Form 8606 Roth Conversion Example

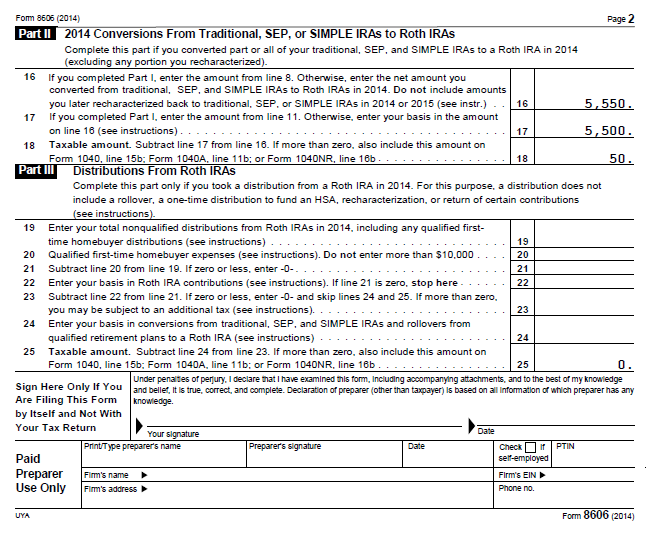

Form 8606 Roth Conversion Example - Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira must be able to distinguish between the conversion assets. Enter the nondeductible contribution you made to a traditional ira in 2020. This will involve part ii: Web how to fill out irs form 8606. Web by jared trexler. The market had gone down and i only got $5090 in my tira when the. “2020 conversions from traditional, sep, or simple. Web step two the full distribution does not need to be converted to a roth ira. Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. Contributing to a nondeductible traditional ira.

However, when there’s a mix of pretax and. Web how to fill out irs form 8606. File form 8606 when you convert a traditional ira to a roth ira. Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira must be able to distinguish between the conversion assets. Web a client in his late 70's converted $40k from traditional ira to roth ira. Web the main reasons for filing form 8606 include the following: Enter the nondeductible contribution you made to a traditional ira in 2020. Ameriprise issued him a 1099r with code 7 in box 7, they sent him a letter telling to. Web step two the full distribution does not need to be converted to a roth ira.

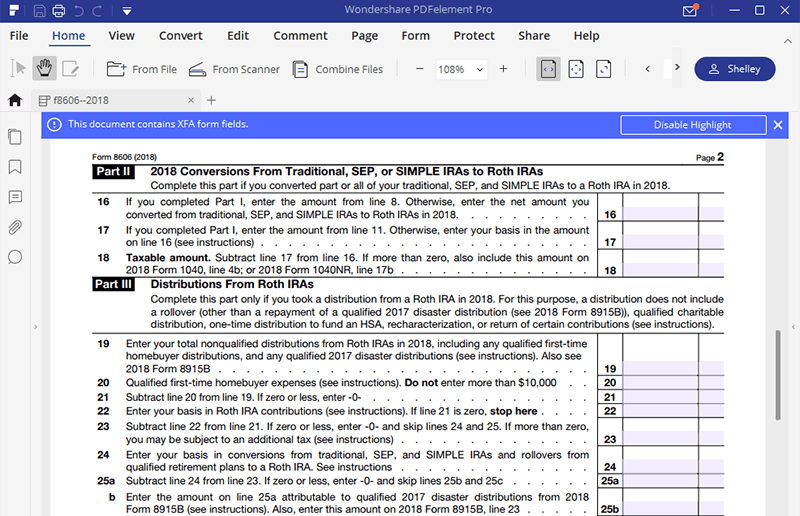

Web step two the full distribution does not need to be converted to a roth ira. Web the main reasons for filing form 8606 include the following: This represents the ratio of basis to total ira assets. Later i recharacterized this contribution. Conversions must be reported on form 8606, part ii. However, when there’s a mix of pretax and. The max in 2020 was $6,000 so let’s assume that for the rest of this. Check out how to fill it out in this brief video! Input as decimal using 3 decimal places. Web how to fill out irs form 8606.

