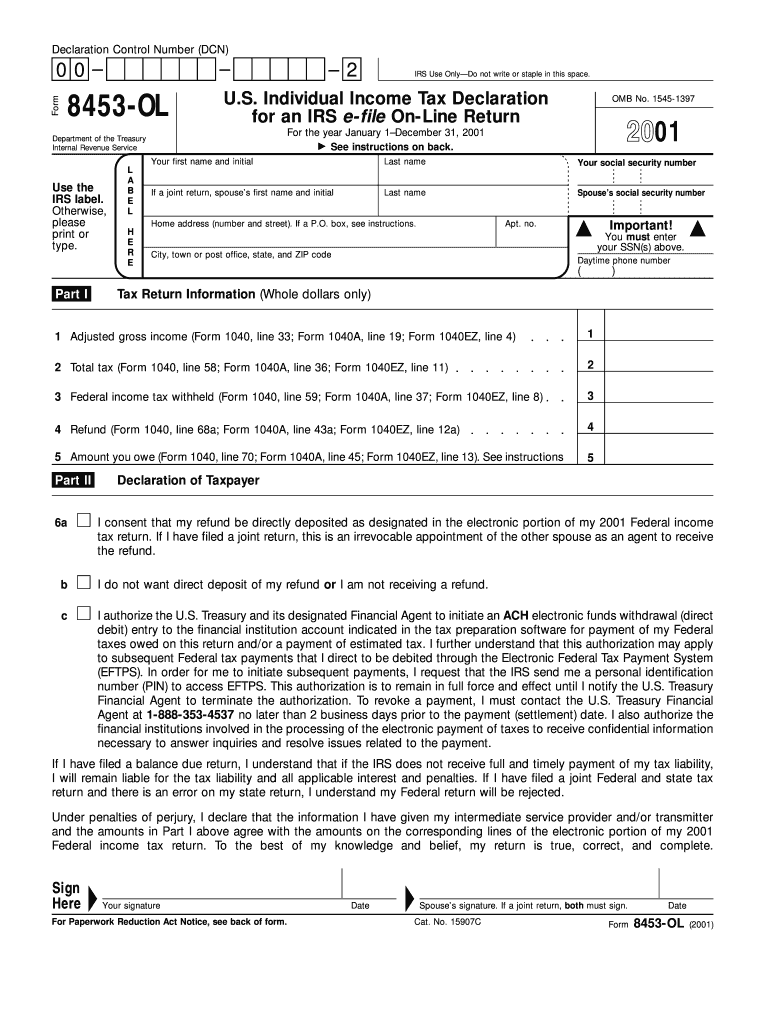

Form 8453-Ol

Form 8453-Ol - Web information about form 8453, u.s. Part i tax return information (whole dollars only) 1. Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. By signing this form, you declare that the return is true, correct, and complete. Web do not mail this form to the ftb. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your Refund or no amount due. By signing this form, you declare that the return is true, correct, and complete. This form is for income earned in tax year 2022, with tax returns due in april 2023.

