Form 4797 Vs 8949

Form 4797 Vs 8949 - The disposition of noncapital assets. Web form 4797, line 2, use the line directly below the line on which you reported the sale. Web purpose of form use form 8949 to report sales and exchanges of capital assets. 8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224. Form 4797 input for sales of business property. Solved•by intuit•14•updated july 14, 2022. Web complete form 4797, line 2, columns (a), (b), and (c); Web form 8949 is used to list all capital gain and loss transactions. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. I operate a home business.

Web form 4797, line 2, use the line directly below the line on which you reported the sale. The disposition of noncapital assets. Web use form 4797 to report: This might include any property used to generate rental income or even a. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. If entering on form 4797 input sheet or detail schedule,. Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates. Sales of assets may be entered in either the income. Report the amount from line 1 above on form 4797, line 2, column (d); I operate a home business.

Or form 8824, parts i and ii. Web trying to fill out 4797, schedule d and 8949 for the sale of primary residence. In column (a), identify the section 1231 gains invested into a qof as “qof investment to. Web use form 4797 to report: Sales of assets may be entered in either the income. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. I operate a home business. Web purpose of form use form 8949 to report sales and exchanges of capital assets. The involuntary conversion of property and capital assets. Or form 8824, line 12 or.

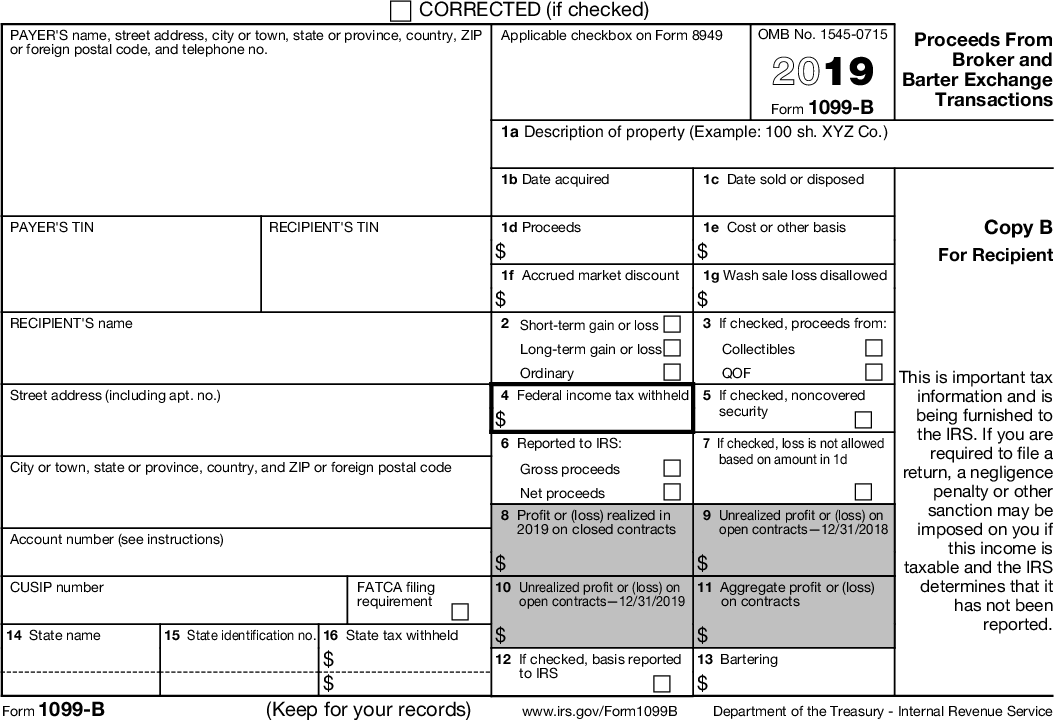

Form 1099B Instructions

I operate a home business. Report the amount from line 1 above on form 4797, line 2, column (d); Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Form 8949 allows you and the irs to reconcile amounts that.

