Form 965 Instructions

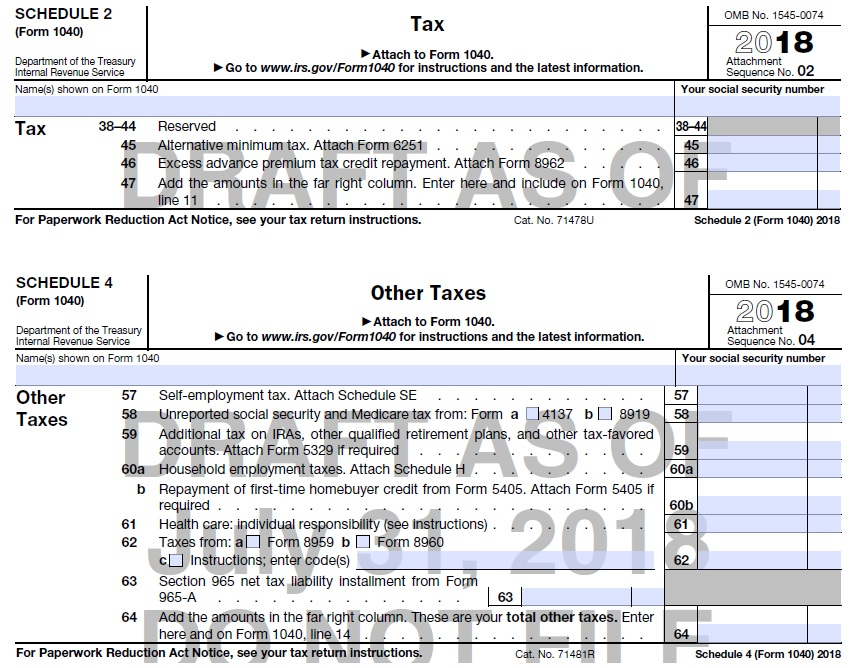

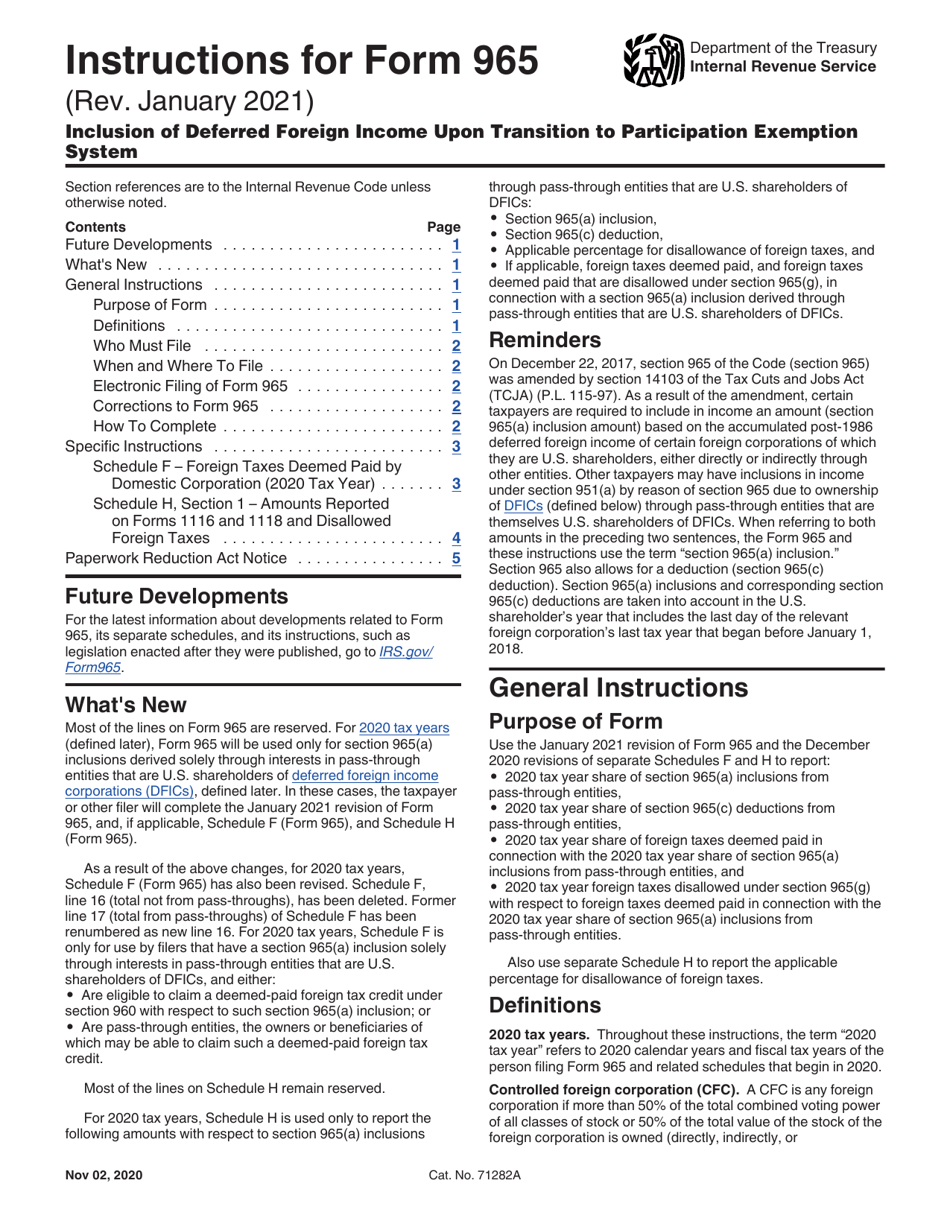

Form 965 Instructions - When and where to file within 30. Web follow these reporting instructions along with attaching the irc 965 transition tax statement form 965(a) amount [1] 965(c) deduction [2] foreign tax credit (ftc). Web up to 10% cash back taxpayers that have a code sec. Web (form 965) (january 2019) u.s. This form is used to report a. Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service attach to form 965. Web most of the lines on form 965 are reserved. On december 22, 2017, section 965 of the code (section 965) was amended. Section 965(a) inclusions from pass. Net 965 tax liability for.

Web most of the lines on form 965 are reserved. This form is used to report a. 965 in a tax year beginning in 2017 or 2018 tax year, or both, must complete and. Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of. Do not use spaces when performing a product number/title search (e.g. Web the person’s deemed paid foreign taxes with respect to the total amount required to be included in income by reason of section 965(a). Web follow these reporting instructions along with attaching the irc 965 transition tax statement: Web up to 10% cash back taxpayers that have a code sec. 965 (a) inclusion and use the streamlined filing compliance procedures must come into compliance for the. As a result of the amendment, certain taxpayers are required to include in income an.

Web (form 965) (january 2019) deferred foreign income corporation’s earnings and profits (e&p) department of the treasury internal revenue service attach to form 965. Do not use spaces when performing a product number/title search (e.g. Web most of the lines on form 965 are reserved. Web daf form 965 is a tax form used by members of the united states armed forces (usaf) who are on an overseas tour duty assignment. Section 965(a) inclusions from pass. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). 965 in a tax year beginning in 2017 or 2018 tax year, or both, must complete and. Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service attach to form 965. Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of. Web instructions to form 965, inclusion of deferred foreign income upon transition to participation exemption system, released january 5.

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

Web follow these reporting instructions along with attaching the irc 965 transition tax statement form 965(a) amount [1] 965(c) deduction [2] foreign tax credit (ftc). Web most of the lines on form 965 are reserved. Web (form 965) (january 2019) deferred foreign income corporation’s earnings and profits (e&p) department of the treasury internal revenue service attach to form 965. 965.

