Form 433 F Irs

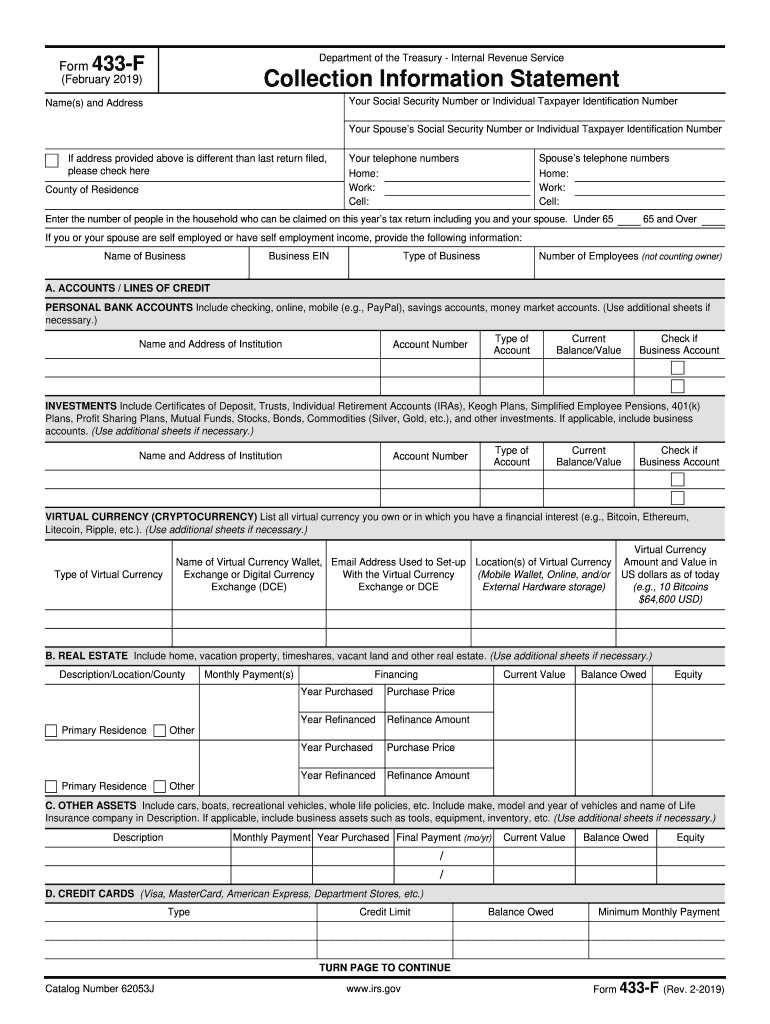

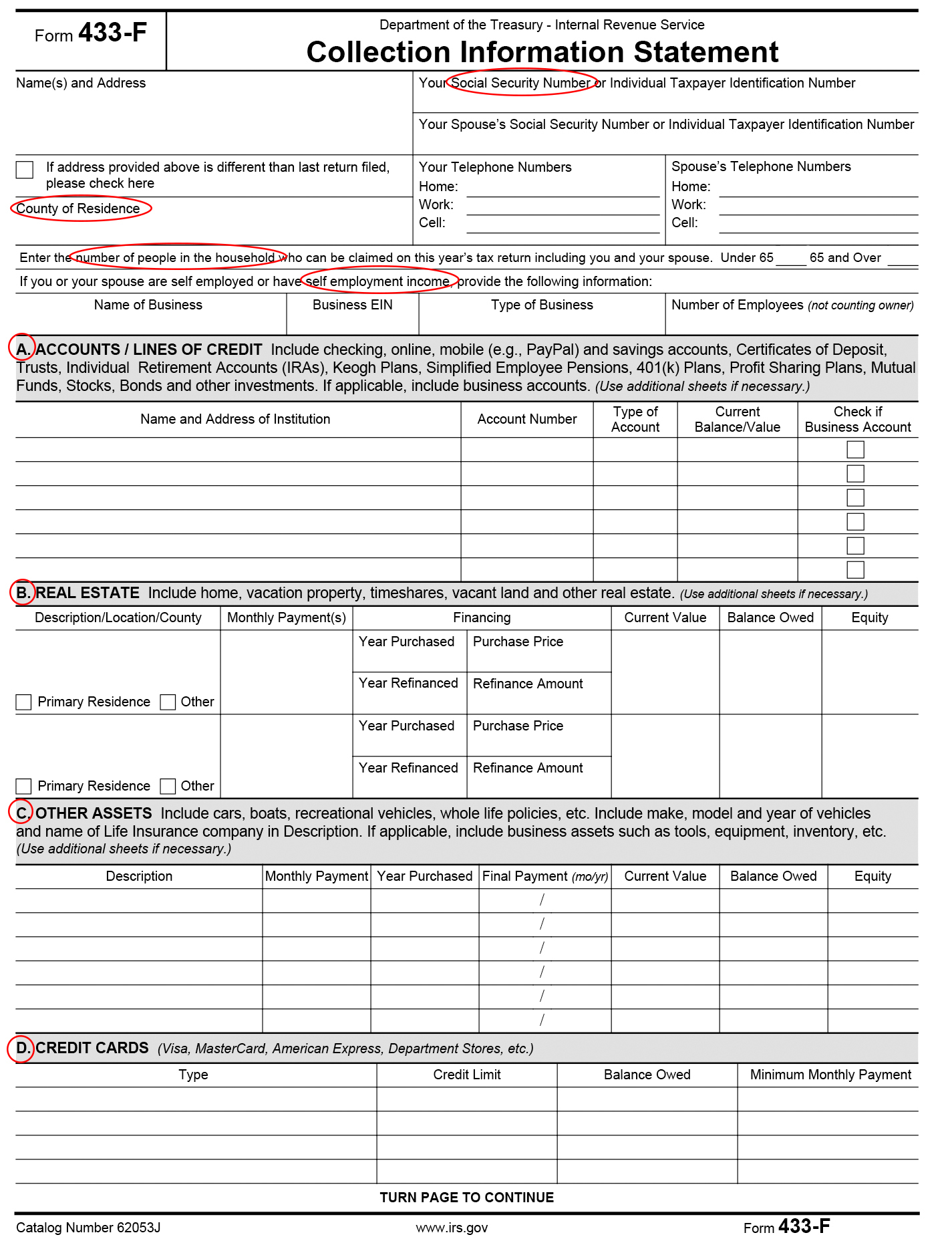

Form 433 F Irs - Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. For a routine installment agreement, you also need to submit another form:. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web cash and investments (domestic and foreign) note: Ad access irs tax forms. Ad bbb accredited & 'a+' rating. Collection information statement for wage earners. If you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad we help get taxpayers relief from owed irs back taxes. Get ready for tax season deadlines by completing any required tax forms today.

Ad bbb accredited & 'a+' rating. Ad access irs tax forms. It shows the irs the taxpayer's ability. Web cash and investments (domestic and foreign) note: Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad we help get taxpayers relief from owed irs back taxes. Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. For a routine installment agreement, you also need to submit another form:.

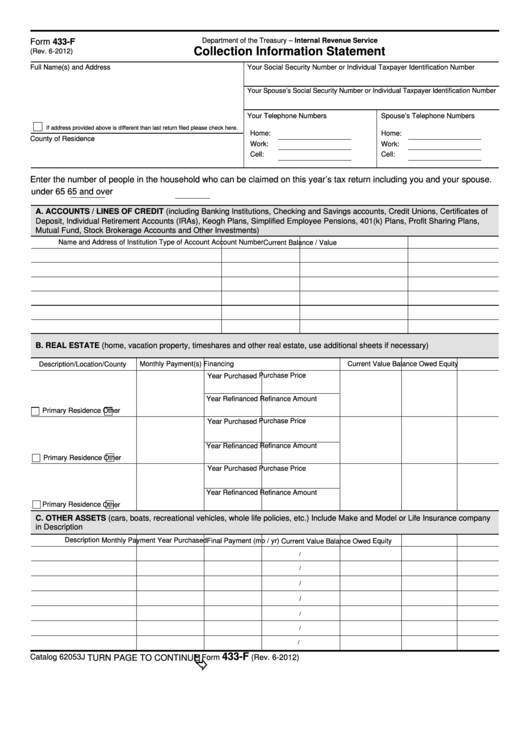

Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. If you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web the irs form 433 f collection information sheet is one of the ways the government gathers your personal information to understand your financial status and your ability to. Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. Ad bbb accredited & 'a+' rating. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. It shows the irs the taxpayer's ability. For a routine installment agreement, you also need to submit another form:. Ad we help get taxpayers relief from owed irs back taxes. Web cash and investments (domestic and foreign) note:

