Form 8865 Instruction

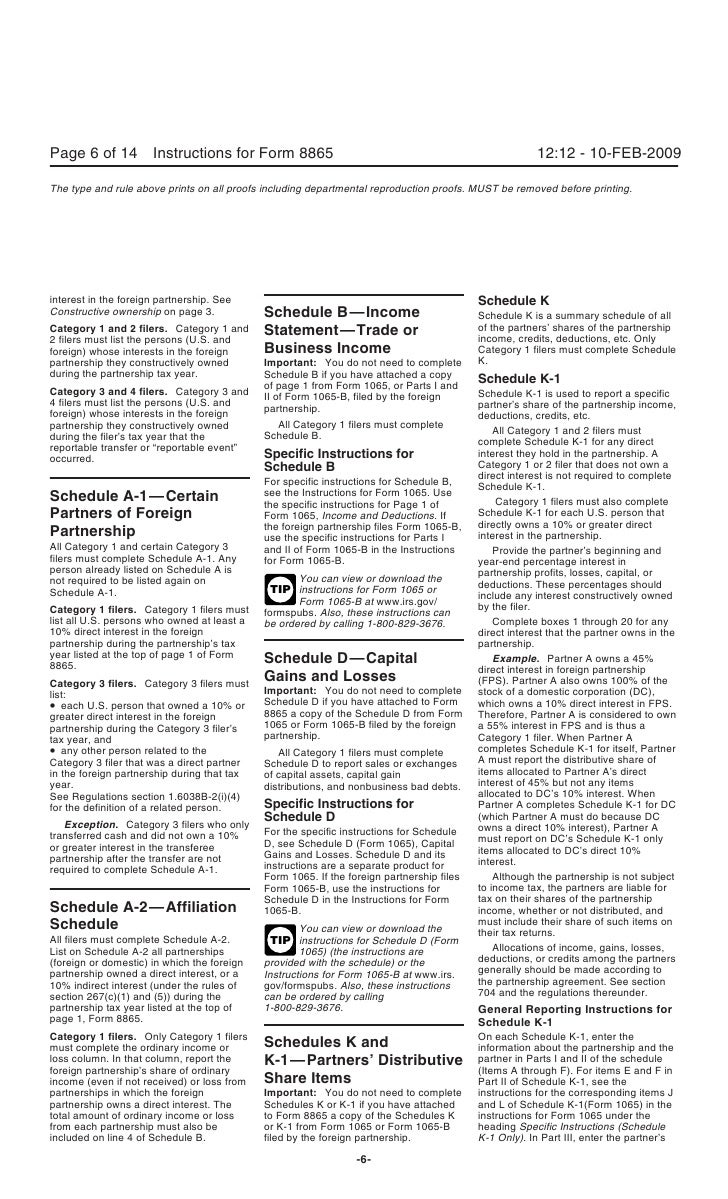

Form 8865 Instruction - Web settings\plkgb\desktop\my forms\8865\8865 instructions\10i8865.xml (init. Printing and scanning is no longer the best way to manage documents. The purpose of the form is to allow the irs to record. Web 5 things you should know about irs form 8865. Web form 8865, schedule k, is a summary schedule of all of the partners’ shares of the partnership income, credits, deductions, etc. Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the tax return to which the form 8865 is being attached. Only category 1 filers must complete form. Income tax return for an s corporation ;and u.s. Persons with respect to certain foreign partnerships. Form 8865 is used to report.

As is the case with many other. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. Web there are several ways to submit form 4868. Try it for free now! Information furnished for the foreign partnership’s tax year. Who must file form 8865; Persons who have an interest in a foreign partnership. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web for instructions and the latest information. Web if form 8865 applies to you, then you’ll need to know:

Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the form 8832 to the tax return to which the form 8865 is being attached. Go digital and save time with signnow, the. Web if form 8865 applies to you, then you’ll need to know: Web there are several ways to submit form 4868. Web form 8865 is used by u.s. As is the case with many other. Use form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If you own at least 10% of a controlled foreign partnership, you may be required to file form 8865. Complete, edit or print tax forms instantly.