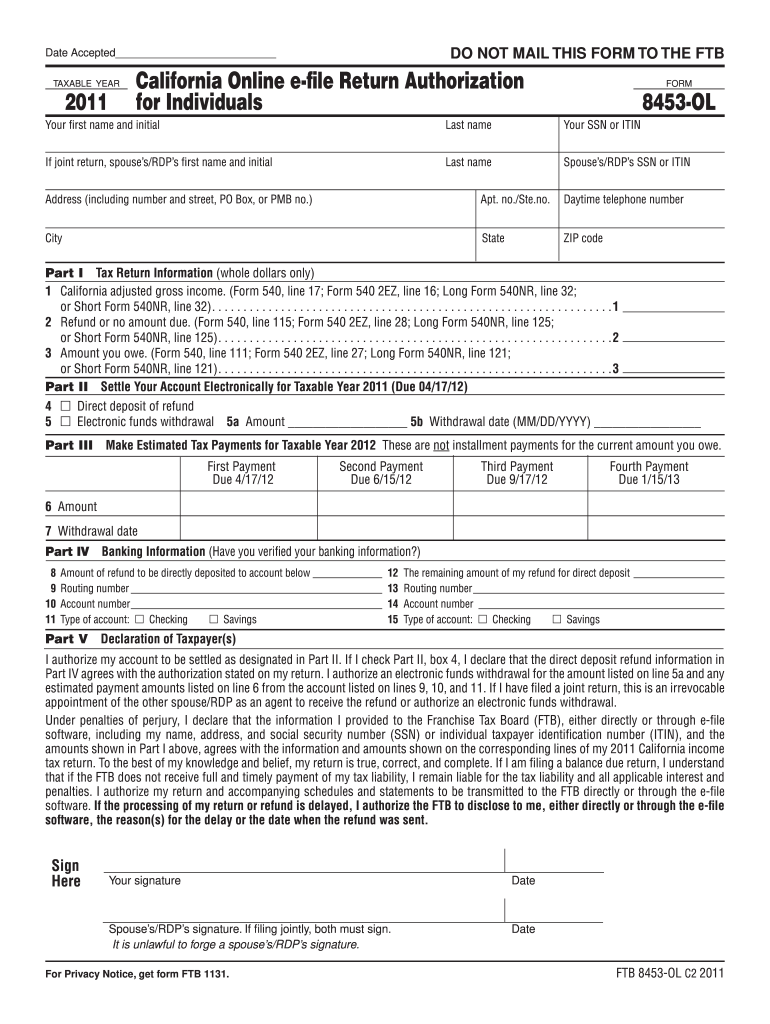

Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Refund or no amount due. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your Web information about form 8453, u.s. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. By signing this form, you declare that the return is true, correct, and complete. Web do not mail this form to the ftb. This form is for income earned in tax year 2022, with tax returns due in april 2023. Part i tax return information (whole dollars only) 1.

Web information about form 8453, u.s. Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. Refund or no amount due. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web do not mail this form to the ftb. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your Part i tax return information (whole dollars only) 1. By signing this form, you declare that the return is true, correct, and complete.

Form Va 8453 Fill Online, Printable, Fillable, Blank pdfFiller

Web do not mail this form to the ftb. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Web information about form 8453, u.s. By signing this form, you declare that the return is true, correct, and complete. Web if you are an ero,.

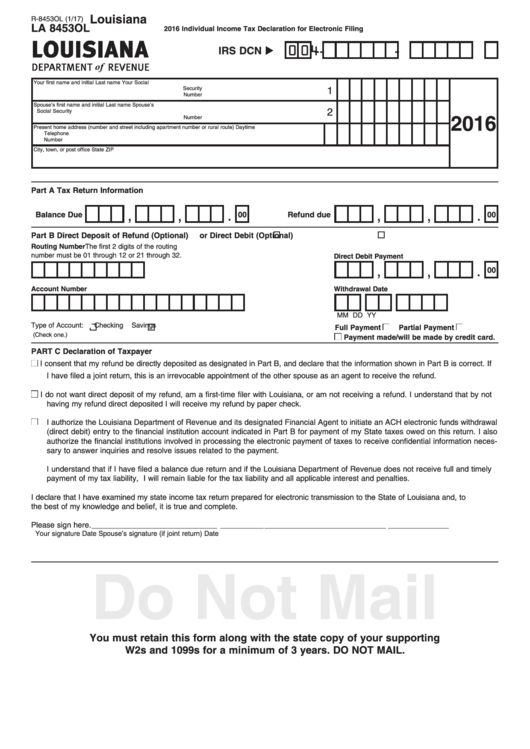

8453 Ol Form Louisiana Department Of Revenue Individual Tax

Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. By signing this form, you declare that the return is true, correct, and complete. Web information about form 8453, u.s. Refund or no amount due. If you are filing.

Form 8453 U.S. Individual Tax Transmittal for an IRS efile

Part i tax return information (whole dollars only) 1. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front.

