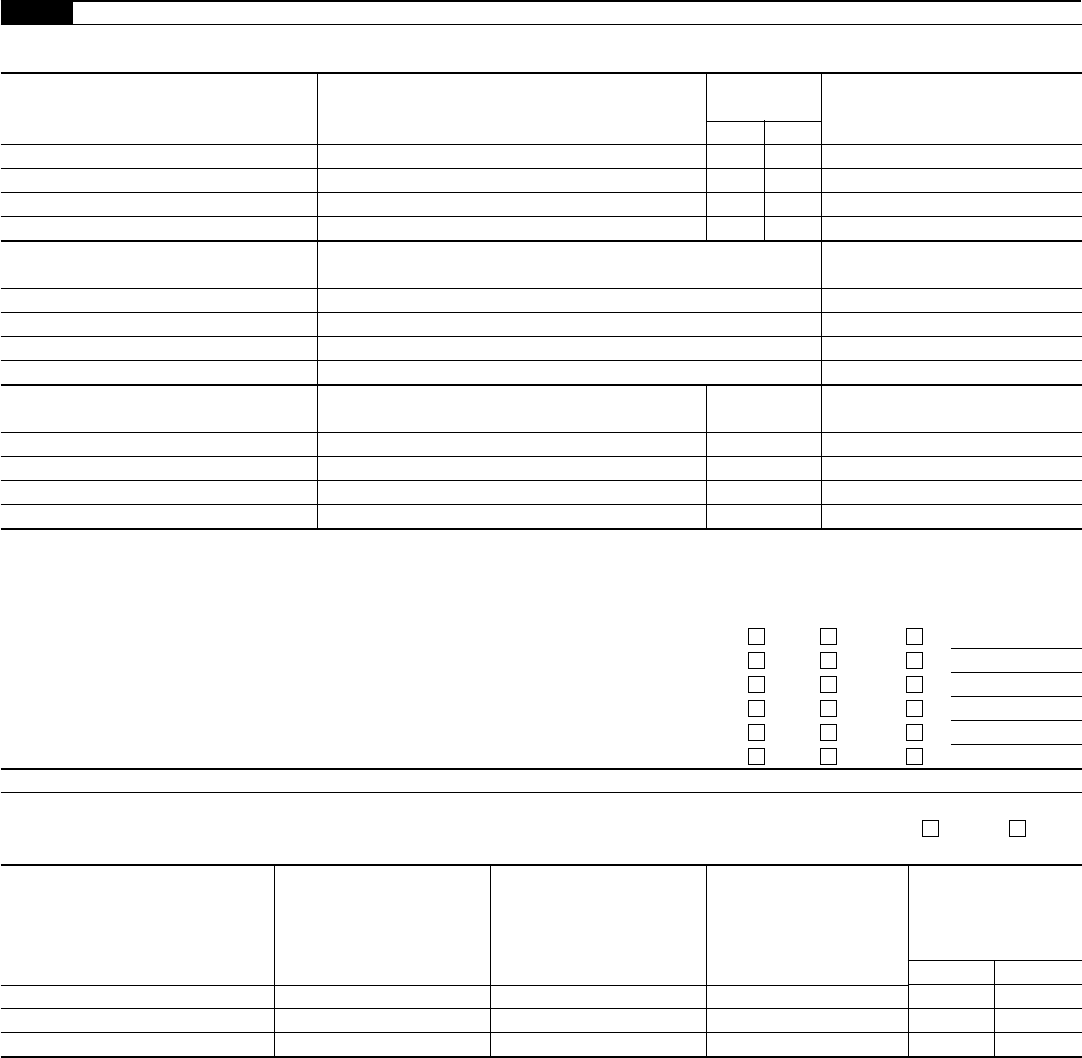

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 filing requirements. Send form 3520 to the. If the due date for filing the tax. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Owner files this form annually to provide information.

form 3520a 2021 Fill Online, Printable, Fillable Blank

Send form 3520 to the. If the due date for filing the tax. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Form 3520 is due at the time of a timely filing of the u.s. Web form 3520 filing requirements.

2020 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Owner a foreign trust with at least one u.s. Send form 3520 to the. Web the maximum penalty is 25% of the amount of the gift. Web married taxpayers can file a joint form 3520 only if they file a joint income tax return and only if part i, ii or iii applies to them jointly (e.g., they are joint.

question about form 3520 TurboTax Support

The deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is. Try it for free now! Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ad register and subscribe now.

Form 3520 Edit, Fill, Sign Online Handypdf

Form 3520 is due at the time of a timely filing of the u.s. Web deadline for 3520 form filing. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Web form 3520 filing requirements. Web form 3520, annual return to report transactions with foreign trusts and receipt of.

US Taxes and Offshore Trusts Understanding Form 3520

If the due date for filing the tax. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 department.

