Form 4506 T

Form 4506 T - Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a tax year. See the product list below. 7 for situations not requiring an exact copy of. This form gives permission for the irs to provide sba your tax return information when applying for. Form 4506 is used by. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. See the product list below. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Taxpayers using a tax year.

Taxpayers using a tax year. The secondary spouse on a joint return must use get. Form 4506 is used by. 7 for situations not requiring an exact copy of. Taxpayers using a tax year. See the product list below. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). You can also designate (on line 5a) a third party to receive the information. See the product list below. Web covid eidl disaster request for transcript of tax return.

Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Web covid eidl disaster request for transcript of tax return. Taxpayers using a tax year. See the product list below. You can also designate (on line 5) a third party to receive the information. Form 4506 is used by. Taxpayers using a tax year beginning in one. You can also designate (on line 5a) a third party to receive the information. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. You can also designate (on line 5) a third party to receive the information.

DISCOVER FORM 4506T??? myFICO® Forums 5645421

Taxpayers using a tax year. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. You can also designate (on line 5) a third party to receive the information. 7 for situations not requiring an exact copy of. Taxpayers using a tax year.

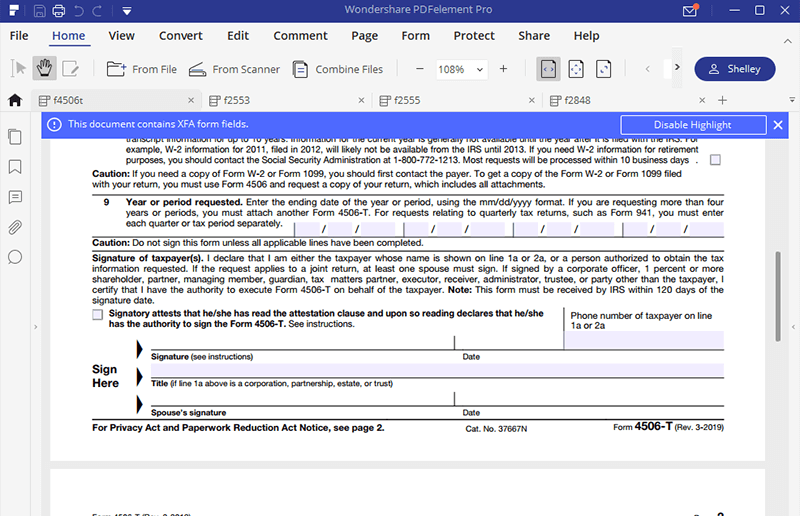

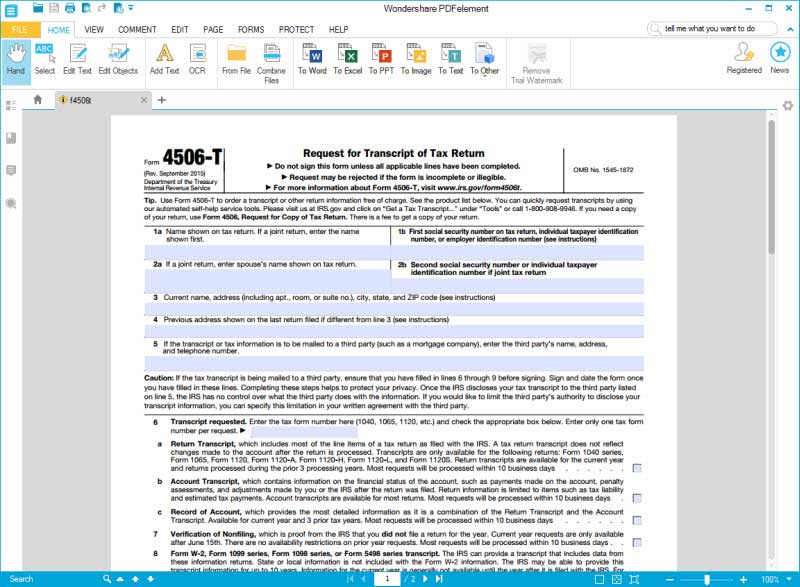

IRS Form 4506TFilling Forms Made Easy by PDFelement

See the product list below. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. You can also designate (on line 5a) a third party to receive the information. You can also designate (on line 5) a third party to receive the information. This form gives permission for the irs to provide sba your.