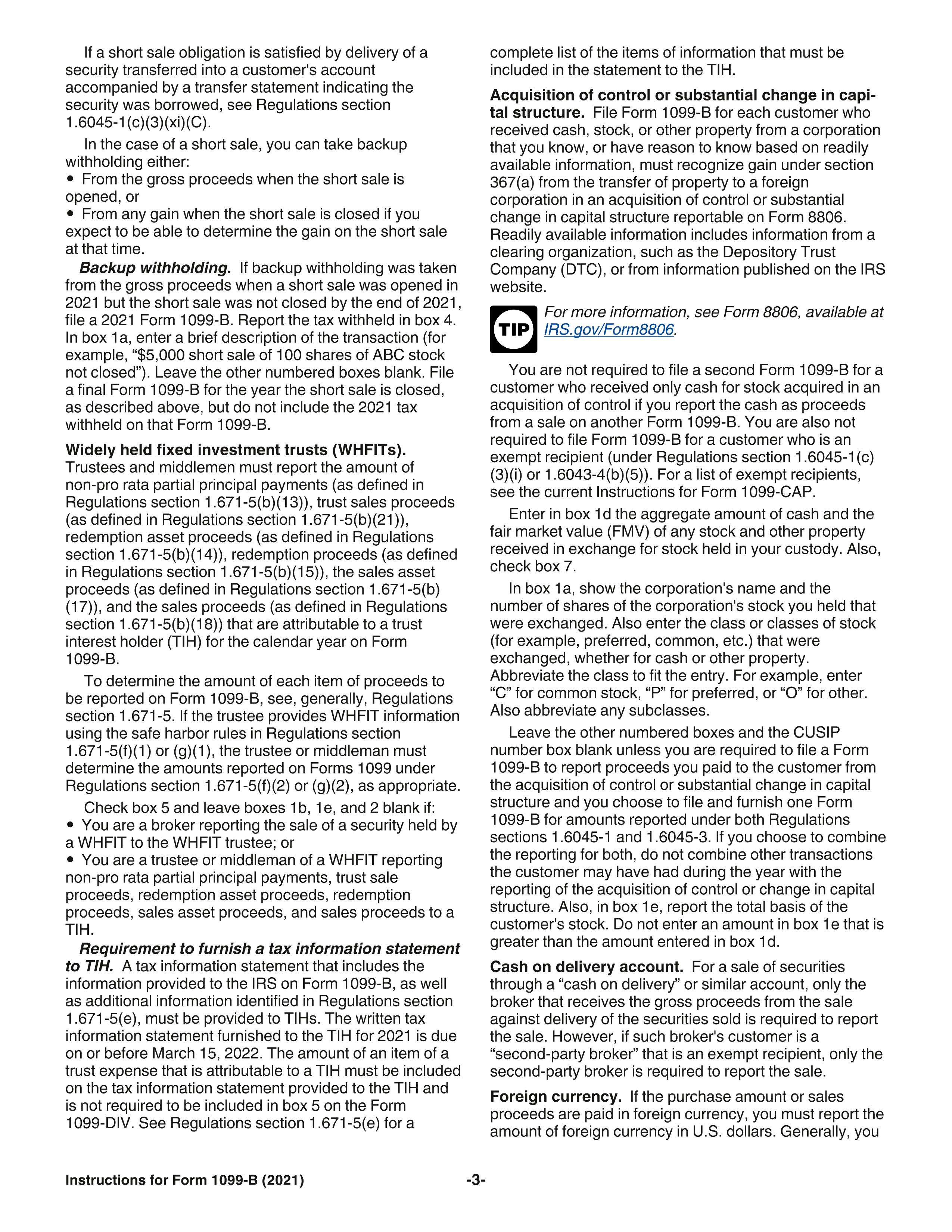

Tax Act Import

Web trying to fill out 4797, schedule d and 8949 for the sale of primary residence. The disposition of noncapital assets. Web purpose of form use form 8949 to report sales and exchanges of capital assets. Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates. 8949 n 97th st is.

Form 1099B Instructions

This might include any property used to generate rental income or even a. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Placed home i sold into business use in 1994. The zestimate for this single. Or form 8824,.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

I operate a home business. Solved•by intuit•14•updated july 14, 2022. Web trying to fill out 4797, schedule d and 8949 for the sale of primary residence. The sale or exchange of property. Web use form 8949, sales and other dispositions of capital assets, to report the sale or exchange of capital assets not reported on another form or schedule;

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Report the amount from line 1 above on form 4797, line 2, column (d); Web use form 4797 to report: This might include any property used to generate rental income or even a. In column (a), identify the section 1231 gains invested into a qof as “qof investment to. Web purpose of form use form 8949 to report sales and.

IRS Instructions 4797 2018 2019 Fill out and Edit Online PDF Template

The involuntary conversion of property and capital assets. Sales of assets may be entered in either the income. Web complete form 4797, line 2, columns (a), (b), and (c); In column (a), identify the section 1231 gains invested into a qof as “qof investment to. The disposition of noncapital assets.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. 8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224. Sales of assets may be entered in either the income. Or form 8824, line 12 or. Web complete form 4797, line 2, columns (a),.

IRS Form 8949 Instructions

Report the amount from line 1 above on form 4797, line 2, column (d); Placed home i sold into business use in 1994. Web form 8949 is used to list all capital gain and loss transactions. I operate a home business. 8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web purpose of form use form 8949 to report sales and exchanges of capital assets. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the. Web use form 4797 to report: The sale or exchange of property. Web form 8949.

Or Form 8824, Line 12 Or.

Or form 8824, parts i and ii. Web form 4797 is strictly used to report the sale and gains of business property real estate transactions. This might include any property used to generate rental income or even a. Web form 8949 is used to list all capital gain and loss transactions.

Sales Of Assets May Be Entered In Either The Income.

I operate a home business. 8949 n 97th st is in the north meadows neighborhood in milwaukee, wi and in zip code 53224. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that result. Web purpose of form use form 8949 to report sales and exchanges of capital assets.

Web Use Form 4797 To Report:

Web complete form 4797, line 2, columns (a), (b), and (c); The involuntary conversion of property and capital assets. Report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of. Placed home i sold into business use in 1994.

The Zestimate For This Single.

Solved•by intuit•14•updated july 14, 2022. Web if entering through fixed assets, the only acceptable date acquired and date of disposition entries are actual dates. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs. The sale or exchange of property.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://proconnect.intuit.com/community/image/serverpage/image-id/1455i57DF454B42459DE0?v=v2)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://i0.wp.com/millerfsllc.com/wp-content/uploads/Form-4797.jpg?fit=521%2C647&ssl=1)