Form 5498 Due Date

Form 5498 Due Date - Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. But, for 2020 tax year, the deadline. Web filing form 5498 with the irs. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. What is irs form 5498? Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. If the due date falls on a weekend or. The irs form 5498 exists so that financial institutions can report ira information. Web generally, the deadline to file form 5498 is may 31.

But, for 2020 tax year, the deadline. Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. If the due date falls on a weekend or. The form will be mailed to you in late may after all contributions have been made for that year. Web generally, the deadline to file form 5498 is may 31. The irs form 5498 exists so that financial institutions can report ira information. Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. Web as a result form 5498 reports all contributions made up until the tax filing date. Web filing form 5498 with the irs. It is by this date form 5498 must be sent to the irs and to ira owners and.

Complete, edit or print tax forms instantly. The trustee or custodian of your ira reports. Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Contributions to similar accounts, such as. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. But, for 2020 tax year, the deadline has been extended to june 30, 2021. The form will be mailed to you in late may after all contributions have been made for that year. It is by this date form 5498 must be sent to the irs and to ira owners and. Web • transmission reporting option:

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

But, for 2020 tax year, the deadline has been extended to june 30, 2021. The form will be mailed to you in late may after all contributions have been made for that year. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Contributions to similar accounts, such as..

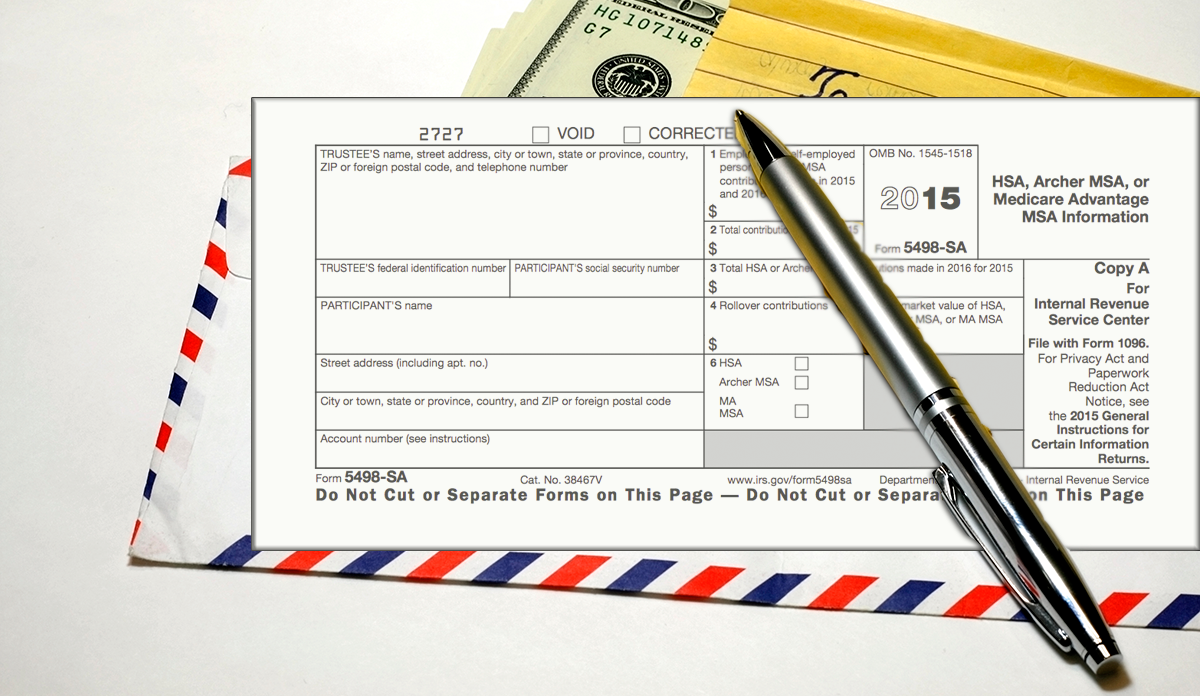

What is IRS Form 5498SA? BRI Benefit Resource

But, for 2020 tax year, the deadline. Web generally, the deadline to file form 5498 is may 31. The trustee or custodian of your ira reports. Contributions to similar accounts, such as. Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023.

5498 Software to Create, Print & EFile IRS Form 5498

Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. The form will be mailed to you in late may after all contributions have been made for that year. But, for 2020 tax year, the deadline. Complete, edit or print tax.

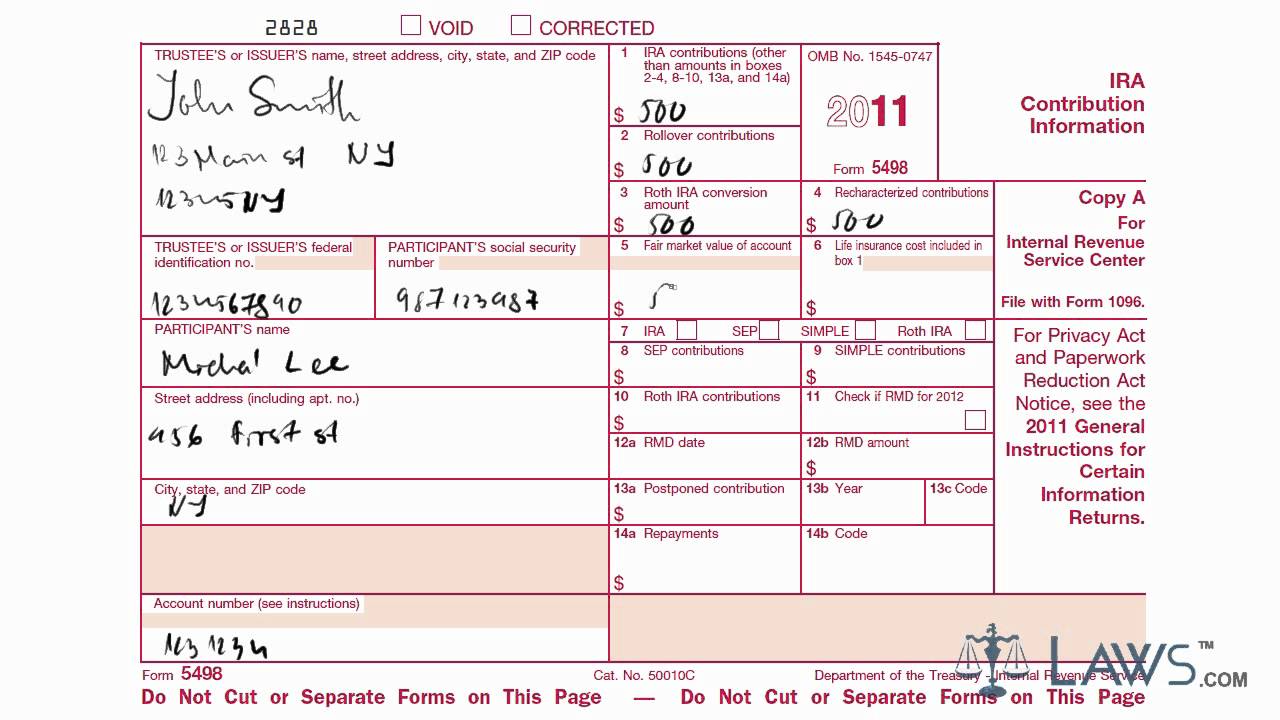

What is Form 5498? New Direction Trust Company

Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. Web • transmission reporting option: Web as a result form 5498 reports all contributions made up until the tax filing date. Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may.

Form 5498 IRA Contribution Information Definition

But, for 2020 tax year, the deadline has been extended to june 30, 2021. Web filing form 5498 with the irs. Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions..

The Purpose of IRS Form 5498

Web filing form 5498 with the irs. What is irs form 5498? When is the deadline for filing form 5498? Complete, edit or print tax forms instantly. If the due date falls on a weekend or.

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. The form will be mailed to you in late may after all contributions have been made for that year. Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing.

How To Prepare and File Form 5498 Blog TaxBandits

Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. Contributions to similar accounts, such as. But, for 2020 tax year, the deadline. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web • transmission reporting option: But, for 2020 tax year, the deadline has been extended to june 30, 2021. Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year. Web generally, the deadline to file form 5498 is may 31. Web file form 5498, ira contribution information, with.

Form 5498 YouTube

It is by this date form 5498 must be sent to the irs and to ira owners and. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. Web the ira contribution tax form, or tax form 5498, is an official.

But, For 2020 Tax Year, The Deadline.

The form will be mailed to you in late may after all contributions have been made for that year. But, for 2020 tax year, the deadline has been extended to june 30, 2021. Web • transmission reporting option: Web the deadline for taxpayers to receive their form 5498 from their ira custodian is may 31 of the following tax year.

Web As A Result Form 5498 Reports All Contributions Made Up Until The Tax Filing Date.

When is the deadline for filing form 5498? If the due date falls on a weekend or. Complete, edit or print tax forms instantly. Web up to 10% cash back as mentioned earlier, the 2022 form 5498 filing deadline is may 31, 2023.

Web Filing Form 5498 With The Irs.

The irs form 5498 exists so that financial institutions can report ira information. It is by this date form 5498 must be sent to the irs and to ira owners and. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Contributions to similar accounts, such as.

Web Generally, The Deadline To File Form 5498 Is May 31.

Web for participants who made a postponed contribution due to an extension of the contribution due date because of a federally designated disaster, shows the code fd. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. The trustee or custodian of your ira reports. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including.

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)