Form 4506T YouTube

Taxpayers using a tax year. You can also designate (on line 5a) a third party to receive the information. See the product list below. You can also designate (on line 5) a third party to receive the information. The secondary spouse on a joint return must use get.

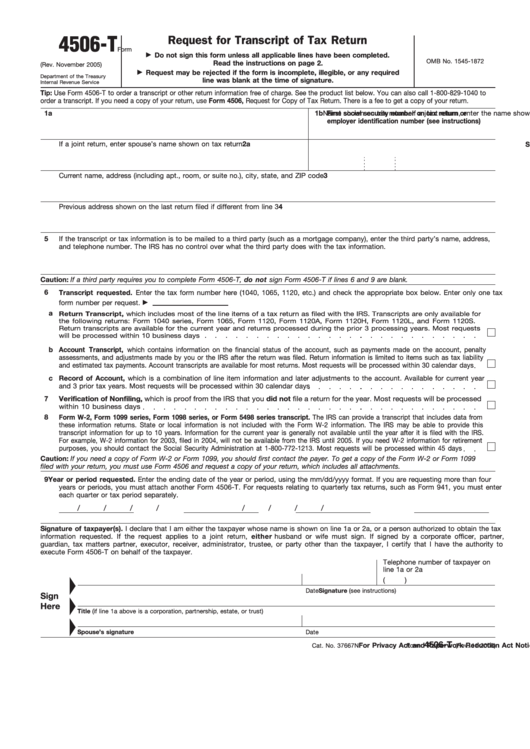

4506 t Fill Online, Printable, Fillable Blank

You can also designate (on line 5) a third party to receive the information. See the product list below. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). You can also designate (on line 5) a third party to receive the information. This form gives permission for the irs to.

Fillable Form 4506T Request For Transcript Of Tax Return printable

Taxpayers using a tax year beginning in one. Form 4506 is used by. You can also designate (on line 5a) a third party to receive the information. Taxpayers using a tax year. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes.

IRS Form 4506T Filling Forms Made Easy by PDFelement

Taxpayers using a tax year. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. You can also designate (on line 5) a third party to receive the information. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. Taxpayers using a.

Fillable Form 4506T Request For Transcript Of Tax Return printable

Web covid eidl disaster request for transcript of tax return. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). See the product list below. See the product list.

