Form 843 Pdf

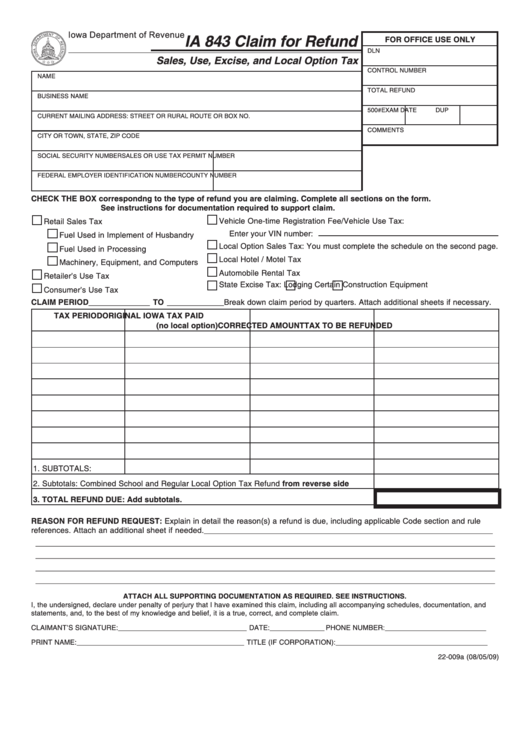

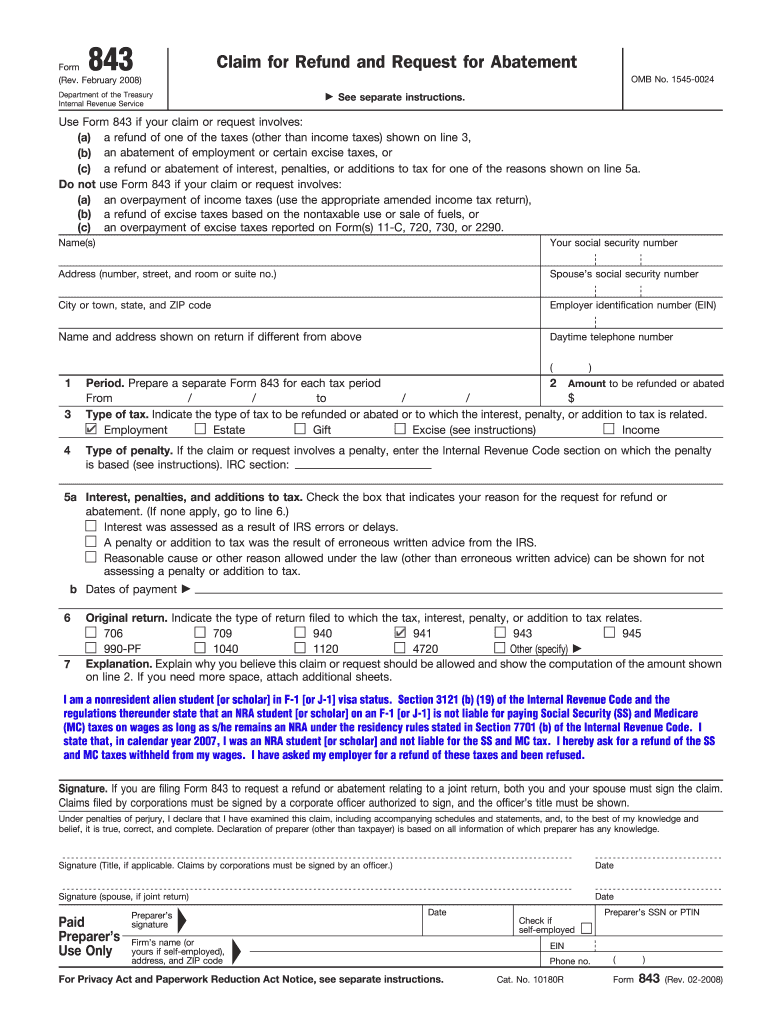

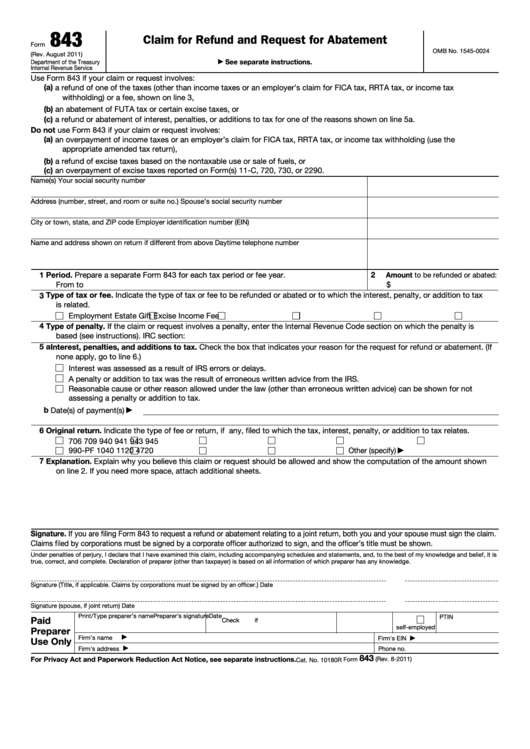

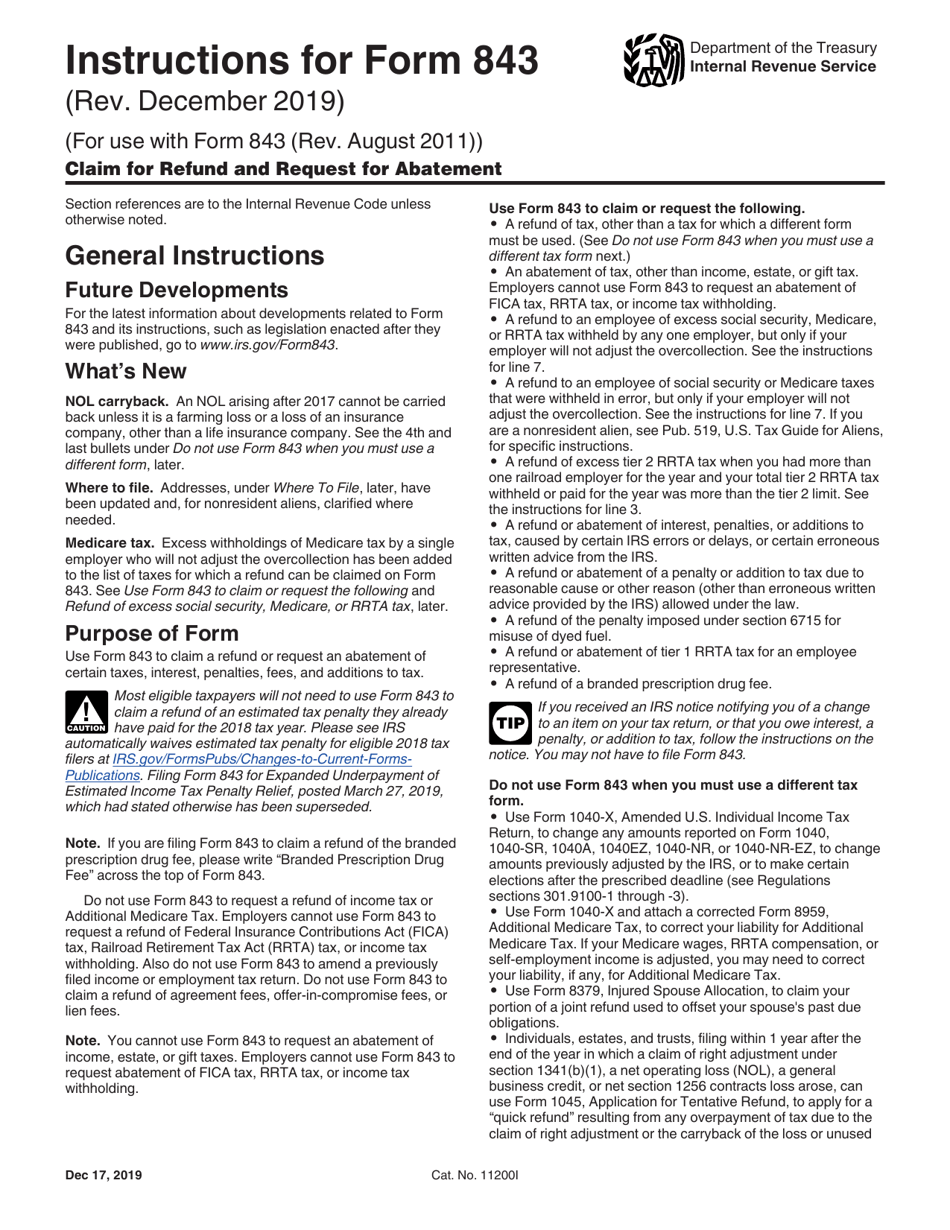

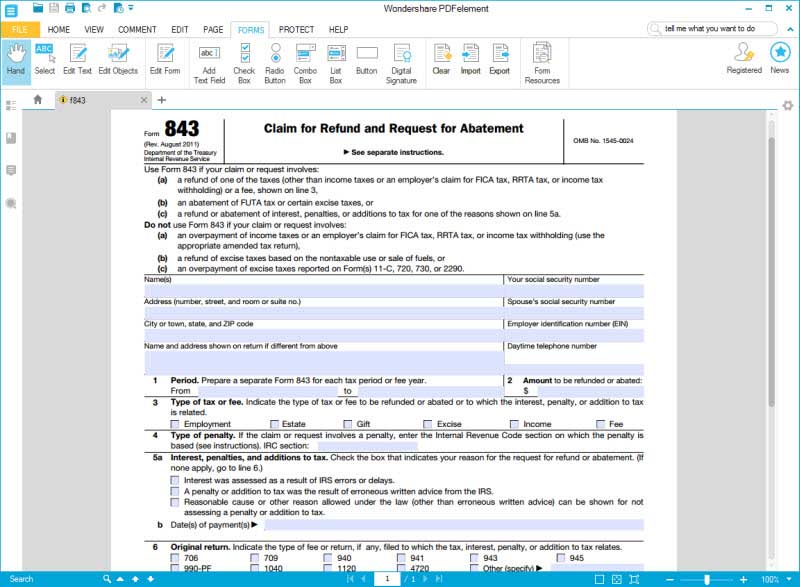

Form 843 Pdf - November 2002) department of the treasury internal revenue service see separate. Web fill online, printable, fillable, blank form 843: Ad access irs tax forms. Web taxpayers can complete form 843: Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web dd form 843, jul 55. Web please note instructions are provided for illustrative purposes. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Check the instructions for form 843 for where to mail.

However, there are quite a few ways. Check the instructions for form 843 for where to mail. The most common use for form 843 is to wipe away a taxes interest, tax penalties, and interest penalties. The presence of form 843 in a return will not prevent the rest of the return from being e. Complete, edit or print tax forms instantly. Web dd form 843, jul 55. Web use form 843 to file a claim for refund of certain overpaid taxes, interest, penalties, and additions to tax. Web form 843 omb no. Get ready for tax season deadlines by completing any required tax forms today. Web effective august 12, 2013, if you are filing form 843 in response to letter 4658 (notice of branded prescription drug fee), note that the mailstop number in the.

