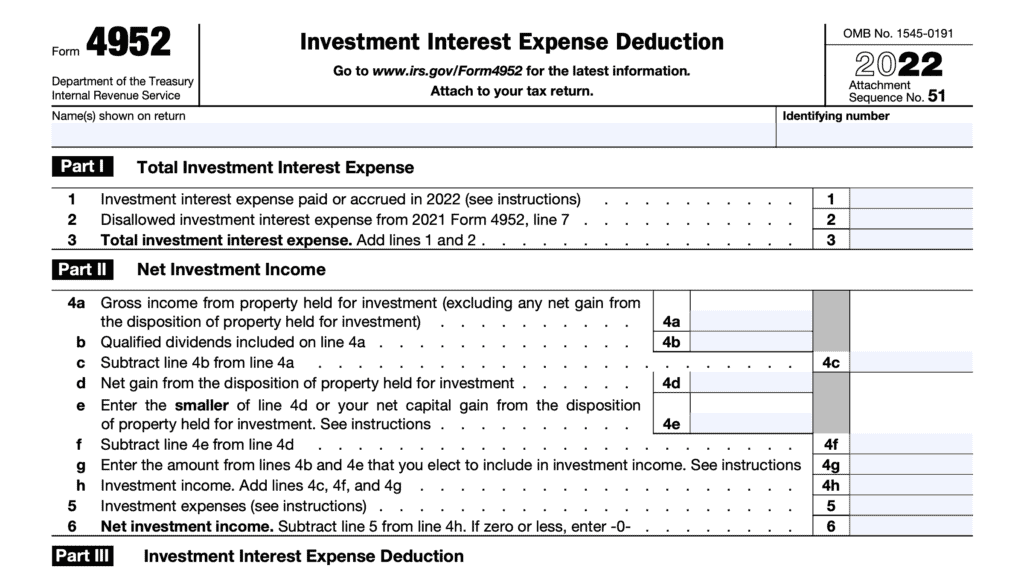

Form 4952 Instructions

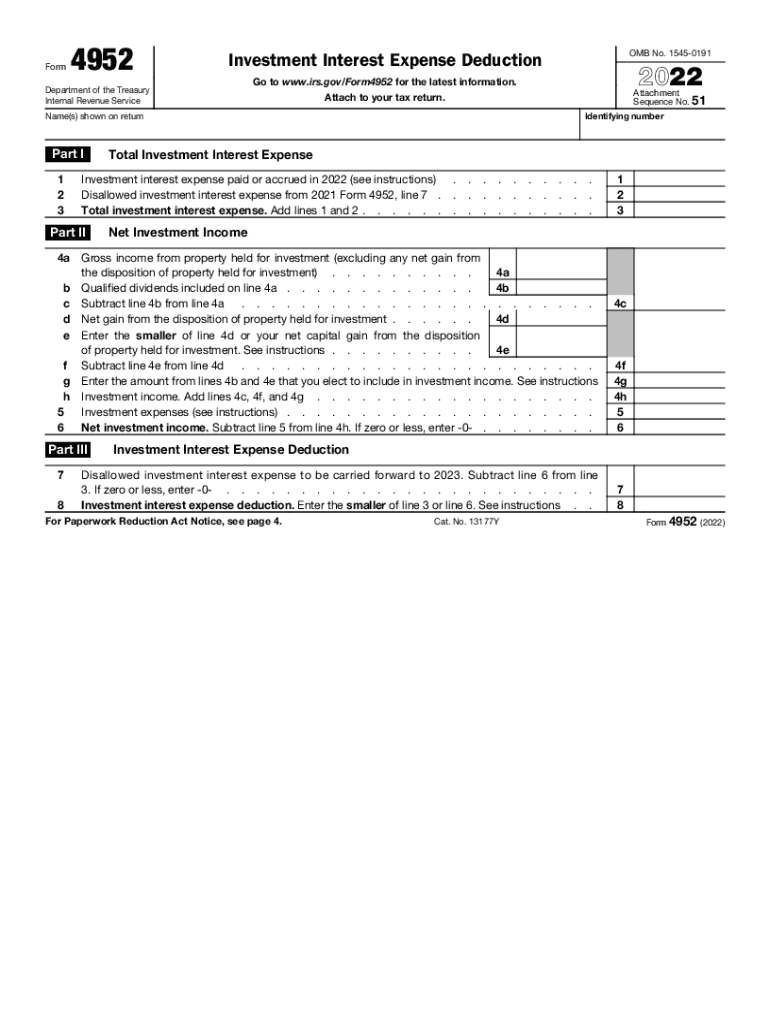

Form 4952 Instructions - Web see the form 8997 instructions. Your investment interest expense deduction is limited to your net investment income. Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest expense. Use form 6252 to report income from an installment sale on the installment method. 550, investment income and expenses. Individuals do not need to. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. For more information, see pub. Web who must file irs form 4952?