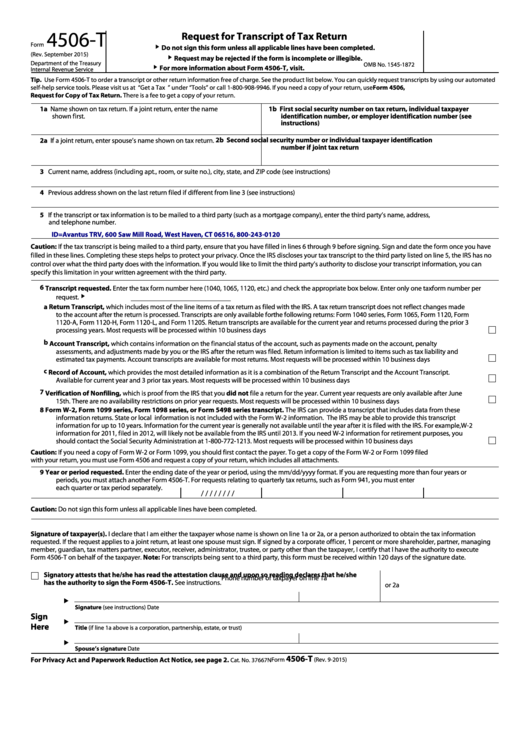

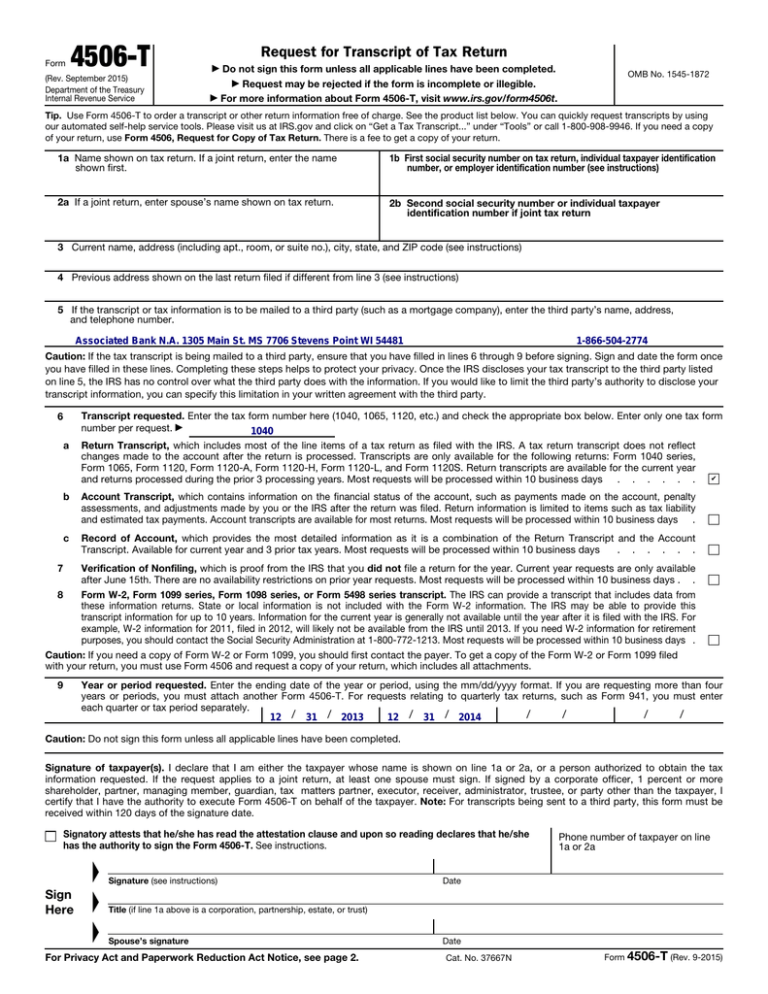

Form 4506T Request for Transcript of Tax Return (2015) Free Download

See the product list below. 7 for situations not requiring an exact copy of. You can also designate (on line 5a) a third party to receive the information. See the product list below. You can also designate (on line 5) a third party to receive the information.

Form 4506T Request for Transcript of Tax Return (2015) Free Download

See the product list below. Web covid eidl disaster request for transcript of tax return. You can also designate (on line 5a) a third party to receive the information. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. See the product list below.

Form 4506T (Rev. September 2015)

The secondary spouse on a joint return must use get. You can also designate (on line 5) a third party to receive the information. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. Taxpayers using a tax year. You can also designate (on line 5) a third.

Taxpayers Using A Tax Year Beginning In One.

7 for situations not requiring an exact copy of. Web covid eidl disaster request for transcript of tax return. You can also designate (on line 5) a third party to receive the information. Form 4506 is used by.

See The Product List Below.

You can also designate (on line 5a) a third party to receive the information. See the product list below. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file.

This Form Gives Permission For The Irs To Provide Sba Your Tax Return Information When Applying For.

Taxpayers using a tax year. The secondary spouse on a joint return must use get. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year).

Taxpayers Using A Tax Year.

You can also designate (on line 5) a third party to receive the information.