Ad access irs tax forms. However, there are quite a few ways. Use fill to complete blank online irs pdf forms for free. Web please note instructions are provided for illustrative purposes. Ad upload, modify or create forms. Web you can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Web effective august 12, 2013, if you are filing form 843 in response to letter 4658 (notice of branded prescription drug fee), note that the mailstop number in the. Check the instructions for form 843 for where to mail. Complete, edit or print tax forms instantly. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause.

Form 843 Edit, Fill, Sign Online Handypdf

Download or email irs 843 & more fillable forms, register and subscribe now! If you are filing form 843. Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. Use fill to complete blank online irs pdf forms for free. November 2002) department of the treasury internal revenue service see.

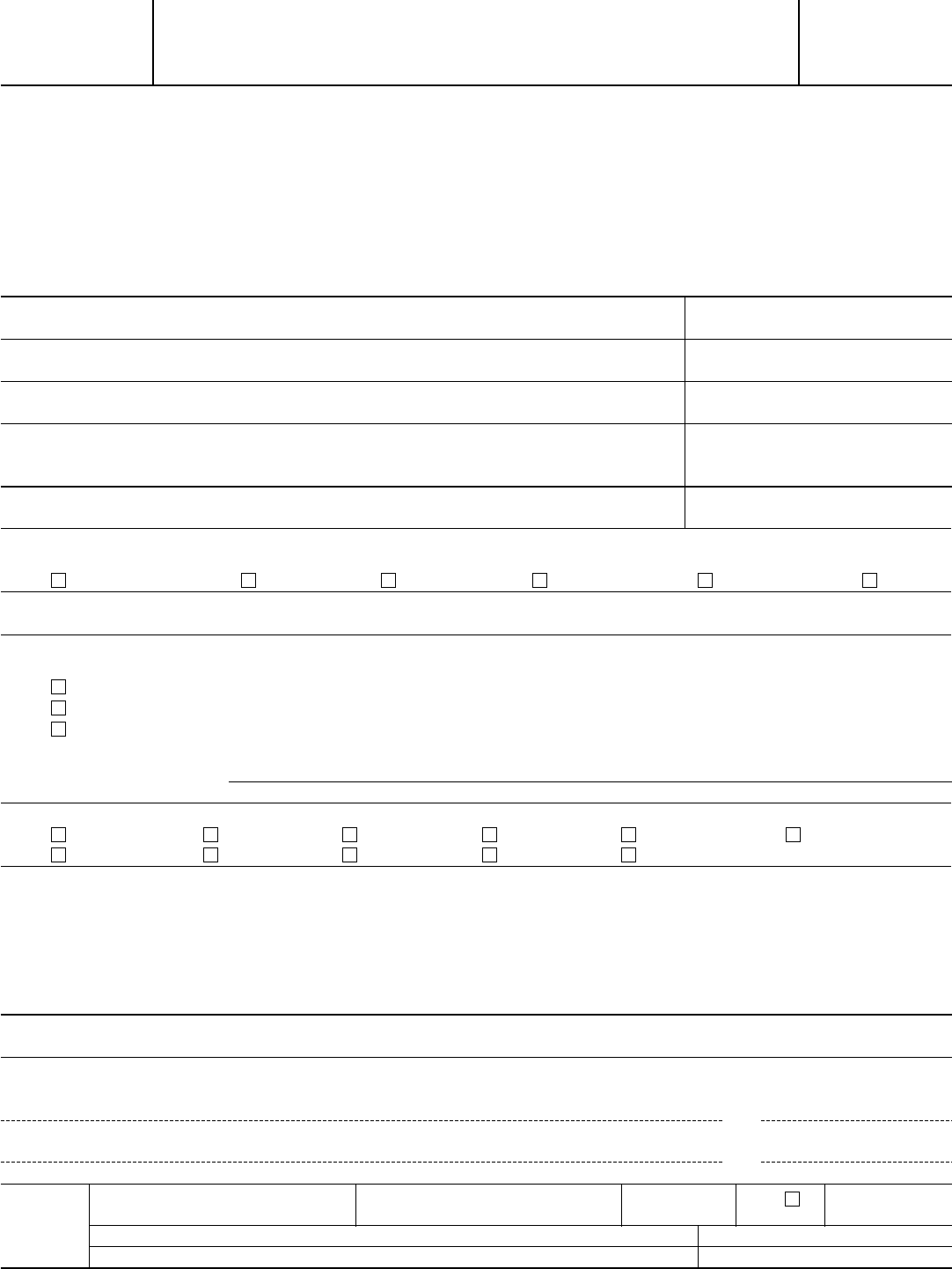

Form Ia 843 Claim For Refund printable pdf download

Web form 843 omb no. Web you can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. The most common use for form 843 is to wipe away a taxes interest, tax penalties, and interest penalties. Choose the correct version of the editable pdf form from the list and. Web information about.

Form 843 Download Fillable PDF or Fill Online Motion to Modify Parental

Only by next of kin. Form 8316 (pdf) form 8316 example (pdf) form. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web you can use form 843 to request the irs to abate or erase certain taxes, penalties, fees, and interest. Try it for free now!

Form 843 Rev February Claim for Refund and Request for Abatement Wings

Complete form 843 “claim for refund. Use fill to complete blank online irs pdf forms for free. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Web effective august 12, 2013, if you are filing form 843 in response to letter 4658 (notice of.

Irs Form 843 Address Fill Out and Sign Printable PDF Template signNow

Web fill online, printable, fillable, blank form 843: Web find and fill out the correct 843 form. Try it for free now! In most cases, you can only get the interest erased if it’s related to an irs. November 2002) department of the treasury internal revenue service see separate.

Get Your Tax Refund Faster by Filing IRS Form 843

Try it for free now! Web find and fill out the correct 843 form. Form 8316 (pdf) form 8316 example (pdf) form. Requisition for printing and binding service. Ad upload, modify or create forms.