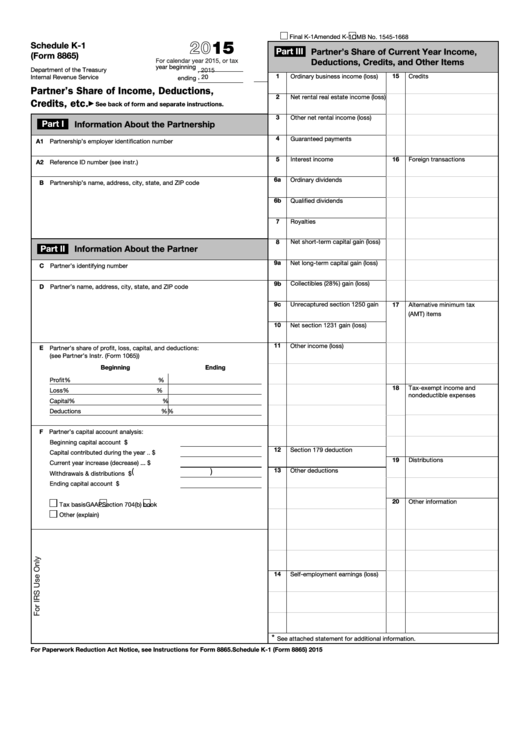

Fillable Form 8865 Schedule K1 Partner'S Share Of

Upload, modify or create forms. Try it for free now! Web settings\plkgb\desktop\my forms\8865\8865 instructions\10i8865.xml (init. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s. A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions.

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Dollars, translating them from the functional currency (i.e., generally a foreign. Form 8865 is used to report. Go digital and save time with signnow, the. The purpose of the form is to allow the irs to record. Web form 8865 requires reporting the foreign partnership’s income statement and balance sheet in u.s.