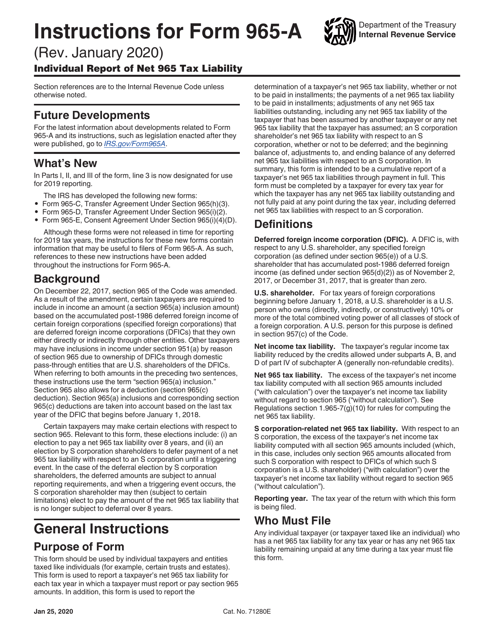

Download Instructions for IRS Form 965A Individual Report of Net 965

This form is used to report a. Web instructions to form 965, inclusion of deferred foreign income upon transition to participation exemption system, released january 5. Web (form 965) (january 2019) deferred foreign income corporation’s earnings and profits (e&p) department of the treasury internal revenue service attach to form 965. Web form 965, inclusion of deferred foreign income upon transition.