550, investment income and expenses. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest expense. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web who must file irs form 4952? Your investment interest expense deduction is limited to your net investment income. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Use form 6252 to report income from an installment sale on the installment method. Web see the form 8997 instructions. Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years.

Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file form 4952 with their income tax return. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest expense. Web who must file irs form 4952? Web the instructions for form 4952, investment interest expense deduction, and form 6251, alternative minimum tax—individuals, instruct taxpayers on how to compute the correct taxes under both systems. Your investment interest expense deduction is limited to your net investment income. Your investment interest expense deduction is limited to your net investment income. Individuals do not need to. Ultimately, whichever of your form 4952s shows the higher tax is the one you will have to file with the irs. 550, investment income and expenses. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years..

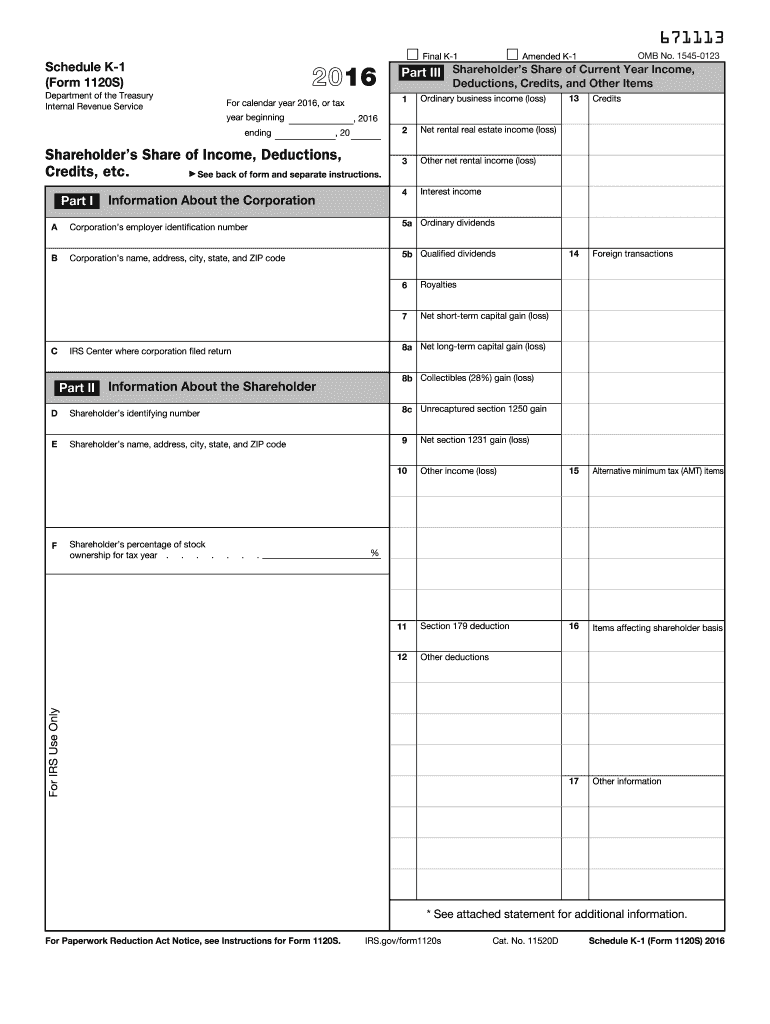

IRS 1120S Schedule K1 2016 Fill out Tax Template Online US Legal

Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Your investment interest expense.

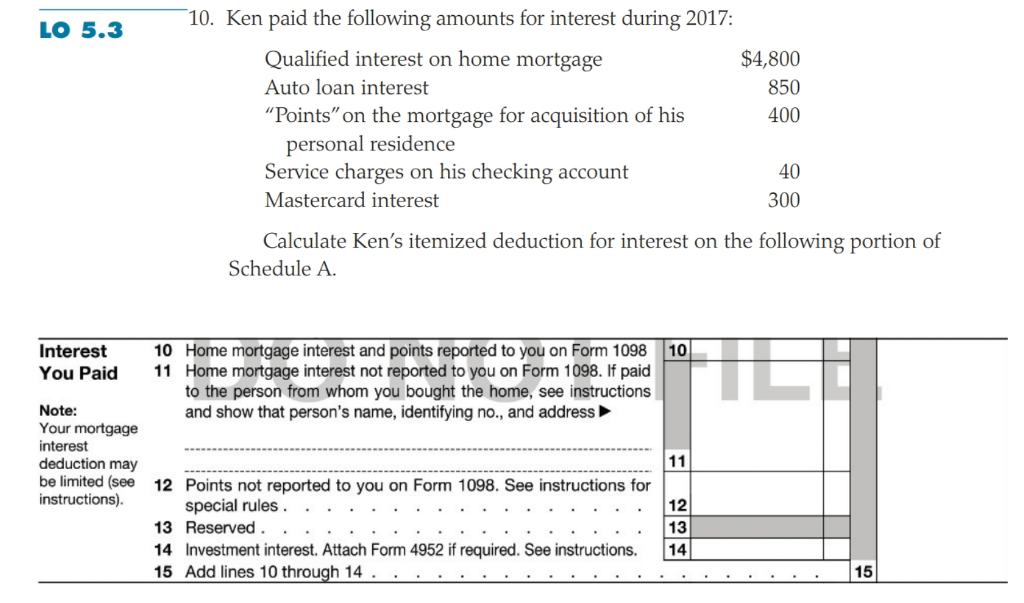

Solved 10. Ken paid the following amounts for interest

Web who must file irs form 4952? Individuals do not need to. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be.

Form 4952 Fill Out and Sign Printable PDF Template signNow

Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Ultimately, whichever of your form 4952s shows the higher tax is the one you will have to file with the irs. Use this form to figure the amount of investment interest expense you can.

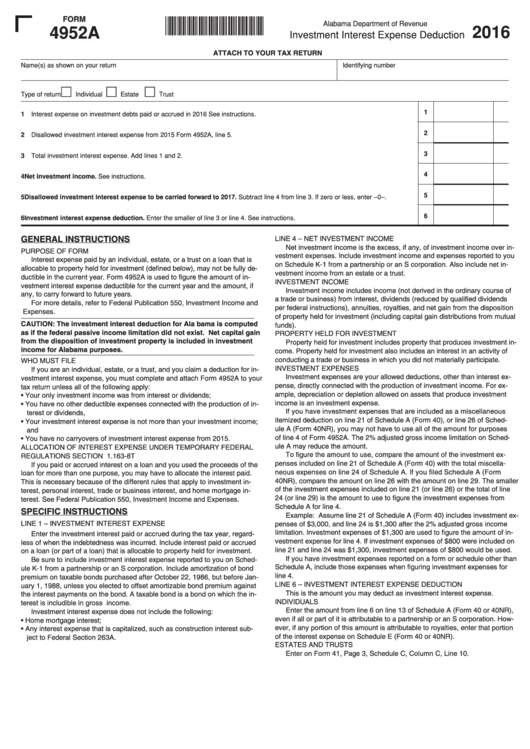

Form 4952a Investment Interest Expense Deduction 2016 printable pdf

Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. Web the instructions for form 4952, investment interest expense deduction, and form 6251, alternative minimum tax—individuals, instruct taxpayers on how to compute the correct taxes under both systems..

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

Your investment interest expense deduction is limited to your net investment income. Web see the form 8997 instructions. Individuals do not need to. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. Web information about form 4952,.

Fill Free fillable F4952 2019 Form 4952 PDF form

Instructions for form 4952 created date: Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. The total investment expense is $14,233 (this amount is calculated from the schedule a, line 27 (individual)). Web information about form 4952, investment interest expense deduction,.

Tax ReturnIndividual Project Three (after Chapter 8) Instructions

Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web who must file irs form 4952? Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future.

Solved Itemized Deductions SCHEDULE A (Form 1040) OMB No.

Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest expense. Instructions for form 4952 created date: For more information, see pub. Web who must file irs form 4952? The form must be filed by individuals, estates, or trusts.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years. Web who must file irs form 4952? Individuals do not need to. Instructions for form 4952 created date: Taxpayers who wish to claim investment interest expenses as a.

550, Investment Income And Expenses.

Use this form to figure the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Generally, an installment sale is a disposition of property where at least one payment is received after the end of the tax year in which the disposition occurs. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest expense. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward.

Web Information About Form 4952, Investment Interest Expense Deduction, Including Recent Updates, Related Forms And Instructions On How To File.

For more information, see pub. Web the instructions for form 4952, investment interest expense deduction, and form 6251, alternative minimum tax—individuals, instruct taxpayers on how to compute the correct taxes under both systems. Individuals do not need to. Web general instructions purpose of form use form 4952 to figure the amount of investment interest expense you can deduct for 2020 and the amount you can carry forward to future years.

Use Form 6252 To Report Income From An Installment Sale On The Installment Method.

Web see the form 8997 instructions. Web who must file irs form 4952? Ultimately, whichever of your form 4952s shows the higher tax is the one you will have to file with the irs. The total investment expense is $14,233 (this amount is calculated from the schedule a, line 27 (individual)).

Instructions For Form 4952 Created Date:

Your investment interest expense deduction is limited to your net investment income. Your investment interest expense deduction is limited to your net investment income. Use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. The form must be filed by individuals, estates, or trusts.