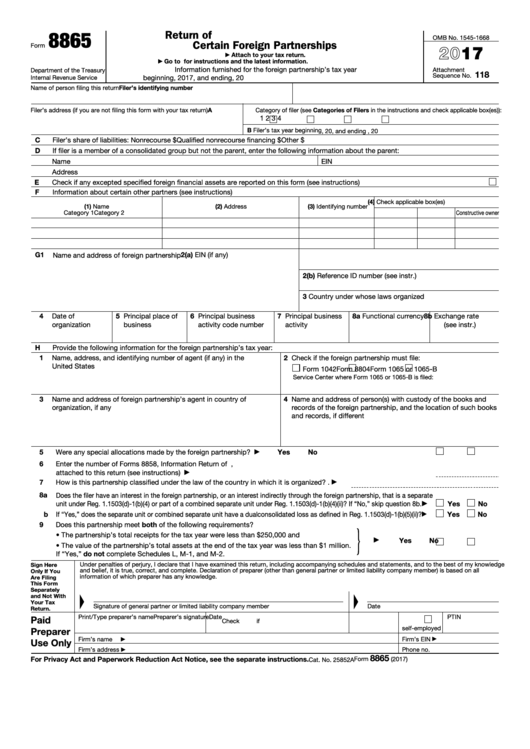

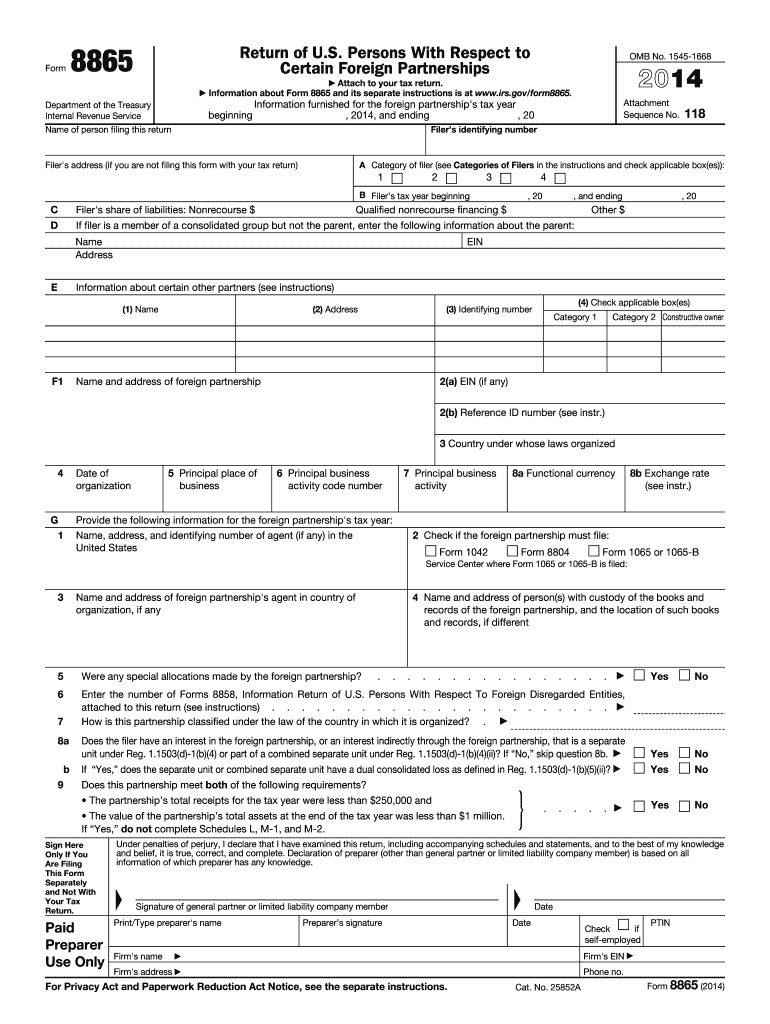

Fillable Form 8865 Return Of U.s. Persons With Respect To Certain

Complete, edit or print tax forms instantly. Web form 8865, schedule k, is a summary schedule of all of the partners’ shares of the partnership income, credits, deductions, etc. Who must file form 8865; Only category 1 filers must complete form. Web form 8865 & instructions form 8865 refers to the irs’ return of u.s.

8865 Form Fill Out and Sign Printable PDF Template signNow

Persons who have an interest in a foreign partnership. A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions. Persons with respect to certain foreign partnerships. Web where to file in the instructions for form 8832 to determine if you are required to attach a copy of the.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

Web irs form 8865 (pdf available here) deals with the deduction of a percentage of foreign or global income beginning in tax year 2018. Persons to report information regarding controlled foreign partnerships (section 6038), transfers to foreign partnerships (section 6038b), and. Go digital and save time with signnow, the. The information that you will need to provide on. Persons with.

Form 8865 Tax Returns for Foreign Partnerships

Beginning, 2020, and ending, 20. Complete, edit or print tax forms instantly. Web handy tips for filling out instructions notice uscis form online. Form 8865 is used to report. Upload, modify or create forms.