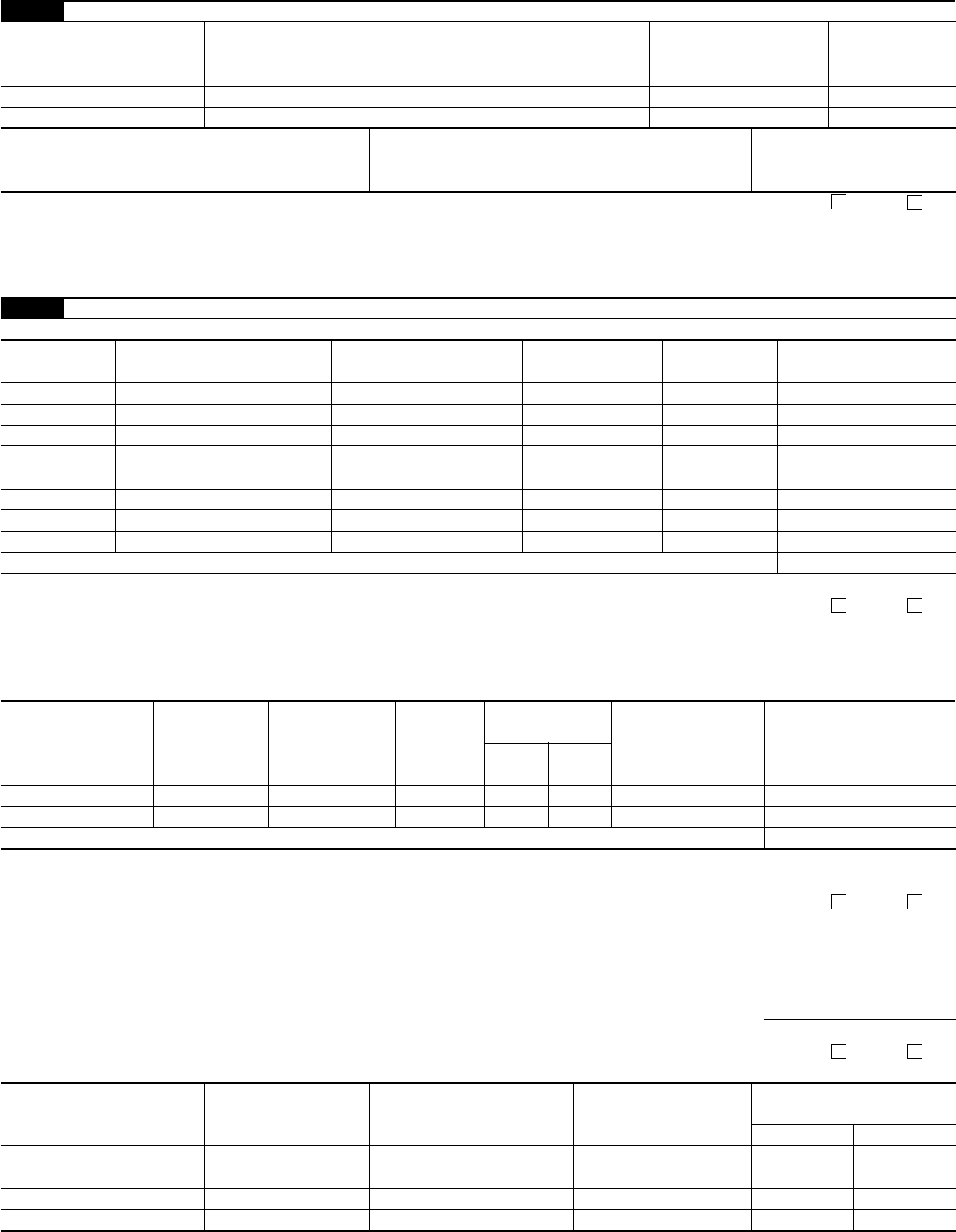

Top Epa Form 35201 Templates free to download in PDF format

Ad talk to our skilled attorneys by scheduling a free consultation today. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 & instructions: Web form 3520 filing.

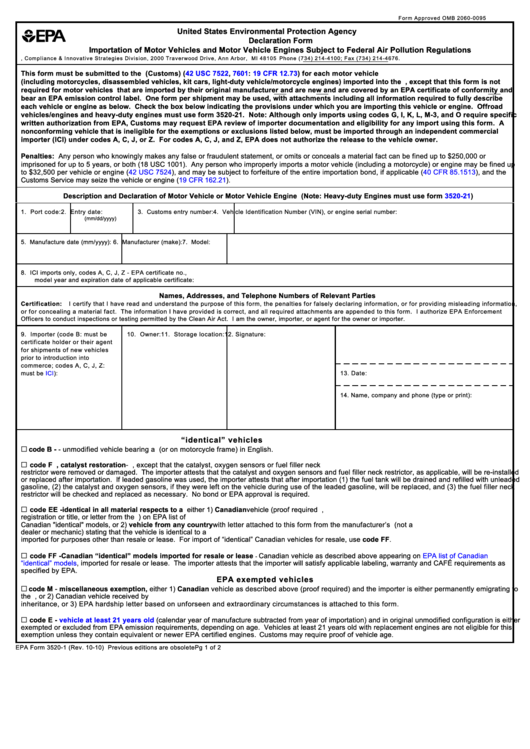

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Ad register and subscribe now to work on your irs form 3520 & more fillable forms. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Upload, modify or create forms. The deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040).

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Send form 3520 to the. It does not have to be a “foreign gift.” rather, if a. The irs f orm 3520 is used to report.

Web The Form 3520 Is An Informational Return Used To Report Certain Transactions With Foreign Trusts, Ownership Of Foreign Trusts, Or Large Gifts From Certain Foreign Persons To The.

Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Owner files this form annually to provide information. Owner a foreign trust with at least one u.s. Web deadline for 3520 form filing.

The Deadline To File Form 3520 Is The Same As The Deadline For Filing An Ordinary Tax Return (1040) — Although The Deadline To File Form 3520A Is.

Form 3520 is due at the time of a timely filing of the u.s. Web form 3520 filing requirements. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Web the maximum penalty is 25% of the amount of the gift.

Web An Income Tax Return, The Due Date For Filing Form 3520 Is The 15Th Day Of The 10Th Month (October 15) Following The End Of The U.s.

Ad talk to our skilled attorneys by scheduling a free consultation today. If the due date for filing the tax. Send form 3520 to the. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go.

Form 3520 Is Technically Referred To As The A Nnual Return To Report Transactions With Foreign Trusts And Receipt Of Certain.

It does not have to be a “foreign gift.” rather, if a. File a separate form 3520 for each foreign trust. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues.