Form 7004 Filing

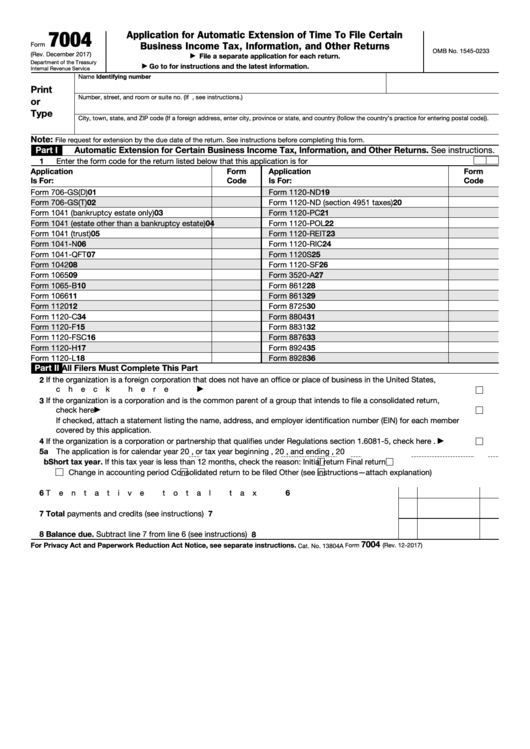

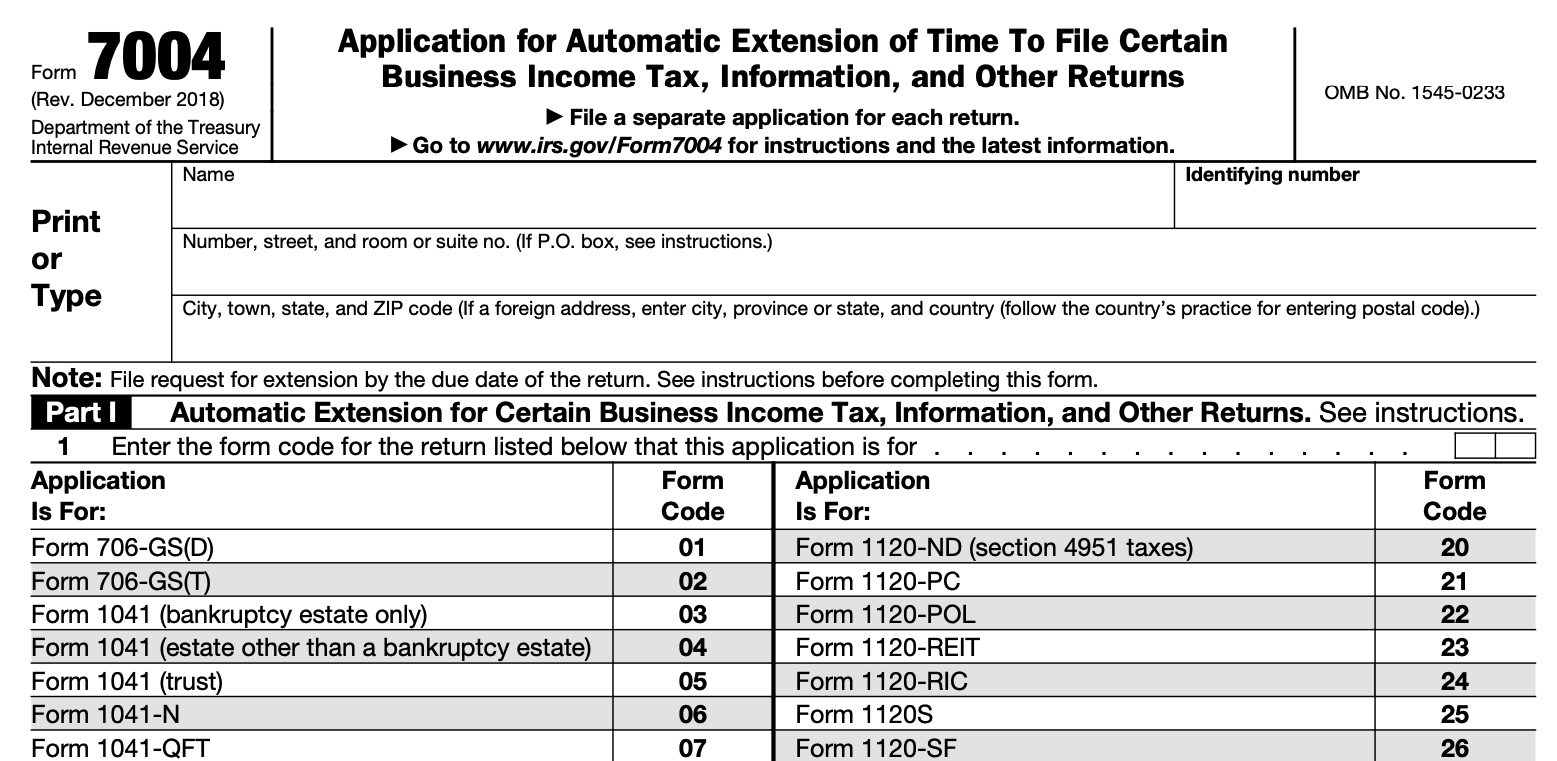

Form 7004 Filing - Select business entity & form step 3: Payment of tax line 1a—extension date. There are three different parts to this tax. A foreign corporation with an office or place of business. Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. Enter tax payment details step 5: Complete, edit or print tax forms instantly. Web form 7004 is a document that enables business owners to request a tax filing extension for certain tax forms. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 7004 can be filed electronically for most returns.

January 6, 2022 | last updated: There are three different parts to this tax. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Enter business details step 2: Select the appropriate form from the table below to determine where to. Complete, edit or print tax forms instantly. Enter tax payment details step 5: The irs form 7004 offers businesses an extension of. Download or email irs 7004 & more fillable forms, register and subscribe now!

Select the tax year step 4: Ad get ready for tax season deadlines by completing any required tax forms today. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? A foreign corporation with an office or place of business. Ad get ready for tax season deadlines by completing any required tax forms today. There are three different parts to this tax. Our website is dedicated to providing. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns.

extension form 7004 for 2022 IRS Authorized

There are three different parts to this tax. Select business entity & form step 3: Select the tax year step 4: Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Payment of tax line 1a—extension date.

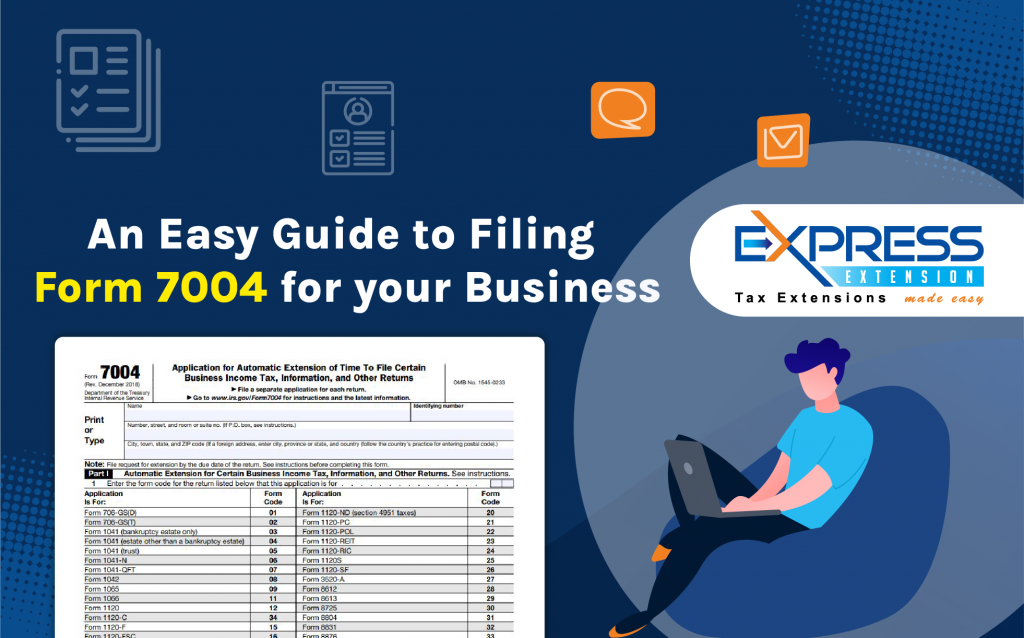

An Easy Guide to Filing Form 7004 for your Business Blog

Web purpose of form. January 6, 2022 | last updated: Web there are two ways to submit form 7004: There are three different parts to this tax. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

How to Fill Out Tax Form 7004 Tax forms, Irs tax forms,

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Enter business details step 2: Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web form 7004 is used to extend the.

E File Form 7004 Online Universal Network

Ad get ready for tax season deadlines by completing any required tax forms today. Web use the chart to determine where to file form 7004 based on the tax form you complete. A foreign corporation with an office or place of business. Enter tax payment details step 5: Web irs form 7004 is the application for automatic extension of time.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Download or email irs 7004 & more fillable forms, register and subscribe now! Our website is dedicated to providing. January 6, 2022 | last updated: Web irs form 7004 is the application for.

An Overview of Tax Extension Form 7004 Blog ExpressExtension

Web march 10, 2023. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Select business entity & form step 3: Enter.

Free Fillable Irs Form 7004 Printable Forms Free Online

Web use the chart to determine where to file form 7004 based on the tax form you complete. Transmit your form to the irs ready to e. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web march 10, 2023. Web generally,.

What Partnerships Need to Know About Form 7004 for Tax Year 2020 Blog

Transmit your form to the irs ready to e. February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Web form 7004 can be filed electronically.

A Simple Guide to Filing the 2020 Form 7004 for Businesses Blog

A foreign corporation with an office or place of business. Download or email irs 7004 & more fillable forms, register and subscribe now! Select business entity & form step 3: February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. Payment of tax line 1a—extension date.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web use the chart to determine where to file form 7004 based on the tax form you complete. Web there are two ways to submit form 7004: Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 is used to extend the deadline for filing tax returns.

Web Form 7004 Is Used To Extend The Deadline For Filing Tax Returns (Certain Business Tax, Information, And Other Returns).

The irs uses the form to document the businesses that have. Enter business details step 2: A foreign corporation with an office or place of business. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns.

Web Form 7004 Is A Document That Enables Business Owners To Request A Tax Filing Extension For Certain Tax Forms.

Download or email irs 7004 & more fillable forms, register and subscribe now! February 2, 2023 extensions of time to file tax day might be circled in red on your calendar, but circumstances may. January 6, 2022 | last updated: Web there are two ways to submit form 7004:

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web purpose of form. Enter tax payment details step 5: Ad get ready for tax season deadlines by completing any required tax forms today. Payment of tax line 1a—extension date.

Web Irs Form 7004 Is The Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns. It's Used To Request More.

Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Web form 7004 can be filed electronically for most returns. The irs form 7004 offers businesses an extension of. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.