Va Form 21 4138 Instructions Form Resume Examples GM9Ow6k9DL

Web the irs form 433 f collection information sheet is one of the ways the government gathers your personal information to understand your financial status and your ability to. Ad bbb accredited & 'a+' rating. Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. It shows the irs the taxpayer's ability. Collection information statement for.

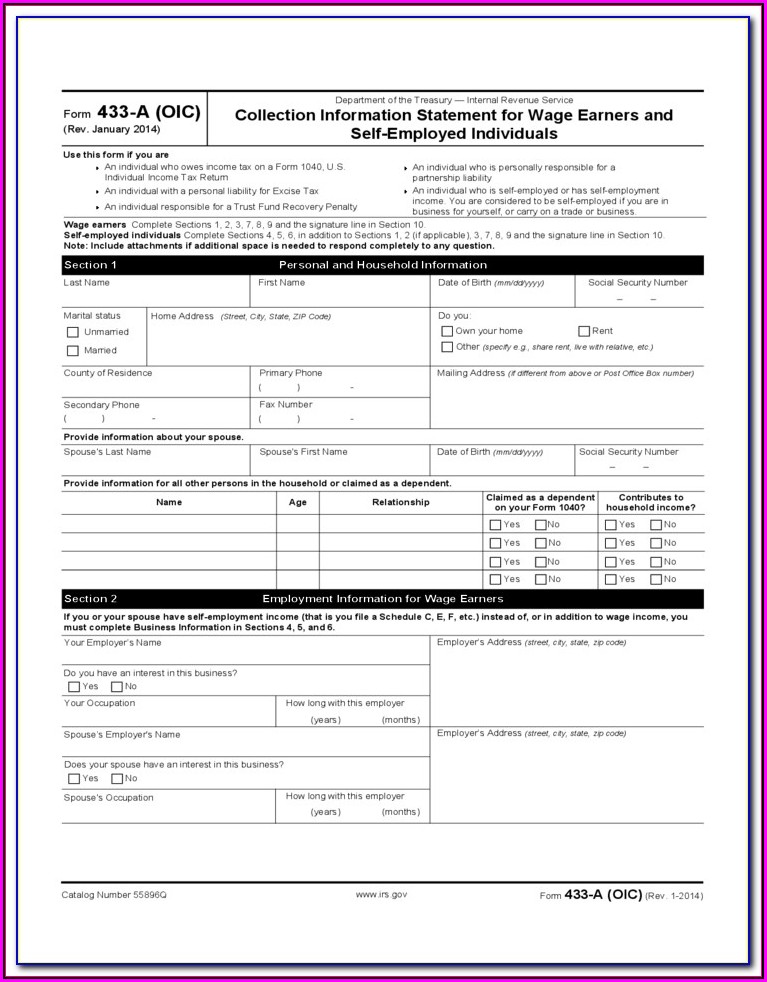

Irs Form 433 A Instructions Form Resume Examples 05KA6wD3wP

It shows the irs the taxpayer's ability. Ad access irs tax forms. Ad we help get taxpayers relief from owed irs back taxes. Get ready for tax season deadlines by completing any required tax forms today. Collection information statement for wage earners.