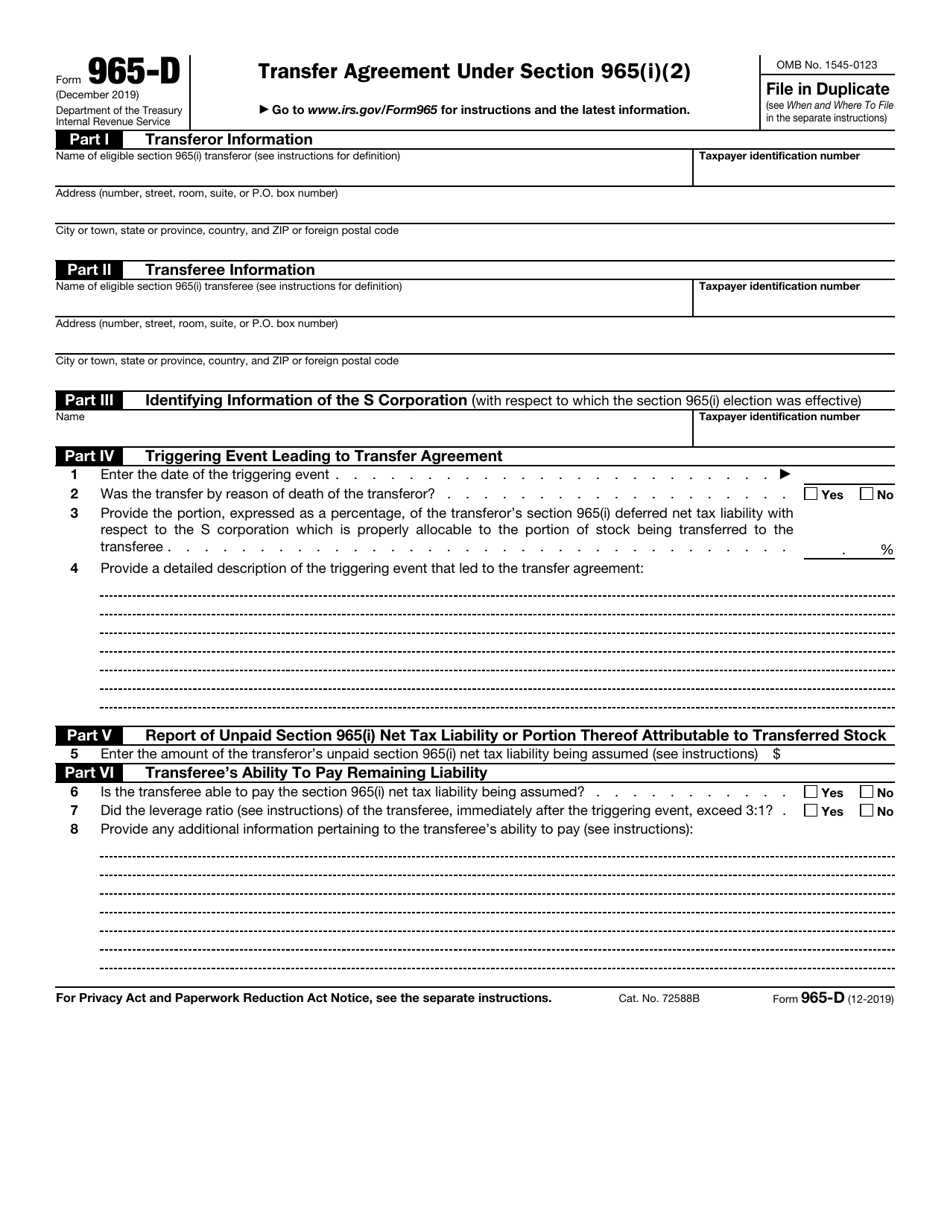

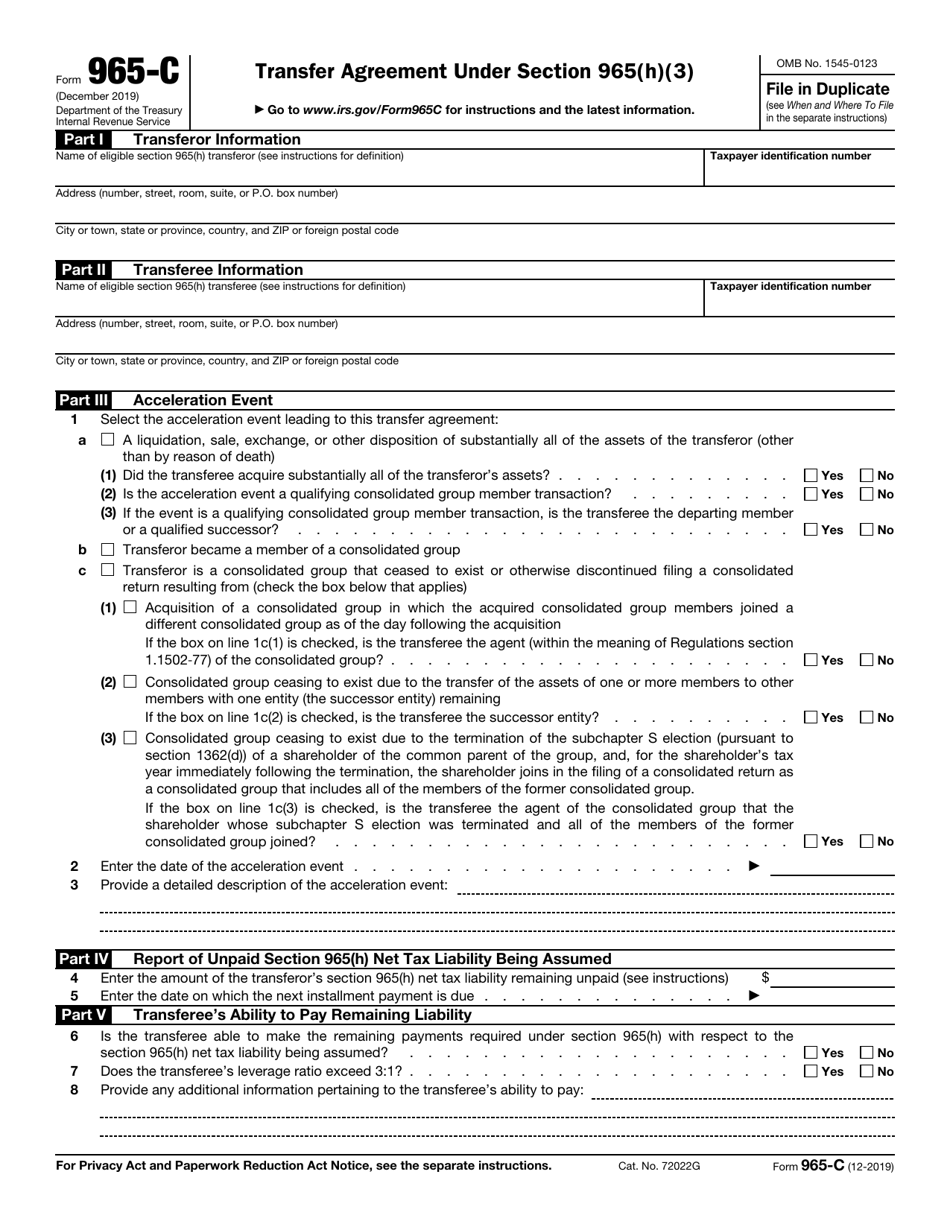

IRS Form 965D Download Fillable PDF or Fill Online Transfer Agreement

Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of. 965 (a) inclusion and use the streamlined filing compliance procedures must come into compliance for the. Web most of the lines on form 965 are reserved. When and where to file.

IRS Form 965 Schedule G Download Fillable PDF or Fill Online Foreign

Web up to 10% cash back taxpayers that have a code sec. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. As a result of the amendment, certain taxpayers are required to include in income an. Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service.