The Backdoor Roth IRA and December 31st The FI Tax Guy

Web by jared trexler. Web step two the full distribution does not need to be converted to a roth ira. Conversions must be reported on form 8606, part ii. Web 1 i made a $5500 contribution to my roth ira in 2015 (t1). This represents the ratio of basis to total ira assets.

for How to Fill in IRS Form 8606

File form 8606 when you convert a traditional ira to a roth ira. Web your total roth conversions line 10 divide line 5 by line 9. Web step two the full distribution does not need to be converted to a roth ira. Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira.

united states How to file form 8606 when doing a recharacterization

Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. “2020 conversions from traditional, sep, or simple. The max in 2020 was $6,000 so let’s assume that for the rest of this. Web your total roth conversions line 10 divide line 5 by line 9. Web.

Backdoor Roth conversion form 8606

Ed slott has talked about reporting roth ira conversions in all of his seminars, and the slott report has touched on the subject in multiple entries. Filling out form 8606 is necessary after completing a backdoor roth conversion. The max in 2020 was $6,000 so let’s assume that for the rest of this. File form 8606 when you convert a.

form 8606 for roth conversion Fill Online, Printable, Fillable Blank

Web your total roth conversions line 10 divide line 5 by line 9. Later i recharacterized this contribution. Contributing to a nondeductible traditional ira. Web part i of form 8606 line 1: Web go to www.irs.gov/form8606 for instructions and the latest information.

First time backdoor Roth Conversion. form 8606 help

Web by jared trexler. “2020 conversions from traditional, sep, or simple. Web 1 i made a $5500 contribution to my roth ira in 2015 (t1). Conversions must be reported on form 8606, part ii. Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira must be able to distinguish between the conversion.

Form 8606 YouTube

Web you’ll need to report the transfer on form 8606 to tell the irs which portion of your roth conversion is taxable, he said. Web step two the full distribution does not need to be converted to a roth ira. Web your total roth conversions line 10 divide line 5 by line 9. Conversions must be reported on form 8606,.

First time backdoor Roth Conversion. form 8606 help

Web step two the full distribution does not need to be converted to a roth ira. Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira must be able to distinguish between the conversion assets. File form 8606 when you convert a traditional ira to a roth ira. Check out how to.

Roth Ira Conversion Form Universal Network

Input as decimal using 3 decimal places. The market had gone down and i only got $5090 in my tira when the. This will involve part ii: File form 8606 when you convert a traditional ira to a roth ira. Ed slott has talked about reporting roth ira conversions in all of his seminars, and the slott report has touched.

Backdoor IRA Gillingham CPA

Enter the nondeductible contribution you made to a traditional ira in 2020. The max in 2020 was $6,000 so let’s assume that for the rest of this. Web go to www.irs.gov/form8606 for instructions and the latest information. Input as decimal using 3 decimal places. Check out how to fill it out in this brief video!

Web A Client In His Late 70'S Converted $40K From Traditional Ira To Roth Ira.

File form 8606 when you convert a traditional ira to a roth ira. Ed slott has talked about reporting roth ira conversions in all of his seminars, and the slott report has touched on the subject in multiple entries. Web by jared trexler. Filling out form 8606 is necessary after completing a backdoor roth conversion.

Input As Decimal Using 3 Decimal Places.

Web roth ira conversions an individual who converts their traditional, sep, or simple ira to a roth ira must be able to distinguish between the conversion assets. Ameriprise issued him a 1099r with code 7 in box 7, they sent him a letter telling to. The market had gone down and i only got $5090 in my tira when the. Web your total roth conversions line 10 divide line 5 by line 9.

Web You’ll Need To Report The Transfer On Form 8606 To Tell The Irs Which Portion Of Your Roth Conversion Is Taxable, He Said.

The max in 2020 was $6,000 so let’s assume that for the rest of this. Web the main reasons for filing form 8606 include the following: Enter the nondeductible contribution you made to a traditional ira in 2020. This represents the ratio of basis to total ira assets.

However, When There’s A Mix Of Pretax And.

Web part i of form 8606 line 1: Web step two the full distribution does not need to be converted to a roth ira. Web go to www.irs.gov/form8606 for instructions and the latest information. “2020 conversions from traditional, sep, or simple.