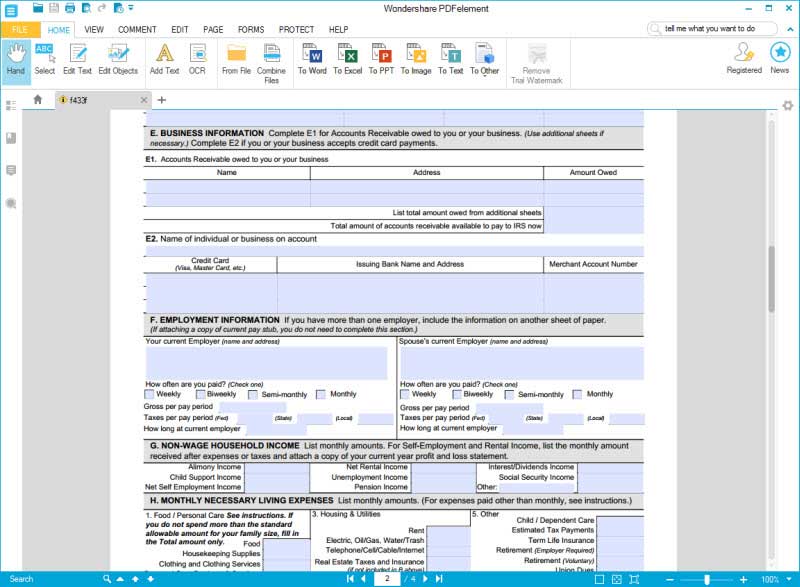

32 433 Forms And Templates free to download in PDF

Ad bbb accredited & 'a+' rating. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Collection information statement for wage earners. Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties.