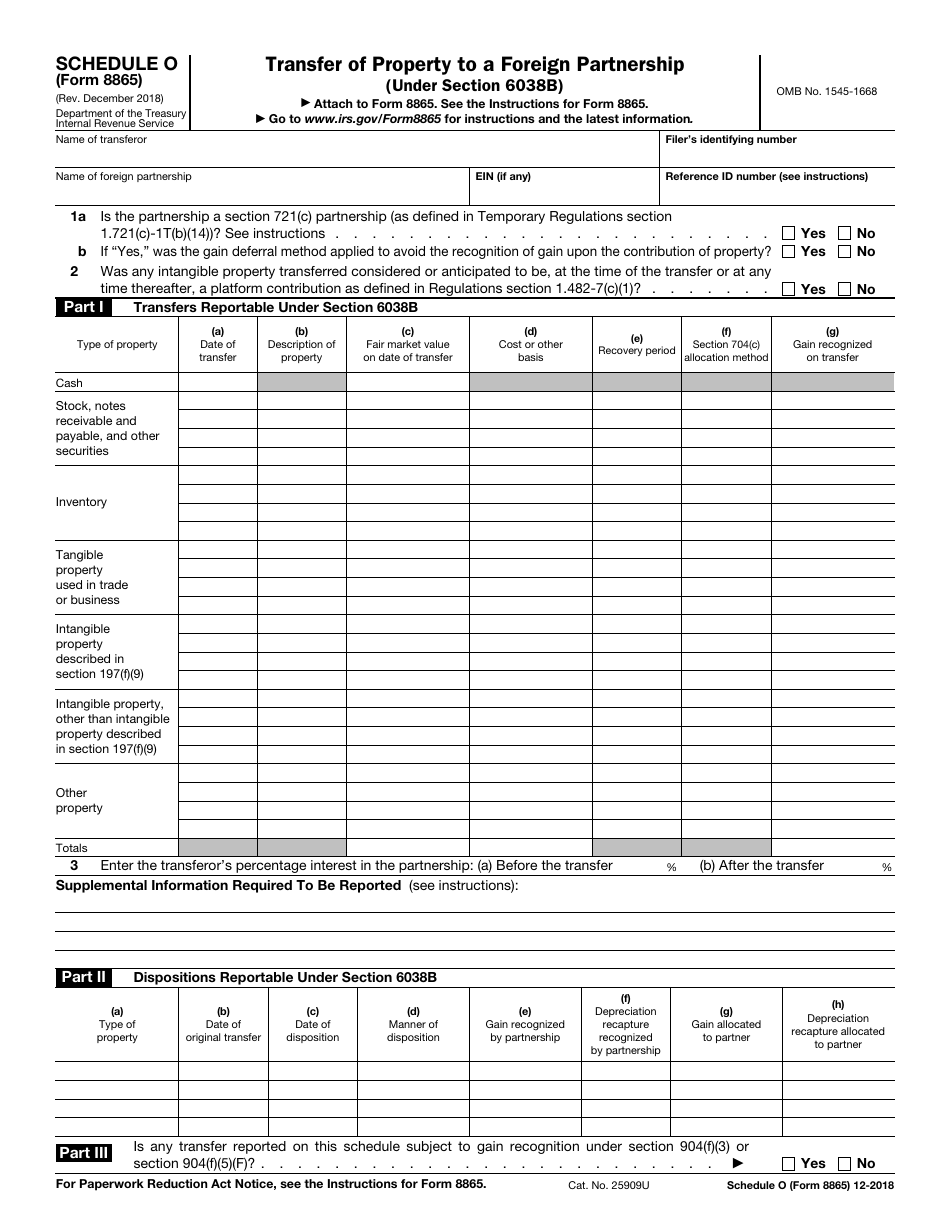

IRS Form 8865 Schedule O Download Fillable PDF or Fill Online Transfer

The information that you will need to provide on. Persons with respect to certain foreign partnerships. Web partnerships filing form 1065, u.s. Try it for free now! Web 5 things you should know about irs form 8865.

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Web form 8865 is an informational tax form that is required to be filed by u.s. Go digital and save time with signnow, the. The information that you will need to provide on. Upload, modify or create forms. Web handy tips for filling out instructions notice uscis form online.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

Persons who have an interest in a foreign partnership. Go digital and save time with signnow, the. The information that you will need to provide on. Complete, edit or print tax forms instantly. Printing and scanning is no longer the best way to manage documents.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

What the irs defines as a partnership; Web 5 things you should know about irs form 8865. Web if form 8865 applies to you, then you’ll need to know: Complete, edit or print tax forms instantly. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Web Where To File In The Instructions For Form 8832 To Determine If You Are Required To Attach A Copy Of The Form 8832 To The Tax Return To Which The Form 8865 Is Being Attached.

Who must file form 8865; Complete, edit or print tax forms instantly. Printing and scanning is no longer the best way to manage documents. Beginning, 2020, and ending, 20.

Dollars, Translating Them From The Functional Currency (I.e., Generally A Foreign.

Web who has to file form 8865? Web irs form 8865 (pdf available here) deals with the deduction of a percentage of foreign or global income beginning in tax year 2018. Web if form 8865 applies to you, then you’ll need to know: The information that you will need to provide on.

Web Form 8865 Is An Informational Tax Form That Is Required To Be Filed By U.s.

As is the case with many other. Upload, modify or create forms. Web settings\plkgb\desktop\my forms\8865\8865 instructions\10i8865.xml (init. Web handy tips for filling out instructions notice uscis form online.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 8865 & instructions form 8865 refers to the irs’ return of u.s. Persons who have an interest in a foreign partnership. Information furnished for the foreign partnership’s tax year. Web 5 things you should know about irs form 8865.