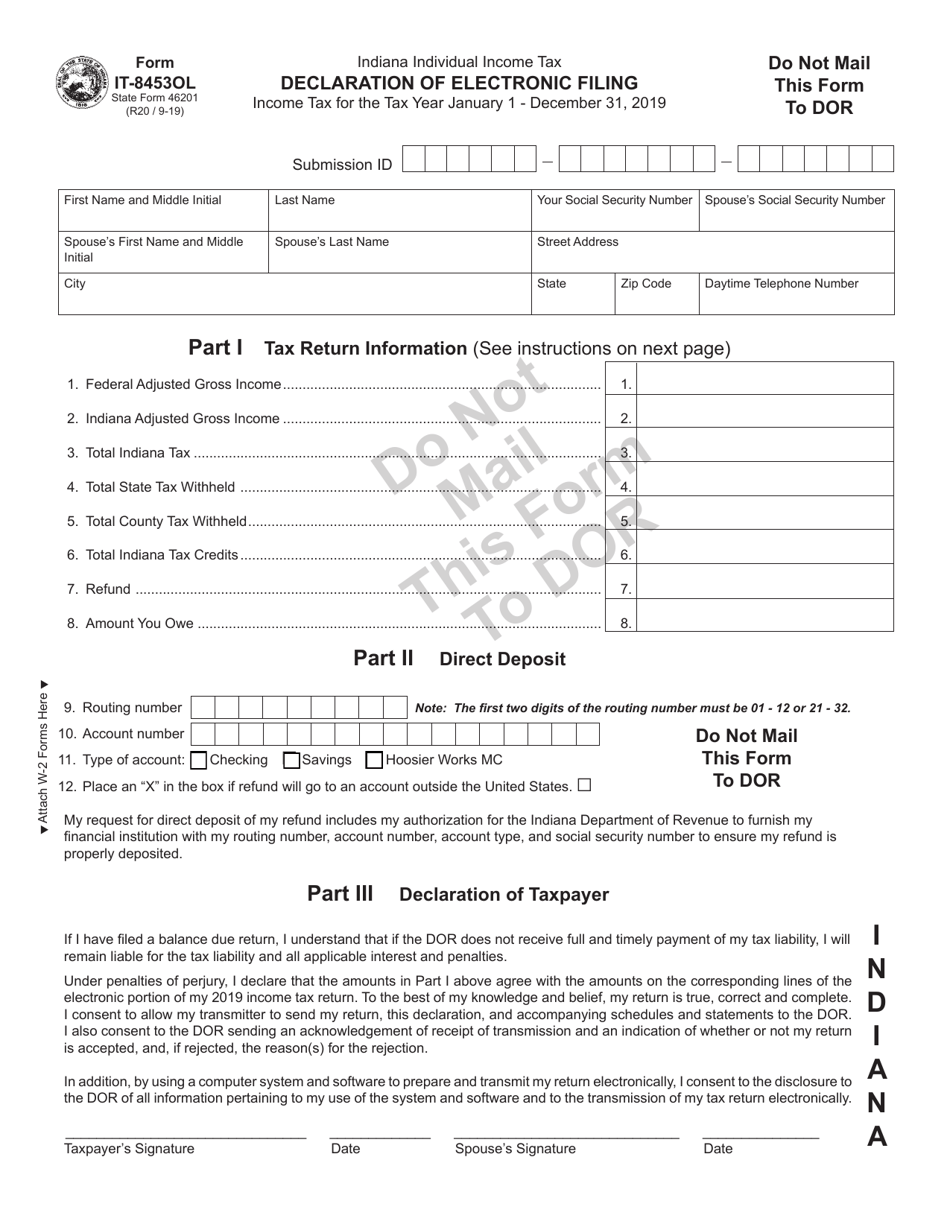

Form IT8453OL (State Form 46201) Download Fillable PDF or Fill Online

Refund or no amount due. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your By signing this form, you declare that the return is true, correct, and complete. Web do not mail this form to the ftb. Part i tax return.