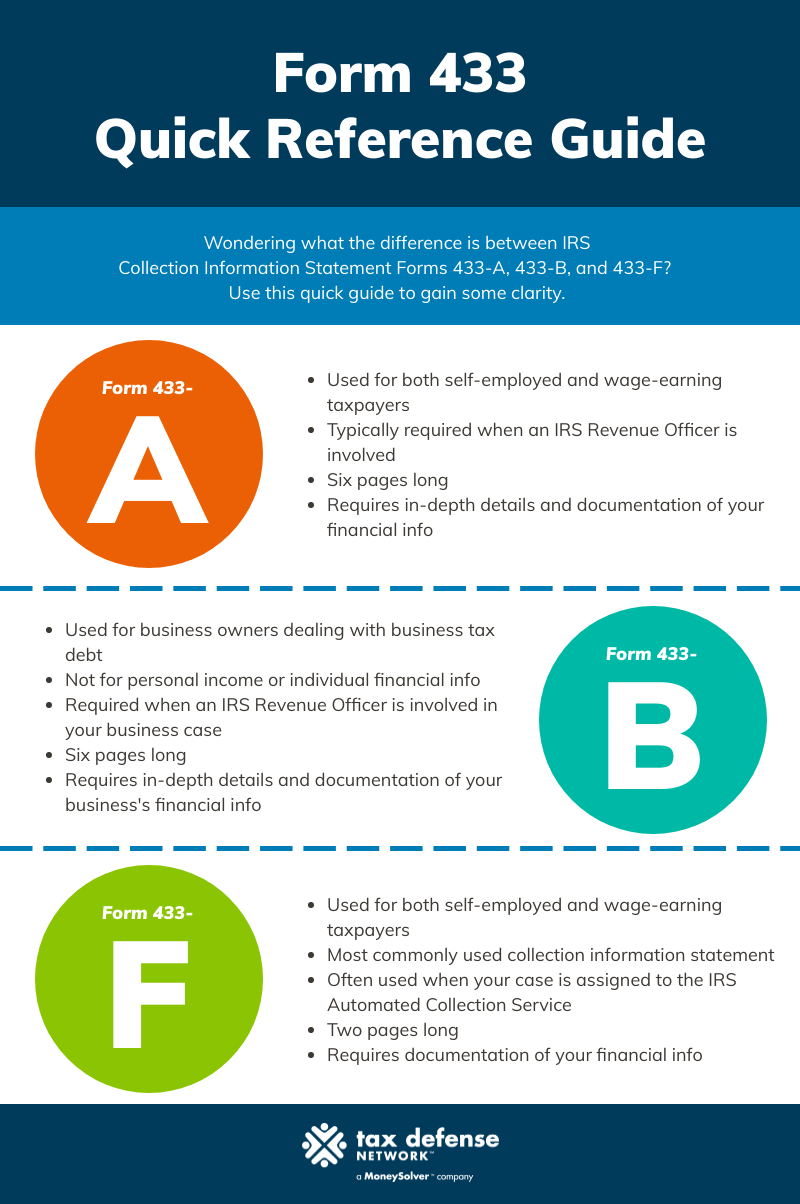

Form 433A & 433F How the IRS Decides Your Ability to Pay

For a routine installment agreement, you also need to submit another form:. Web cash and investments (domestic and foreign) note: Get ready for tax season deadlines by completing any required tax forms today. It shows the irs the taxpayer's ability. Bank names, account numbers, and current balance of all bank accounts, including checking, savings,.

2003 Form IRS 433F Fill Online, Printable, Fillable, Blank pdfFiller

Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. It shows the irs the taxpayer's ability. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today.

IRS Form 433F Fill it out in Style

Ad bbb accredited & 'a+' rating. Web the irs form 433 f collection information sheet is one of the ways the government gathers your personal information to understand your financial status and your ability to. If you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad we help get taxpayers relief from owed.

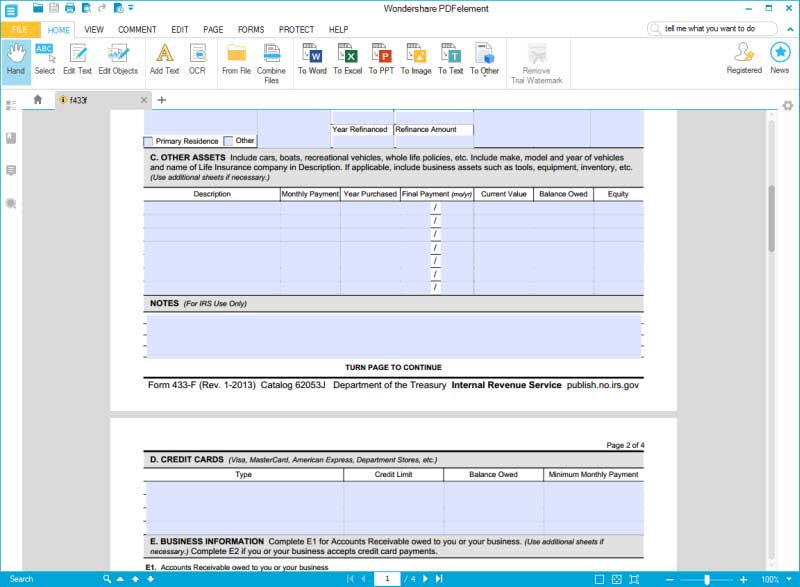

Form 433F Collection Information Statement (2013) Free Download

Web cash and investments (domestic and foreign) note: Complete, edit or print tax forms instantly. Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. Web the irs form 433 f collection information sheet is one of the ways the government gathers your personal information to understand your financial status and your ability to. Collection information.

IRS Form 433F Fill it out in Style

Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Ad bbb accredited & 'a+' rating. Web cash and investments (domestic and foreign) note: Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. Web.

F Financial Necessary Latest Fill Out and Sign Printable PDF Template

Ad bbb accredited & 'a+' rating. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. If you owe more than $5,000 in back taxes.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Collection information statement for wage earners. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web the irs form 433 f collection information sheet is one of the ways the government gathers your personal information to understand your financial status and.

Ad Access Irs Tax Forms.

Get ready for tax season deadlines by completing any required tax forms today. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Your reduction from current market value may be greater than 20% due to potential tax consequences/withdrawal penalties. Ad we help get taxpayers relief from owed irs back taxes.

Web The Irs Form 433 F Collection Information Sheet Is One Of The Ways The Government Gathers Your Personal Information To Understand Your Financial Status And Your Ability To.

Ad bbb accredited & 'a+' rating. For a routine installment agreement, you also need to submit another form:. Complete, edit or print tax forms instantly. It shows the irs the taxpayer's ability.

Web Cash And Investments (Domestic And Foreign) Note:

Bank names, account numbers, and current balance of all bank accounts, including checking, savings,. Collection information statement for wage earners. If you owe more than $5,000 in back taxes tax advocates can help you get tax relief.