Fillable Form 843 (Rev. August 2011) printable pdf download

Check the instructions for form 843 for where to mail. Web what is irs form 843 used for? Choose the correct version of the editable pdf form from the list and. Web dd form 843, jul 55. Web effective august 12, 2013, if you are filing form 843 in response to letter 4658 (notice of branded prescription drug fee), note.

Download Instructions for IRS Form 843 Claim for Refund and Request for

Form 8316 (pdf) form 8316 example (pdf) form. Web please note instructions are provided for illustrative purposes. Web find and fill out the correct 843 form. In most cases, you can only get the interest erased if it’s related to an irs. Check the instructions for form 843 for where to mail.

AF Form 843 Download Fillable PDF or Fill Online Backflow Prevention

Web what is irs form 843 used for? November 2002) department of the treasury internal revenue service see separate. Complete form 843 “claim for refund. Use fill to complete blank online irs pdf forms for free. Web mailing addresses for form 843;

IRS Form 843 Fill it Right the First Time

The most common use for form 843 is to wipe away a taxes interest, tax penalties, and interest penalties. Web required to request a refund of social security and medicare taxes and must be submitted with form 843. Claim for refund and request for abatement (irs) form. Only by next of kin. Web what is irs form 843 used for?

Check The Instructions For Form 843 For Where To Mail.

Complete, edit or print tax forms instantly. Form 8316 (pdf) form 8316 example (pdf) form. More about the federal form 843 we last updated federal. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to.

Web Find And Fill Out The Correct 843 Form.

Only by next of kin. Web required to request a refund of social security and medicare taxes and must be submitted with form 843. Web taxpayers can complete form 843: The value of the one vehicle cannot be more than $25,000.

Claim For Refund And Request For Abatement (Irs) Form.

Try it for free now! If you are filing form 843. Web please note instructions are provided for illustrative purposes. Web mailing addresses for form 843;

For Example, If On Your Employment Tax Return You Reported And Paid.

Choose the correct version of the editable pdf form from the list and. Ad upload, modify or create forms. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return.