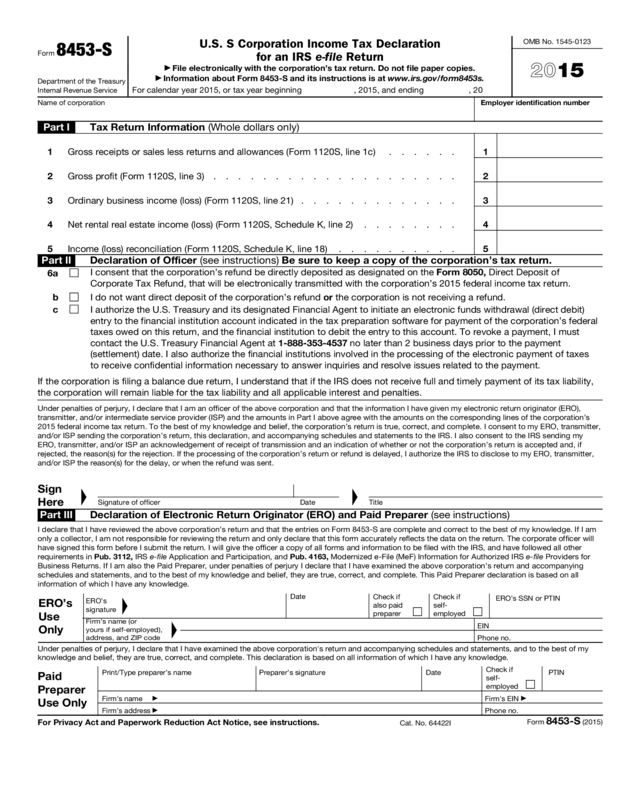

Form 8453S Edit, Fill, Sign Online Handypdf

Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. Refund or no amount due. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on.

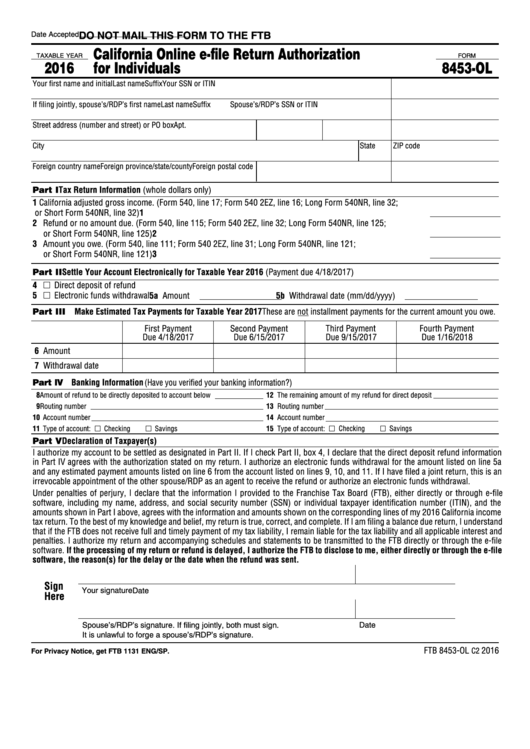

Fillable Form 8453Ol California Online EFile Return Authorization

Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. By signing this form, you declare that the return is true, correct, and complete. Web do not mail this form to the ftb. By signing this form, you declare that the return is.

8453 Fill out and Edit Online PDF Template

By signing this form, you declare that the return is true, correct, and complete. Refund or no amount due. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. By signing this form, you declare that the return is true, correct, and complete. This form.

Form 8453OL Fill out & sign online DocHub

Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. By signing this form, you declare that the return is true, correct, and complete. We will update this page with a new version of the form for 2024 as soon as it is.

8453 ol Fill out & sign online DocHub

If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your Web do not mail this form to the ftb. Part i tax return information (whole dollars only) 1. We will update this page with a new version of the form for 2024.

Online Tax Where To File Online Tax Return

We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your By signing this form, you declare that.

By Signing This Form, You Declare That The Return Is True, Correct, And Complete.

Web if you are an ero, you must mail form 8453 to the irs within 3 business days after receiving acknowledgement that the irs has accepted the electronically filed tax return. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Web do not mail this form to the ftb. If you are filing your tax return using an online provider, mail form 8453 to the irs within 3 business days after you have received acknowledgement from your

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

By signing this form, you declare that the return is true, correct, and complete. Refund or no amount due. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Part i tax return information (whole dollars only) 1.