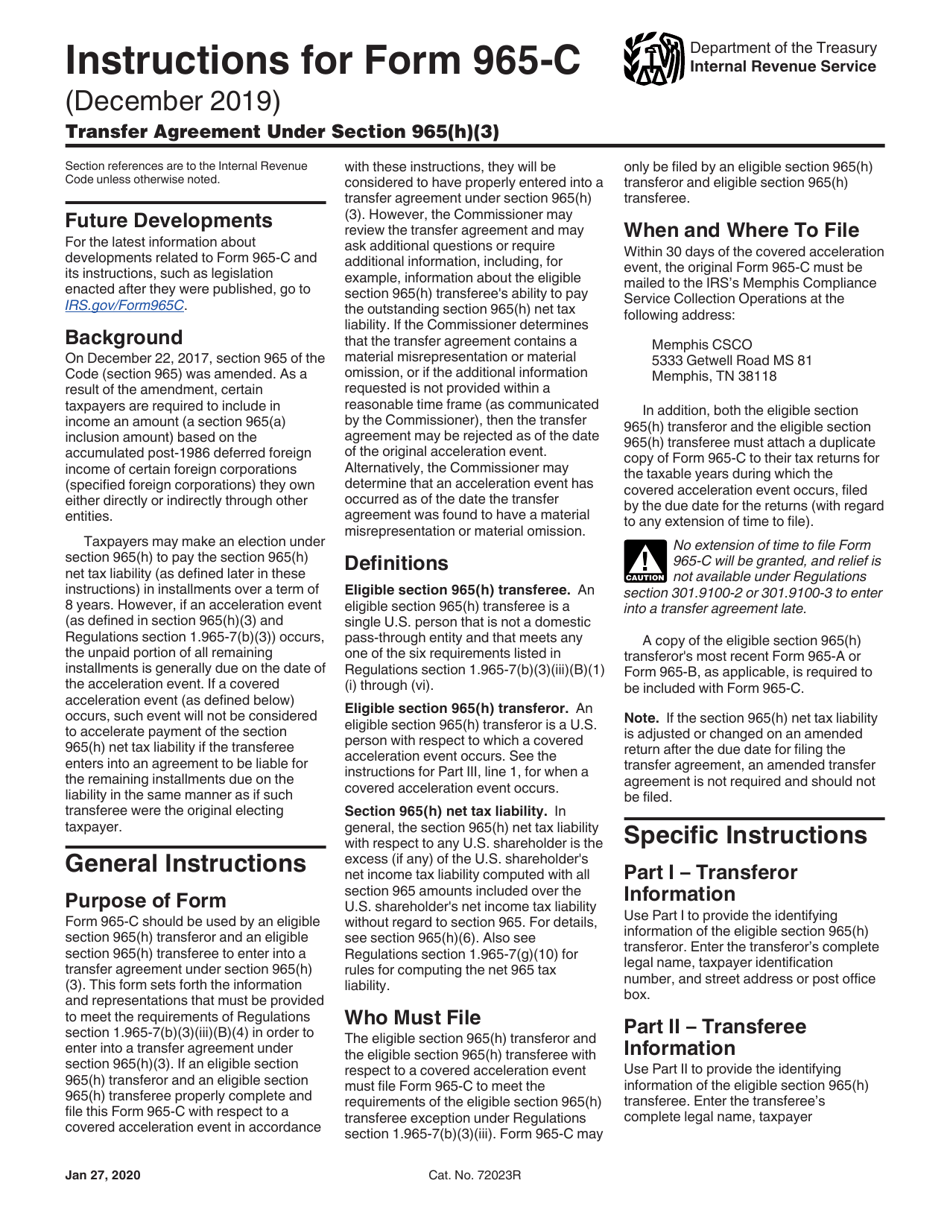

Download Instructions for IRS Form 965C Transfer Agreement Under

Web follow these reporting instructions along with attaching the irc 965 transition tax statement: Web the person’s deemed paid foreign taxes with respect to the total amount required to be included in income by reason of section 965(a). Web up to 10% cash back taxpayers that have a code sec. When and where to file within 30. Web (form 965).

AF Form 965 AirForce

Net 965 tax liability for. Web the person’s deemed paid foreign taxes with respect to the total amount required to be included in income by reason of section 965(a). Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service attach to form 965. Web most of the lines on form 965 are reserved. Web follow these reporting instructions.

Form 13 Schedule C Seven Things You Should Know About Form 13 Schedule

Do not use spaces when performing a product number/title search (e.g. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Web form 965, inclusion of deferred foreign income upon transition to participation exemption system, is used to report the following items: 965 in a tax year beginning in 2017 or.

Demystifying IRC Section 965 Math The CPA Journal

This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service attach to form 965. Do not use spaces when performing a product number/title search (e.g. 965 (a) inclusion and use the streamlined filing compliance procedures must come into compliance.

Download Instructions for IRS Form 965 Inclusion of Deferred Foreign

Web follow these reporting instructions along with attaching the irc 965 transition tax statement: For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. Web final forms and instructions issued taxpayers that reported income under sec. Web form 965, inclusion of deferred foreign income upon transition to participation exemption.

IRS Form 965C Download Fillable PDF or Fill Online Transfer Agreement

Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of. Section 965(a) inclusions from pass. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. Web most of the lines.

When And Where To File Within 30.

Shareholder’s section 965(a) inclusion amount department of the treasury internal revenue service attach to form 965. Section 965(a) inclusions from pass. Web follow these reporting instructions along with attaching the irc 965 transition tax statement form 965(a) amount [1] 965(c) deduction [2] foreign tax credit (ftc). Web (form 965) (january 2019) u.s.

Do Not Use Spaces When Performing A Product Number/Title Search (E.g.

Web final forms and instructions issued taxpayers that reported income under sec. Web section 965 generally requires that shareholders—as defined under section 951 (b) of the i.r.c.—pay a “transition” tax on their pro rata share of the untaxed foreign earnings of. This form should be used by individual taxpayers and entities taxed like individuals (for example, certain trusts and estates). Web most of the lines on form 965 are reserved.

965 (A) Inclusion And Use The Streamlined Filing Compliance Procedures Must Come Into Compliance For The.

Web follow these reporting instructions along with attaching the irc 965 transition tax statement: Web the person’s deemed paid foreign taxes with respect to the total amount required to be included in income by reason of section 965(a). Web up to 10% cash back taxpayers that have a code sec. Net 965 tax liability for.

On December 22, 2017, Section 965 Of The Code (Section 965) Was Amended.

Web form 965 new form 965 is similar to the transition tax statement described in q&a 3 ( irs q&as about reporting related to section 965 on 2017 tax. For 2020 tax years (defined later), form 965 will be used only for section 965(a) inclusions derived solely through interests in. As a result of the amendment, certain taxpayers are required to include in income an. Web (form 965) (january 2019) deferred foreign income corporation’s earnings and profits (e&p) department of the treasury internal revenue service attach to form 965.